Modern real estate investing is made better with artificial intelligence. That said, you need the right platform to find rental property using AI.

Table of Contents

- Artificial Intelligence in Real Estate

- How to Find Rental Property for Sale

- Five Things to Consider When Finding a Rental Property for Investment

- Start Looking for Rental Property for Sale Using AI

Real estate, as an industry, has grown by leaps and bounds over the past couple of decades. Thanks to the fast-paced advancement of technology, real estate investing is now easier and more efficient. Artificial intelligence in real estate platforms has opened plenty of opportunities for 21st-century investors.

It is now easier to find investment and rental property online compared to ten, twenty, or even thirty years ago. People were skeptical the first time real estate websites came out. However, it didn’t take long for them to find out the value that online real estate platforms bring. It is now easier to buy and sell houses, screen tenants for rentals, and even connect with an out-of-state real estate agent.

What is artificial intelligence? And how does it apply to real estate investing? Most importantly, how can it help you in your search for rental property for sale?

This blog will answer all these questions to get you ready for the next step in your real estate career. We will talk about AI and its role in real estate investing. We will also discuss how to find rental property online using Mashvisor and why it’s the best website to use.

Artificial Intelligence in Real Estate

Before the technological blow-up we’ve seen in the last few decades, the world was a much different place. The real estate world was especially different.

Real estate investors used to drive around neighborhoods to hunt down “For Sale” signs to find potential investment properties near them. They would check newspapers and go to auction houses to find rental properties for sale. While some may still do them, most now use artificial intelligence (AI).

Artificial intelligence is basically the development of machines to do research work faster than humans can using online platforms and methodologies. AI draws from predictive analytics and machine learning algorithms to make research and analysis much easier.

So how has artificial intelligence changed real estate today? With these property search tools, real estate investors can find rental properties for sale based on a large amount of numerical and historical data. These new systems have drastically altered the amount of time and effort needed to research real estate properties.

A lot of real estate investors have the same questions in mind. How do I find good investment properties near me? What factors should I consider first when looking for an investment property? Which is a good market to find and buy a rental property online? How do I know if a property is worth investing in? Should I hire a real estate agent?

The questions above can all be addressed through real estate platforms that run on AI. And the best way the online platforms can help you find the answers is through predictive analytics and machine learning algorithms.

Let’s take a closer look at predictive analytics and machine learning algorithms. Find out how they’re used in real estate to further explore the concept of AI in real estate.

Predictive Analytics and Machine Learning Algorithms

Predictive analytics is the use of historical real estate data to estimate the future trends and performance of investment properties, house prices, housing markets, etc.

Machine learning algorithms are programming methods that allow AI tools to learn from real-time data in order to get the best results, solutions, and predictions. This is especially helpful in projecting ROI on rental property.

The main idea of using these real estate investment tools is to find the rental property for sale that will give you the greatest cash on cash return possible. It will still depend, though, on the online platform you use.

If you want highly accurate results, you need to first find the best website there is for real estate market analysis. Using the best website will all the more increase your confidence as you choose and buy the rental property that’s right for you.

Related: How to Find Investment Properties Using Analytics

How to Find Rental Property for Sale

When finding rental properties, you must take advantage of all the real estate technology available to you. Here, we will list the different investment property analysis tools that can assist you in your property search. When looking for rental properties for sale, you are guaranteed to find the best options using the following real estate instruments:

1. Using AI: Mashvisor’s Real Estate Search Engine

If you’re in the market to buy a rental property, one of the best ways to find them online is through Mashvisor.

Mashvisor is one of the best websites and real estate analytics platforms on the internet today. It can help you locate a good property at excellent value with greater ease.

One of the platform’s most successful tools for finding rental property for sale is its search engine. Mashvisor has a comprehensive real estate search engine that can give you property listings, calculations, and analyses to help you make your next investment decision. Basically, the system handles all the how-to-dos you can think of.

With Mashvisor, it’s now easier to figure out how to look for the right rental property. You can use the platform to compute your potential return on investment in less time. It’s a lot more efficient than learning how to conduct a comparative market analysis on your own.

Mashvisor does all of these things by using specific mathematical algorithms together with the filters set by the user to find the best possible rental property. Simply type in the city or neighborhood where you wish to start your search.

