While determining rental demand is one of the most important steps in buying an investment property, many investors are not sure how to do it.

Investing in real estate is a great way to generate steady monthly income and secure your financial future. The key to success is choosing a rental property that will bring a good return on investment. While there are several factors to take into account when looking for profitable investment properties for sale, your best bet is to first find a location with strong rental property demand.

Table of Contents

- How to Determine Rental Demand in a Market

- What Rent Demand Can Investors Expect Across the US in 2023?

- Rental Demand Trends in the US Housing Market in 2023

- Using Mashvisor to Find Real Estate Markets With Strong Rental Performance

Rental demand measures the need for rental properties in a particular real estate market. It is a key indicator of the income potential in a rental market. If you buy an income property in a housing market with high demand, it means that your rental will have little risk of vacancy and will be able to get high rental rates. This translates into good monthly rental income and steady cash flow.

Moreover, since you’ll have more prospective tenants to screen, it will be easier to find quality tenants. It will lead to minimum tear and wear and no need for evictions.

If you want to find the best places to buy a rental property, it’s important you learn how to check rental demand in an area before purchasing a property there. Traditionally, this requires a thorough rental market analysis. Alternatively, the Mashvisor platform can help you find locations with high demand for rental properties quickly and easily.

How to Determine Rental Demand in a Market

You need to look at many different factors to evaluate how demanded rental units are in a particular location.

Let’s go over the key drivers that you need to keep an eye on:

1. Number of Rental Listings

The first thing to look at when analyzing rental demand in my area is the number of listings. It includes both vacant and rented-out listings and is one of the most straightforward indicators of demand.

If a housing market is oversaturated with a high number of available rentals compared to relatively few rented units, it means that there is a lot of competition for tenants. Such areas suffer from high vacancy rates, so landlords are forced to lower their rents to attract tenants.

Meanwhile, the best rental markets for investing are those with few vacant listings. It’s even better if there is a large number of occupied rentals, as this indicates a well-established rental market with strong rental activities. It means many potential tenants are ready to choose the best property with the most competitive rental rate.

2. Demographics

Another key factor to consider when looking for rental markets with high demand for long term rentals is the demographics. It comprises population data such as age, gender, migration patterns, population growth, job opportunities, and disposable income.

A real estate market’s demographic profile can help you understand the general demand and the demand for specific property types. For instance, a housing market with a high number of millennials would have a high demand for single-family home rentals as they are starting to get married and have families. A location with older people would see an interest in smaller, one-story properties.

With regards to demographics, you should also look into the share of renters vs homeowners among the population. Markets with more than 50% residential renters tend to provide a better demand.

3. Price to Rent Ratio

The price to rent ratio is one of the most straightforward ways to gauge the rental demand by zip code or city. This metric measures the balance between the average property price and annual rent in a market. So, it shows which option–homeownership or renting–is more affordable in a specific area.

A high price to rent ratio means that the cost of buying a home in the market is higher than the cost of renting. In such an area, the renter population will be more than the population of homeowners. Even if residents can afford a home, it doesn’t make financial sense as rents are relatively cheaper. It translates into strong demand for rentals.

In the opposite scenario, a city with a low price to rent ratio will suffer from low demand. The population finds it cheaper to buy a home.

Related: The Complete Guide to Price to Rent Ratio in Real Estate Investing

4. Job Market and General State of the Economy

Areas with high job growth and a strong economy attract young people searching for employment opportunities. When they relocate to these areas for jobs, they require a roof over their heads. However, they are not always ready to immediately buy a home since they might not stay there long term.

As a result, there is a surge in the demand for rental housing. As the renter population increases, there is also an increase in the rent growth rate.

5. Future Development

When looking for where to buy a rental property, you should consider the future demand for housing. A growing market with major development projects planned is more attractive for potential tenants looking for the best opportunities. Such development projects may include infrastructure improvement, new hospitals, schools, and others.

Moreover, areas that expect large-scale developments will see a surge in demand for rental properties once these projects get finalized. When investing in real estate, you have to be forward-looking. After all, you buy a property to rent out for years to come, not just in the next couple of months.

6. Mortgage Rates

The last year saw a major increase in mortgage rates across the US market, but not all locations were equally impacted. At any point in time, different US states have different rates, mostly due to varying foreclosure laws and occurrences. So, that’s one more factor that you should take into account when evaluating a rental market.

