Beginner investors should learn how to do rental property analysis if they want their real estate investments to be successful.

Table of Contents

- What Is Rental Property Analysis?

- 9 Essential Factors to Include In Your Rental Property Analysis

- 4 Steps to Doing a Proper Rental Property Analysis

- Bottom Line: Rental Property Analysis

Rental properties are the most common type of real estate investment across the globe. It is because real estate investors find rental properties generally easier to manage. This is why most beginner investors choose them as the starting point of their careers.

If you want to invest in a rental property, how do you pick the right property to invest in? How do you guarantee that the property will generate enough profit to at least cover all of its expenses? This is where rental property analysis comes in.

What Is Rental Property Analysis?

Rental property analysis is the process of analyzing an investment property to determine if it’s viable for renting out. It also gives an accurate projection of how profitable it can be as an income property. With a thorough rental property analysis, you will be able to make a reasonable offer for a potential investment property. Doing so can also eliminate the risks associated with real estate investment.

9 Essential Factors to Include in Your Rental Property Analysis

When analyzing a rental property, there are several aspects, metrics, and factors that you will want to take into consideration. Some factors can directly affect the performance of an investment property. Others are used to measure its performance and calculate its returns.

Here are the most important aspects, factors, and metrics used to analyze a rental property.

1. Location

It is said that in real estate investing, location is everything. That statement is very true in almost all situations. The same can be said for the location of a rental property.

The location of an income property can and will directly affect its performance. It will help determine your marketing strategy and the types of tenants that you want to attract to the property. Investing in rental properties in a college town, for example, means that you have to target either students or teachers. Going after this demographic will allow you to get the most out of the location.

Related: Is Location the Main Determinant of Positive Cash Flow in Real Estate Investing?

2. Rental Strategy

Choosing the right investment strategy for an income property can either make or break real estate investors’ careers. Before starting to rent out your property, you must take into consideration the options that are available to you. There are two main rental strategies to use, and they both cannot work on the same property.

- Long-term or traditional rental properties

- Short-term or Airbnb rental properties

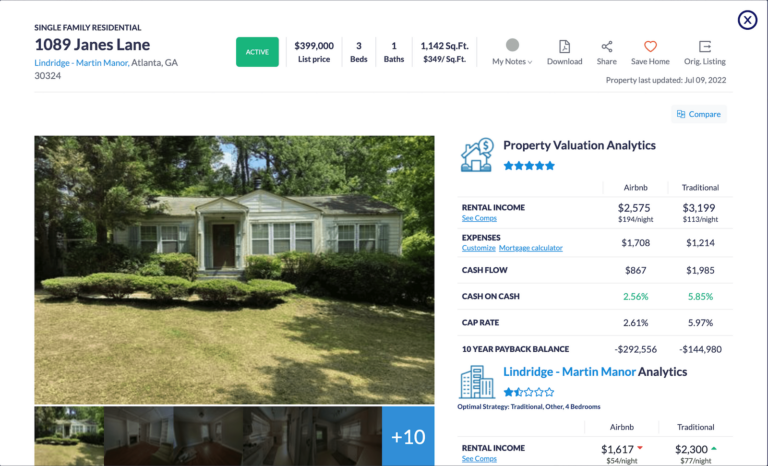

To have a better understanding of which strategy to choose, you should use Mashvisor’s rental property analysis tools. They make investment property analysis and neighborhood analysis for real estate investors a lot easier and more efficient. Using Mashvisor’s tools gives you an idea of how much return on investment a property can bring. By this, real estate investors can figure out if the property’s market value is worth spending on or not.

Mashvisor’s Property Valuation Analytics helps you decide which rental strategy is more lucrative for the listing you are viewing.

3. Property Type

When you first start learning about real estate, you do not realize the wide variety of property types that exist in real estate. There are apartment buildings, townhomes, luxury houses, condos, vacation rental homes, and a lot more. Each type of real estate property has its own advantages and disadvantages for being used as a rental property.

Knowing the type of property you’re investing in is crucial when doing comparative market analysis.

A comparative market analysis (CMA) does not necessarily take all properties in the area into account. Comparative market analysis should only include properties that are similar to your property, which includes the type of the property, as well as its size, age, and other features. These are also known as real estate comparables or real estate comps.

4. Target Tenants

The tenants are the heart and soul of every rental property. A tenant is an individual who pays a monthly/weekly/daily rent to reside on your income property. Perhaps, the most attractive aspect of rental properties is that tenants are the ones paying off your mortgage and other related expenses.

However, not all tenants are alike. There are different types of tenants and they have different needs and preferences. You need to know what type of renter is ideal and common in your chosen location so you can tailor your marketing techniques and home design to suit their needs.

5. Rental Income and Cash Flow

The rental income of an investment property is how much rent you get from your tenants on a regular basis. The cash flow, on the other hand, is the amount of actual profit or loss that the property is generating.

The cash flow of an income property is one of the main indicators of its profitability. It can either be positive or negative, depending on how much money you’re making or losing. To calculate the cash flow, we simply take the rental income value and subtract all the costs and expenses that apply to the property from that value.

With Mashvisor’s rental property cash flow analysis, investors can obtain the rental income and cash flow values for listed properties.

6. Vacancy and Occupancy Rates

The vacancy rate of a rental property is the percentage of time each year that the property is vacant. The occupancy rate is, as you might’ve guessed, the percentage of time that the property remains occupied.