Then, you can set the filters, such as the type of investment property, your mortgage information, preferred cash on cash return and cap rate, and many more.

Besides the search engine, Mashvisor also offers several other AI and data-driven real estate investment tools. We’ll talk more about finding rental property for sale using the AI tools next.

Heatmap Analysis Tool

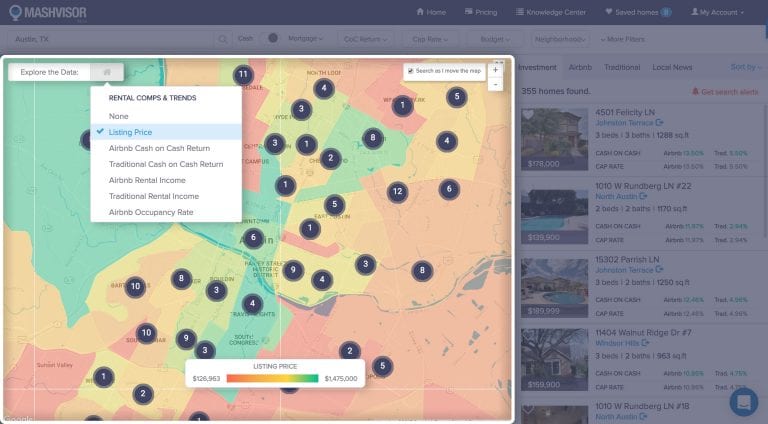

An example of predictive analytics that can help you find homes for sale is the heatmap analysis tool. Mashvisor’s heatmap analysis tool will show you the best neighborhoods with investment property for sale in the city of your choice.

It is an easily understandable visual representation of the best investment opportunities available to you based on large amounts of housing data and forecasts.

Related: Finding Income Properties Using a Heatmap

Rental Property Finder

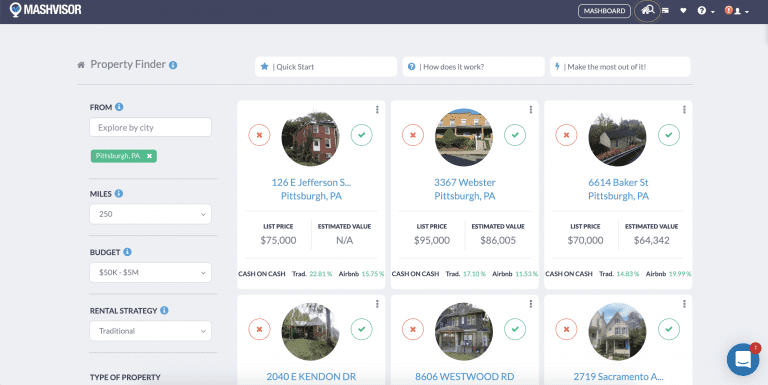

Mashvisor’s Property Finder is a unique tool that uses AI and machine learning algorithms to find the most profitable investment properties in the shortest amount of time.

With the Rental Property Finder, you can adjust a few filters that will help narrow down your search results. Some of the filters include your budget, the type of property you want (single-family homes, condos/coops, multi family homes for sale), and as many as ten desired cities. You can also put in your rental strategy of choice (short-term or long-term rentals).

By choosing up to ten completely different markets, you’ve widened your search results so that the AI resources will find the perfect real estate investment property for you.

After you set the filters, the Rental Property Finder will display rental income properties for sale that meet your criteria sorted from the highest return on investment.

Investment Property Calculator

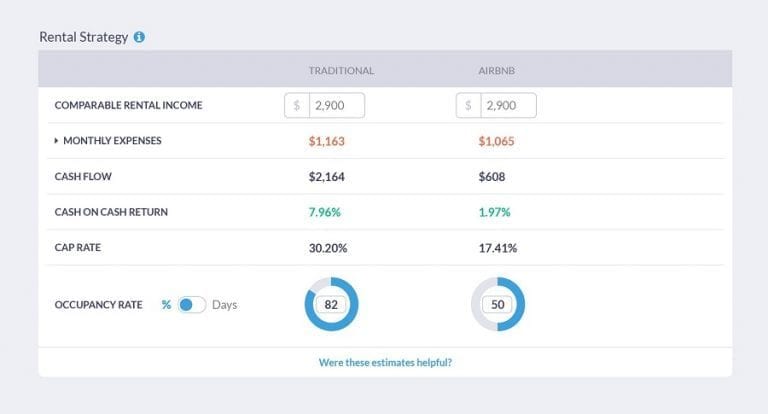

Another AI tool in real estate is the investment property calculator, which also works as an Airbnb calculator. You can use the calculator after you find a rental property for sale. Then, it will tell you if it is a good real estate investment or not based on metrics like cash flow and cap rate.

