Soon after assuming office, President Joe Biden issued several executive orders, agency directives, and presidential memoranda. As part of these directives, the President asked the Department of Housing and Urban Development (HUD), the Department of Veteran Affairs (VA), and the Department of Agriculture (USDA) to extend their foreclosure moratoriums for USDA, VA, and FHA insured loans to at least March 31, 2021.

When the moratorium eventually expires, many homeowners will still be unable to pay off their mortgage payments. As a result, it is expected that numerous foreclosed homes for sale will hit the market this year. This will present a great opportunity for investors that are prepared to grab a good real estate deal.

To learn more about how Mashvisor can help you find profitable investment properties, schedule a demo.

How to find foreclosed homes for sale

There are several places where you can find foreclosed homes for sale:

- Work with a real estate agent – If you don’t have any experience buying foreclosures, it would be wise to hire a real estate agent for assistance and guidance. With an agent, you will find real estate deals listed on the Multiple Listing Service (the MLS).

- Major bank websites – Banks usually list their foreclosures for sale online. This includes CitiBank, Bank of America, and Wells Fargo, among others.

- Subscription sites – When you pay a monthly subscription fee on sites like Foreclosure.com and RealtyTrac, you get access to numerous foreclosed homes for sale that cover most of the US housing market. This includes investment properties that are already foreclosed, as well as such that are pre-foreclosed.

- Government websites – Real estate investors can find foreclosed homes for sale on government sites like HUD.gov, HomeSales.gov, Resales.usda.gov, HomePath.com, and HomeSteps.com. You can also visit the Department of Treasury website to see a listing of properties repossessed by the Internal Revenue Service (IRS).

- Auction houses – Though auction sales are very competitive, you can still get a good deal. Popular auction companies include Bid4Assets, J.P. King, Auction.com. and Williams & Williams.

- County records – Foreclosure details are usually filed with county offices. Interested buyers can check the county websites or visit the offices physically.

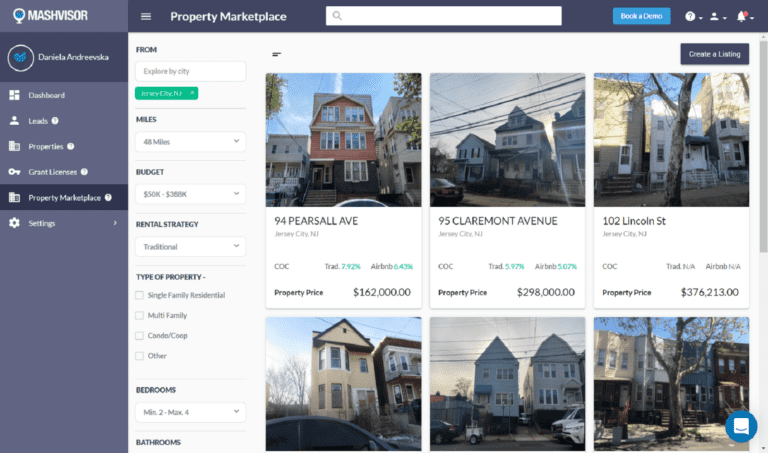

- Mashvisor Property Marketplace – When wondering how to find foreclosed homes for sale, keep in mind that the Mashvisor Property Marketplace is a one-stop shop for all kinds of off market properties. This includes foreclosed homes, short sales, bank owned homes, auctioned homes, and even tenant-occupied rentals. To narrow down listings to fit your criteria, you can use filters like location, budget, rental strategy, property type, number of bedrooms, and desired cash in cash return. Contact details of current property owners are readily available on our online marketplace.

You can find good deals on foreclosed homes on the Mashvisor Property Marketplace

To start looking for and analyzing the best investment properties in your city and neighborhood of choice, click here.

How do you identify a good deal when buying foreclosed homes for sale?

Just because a foreclosed home is being sold below market value doesn’t mean that it’s a good deal. Some can turn out to be nightmares in the long term.

Here are some things to consider when purchasing foreclosed homes for sale:

1. Environmental issues

Environmental due diligence is very important when buying foreclosed homes for sale. This involves checking for things like groundwater or soil contamination beneath the home as well as for the presence of hazardous building materials like lead-based paints and asbestos. Get the home inspection done professionally to be sure that the environment is suitable for investment and will not compromise your long-term positive cash flow.

Related: What Makes Buying a Foreclosed Property Risky?

2. Condition of the home

Homeowners that have defaulted on their mortgage payments usually don’t have money to spend on maintaining their properties. As a result, foreclosed homes are usually in a bad shape. In addition, banks and other financial institutions that sell such homes rarely make repairs. Therefore, buying a foreclosed home means that you are likely to get the income property as is. To be sure you are getting a good deal as a savvy real estate investor, stick to foreclosure sales that allow you to inspect the property before bidding. If the repair costs are too high, then the home might not be a viable investment.

3. Real estate title

The condition of the title is as important as the physical condition of the home. If you buy property with unpaid HOA fees, utilities, contractors, municipal assessments, or property taxes, you will have to settle those payments yourself. Therefore, before placing a bid, conduct a title search with a title company or at the county courthouse.

Related: 4 Risks of Buying a Foreclosed Home and How to Mitigate Them

4. Return on investment

The main aim of buying a foreclosed home should be to generate a good return on investment (ROI).

So how can you tell if an investment property is profitable?

By conducting an investment property analysis using Mashvisor’s investment property calculator. Also known as the rental property calculator, this tool uses the most up-to-date trends and data for its analysis. This calculator measures return on investment in terms of cash flow, cash on cash return, and cap rate. It also provides real estate comps and the optimal rental strategy (traditional or Airbnb).

5. Zoning laws

All foreclosed homes for sale fall within a zoned area which has laws that control how homes are built or used. The previous homeowner might have made additions or modifications to the original home which violate the zoning laws. If those get discovered, the local authority will demand that the home be restored to a state that complies with its zoned classification. To avoid such problems, always check if the property you are considering is compliant with zoning laws.

6. Property valuation

Knowing the value of a foreclosed home will help you determine what a fair asking price would be. If you type the phrase ‘How much is my home worth?’ on Google, you will see a wide range of home value estimators. Tools from Zillow, Redfin, Remax, and other sites will give you an idea concerning the fair market value of a foreclosed home. Alternatively, you could ask a real estate agent to conduct a comparative market analysis (CMA). However, the best option would be to hire a professional appraiser who will evaluate:

- The property – Characteristics of the home, including the land it sits on and improvements made.

- The market – Real estate market analysis of the state, city, and neighborhood where the property is located.

- Comparable properties – Listings, sales, cost, vacancies, depreciation, and other factors affecting similar homes in the market.

Alternatively, if you want to make your real estate investment decisions based on industry-leading data and analytics, you can use Mashvisor. Simply enter the address of the foreclosed home for sale to get access to real estate comps. You will see MLS listings in addition to off market properties in the area. Find the closest in terms of characteristics to the investment property that you are contemplating. Then make sure that you pay below market value for your property as that’s a main benefit of investing in foreclosures.

Related: What Are the Main Property Valuation Methods?

Conclusion

Is it dangerous to buy a foreclosed home? No, investing in foreclosed homes for sale is not risky if you do your due diligence. Now that you’ve read through our tips, you are much better prepared on how to analyze real estate deals with regards to foreclosed homes. To find a profitable foreclosed property to invest in, sign up for Mashvisor now.