Purchasing and owning rental property will be a very effective strategy for generating wealth in the US housing market . According to statista.com, the demand for single family homes and multi family housing units has continued growing steadily over recent years. In 2019, about 43 million rental properties were occupied by renters. Since many people cannot afford to buy a home and prices are expected to continue climbing in many cities across the nation, the demand for rentals will continue rising.

However, merely owning a rental property is not a guarantee for making profits. You must find cash flow properties in order to make a good return on investment. The last thing you want to do is lose money through negative cash flow investment properties.

So, What Is a Positive Cash Flow Property?

Real estate cash flow is simply income minus expenses. Therefore, a positive cash flow property is one where the rental income collected exceeds the expenses of owning, managing, and operating the rental.

Since positive cash flow income properties pay for themselves, you won’t have to worry about digging into your own pocket to cover costs. With the positive cash flow, you can pay off your mortgage faster and then invest in more cash flow properties.

How to Calculate Cash Flow

The formula for calculating cash flow is as follows:

Cash Flow = Monthly Rental Income – Monthly Rental Expenses

Estimating rental income before buying an investment property would require looking at rental comps. You can also use comps to figure out your potential rental expenses, which could include:

- Mortgage payments

- Property insurance

- Property taxes

- Tenant search costs

- Utilities

- Home association fees

- Property management fees

Because it can be difficult to calculate cash flow for an investment property you don’t own and manage yet, it’s best to use online tools to do so. Mashvisor’s real estate cash flow calculator provides an easy way to calculate the cash flow of traditional and Airbnb rental properties. This tool uses machine learning algorithms, predictive analytics, and big data to estimate the expenses associated with owning a rental, as well as the expected rental income. Besides calculating cash flow, the Airbnb calculator will also compute metrics like traditional and Airbnb cap rate, traditional and Airbnb cash on cash return, and traditional and Airbnb occupancy rate.

Try out our cash flow calculator for yourself now.

How to Find Positive Cash Flow Properties: 4 Ways

Here are some of the ways you can find cash flowing properties to invest in:

Look for a good rental market

Start your search for cash flow properties in a good location. A good location will mean that your future rental property will be able to attract tenants easily and you will be able to keep your occupancy rate high. This will allow you to easily generate a positive cash flow.

A good rental market should have a strong economy, high median income, a growing employment rate, and high rental demand. You should also look for an area with low crime rates, access to transportation hubs, good school districts, and proximity to amenities. Finally, you need to consider the profitability potential of the area.

These are some of the best cities for cash flow properties based on cash return (the data is taken from Mashvisor’s real estate database):

