Real estate has a number of benefits and can be a lucrative investment choice. However, to reap the rewards, you need to conduct due diligence on potential rental properties before you buy one. This is because real estate has a number of risks and knowing the numbers can help mitigate them. One of the key metrics that savvy real estate investors look at before buying rental property is real estate income. While real estate markets usually fluctuate, you can still predict your potential rental income. Your real estate income will determine your cash flow and return on investment. In other words, the higher the potential rental income, the more profitable it is likely to be. Therefore, as a real estate investor, it is important to learn how to estimate real estate income. Read on to find out how to find the potential rental income of income generating real estate.

Conduct a Real Estate Market Analysis

The first step to estimating real estate income is finding a good location for real estate investing. This is because location will have a huge influence on the income of the investment property you choose to purchase. Therefore, you need to conduct real estate market analysis to get an estimate of real estate income for the whole location. Through real estate market analysis, you will find out about different aspects of the area that will impact your rental income such as rental demand and real estate appreciation rates. Real estate market analysis also tells you the optimal rental strategy (Airbnb or traditional) for the area. For instance, some areas are better for Airbnb rental properties. In such areas, Airbnb rentals would produce more income than traditional rentals. You should also look at historic property data, current property data, and use predictive analytics to help you “predict the future” of a particular real estate market. Make sure you are familiar with the possible market trends that can influence your real estate income.

Related: How to Perform a Real Estate Market Analysis

Perform Investment Property Analysis

After finding a suitable location, the next step is to search for investment properties and do an in-depth analysis. Once you have found a few rental properties that meet your criteria, you want to work out the real estate return on investment of each property. Here are the ROI metrics to consider:

-

Rental Property Cash Flow

Real estate income can be estimated by analyzing the cash flow of an income property. Rental property cash flow refers to the difference between rental property income and rental expenses. Depending on your rental income, you can have positive cash flow, negative cash flow, or break even. Positive cash flow is desirable because it will provide you with consistent monthly income.

-

Capitalization Rate (Cap Rate)

Another ROI metric used to estimate real estate income is the capitalization rate. Cap rate is essentially net operating income (annual cash flow) relative to the property price. It is used to compare different rental properties without taking into consideration the financing method. It will vary depending on location, the property type, and the real estate investment strategy. However, a good cap rate should range from 8% to 12%.

Related: The Cap Rate Formula and How It Helps Find Profitable Investments

-

Cash on Cash Return

Another ROI metric useful in estimating real estate income is the cash on cash return. It is calculated by dividing the net operating income of income producing real estate by the actual cash invested. When it comes to cash on cash return, the investment property financing method is taken into account. Like cap rate, cash on cash return will be dependent on factors such as location, property type, and the investment strategy. Nevertheless, good cash on cash return should range from 8% to 12%.

Conduct a Comparative Market Analysis

As seen above, you can estimate real estate rental income by performing real estate market analysis and investment property analysis. However, you can also estimate real estate income through comparative market analysis. This involves looking at the rental history of real estate comparables. For instance, if you want to estimate Airbnb income before buying a short-term rental, you should find other Airbnb rental properties that are similar to yours and that are within the same neighborhood, and check what they rent for. If you know the neighborhood’s average rental rate and Airbnb occupancy rate, you can estimate the real estate investment income. Nevertheless, this strategy can be time-consuming especially if you try to do it without the help of real estate investment tools.

Use Real Estate Investment Tools

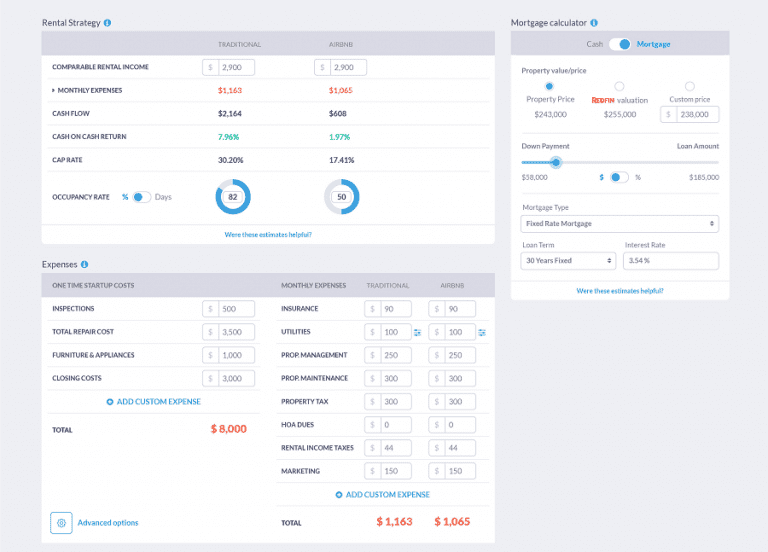

Estimating real estate income manually or by use of spreadsheets can be time-consuming and sometimes inaccurate. The most effective way to perform such estimates is to use proper real estate investment tools. Mashvisor’s tools use big data, predictive analytics, and machine learning algorithms to help real estate investors analyze investment properties with ease. Our real estate income calculator will help you estimate real estate income in a matter of minutes. Our tools will allow you to analyze neighborhoods and rental properties in the U.S. housing market for both Airbnb and traditional rental strategies. You’ll also get readily available comps for every property listing on the platform.

The readily available analysis that will be given includes rental income, cash flow, occupancy rate, cap rate, and cash on cash return. By using our calculator, you will be able to make informed investment decisions faster and have an edge over the competition.

Related: 5 Best Real Estate Investment Tools for 2020

The Bottom Line

Knowing how to estimate rental income of a property can be the difference between having a profitable investment and losing money. While there are a number of ways you can estimate income, using Mashvisor’s real estate investment tool is the easiest and most efficient. With Mashvisor, you will be able to find rental properties that will enable you to make money in real estate with ease. If the estimated real estate income is high enough, you can buy the investment property with more confidence and it won’t feel like you’re gambling!

Start out your 7-day free trial with Mashvisor now.