Buying cash flow investment properties is one of the best ways to make money in real estate. Even though investing for appreciation is still viable, positive cash flow is a more upfront way to make money in real estate. This makes it a lucrative investment for beginner real estate investors.

Positive cash flow investment properties generate more rental income than the total rental expenses. This means that you are left with some profit each month that you can use for personal needs or reinvest. Therefore, the higher the rental property cash flow, the better. If you are thinking of getting into real estate investing, you should consider buying positive cash flow properties.

Even though buying cash flow investment properties can be lucrative, finding them can be challenging. For you to know how to find cash flow investment properties, you need to understand the factors that will bring positive cash flow and the steps to follow. Here’s how to find cash flow investment properties:

How to Find Cash Flow Investment Properties

1. Find a Good Real Estate Market

Location is the most important factor in real estate investing since it dictates most aspects of investment property including listing price, expenses, tenant pool, real estate laws, occupancy rate, and optimal rental strategy. Where you purchase your investment property will have the biggest influence on your cash flow potential. Therefore, the first thing to do when looking for the best cash flow investment is to find a suitable location.

When it comes to looking for a good investment location for positive cash flow properties, you may have to explore even the areas that are not close to you. A good location for cash flow investment properties is one with affordable prices for investment properties for sale. This means that your mortgage payments will be lower, thus increasing your cash flow.

A good location for real estate investment should also have a good job market, low crime rate, good infrastructure, schools, and other social amenities. Such areas attract more people to live there, thus increasing the housing demand. With increased demand, vacancy rates will be lower. Landlords will also be able to increase rental rates and earn more rental income.

To find the best real estate markets, you should also look at real estate data. You can find accurate city data on Mashvisor’s blog to help you make better investment decisions. You will be able to view rental data like average rental income, average Airbnb occupancy rate, and much more. Focus on locations with a low price to rent ratio and low recurring expenses like property taxes and insurance costs.

Related: How to Identify the Best Places to Invest in Real Estate

2. Find the Best Neighborhood in Your Real Estate Market of Choice

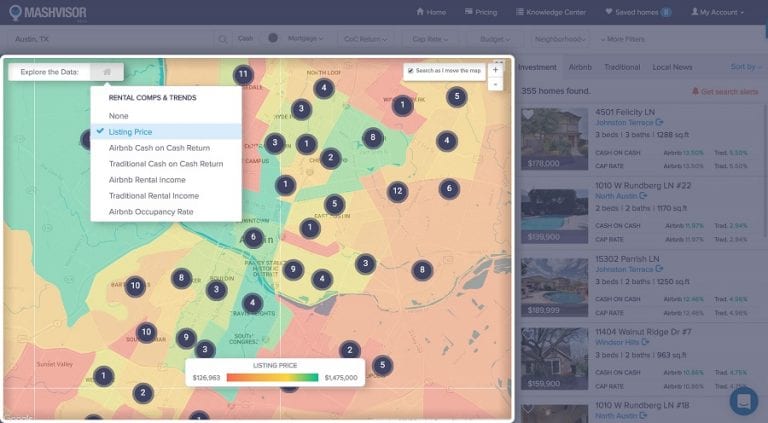

Once you have found a potentially profitable real estate market, the next step is to perform neighborhood analysis. The purpose of this analysis is to identify the best areas in your city of choice for cash flow investing. The best way to conduct a neighborhood analysis in a quick and efficient manner is by using Mashvisor’s heatmap analysis tool.

The tool allows you to search for the best neighborhoods in any US housing market based on metrics like:

- Median property price

- Rental income for Airbnb and traditional rental properties

- Cash on cash return for Airbnb and traditional rental properties

- Airbnb occupancy rate

When looking to buy cash flow investment properties, you should focus on neighborhoods with relatively high rental income and low home prices. As mentioned earlier, low home prices will lower your mortgage payments and increase your cash flow. High occupancy rates can also indicate that cash flow real estate can be found in the area.