#1. Redford, Michigan

- Median Property Price: $140,127

- Price/Square Foot: $117

- Price to Rent Ratio: 9

- Traditional Rental Income: $1,300

- Traditional Cash on Cash Return: 6.8%

#2. Mesquite, Texas

- Median Property Price: $215,251

- Price/Square Foot: $129

- Price to Rent Ratio: 12

- Traditional Rental Income: $1,480

- Traditional Cash on Cash Return: 5.3%

#3. Moss Point, Mississippi

- Median Property Price: $147,159

- Price/Square Foot: $83

- Price to Rent Ratio: 14

- Traditional Rental Income: $906

- Traditional Cash on Cash Return: 5.3%

Related: How to Find Positive Cash Flow Properties in the US Housing Market

#4. Saint Cloud, Minnesota

- Median Property Price: $212,232

- Price/Square Foot: $116

- Price to Rent Ratio: 13

- Traditional Rental Income: $1,354

- Traditional Cash on Cash Return: 5.2%

#5. Pahoa, Hawaii

- Median Property Price: $235,645

- Price/Square Foot: $204

- Price to Rent Ratio: 15

- Traditional Rental Income: $1,319

- Traditional Cash on Cash Return: 4.9%

#6. Venice, Florida

- Median Property Price: $412,105

- Price/Square Foot: $239

- Price to Rent Ratio: 14

- Traditional Rental Income: $2,403

- Traditional Cash on Cash Return: 4.8%

#7. Lake Charles, Louisiana

- Median Property Price: $227,517

- Price/Square Foot: $115

- Price to Rent Ratio: 15

- Traditional Rental Income: $1,304

- Traditional Cash on Cash Return: 4.8%

#8. Livonia, Michigan

- Median Property Price: $245,315

- Price/Square Foot: $162

- Price to Rent Ratio: 13

- Traditional Rental Income: $1,620

- Traditional Cash on Cash Return: 4.8%

Remember, choosing a good city is only step #1 of finding a good location; you also need to identify a profitable neighborhood. Mashvisor’s real estate heatmap will help you find the areas with the highest profitability-potential in these cities. With this tool, you can analyze different neighborhoods using metrics like Airbnb occupancy rate, rental income, listing price, and cash on cash return – all key indicators of cash flow.

Find off market properties

If you want to get a good deal in real estate, consider investing in off market properties like REOs, short sales, foreclosures, and bank-owned homes. Since such properties are not found through traditional listings, there is less competition and you can negotiate a below-market price. With lower monthly mortgage payments, it is easier to generate a positive cash flow from off market properties.

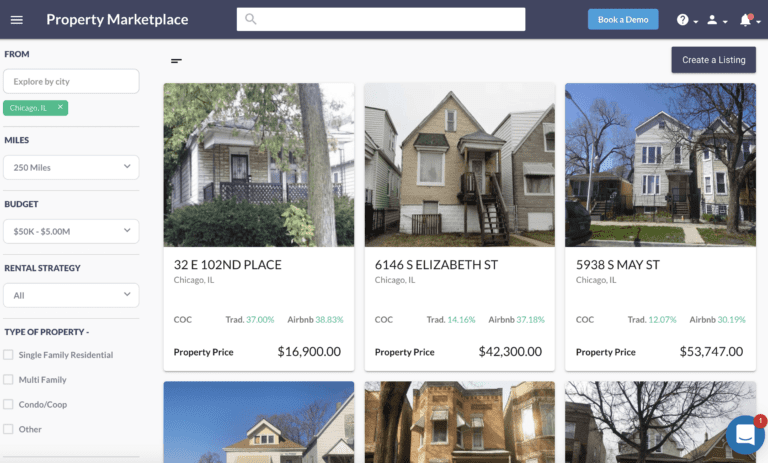

You can find off market cash flow properties for sale by driving for dollars, direct mail marketing, attending real estate auctions, or working with real estate agents. Alternatively, you could use tools like the Mashvisor Property Marketplace. This tool allows you to narrow down your search using filters like listing type, miles, number of bathrooms/bedrooms, budget, type of property, and rental strategy.

Related: Mashvisor Property Marketplace: A Guide for Real Estate Investors

Conduct comparative market analysis

Also referred to as real estate market analysis, comparative market analysis (CMA) involves comparing one rental property with other similar properties (real estate comparables) in the area. This is key to finding cash flow properties. The idea is to determine the fair market value before you buy a property. This way, you will avoid paying too much for a property and enhance your chances of having a positive cash flow.

Real estate comparables should be similar in terms of location, square footage, acreage, property type, number of bedrooms/bathrooms, and age of construction. You can hire an agent to conduct a CMA on your behalf, or you can do it yourself using Mashvisor’s rental property calculator.

To get access to our real estate investment tools, click here to sign up for Mashvisor today and enjoy 15% off.

Consult a real estate agent

A real estate agent will be of great help in finding cash flow properties thanks to their experience and knowledge. A good real estate agent will not only help you find cash flow properties but will also come in handy at the negotiation and closing stages.

Find a real estate agent that has relevant certifications, as well as experience buying and selling houses in the area of your choice. Though working with an agent will cost you, it will be worth it in the end when you buy an investment property that generates positive cash flow.

Find a top-performing real estate agent anywhere in the US right now.

A Few Final Tips

After finding positive cash flow properties, you need to ensure you maintain the cash flow. So our final tip is to find and retain good tenants. Before admitting tenants, check their income sources, social media profiles, credit scores, criminal background, and eviction record. Getting and keeping good tenants will ensure that your cash flow properties remain profitable.

Related: Real Estate Investing 101: How to Find Positive Cash Flow Properties in the US Housing Market