Because Mashvisor’s investment property calculator can perform its analysis instantly, you can compare a multitude of properties at the same time. Comparing a few rental homes with each other will take you as short a time as researching just one property.

Also, the tool uses Airbnb analytics, which can be just as helpful as any other type of analytics. Airbnb real estate predictive analytics will let you know whether or not renting out on Airbnb is profitable with the specific property of your choice.

Related: How to Do Investment Property Analysis

2. Networking With Real Estate Professionals and Investors

Another good way of locating rental property is by connecting with other investors and industry professionals.

As an investor, you should learn to find value in making the right connections. You should know how to build a solid real estate investment network. Connecting with a good network of professionals and investors will significantly help your search for the right property. It is one of the best ways of finding good deals in your area or out-of-town neighborhoods.

Whether you’re buying or selling a property, the connections will help you speed up the buying or selling process. They can even give you recommendations on where to look for high-value properties at below-market prices. Some can give you pointers on how to set the right rental rates or how to filter tenants, so you don’t end up with a bad one.

How to Widen Your Real Estate Investing Network

We’ve already discussed why connections are of high value to any investor. Here are some ways you can expand your network:

- Join clubs and go to events. Joining clubs and attending events are the best ways to get to know people and generate contacts. The great thing about them is it doesn’t seem like you’re doing any work at all.

- Join online groups on Facebook or LinkedIn. Technology not only allows you to look for properties online but connect with people as well. Social media plays an integral role in building and establishing connections today. There are plenty of online groups you can join where you can meet new people, even from faraway locations.

- Connect with them regularly. First and foremost, understand that establishing a network needs some form of time and emotional investment. It’s not just enough to meet new people at events. Building rapport and establishing a relationship are keys to having a solid network. Remain visible and reach out regularly, even if you’re not looking to buy at the moment. They will help you build stronger connections.

3. Getting the Services of a Real Estate Agent

Working with an agent is a good way of finding an income property. It is actually one of the best ways to locate a good-value property out of state.

An agent who knows the local market is an asset to any investor. There are several great benefits to working with a good agent.

First, working with a reputable local real estate agent will save you plenty of time and money. It also relieves you of unnecessary pressure, especially when you’re considering out-of-state investments.

It is quite risky to buy a rental property in a place you’re not familiar with. Working with an agent minimizes the risk and keeps you right on track.

Second, an agent can give you guidance and sound investing advice, especially when you’re from out of town. An agent who has access to the local MLS can give you heaps of information that’s more accurate than any newspaper ad. If you let them know exactly what you’re looking for, they can find a rental property at a great value that fits your needs.

A good local real estate agent can also help you find buyers for your property if you’re also selling. They can even connect you to potential tenants or property managers if you’re renting out your property.

How to Find Real Estate Agents

If you want to hire the services of an agent, you first need to do a quick background check. Don’t just go for any agent you see. It is in your best interest to screen potential agents as you would potential tenants.

The best ways to determine if an agent is a good fit for you are the following:

- Know what you’re looking for. For instance, if you want access to the local MLS, you should look for an agent who can provide you with such access.

- Check online. There are many websites where you can check out real estate agents from different locations. One of the best websites that can help you is Mashvisor. It has a massive real estate agent directory from almost every market in the country.

- Reach out to other professionals and investors. Nobody knows agents better than those who are active in the industry. Talk to realtors, brokers, lenders, bankers, and other investors for recommendations.

Sure, you will need to spend a little more when working with an agent, but in most cases—especially if you do your homework—it is well worth it. Think of it not as an additional expense but as an investment that will add value to your decision-making process.

5 Things To Consider When Finding a Rental Property for Investment

First things first: before you buy an income property, you need to take into account certain factors that can affect your rental business in the long haul.