3. Narrow Down Your Investment Property Search

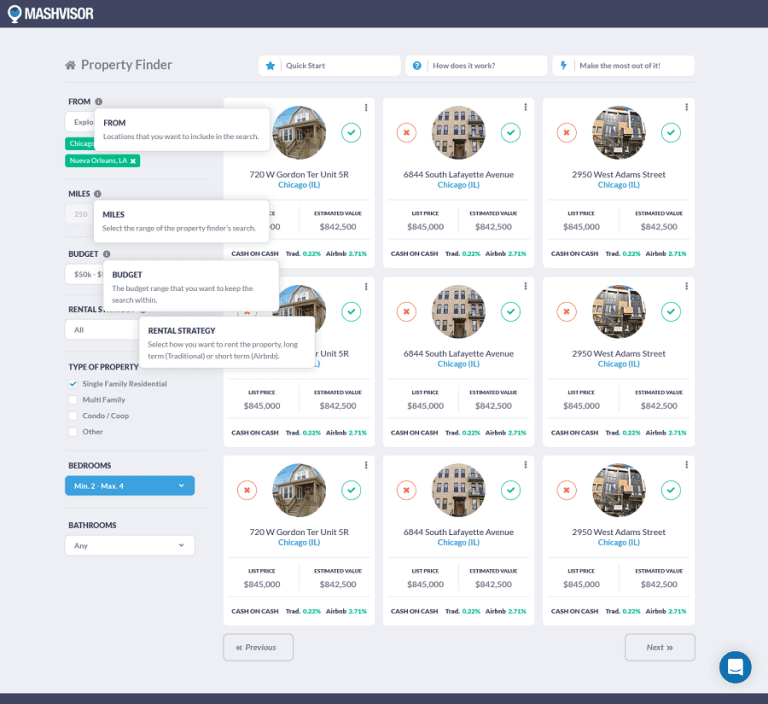

Now that you have found a lucrative neighborhood, it’s time to find cash flow investment properties in the area that meet your criteria. Decide on the investment property type and property features you want and begin narrowing down your search. From your neighborhood analysis, you should have some insights into what would have a high return on investment in the area. You can use Mashvisor’s Property Finder to search for cash flow investment properties for sale in any U.S. housing market that meet your budget and criteria.

Related: The Best Investment Property Deal Finder for 2020

4. Conduct Investment Property Analysis

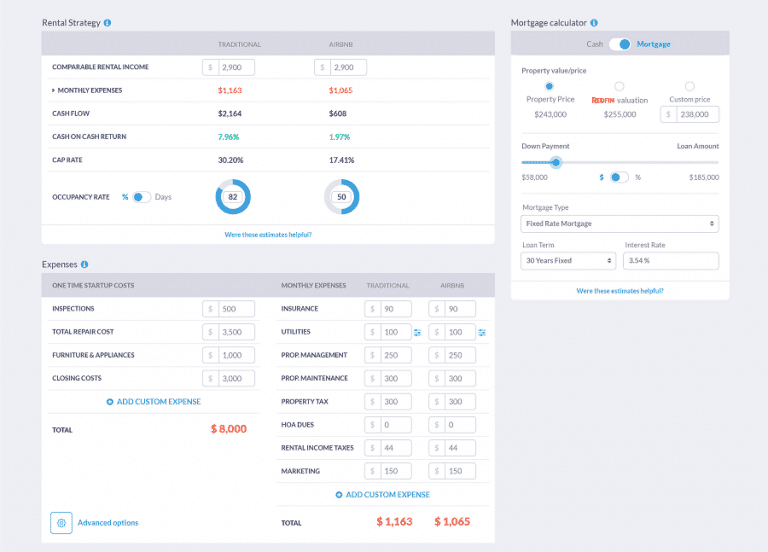

By now you should have a few potentially positive cash flow investment properties that meet your criteria. The next step is to analyze each of the investment properties for sale in-depth. With Mashvisor’s investment property cash flow calculator, you can find out the cash flow of each investment property and the optimal rental strategy for positive cash flow. Our cash flow calculator and Airbnb calculator also provide you with the rental income and monthly expenses relating to the displayed cash flow, which you can add to or change.

To get access to all of Mashvisor’s tools to facilitate your real estate market analysis and investment property analysis, sign up for a free 7-day trial now!

5. Work with a Real Estate Agent

When looking for positive cash flow income properties as a beginner real estate investor, it is recommended that you work with a real estate agent. An experienced agent will not only help you find the right investment property but help you in negotiating for the best purchase price. Being expert negotiators, they can significantly drop the listing price. This will further increase your potential cash flow.

Related: A Guide for Finding the Best Real Estate Agents for Buying Houses for Rent Near Me

The Bottom Line

Even though finding cash flow investment properties needs a lot of research and knowledge, it is worth it. If you are looking to make positive cash flow with your new income properties, be sure to follow these easy steps. However, finding a positive cash flow rental property is not the end. You still have to maintain a positive cash flow. You can do so by finding ways to reduce your monthly expenses and/or increasing your rental income. For instance, screen tenants to reduce maintenance costs, ensure that your tenants are happy to minimize turnover, etc.