Generally speaking, places with high-interest rates on mortgage loans have more demand for rental properties. This is because buying a home costs more in the long run. And vice versa, markets with lower mortgage rates witness less need for rentals.

Related: How to Get the Best Mortgage Rate for Investment Property in 2023

7. Tourism

If you are looking to invest in Airbnb properties for sale, you need to focus on the tourist activities in the area. A thriving tourism industry with numerous attractions and millions of annual visitors is the most important indicator of strong demand for short term rentals.

These areas have tourist attractions like beaches, mountains, natural parks, museums, and theaters. If you buy an investment property in such a market, you are likely to enjoy a high Airbnb occupancy rate.

There are other factors to consider when it comes to vacation rentals, but here our focus remains on long term rental markets.

What Rent Demand Can Investors Expect Across the US in 2023?

Now that you know how to check rental market demand in a specific area, we’ll look at what demand you can expect in different markets across the US. We’ll use Mashvisor nationwide real estate market data from June 2023 to see what price to rent ratios will run in the US, as this is the most direct measure of demand for rentals.

We’ll look at the most prominent markets with low, medium, and high price to rent ratios. In each category, we’ll include cities with median property prices below $1,000,000 (for affordability) and average rental income above $2,000 (for profitability). Moreover, all these locations have at least 100 rental listings to ensure a strong market.

5 US Markets With Low Price to Rent Ratio (Below 15): Weak Rental Demand

Real estate investors can expect to encounter low price to rent ratios, translating into suboptimal interest in long-term rentals, in:

1. Coconut Creek, FL

- Median Property Price: $347,975

- Average Price per Square Foot: $236

- Days on Market: 66

- Number of Long Term Rental Listings: 284

- Monthly Long Term Rental Income: $2,441

- Long Term Rental Cash on Cash Return: 4.51%

- Long Term Rental Cap Rate: 4.61%

- Price to Rent Ratio: 12

- Walk Score: 10

2. Mesquite, TX

- Median Property Price: $350,704

- Average Price per Square Foot: $188

- Days on Market: 15

- Number of Long Term Rental Listings: 419

- Monthly Long Term Rental Income: $2,289

- Long Term Rental Cash on Cash Return: 4.81%

- Long Term Rental Cap Rate: 4.89%

- Price to Rent Ratio: 13

- Walk Score: 42

3. Kissimmee, FL

- Median Property Price: $428,542

- Average Price per Square Foot: $241

- Days on Market: 80

- Number of Long Term Rental Listings: 770

- Monthly Long Term Rental Income: $2,511

- Long Term Rental Cash on Cash Return: 3.93%

- Long Term Rental Cap Rate: 3.98%

- Price to Rent Ratio: 14

- Walk Score: 65

4. Minneapolis, MN

- Median Property Price: $394,729

- Average Price per Square Foot: $239

- Days on Market: 51

- Number of Long Term Rental Listings: 962

- Monthly Long Term Rental Income: $2,230

- Long Term Rental Cash on Cash Return: 3.66%

- Long Term Rental Cap Rate: 3.73%

- Price to Rent Ratio: 15

- Walk Score: 62

5. Fort Worth, TX

- Median Property Price: $417,710

- Average Price per Square Foot: $201

- Days on Market: 126

- Number of Long Term Rental Listings: 4,951

- Monthly Long Term Rental Income: $2,325

- Long Term Rental Cash on Cash Return: 3.72%

- Long Term Rental Cap Rate: 3.78%

- Price to Rent Ratio: 15

- Walk Score: 38

5 US Markets With Medium Price to Rent Ratio (16-20): Moderate Rental Demand

For moderate demand for rental properties, investors can look into the following:

