Buying a rental property is a great way to earn extra income and build wealth over time. However, not all investment properties for sale will be profitable. Savvy real estate investors know that finding income properties with a high return potential begins with identifying the right real estate market. Location is an important factor in real estate investing because it will have a huge impact on your return on investment. And since all housing markets are not the same, doing a real estate market analysis would help you find the best places to buy a rental property.

If you are looking to buy a rental property, we have put together this guide to help you learn how to evaluate a real estate market before choosing to buy a rental property there.

How to Evaluate a Real Estate Market

With the sheer size of the US housing market, trying to figure out where to invest in real estate can be daunting. You also can’t just decide to invest in your local real estate market before you analyze it. It might not be the optimal housing market for the best rate of return.

To be successful in real estate investing, you should be willing to consider buying rental property in any area with good investment potential. To find such a market, you need to do comprehensive real estate market analysis. So, what’s the best way to evaluate a real estate market?

Finding the best places to invest in real estate requires a lot of research and analysis of real estate market data. You need to consider real estate market factors on both macro and micro levels. In this respect, real estate market evaluation should be conducted systematically in two main steps:

- Analyze the Cities

- Analyze the Neighborhoods within the Best City

Let’s now look at these two steps in a little more detail.

1. Analyze the Cities

To properly evaluate a real estate market, you first need to analyze the macro markets (cities). For you to find the best cities for rental investment, there are some key things you should keep an eye on.

Here are some of the features of a city with good rental investment potential:

-

A Growing Job Market

The best cities for rental investment have a growing economy and a diverse job market. Such cities are usually major business hubs and house several big companies.

As a result, employment opportunities in such cities are ever-growing. This creates an influx of young people looking for job opportunities. Definitely, these people will also be looking for places to live. As a result, there will be a high demand for rental properties. This will not only increase occupancy rates but also allow real estate investors to charge higher rates. The result is a higher rental income.

-

A Thriving Tourism Industry

Airbnb real estate investing is gaining popularity and is currently one of the best ways to invest in real estate. If you are looking to invest in Airbnb, a thriving tourism industry is an important factor to take into account when you evaluate a real estate market.

The best cities for Airbnb investment enjoy a high number of tourists all year round. Therefore, you should focus on cities with tourist attractions like beaches, parks, museums, etc. In such cities, you will be able to enjoy a high Airbnb occupancy rate and high nightly rates. This translates into a high Airbnb rental income.

Nevertheless, be sure to also check the Airbnb regulations before you decide to invest in such a market. Some cities have unfavorable Airbnb laws.

-

Good Price to Rent Ratio

The price to rent ratio is an important metric to real estate investors. It is used to determine the most affordable option between renting and buying a home for the average person in the city. This lets investors know if long-term rental properties are in high demand in a city or not. A high price to rent ratio (above 21) means that there will be more renters than homeowners. However, these cities will also be quite expensive. If the median listing price of such a market is in your budget, then this would be a good price to rent ratio for you. A low price to rent ratio (15 and below) means more residents can afford to buy a home and there may be less demand for rental properties. However, if you find the city still has a high enough renter population that drives demand, a low price to rent ratio may make sense for your budget.

-

Affordable Property Taxes

One advantage of investing in rental properties is that they come with many tax deductions that an investor can take advantage of. However, some cities have higher property taxes than others. To increase your chances of generating positive cash flow, it’s best to research local property tax rates whenever you evaluate a real estate market.

We have gone through just a few of the main features of the best cities for rental investment. However, there are several other features you should take into account including:

- A high population growth rate

- Future developments

- A low crime rate

- Low insurance costs

- A low number of rental property listings

- Favorable landlord-tenant laws

- A median listing price that fits your budget

Collectively, all these features make a city a good rental market. However, there’s a shortcut to evaluating a real estate market in the US. By checking out Mashvisor’s comprehensive real estate market reports or blog, you will be able to access key real estate market data on some of the hottest markets in the US. All the hard real estate market analysis work has already been done for you.

2. Analyze the Neighborhoods within the Best City

Trends in the macro market (city) can show that, as a whole, it is an excellent market for real estate investing. However, the neighborhoods within the city may be experiencing different conditions. That being so, you need to do a neighborhood analysis to find the best neighborhood in the city you have selected.

The best neighborhoods for rental investment have good infrastructure and are in close proximity to public amenities like hospitals, good schools, restaurants, shopping centers, gyms, etc. Such areas attract more tenants because they offer a better lifestyle quality.

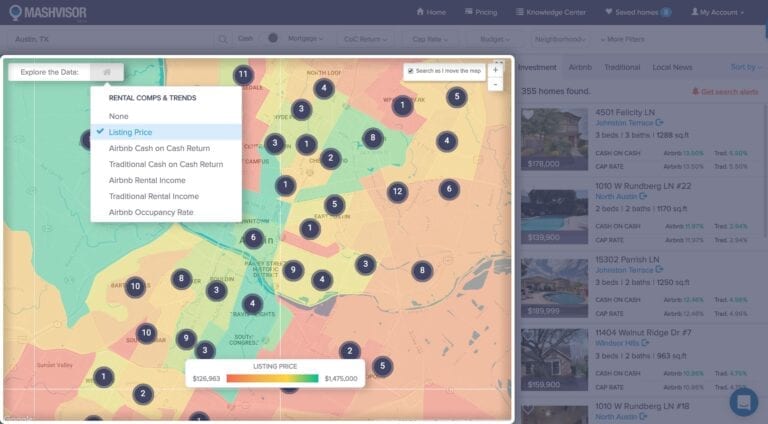

However, the best and easiest way to do a neighborhood analysis is to check for neighborhood data using Mashvisor’s Real Estate Heatmap. This tool allows you to find the best-performing neighborhoods by selecting filters that match the following data:

- Listing Price

- Traditional Rental Income

- Airbnb Rental Income

- Traditional Cash on Cash Return

- Airbnb Cash on Cash Return

- Airbnb Occupancy Rate

The tool will show the difference in the performance of the neighborhoods in the city using a range of colors. The best-performing neighborhoods for each metric will be marked in green. The lowest will be marked in red.

The Bottom Line

Knowing how to conduct a real estate market analysis is key to finding lucrative real estate deals. This involves considering real estate market factors at both city and neighborhood levels. If you follow this guide closely and use Mashvisor’s real estate investment software, you will be able to evaluate a real estate market in a matter of minutes and start your search for investment properties for sale.