1. Good Neighborhood

As an investor, you need to first learn how to identify a good neighborhood from a bad one. Here are some ways to know if a neighborhood is worth investing in or not:

- Location. Location is key to any real estate investment. A property’s location may either drive up its value or bring it down.

- Ease of Access. How accessible is the property? Is there public transportation like bus stops or subway stations nearby? How about the roads? These are some things to consider before you buy an investment property.

- Public Amenities. Accessibility and proximity to public amenities also affect a property’s value. If a property is near parks, libraries, restaurants, hospitals, schools, and other similar amenities, they tend to get more tenants and guests.

- Economy. Another driver of rental property value is the local economy. Is the economy growing and thriving? Does it offer job opportunities to attract tenants and in-migrants?

- Safety and Security. Fact: no one wants to live in an area with a high crime rate. How safe is the neighborhood you’re looking at?

- Future Development. Lastly, you need to find out what the local government’s plans are for the neighborhood. Depending on what these are, a property may increase or lose value over time.

2. Constant Demand for Housing

Let’s say a neighborhood you’re considering checks out, you then need to know if there is a constant demand for rental properties in the area.

Is the population growing at a rapid pace or has it plateaued? How high is the demand for rentals? Are people more inclined to rent a property or buy one? These are some questions you need to ask yourself before making any decisions.

The best way to know if there is a high demand for rental properties is to find out the price to rent ratio. A high price to rent ratio (20 and above) indicates that people are more likely to rent than buy because owning a house is expensive.

A lower price to rent ratio (14 and below), on the other hand, means housing is more affordable. It implies that people find buying a house more practical than becoming tenants.

3. Competitive Rates

When you’ve already established that a location has a strong renters’ market, it’s time to look at the rental rates in the area.

As a rental property investor, you would want to make enough money to pay for all the recurring expenses and still make a decent profit. However, you also don’t want to turn off potential tenants and guests by charging unreasonable rates.

As a rule of thumb, rental property owners go by the 1% rule. The rule states that the monthly rental income should not go below 1% of the property’s overall purchase price. Now, depending on your rental strategy, you need to figure out how much you’re charging monthly for long-term rentals and nightly for short-term rentals.

Each investment strategy comes with its own pros and cons. The upside of having a traditional rental business is you know exactly how much you’re getting each month from your tenants. The downside is that you may end up with a bad tenant who misses payments and is poor at home maintenance.

Vacation rental owners may enjoy higher earning potential than landlords, given the higher demand for Airbnb properties. The downside is that their income will depend on seasonality and occupancy rates. They don’t have a fixed amount to look forward to from guests, unlike landlords do with their tenants.

The best way to figure out how to price your rental property is to take a look at rental comps. You can easily find them online on websites like Mashvisor.

4. Property Condition

A property’s overall condition also matters a lot. If you’re buying a used property, you need to find out how many repairs are needed. It’s normal for used properties to have flaws but if it’s too much of a fixer-upper, you might want to rethink it.

If you’re unsure how to assess a property’s condition, consider working with a professional. The important thing is it doesn’t have any structural, plumbing, or electrical issues.

5. Cash Flow

Perhaps the most important aspect of buying a rental property online is finding its potential cash flow. Its regular expenses should be a lot less than its projected monthly income. A monthly income that is less than the regular expenses puts you in the red. You want a good positive cash flow to make the business sustainable.

You can figure out what a subject property’s potential cash flow is by using Mashvisor’s rental property cash flow calculator. It is one of the many unique features its investment property calculator offers users and subscribers. Because of this feature, it is one of the best websites for real estate investors who want a more comprehensive rental property analysis.

To learn more about how we can help you make faster and smarter real estate investment decisions, click here.

Start Looking for Rental Property for Sale Using AI

Why waste time when all the information you need is just a click away? We no longer live in the real estate world that relies on driving around, looking for “For Sale” signs, or going to every auction in the neighborhood. If you’re looking to find good rental property for sale, don’t be afraid to use all the tools that are provided to you.

Technology has, indeed, taken us to great heights. It is now easier and faster to find rental property online using AI. And the best website for this is one that can help you find the right investment property that suits your needs, as well as makes investment property analysis a breeze.

You no longer need to wrestle with spreadsheets and calculations. Mashvisor’s AI will do all the work for you: from searching for neighborhoods to crunching numbers. Mashvisor is here to help you take that next step in your investing journey!

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.