1. Albuquerque, NM

- Median Property Price: $428,925

- Average Price per Square Foot: $213

- Days on Market: 98

- Number of Long Term Rental Listings: 429

- Monthly Long Term Rental Income: $2,288

- Long Term Rental Cash on Cash Return: 4.30%

- Long Term Rental Cap Rate: 4.37%

- Price to Rent Ratio: 16

- Walk Score: 42

2. Chattanooga, TN

- Median Property Price: $464,549

- Average Price per Square Foot: $254

- Days on Market: 70

- Number of Long Term Rental Listings: 340

- Monthly Long Term Rental Income: $2,295

- Long Term Rental Cash on Cash Return: 4.37%

- Long Term Rental Cap Rate: 4.44%

- Price to Rent Ratio: 17

- Walk Score: 38

3. Mesa, AZ

- Median Property Price: $524,932

- Average Price per Square Foot: $278

- Days on Market: 21

- Number of Long Term Rental Listings: 469

- Monthly Long Term Rental Income: $2,413

- Long Term Rental Cash on Cash Return: 3.44%

- Long Term Rental Cap Rate: 3.47%

- Price to Rent Ratio: 18

- Walk Score: 36

4. New Orleans, LA

- Median Property Price: $515,216

- Average Price per Square Foot: $282

- Days on Market: 76

- Number of Long Term Rental Listings: 1,890

- Monthly Long Term Rental Income: $2,256

- Long Term Rental Cash on Cash Return: 3.58%

- Long Term Rental Cap Rate: 3.64%

- Price to Rent Ratio: 19

- Walk Score: 55

5. Dallas, TX

- Median Property Price: $705,562

- Average Price per Square Foot: $455

- Days on Market: 17

- Number of Long Term Rental Listings: 5,610

- Monthly Long Term Rental Income: $2,921

- Long Term Rental Cash on Cash Return: 3.13%

- Long Term Rental Cap Rate: 3.19%

- Price to Rent Ratio: 20

- Walk Score: 48

5 US Markets With High Price to Rent Ratio (21 and Above): Strong Rental Demand

In 2023, the strongest demands for rental housing are in:

1. Charlotte, NC

- Median Property Price: $578,062

- Average Price per Square Foot: $433

- Days on Market: 50

- Number of Long Term Rental Listings: 2,551

- Monthly Long Term Rental Income: $2,263

- Long Term Rental Cash on Cash Return: 2.86%

- Long Term Rental Cap Rate: 2.90%

- Price to Rent Ratio: 21

- Walk Score: 36

2. Oakland, CA

- Median Property Price: $928,225

- Average Price per Square Foot: $560

- Days on Market: 50

- Number of Long Term Rental Listings: 175

- Monthly Long Term Rental Income: $3,307

- Long Term Rental Cash on Cash Return: 2.34%

- Long Term Rental Cap Rate: 2.35%

- Price to Rent Ratio: 23

- Walk Score: 60

3. Denver, CO

- Median Property Price: $813,679

- Average Price per Square Foot: $415

- Days on Market: 18

- Number of Long Term Rental Listings: 262

- Monthly Long Term Rental Income: $2,602

- Long Term Rental Cash on Cash Return: 2.44%

- Long Term Rental Cap Rate: 2.47%

- Price to Rent Ratio: 26

- Walk Score: 58

4. Reno, NV

- Median Property Price: $873,749

- Average Price per Square Foot: $1,617

- Days on Market: 76

- Number of Long Term Rental Listings: 405

- Monthly Long Term Rental Income: $2,649

- Long Term Rental Cash on Cash Return: 2.26%

- Long Term Rental Cap Rate: 2.28%

- Price to Rent Ratio: 27

- Walk Score: 16

5. Mooresville, NC

- Median Property Price: $858,671

- Average Price per Square Foot: $597

- Days on Market: 114

- Number of Long Term Rental Listings: 236

- Monthly Long Term Rental Income: $2,318

- Long Term Rental Cash on Cash Return: 2.02%

- Long Term Rental Cap Rate: 2.04%

- Price to Rent Ratio: 31

- Walk Score: 67

Rental Demand Trends in the US Housing Market in 2023

Those considering investing in a long term rental property would like to know not only what demand they will face now but also what they can expect for the rest of the year and the next few years. So, let’s take a look at the recent and forecast trends in rental rates and demand in 2023.

Since the beginning of the year, the rental market has somewhat relaxed, driven by the slowly increasing housing supply and the deceleration in residential property price rises. As the US housing market is generally cooling down and becoming more neutral, this is having an imminent impact on rental activities, too.

Recently, Rent.com reported that the national median rent in April 2023 (latest available data) was $1,967, a slight year over year increase of 0.29%. In terms of month over month change, there was a decline of 0.23% compared to March 2023. The year over year rise was one of the smallest in recent years.

