The novel coronavirus (COVID-19) and restrictions meant to slow its spread had brought the US housing market to a near halt. But even though the virus continues to reshape the way we do business and live our lives, signs of recovery in the real estate market are emerging. A lot has happened and is currently happening in the US housing market as states enact their reopening plans. The typical spring seasonal peak has shifted to the summer as buyers and sellers cautiously re-engage in real estate activity. Now, as we’ve entered the middle of the summer, real estate activity across the nation is following an uphill trend.

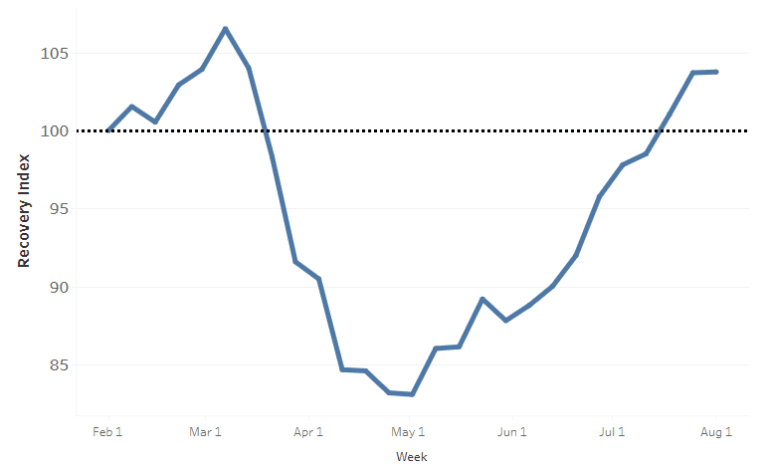

Realtor.com released its Housing Market Recovery Index Highlights for the week of July 25. According to this report, the housing market recovery index reached 103.7 nationwide. This marked a 2.7 point jump week over week, meaning the index actually surpassed the pre-coronavirus baseline by 3.7 points. The company kept track of the path to this initial point of recovery and issued a real estate market forecast for what’s to come. In this article, we explore the updated national real estate trends and provide insights from market experts on the evolving situation regarding the effect of the coronavirus in 2020 and 2021.

Resource: Realtor’s Housing Market Recovery Index

#1 Demand for Homes

Housing demand has bounced back in June as summer homebuying was in full-force. According to a Redfin report, housing demand during the first week of June was 25% higher than pre-COVID-19 levels. The Realtor’s housing demand index (calculated using trends in online search activity) reached 116.8. This exceeded the January baseline by 16.8 points and indicates that the summer market is seeing more activity. Furthermore, 47 of the largest cities (out of 50) are doing even better in terms of recovery. Among the markets where interest in homes for sale has recovered the most are Minneapolis, New York, Sacramento, Riverside-San Bernardino, and Oklahoma City.

Of course, this quick bounce-back in demand is a result of the record-low mortgage rates, virtual home shopping solutions, and easing of local coronavirus restrictions. In addition, it appears that homebuyer interest has fully recovered as well. This trend is seen as mortgage application volume increased 4.1% for the week ending July 17 according to data from the Mortgage Bankers Association’s (MBA) Market Composite Index. With demand driving up while supply levels remain low in the US real estate market, this indicates increasing competition among buyers and the emergence of a seller’s market.

#2 National House Prices

An increase in housing demand will naturally lead to increasing home prices. According to Realtor, the growth in asking prices increased by 1.2 points. Now, it’s at 105.4 which is 5.4 points above the January baseline prior to the coronavirus pandemic. From the 50 largest housing markets, 32 are seeing growth in asking prices have surpassed this trend. The markets that have recovered the most in terms of house prices are Cleveland, Pittsburgh, Cincinnati, Louisville, and San Francisco. Moreover, asking prices are currently increasing at an average of 12% year-over-year in the top 10 most-recovered markets.

