Investing in real estate can be a lucrative venture if you know what you are doing. The first step when looking for a profitable investment property is finding a good investment location. As you have probably heard before, location is the most important factor in real estate investing because of its impact on the return on investment. While investing in your local real estate market may seem easier, it may not be the best market. To find the best places to invest in real estate, you need to expand your search far and wide.

However, the US housing market is quite broad, and trying to find the best markets can feel overwhelming to a newbie. So, where are the best places to invest in real estate? In this blog, we look at the steps you need to follow and the tools you need to use for finding the best places to invest in real estate in 2020.

How to Find the Best Places to Invest in Real Estate

There are two main steps involved in choosing the best places to invest in real estate:

- Finding the best cities

- Finding the best neighborhoods within the city

1. Finding the Best Cities

The real estate market analysis process begins with finding the best cities for real estate investment. Here are some key things you need to look for in a target city.

-

Median Listing Price That Fits Your Budget

When looking for the best places to buy rental property, the first thing you should consider is your budget. What can you realistically afford? What you can afford will depend on a number of factors including whether you can qualify for a mortgage loan if needed, the amount of savings you have for a down payment, etc. You should review your financial situation in order to determine what fits your budget. Your budget will determine the city you can invest in.

Once you have figured out your budget, you need to do research for city data with regard to the median property prices. You can easily find most of this data online, such as on Mashvisor’s blog. Next, make a list of the cities that meet your budget. You have begun to narrow down your options so that you can focus only on the cities where you can afford to buy an investment property.

-

Average Performance of Investment Properties (Airbnb and Traditional)

Another thing you should look at when trying to find the best places to invest in real estate at the city level is the average performance of both Airbnb rental properties and traditional rental properties.

From the list of cities you came up with above, you want to find the average performance by city for the following metrics:

- Rental Income (Airbnb and traditional)

- Cap rate (Airbnb and traditional)

- Airbnb occupancy rate

You can narrow down your list further by selecting cities with relatively higher rental income, higher cap rates, and higher Airbnb occupancy rates. If you are looking for the best places to buy a vacation home, markets with the highest Airbnb occupancy rate should be top on your priority list. Again, this kind of data can be found here, on Mashvisor’s blog.

-

Growing Job Market

Another real estate market feature you should consider is a growing job market. You should focus on real estate markets with a growing economy and a flourishing job market. These markets are usually major business hubs with a diverse range of industries. As a result, many workers looking for job opportunities are attracted to such markets. This results in a higher demand for rental properties. An increase in demand also pushes rental prices and house prices up.

-

Booming Tourism Industry

If you are interested in buying short-term rentals, tourism should be a key element in your Airbnb market research. The most profitable Airbnb locations are those with tourist attractions like parks and beaches. Cities that have a regular influx of tourists will have a higher Airbnb occupancy rate.

-

A High Price to Rent Ratio

Price to rent ratio is another important metric to consider when looking for a good market to buy rental property. It basically refers to the ratio of the median property price to the average annual rent.

This metric helps investors to determine what is more affordable for the average person between buying a home and renting. The best places to invest in real estate are typically those with a higher price to rent ratio. These areas are likely to have a higher demand for rental properties since most people can’t afford to purchase their own homes.

Of course, you too should be able to afford an investment property in a market with a high price to rent ratio. Otherwise, it may not be the right investment location for you. Ultimately, there is more to consider when trying to determine what is a good price to rent ratio.

-

Low Crime Rate

It’s important that you check the crime rate of the cities on your list because it will influence your rental business. The best places to invest in real estate are those with a low crime rate. Tenants will prefer such areas because they feel safer living there. Actually, most tenants would rather pay more to live in a safer environment. Be sure to check the crime statistics of the potential real estate markets before deciding to invest there.

-

Favorable Airbnb Regulations

For those looking to buy Airbnb investment properties, you should also consider the Airbnb regulations in the potential markets. Not all cities that have tourist attractions would be good for Airbnb real estate investing. You have to check the local Airbnb regulations to avoid any legal problems. For instance, some cities in the US have banned non-owner occupied short-term rentals.

2. Finding the Best Neighborhoods

After analyzing several cities, you’re probably left with one or two. The next step in finding the best places to buy investment property is to narrow down your search to neighborhood level. While the whole city you have selected may be profitable, the neighborhoods will vary in profitability.

A good neighborhood for real estate investment should have neighborhood amenities like public transportation, gyms, shopping centers, good schools, and hospitals. Tenants are usually attracted to areas with desirable neighborhood amenities because it improves their lifestyle quality.

However, the best way to find profitable neighborhoods in your city of choice is to conduct a neighborhood analysis using Mashvisor’s heatmap tool. Here is a brief overview of how to use it.

Using the Real Estate Heatmap

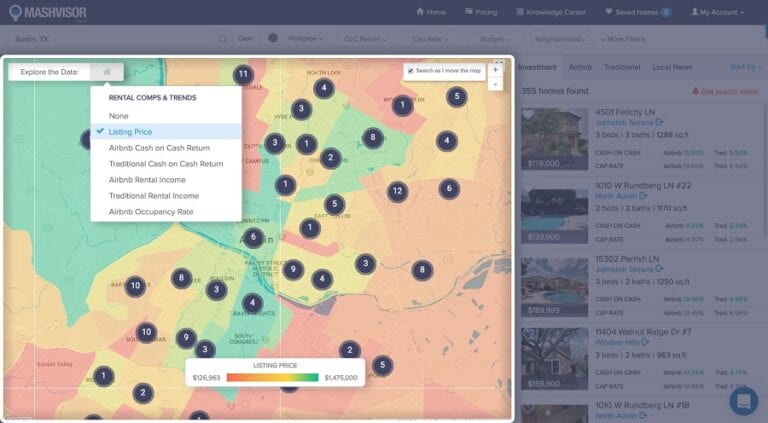

Mashvisor’s real estate heatmap uses different colors (green, yellow, orange, and red) to show the performance of different neighborhoods in your selected market. All you have to do is select your city of choice and set the filters for the real estate metrics that match your criteria.

Here are the real estate metrics you can use:

- Listing Price

- Rental income

- Cash on cash return

- Airbnb occupancy rate

For instance, if you want to find the best places to invest in real estate based on expected Airbnb rental income, you just set “Airbnb rental income” as the filter. Neighborhoods with the highest Airbnb rental income will be marked on the heatmap in green. Those with the lowest Airbnb rental income will be marked in red. The heatmap analysis tool is user-friendly and allows you to do your neighborhood analysis in a matter of minutes. Try out the heatmap now.

The Bottom Line

One very crucial skill every real estate investor should have is knowing how to choose a real estate market. By following the right process and using the right tools to research real estate markets, you will be one step closer to finding a profitable investment property.

Start out your 7-day free trial with Mashvisor now.