The reasons behind this trend are straightforward. The national inventory of homes for sale increased by 21.5% between May 2022 and May 2023, according to Realtor.com. Meanwhile, the year over year rise in home values is only 2.0%, based on Zillow data. Mortgage rates are also slightly down to 6.07% for a 15-year fixed-rate and 6.71% for a 30-year fixed-rate, according to Freddie Mac.

All these factors together make it easier for individuals to buy a home than a couple of years ago. This is leading to a predictable slowdown in the rental market.

Nevertheless, things are not looking bleak by any means for future landlords.

What Will Drive Rental Demand in the Near Future?

If you’re thinking of buying an investment property to rent out, you shouldn’t get discouraged by the numbers above. Long term rentals can still be a very profitable real estate strategy as long as you plan carefully and execute diligently.

Despite the recent cooldown, the median rent price is still significantly above the pre-pandemic level. According to Rent.com, rents increased by 23.4% between December 2019 ($1,594) and April 2023 ($1,967).

Moreover, the rental market–just like the real estate market–is highly regional. Even if the average national rental rate slows down, some markets are still blooming. For instance, Zumper highlights the stability of the Columbus, OH, and Colorado Springs, CO, markets. These markets stayed relatively calm during the pandemic and are now continuing their stable growth.

After all, each market is affected by the local economy, job market, and single-family and multi-family construction projects around. So, you need to conduct a careful rental market analysis before making a decision.

Related: Find High-Income Properties for Maximum Returns

Using Mashvisor to Find Real Estate Markets With Strong Rental Performance

With numerous factors to consider, finding markets with high rent demand and strong rental performance is very time-consuming. You need to collect and analyze a lot of real estate and rental data on multiple properties to draw reliable conclusions. This is even more challenging for beginner investors without access to proven data sources.

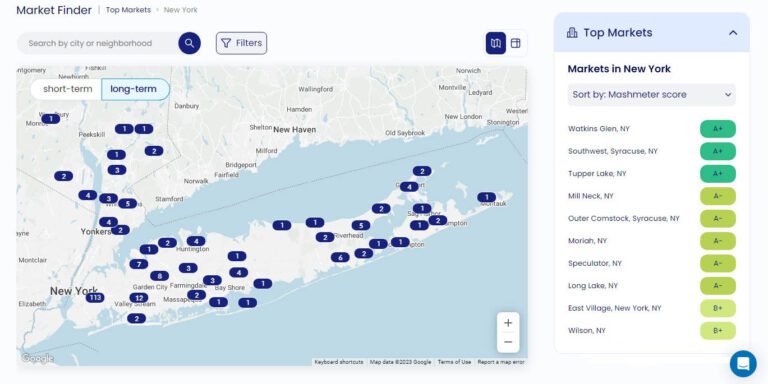

The good news is that Mashvisor provides investors with a tool that helps them find the best rental markets for investing right away. This is the Mashvisor Market Finder.

First of all, the Market Finder provides you with a list of the 10 absolute best long term rental markets across the US, based on the Mashmeter score. It is a proprietary score that our Data Team calculates to evaluate how good a market is for investing in rental properties.

However, the fact that these 10 markets are the best doesn’t mean that they match your specific needs. To ensure that, investors can use several different filters to narrow down their rental market search to what makes sense for their individual needs.

These filters include:

- Mashmeter score

- School rankings

- Property value

- Property type

- Rental income

- Occupancy rate

- Cap rate

This way, with a few clicks of a button, you can find the best rental market for your particular requirements.

Mashvisor’s Market Finder tool shows you the top ten markets in any given location that could give you a better understanding of the rental demand in the area.

Rental Demand: The Bottom Line

When deciding where to buy an income property, rental demand is a key factor to take into consideration. It influences the occupancy rate, the rental income, and–ultimately–the return on investment, whether you look at cash on cash return or cap rate. Thus, be sure to include the seven factors listed above in your research.

In case you need some extra help, don’t forget to check out the Mashvisor Market Finder. This tool allows even beginner investors to locate the best places for investing in rental properties for sale in a matter of minutes. It eliminates the need for manual data collection and analysis and allows investors to make faster and smarter investment decisions.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.