Flipping houses in Florida is an excellent strategy for investors who are looking for quick but solid returns. This guide shows how you can succeed.

House flipping is a real estate investment strategy where an investor buys a house that usually needs fixing at a very low price, remodels it, and then resells it for a profit. As the strategy became more popular, its definition has expanded to something similar to BRRRR, which is to buy a house, remodel it, and rent it out.

If you are considering this strategy, there is no better place to start than in Florida. The Florida housing market has been on an uptrend in the last 10 years. Thanks to the fast-growing industries that make the Sunshine State their home, they have created millions of job opportunities for its residents. Not only did this has kept the state’s unemployment rate low, but it has also attracted highly educated Americans from other areas to move here.

In this blog post, we will discuss why flipping houses in Florida is a lucrative business in 2022. Then, we will outline a step-by-step process on how to find a house to flip. And finally, we will list the 10 best places in Florida for flipping houses.

Why Start Flipping Houses in Florida?

The Sunshine State has long been a favorite location for real estate investments. And it makes sense why:

- Rapid population growth: Experts predict that Florida’s population will exceed 22 million by the end of this year, a 1.19% growth compared to last year. That means over 259,000 new Floridians will need a new place to live in.

- Inventory of new homes will remain tight: Due to supply chain issues and labor shortages, builders will continue to struggle to catch up with their backlog of new constructions. Thus, investors who flip houses for sale in Florida are likely to get many offers from homebuyers who want a move-in-ready residence.

- Taxes remain low: Florida is known to have some of the lowest tax rates in the country. It does not collect state income tax or tax on intangible assets like investments.

- Easy to finance: According to Mashvisor’s latest data, the median sales price across the state is $609,596. The amount is high because some cities are selling for below $100,000, while others are in the millions. Despite this, flipping houses in Florida can still be affordable with financing. If you plan to hold onto the property, you may be able to get a conventional mortgage. But if you are selling it afterward, a hard money loan would better suit your needs.

Even though foreclosure activity was at its all-time low at the end of 2021, this does not mean finding a cheap fixer-upper is impossible. Regular buyers usually go for move-in-ready homes, so your only competition on foreclosed properties is your fellow investors.

Flipping Houses in Florida, Step-by-Step

Experienced investors may have their own methods of flipping houses. But if this will be your first time, here is a step-by-step guide to help you out:

Step 1: Research Neighborhoods and Property Types

As a real estate investor, you need to make sure that the neighborhood you want to invest in is desirable to live in and has properties for sale that people would want to buy or rent. To do this, you need to study the local real estate market. One method is to consult with a realtor who specializes in the area of your interest. Another way is to use a real estate investment tool like Mashvisor that provides accurate neighborhood analytics.

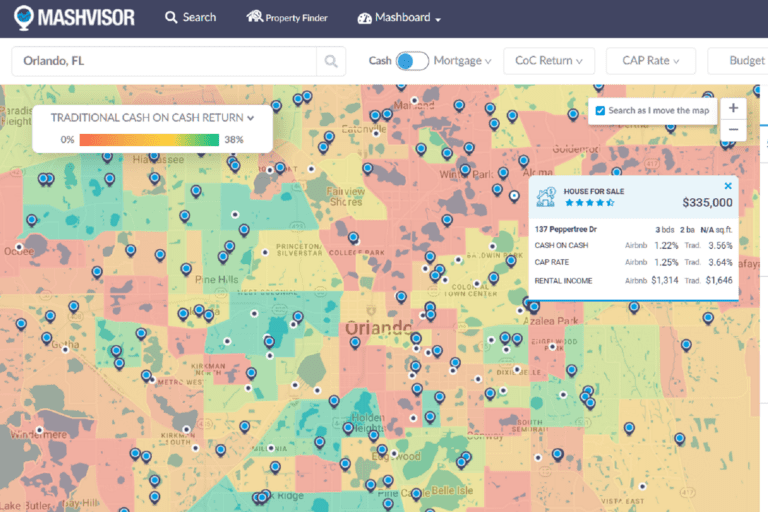

On Mashvisor, you can discover which areas have higher profit potential for your chosen investment strategy. Type in your city of interest on our search box to open our Property Search page, which shows a map view of the city or neighborhood you searched for as well as a list of homes for sale.

While you can start looking for properties from there, you can also focus your search on a particular area by setting the real estate heatmap to highlight the parts with the highest returns, rental income, listing price, or occupancy rate. Once you see which neighborhoods are better performing, you can start searching for properties then and there.

But if you want to know the best property type in that area, open that neighborhood’s analytics page and go to the Insights section. There, our AI recommends the optimal property type, number of bedrooms, and rental strategy for that neighborhood. You can also study the area further by exploring the other sections of the analytics page.

Step 2: Evaluate Your Financial Health and Budget

You have to decide how much you should spend on flipping houses in Florida. The actual cost includes buying a house and actually renovating it. Unless you can pay cash for everything, you will need to finance your project. So make sure you have the following in order before you shop around for a lender:

- Debt-to-income ratio: This is the measure of your outstanding monthly debt compared to your monthly income. Lenders use this metric to determine how financially comfortable you would be to take on new debt. The acceptable ratio depends on the lender, though some approve loans to borrowers with ratios as high as 40%.