With buyer competition gradually increasing while real estate supply is at record lows, we can say that sellers have recovered leverage and negotiating powers. We will have to wait and see whether or not homes actually sell at the same high price as the asking price. US real estate market as more offers come through this summer. Still, they predict that this is likely due to limited supply in 2020. If this housing market forecast is true, some homebuyers would find themselves sidelined with a deep affordability gap in the market. For investors, this makes 2021 a good time to invest in real estate rental properties.

Related: Owning a Rental Property by 2021: Will It Be Worth It?

#3 Pace of Home Sales

One of the biggest COVID-19 impacts on real estate was on the pace of home sales across the US. This trend tracks differences in the time on market. And according to Realtor’s latest report, home sales continued to recover for the 6th week in a row and have now exceeded the pre-coronavirus baseline. The time on market index went up 4.9 points in the week ending July 25 to reach 104.5. This is 4.5 points higher than the January baseline, indicating that transactions are happening at a faster rate. However, each housing market’s response to the coronavirus and ability to weather its economic impact will highly affect further improvement in the pace of home sales.

Realtor reports that in the top 10 most recovered markets for the pace of home sales, days on market (DOM) has dropped an average of 19% year-over-year. At the same time, cities where DOM is experiencing a speedy recovery are moving faster than those where the recovery has been slower. Hence, this suggests that seller markets prior to the COVID-19 pandemic are more likely to recover in the coming months. 34 of the largest markets are seeing the days on market index exceed the January baseline, among the most recovered are Boston, Philadelphia, Washington, Virginia Beach, and Seattle.

#4 Supply of New Listing

When the coronavirus pandemic hit in March, home sellers across the US quickly retreated. As a result, this suddenly made the supply of homes for sale even tighter. In mid-April, Redfin recorded the largest year-over-year slide of new home listings – a little over 50%. But while supply remains substantially lower than their level a year ago, real estate data shows that the rate of their weekly decline has started to improve. Realtor’s new listings index reached 96.8 in the week ending July 15, just 3.2 points below the January growth baseline. This suggests that sellers are still cautious, but are re-entering the market.

Still, the new listings index exceeded the January baseline in 19 of the largest real estate markets. Cities with higher prices are experiencing the fastest recovery in terms of new supply. This indicates that sellers are jumping back into the more pricey housing markets at a faster pace. The markets that have recovered the most in terms of new listings in 2020 according to Realtor are San Jose, New York, Seattle, San Francisco, and Las Vegas.

Still, experts say that further improvement in new listings could be constrained by lingering COVID-19 concerns and economic uncertainty going into the fall. In addition, although new listings have increased every week for the past four weeks, they still can’t keep up with housing demand. And some sellers (who can afford to wait) are still sitting on the sidelines. New housing market predictions 2020 suggest this limited supply could keep a lid on real estate activity for the rest of the year. If you want to stay ahead of the competition and buy rental property in 2020, use our Property Finder to find lucrative investment opportunities in your city of choice!

Future Real Estate Market Predictions

So what the will state of the US housing market 2020 be like over the next months? Given the current real estate trends and fundamentals, there are no signs of a looming housing market crash. The biggest fear, however, is that the coronavirus pandemic will continue for months and months and cause house prices to tank. So, it all depends on how much longer the US must deal with COVID-19 and how quickly the economy can recover.

Speaking of market recovery, many experts predict that it’ll be a W-shape. They believe that there will be an initial rebound in the summer simply due to pent-up demand for homes (which is what we’re seeing now). However, experts predict that the virus will make a comeback in the fall, which will lead to less demand for buying and cause another drop in real estate activity. Nevertheless, many are positive that the second dip likely to be way more muted than the first.

For more details, read our Forecast: A W-Shaped US Housing Market Recovery

The Bottom Line

Savvy real estate investors and perhaps sellers in suburban markets are clear winners in this case. If you have good credit and enough money for a significant down payment, then you could land yourself some very good real estate deals – if you know where to look for them. Following the downturn at the end of the year, most experts predict a housing market recovery to take place in 2021. Although it may come slowly, experts are optimistic. This presents a good opportunity to buy rental properties now and flip them when the market bounces back. To start searching for a rental property for sale, do so with Mashvisor and enjoy 15% off if you sign up now!