Across America, collecting rent has suddenly become a pressing issue for landlords. What was always a difficult part of every rental property investor’s job has suddenly become critical to survival. Political headwinds are blowing hard against landlords. Negative stereotyping of property owners has been part of the rental property business for ages, but now it is en vogue. Into this new reality falls guaranteed rent.

Guaranteed rent has had more than one definition, but we don’t intend to parse words in this story. To us, guaranteed rent means what it says – a guarantee that a landlord will collect the rent due to them. Legally-binding real estate contracts with tenants are no longer enough in many cases. Therefore, guaranteed rent is a hot topic.

Guaranteed Rent – Not a New Concept

The idea of a rental property owner being guaranteed rent is not new by any means. The American government began formally guaranteeing rent as far back as the Great Depression. The term “Section 8,” known to all landlords, dates back to the eighth section of the 1937 Housing Act. This law opened the door to the federal government paying local housing authorities to provide low-income housing.

In 1974, the law shifted. From this point until the present day, the law has been and is a federal program to guarantee a landlord at least a majority of the rent due from a tenant. The original idea was to subsidize a segment of the local community’s poorest residents so that they would not spend more than a certain percentage of their available income on housing. In practice today, there are entire communities where the rental units are nearly all “Section 8” units. As history shows, the government has long been a provider of guaranteed rent in America.

Related: Are Section 8 Rentals a Good Real Estate Investment Opportunity?

Deferred Rent and Cancelled Rent – New in Many Ways

In the modern era, the global COVID-19 pandemic has changed the game in the rental property business. The federal government, as well as many states, passed sweeping new laws that inhibit landlords from the collection of legally-due rent. Eviction moratoriums, harsh restrictions on demand notices, and new rules regarding credit reporting have taken away the few tools rental property business owners had.

Incredibly, states including the Commonwealth of Massachusetts are considering rent cancellation. Even retroactive rent cancellation is being discussed. Far from guaranteed rent, both the federal and local governments are teaming up to take away rent from landlords through what would appear to be unconstitutional new laws.

Related: What to Do With a Tenant Not Paying Rent

Guaranteed Rent – Insurance Products That Help Investment Property Owners

The new definition of guaranteed rent is a product that an insurance company provides to a landlord insuring them from a tenant not paying rent for a fee. The rent guarantee product is simply an insurance policy. Under certain conditions, if the tenant does not pay the rent, the rent guarantee product will make up the lost rent. Simple in concept, but is it simple in execution?

Policies we looked at come with some conditions. For example, the insurance company will require that the tenant be professionally evaluated for creditworthiness (are you seeing dollar signs yet?). Also, there is a waiting period. Typically, one month is the minimum time that the policy will make a landlord wait. So, the policy does not cover the first month of lost rent. While there is more fine print, these two qualifications seem to be the most common.

Related: 10 Types of Insurance for Real Estate Investors

Of course, a landlord needs to conduct a cost-benefit analysis of a guaranteed rent policy. Given that the policy will have a month with no coverage and that the policy comes with some fees, the policy cost only adds to the downside to the policy. If the policy had a cost equivalent to “one month’s rent,” would that policy’s total cost be too high for a landlord to accept? How much could be recouped if the tenant was in the unit for say, five months without having paid rent? Like all insurance policies, you are betting against yourself by signing up. However, unlike most rental property expenses, this one comes with an upside.

One thing that can help tip the balance toward making a rent guarantee policy worthwhile is legal coverage. Just covering the lost rent really only solves half of a landlord’s problem. The tenant must also be removed to make space for one that will honor a legal contract. That can be a costly legal process. SteadyMarketplace.com says that there are 2.2-million tenant-landlord court cases filed every year. Guaranteed rent policies can help with these costs.

Rent Guarantee Schemes

A subset of guaranteed rent is what is termed a rent guarantee scheme. This is a property management agreement in which a property manager guarantees the landlord rent. The way it works is this. The property manager takes on a more active roll in vacancy fulfillment. They screen tenants and fill the unit. They then charge the rent they wish to receive and guarantee the landlord a fixed (lower) amount each month, whether the tenant pays or not. This model is currently popular in Europe and is migrating to the U.S.

Step Back and Consider Rent Flow Research

We’ve laid out the reasons why guaranteed rent is a hot topic right now. However, it is always a topic. One of the best ways to “guarantee rent,” is by doing the upfront work and research to ensure a property will have a reliable rent roll.

While there is no guarantee that a tenant will pay, there are steps that rental property investors take to minimize risk. There are two main ways they hedge their bets to ensure rent will be reliable. The first is proper tenant screening. There are still some tools that landlords are allowed to employ to screen tenants. For example, one can still verify the employment of an applicant. Credit checks and a fairly-employed minimum credit rating requirement are still allowable.

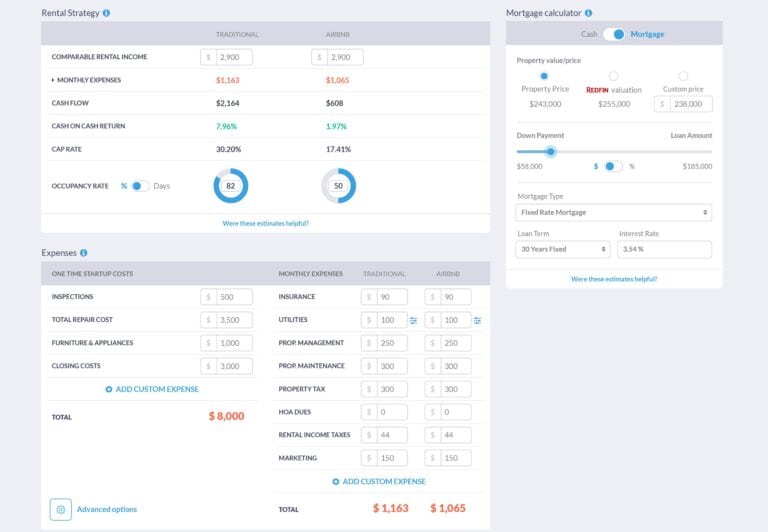

Mashvisor has tools to help an investor determine what the cash flow from a given property under consideration will be. Analyzing a rental property to ensure that the cash flow will be positive is a must. And it’s not difficult to do. Let Mashvisor leverage its data for you. Check out our rental property calculator now.

The Bottom Line

No landlord wishes to be burdened with a negative cash flow property. Rental property cash flow is the only revenue a landlord can count on to make his or her business viable. Before you purchase an apartment for rent, check out Mashvisor’s investment property calculator to see rental comps and to determine what rent rate will make it profitable. Then, check our Mashvisor’s guide to tenant screening to minimize risk. If you are risk-averse, consider a guaranteed rent policy. We are betting every landlord holding one now in a region considering rent cancellation is happy they have it.

If you have a rental unit and are interested in learning more ways to improve your business, why not sign up for Mashvisor today?