- Credit history: This is a record showing your ability to repay your debts. This shows lenders whether you are likely to pay your mortgage on time. If you do not have a substantial credit history, you can start building this by getting and using a credit card or taking out a smaller loan.

- Employment and income history: Some lenders would want to know whether your income source is stable. Make sure you have had stable employment (or income if you are running a business) in the last two years.

The best way to set a budget is by using one of the most important rules for flipping houses in Florida (or anywhere else). It is called the 70% rule, which states that you should pay no more than 70% of the after-repair value of a property minus the remodeling costs.

70% Rule Example

Let’s say move-in-ready homes in your chosen neighborhood sell for $600,000. To aim for this target, you should keep your total expenses at $420,000, which is 70% of $600,000. This may mean buying a house for $300,000 then using the remaining $120,000 to remodel. Note that this is the maximum you should spend. If you end up spending less than 70% of a house’s after-repair value, the higher your profit will be.

Step 3: Plan Your Exit Strategy

While the term house flipping originally referred to fixing up a house and then selling it, investors now use the term even if they plan to hold onto the property after remodeling. Knowing what you will do with the property will help with your decision-making process in the later stages.

For example, if you plan to buy a fixer-upper to start an Airbnb business, you need to make sure you have enough budget for remodeling and furnishing. Meanwhile, for those who plan to resell the property or rent it out as a bare unit, foundational repairs, upgrades, and some cosmetic fixes may be enough.

Step 4: Secure Your Funds

If you plan to pay using financing, you may have an easier time buying a property if you get pre-approved for a mortgage before you start searching. Especially in a hot market, sellers are more likely to accept offers from buyers who are either paying with cash or have proof that they can afford the property with a loan. Getting a pre-approval letter will also help smoothen the closing process later on.

Step 5: Set the Right Price

The only time you will start making money is when you either resell the house you flipped or rent it out. When reselling, you need to make sure that the price you set is competitive against similar houses for sale, or your listing will stay on the market for a while. As for the rent, it should be close to how much other properties with similar features charge while making sure that it generates a positive cash flow.

If you have used a real estate investment tool like Mashvisor from the start, you should already have an idea of how much the property will sell or rent for. But if you have not, it’s not too late to start. Instead of driving around doing comparative analysis, you can still use our website to look up similar properties and their performance metrics.

Use Mashvisor’s analytics data to find the best locations for flipping houses in Florida.

Best Places for Flipping Houses in Florida

These are the best places to flip houses in Florida based on potential returns according to Mashvisor’s latest analytics. We then sorted the order starting from the lowest median property price.

Located in Citrus County, the community of Citrus Springs has a population of 10,246. It has low crime and mild winters. And though homes in this area are affordable, landlords renting out their property here earn a solid 4% cash on cash return, on average. As part of Citrus County, Citrus Springs is home to natural springs, breathtaking landscapes, and marine animals. Property prices in this community start at $77,000, with potential returns going up to 13%, according to our Airbnb analysis.

1. Orlando

- Median Property Price: $426,921

- Average Price per Square Foot: $256

- Days on Market: 72

- Traditional Rental Income: $1,699

- Traditional Cash on Cash Return: 2.72%

- Price to Rent Ratio: 21 (high)

- Airbnb Rental Income: $2,219

- Airbnb Cash on Cash Return: 1.53%

- Airbnb Daily Rate: $122

- Airbnb Occupancy Rate: 49%

- Walk Score: 43

Flipping houses in Orlando is especially lucrative for BRRRR investors as it is considered one of the best places to buy a rental property. Its economy is stable, thanks to its world-famous tourist attractions, such as Walt Disney World, and fast-growing industries that keep residents employed. At the time of writing, homes for sale in Orlando start at $55,000, which can generate cash on cash returns ranging from 5% to 9%.

2. Tampa

- Median Property Price: $618,291

- Average Price per Square Foot: $337

- Days on Market: 54

- Traditional Rental Income: $1,992

- Traditional Cash on Cash Return: 2.49%

- Price to Rent Ratio: 26 (high)

- Airbnb Rental Income: $2,505

- Airbnb Cash on Cash Return: 2.16%

- Airbnb Daily Rate: $159

- Airbnb Occupancy Rate: 50%

- Walk Score: 48

Tampa has always been one of the best places for flipping houses in Florida. Its local economy is strong, with a lower unemployment rate and higher job growth than the national average. Thus, the demand for housing remains robust in this area. Even though the median property price in the city is high, you can find fixer-uppers for as low as $78,000. Buying a house like this can generate good cash on cash return of up to 20%.

3. Crestview

- Median Property Price: $369,037

- Average Price per Square Foot: $198

- Days on Market: 52

- Traditional Rental Income: $1,373

- Traditional Cash on Cash Return: 2.40%

- Price to Rent Ratio: 22 (high)

- Airbnb Rental Income: $3,792

- Airbnb Cash on Cash Return: 7.66%

- Airbnb Daily Rate: $120

- Airbnb Occupancy Rate: 77%

- Walk Score: 57

Crestview is a city in Okaloosa County, with a population of 27,134. It once made the list of USA Today’s Fastest Growing Cities in the United States. The city’s 29% population growth since 2010 created opportunities for both small and large businesses to prosper. Most of the visitors traveling to the city are there to see their loved ones who are stationed at the Eglin Air Force Base, though Crestview also offers attractions for them to explore.

4. Jacksonville

- Median Property Price: $322,052

- Average Price per Square Foot: $195

- Days on Market: 81

- Traditional Rental Income: $1,300

- Traditional Cash on Cash Return: 2.34%

- Price to Rent Ratio: 21

- Airbnb Rental Income: $2,101

- Airbnb Cash on Cash Return: 3.42%

- Airbnb Daily Rate: $154

- Airbnb Occupancy Rate: 52%

- Walk Score: 33

Jacksonville’s economy continued to do well despite the ongoing pandemic. This has resulted in people moving into the city, which continues to make it one of the best places in Florida to flip houses. Unlike Orlando, Tampa, and Miami, houses remained affordable in Jacksonville. House flippers can find a fixer-upper for as low as $51,000, which our Airbnb calculator estimates can generate up to an 18% return.

The one challenge, however, is that short-term rentals are only allowed in two zones. However, you can get around the restriction by renting out your residential investment for 30 days or more, in which you will get bookings from remote workers looking to do their jobs from anywhere.

5. Middleburg

- Median Property Price: $488,778

- Average Price per Square Foot: $240

- Days on Market: 78

- Traditional Rental Income: $1,548

- Traditional Cash on Cash Return: 2.10%

- Price to Rent Ratio: 26 (high)

- Airbnb Rental Income: $3,964.86

- Airbnb Cash on Cash Return: 7.31%

- Airbnb Daily Rate: $169

- Airbnb Occupancy Rate: 68%

- Walk Score: 39

The community of Middleburg is an unincorporated area located southwest of downtown Jacksonville. Residents have enjoyed living in the quiet area, though its population has slightly decreased (<1%) over the last 10 years. However, people looking for a more serene community while being close to big cities are likely to move here. This is the perfect place to buy Airbnb property, especially for beginner investors.

6. Miami

- Median Property Price: $795,968

- Average Price per Square Foot: $519

- Days on Market: 141

- Traditional Rental Income: $2,931

- Traditional Cash on Cash Return: 1.94%

- Price to Rent Ratio: 23 (high)

- Airbnb Rental Income: $3,982

- Airbnb Cash on Cash Return: 2.38%

- Airbnb Daily Rate: $239

- Airbnb Occupancy Rate: 60%

- Walk Score: 23

Many investors recommend flipping houses in Miami because of its abundance of foreclosures. According to ATTOM Data Solutions’s January 2022 Foreclosure Market Report, the city had one of the newest REOs added at 113. It also had one of the worst foreclosure rates in January, with one out of 2,731 housing going into the process. The figure was a 242% increase from a year ago.

Despite the strict Airbnb regulations in Miami, it is still possible for you to invest here, provided that you buy a property in the correct zone.

7. Fort Lauderdale

- Median Property Price: $1,122,716

- Average Price per Square Foot: $535

- Days on Market: 123

- Traditional Rental Income: $3,504

- Traditional Cash on Cash Return: 1.62%

- Price to Rent Ratio: 27 (high)

- Airbnb Rental Income: $4,095

- Airbnb Cash on Cash Return: 1.27%

- Airbnb Daily Rate: $279

- Airbnb Occupancy Rate: 55%

- Walk Score: 47

In the past few years, Fort Lauderdale has become a popular location for flipping houses in South Florida. With a significant number of distressed properties for sale and an increase in people moving in, home flippers will have an easy time finding a fixer-upper and then selling or renting it out. While the median property price is above $1 million, homes for sale in Fort Lauderdale actually start at $85,000. Buying a home at this price can generate a 2% to 3% return.

Find Your Next Fixer-Upper in Florida Using Mashvisor

Flipping houses in Florida is an excellent way to make a quick profit, especially if you are a beginner who needs to build capital. Because of growing job opportunities, the Florida real estate market has been hot, making it easier for you to find a buyer or tenant. But this does not mean you should just find the cheapest property in the state and flip it. Wherever you decide to invest, you need knowledge, careful planning, and a good understanding of the strategy involved to succeed.

Aside from gaining skills, having a real estate investment app such as Mashvisor helps. We have made it our mission to empower investors, both beginners and veterans alike, to find and analyze properties without leaving their homes. With over 450,000 properties sourced from the MLS database as well as up-to-date analytics, investors who have used our software finish their research in 15 minutes. To access our real estate investment tools, click here to sign up for a 7-day free trial of Mashvisor today, followed by 15% off for life.