In an ideal situation, the occupancy rate of a property should be 100%. This dream scenario would allow you to generate a very good profit from the property’s rental income throughout the year.

The vacancy rate is typically considered and calculated as an expense. To get the property’s cash flow potential, you need to figure out your rental income and subtract all other expenses. Then you multiply the amount by the vacancy or occupancy rate to get the property’s cash flow. You can use a rental property analysis calculator like the one Mashvisor has to speed up the process.

7. Cap Rate

The cap rate is a metric used to calculate the return on investment of an income property based on its current market value.

The formula for calculating the cap rate is as follows:

Cap Rate = (Net Operating Income or NOI / Current Market Value) x 100

This metric is widely used by real estate investors as an indicator of the property’s profitability. The cap rate value is also expressed as a percentage. It represents how much profit you can make each year against its actual market value at that point in time.

Investors should note that the cap rate metric does not take into account the method of financing used. The formula assumes that the property was fully purchased with cash.

Related: What You Must Know About Real Estate Investment Analysis

8. Cash on Cash Return

Cash on cash return is another metric for calculating the return on investment of an income property. However, it is different from the cap rate in that it takes into consideration the method of financing. It does not just take into account the property’s market value or make assumptions that it is an all-cash transaction. To be more precise, cash on cash return only takes into account the actual cash invested in the property’s purchase.

Generally, most investors take out loans to purchase investment properties. For instance, an investor can only afford to pay 20% of the property price in cash. He or she takes out a loan to pay for the rest. Cash on cash return will only use the 20% out-of-pocket money to compute the property’s profitability.

The formula for calculating the cash on cash return is as follows:

Cash on Cash Return = (NOI / Cash Invested) x 100

The cash on cash return represents how much money you can make each year against the amount of cash invested. This metric is also expressed in percentage, just like the cap rate.

If you own or manage several properties, you can create your own rental property analysis spreadsheet. This will allow you to compile all information and do the calculations automatically. Check out our guide on how to make a spreadsheet for rental property analysis here.

Depending on your investment strategy, you may also use a rental property or Airbnb calculator. This will help you get a more accurate computation on your ROI and revenue.

Related: Cap Rate vs. Cash on Cash Return

9. Comparative Market Analysis

To make an accurate assessment of a rental property, investors should compare it with other similar properties in the area. It’s not enough for investors to know what the property’s market value and cash on cash return are. A comparative market analysis is used to compare properties to other similar properties in a market to see how well they are performing. For this type of real estate analysis, real estate comps and rental comps are used for greater accuracy.

By using a CMA, investors can determine which properties have the highest return potential in a market by comparing all the different values and metrics.

For example, you do a comparative market analysis and you discover that the average cap rate for that market is 4%. It is safe to say that properties with a 7% cap rate are performing well above the market average.

Mashvisor provides investors with neighborhood analytics that can help you conduct comparative market analysis with ease.

To learn more about how Mashvisor can help you find profitable investment properties, schedule a demo.

4 Steps to Doing a Proper Rental Property Analysis

For real estate investors wanting to know how to do a proper rental property analysis, we have outlined the steps for you:

Step 1: Make a Neighborhood Evaluation

As we already mentioned earlier, location plays a crucial role in a rental property’s success. For this reason, one should look closer into a neighborhood before making any decisions. Knowing if a city is performing well is just the start. Each city is made up of different neighborhoods and districts and each of them varies in performance. Investors then have to identify which neighborhoods are worth investing in.

To do this, you will need to evaluate and assess the neighborhoods you are considering. Ideally, investors should pick neighborhoods that aren’t just good but highly desirable. As an investor, you will need to filter the good neighborhoods from the bad ones. Here are a few things to consider:

- Accessibility to public transportation

- High walk score

- Reputable public and private educational institutions

- Accessibility to public amenities, such as parks and libraries

- Shopping and dining options

- Business establishments

- Cleanliness and safety

Generally, tenants are looking for the above-mentioned factors. Neighborhoods that offer these things are very likely to be more in demand compared to those that don’t.

A clean and visually appealing neighborhood also attracts more tenants. While you can improve any property’s curb appeal, if it belongs in a poorly maintained neighborhood, it will not attract as much attention. That said, it is best to avoid neighborhoods that:

- Have plenty of distressed and vacant properties

- Have plenty of closed shops and business establishments

- Have poorly maintained streets and public amenities

- Are noisy and disorderly

While properties in such neighborhoods are generally cheaper, they are not ideal for attracting tenants for your rentals.

Step 2: Look for Similar Rental Properties

Once you have found a good neighborhood that you’re comfortable with, it’s time to find out how rental properties in the area are performing. Specifically, those that are similar to what you have in mind. For instance, if you plan to buy a townhouse complex, you should look at how townhouses are performing as rentals.

These similar properties are what you call real estate or rental comps. These comparables will help investors determine rental rates for their properties. They can also use these comps to find out what the occupancy rate and cash on cash return rates are in a given neighborhood. Investors should take note that they cannot just use any type of property as rental comps. The properties to be considered should be very similar to what they plan to purchase. Ideally, comps and the subject property should have the following similarities:

- Property size in square feet

- Number of bedrooms

- Number of bathrooms

- Condition (brand new, refurbished, distressed, etc.)

- Amenities

- Days on market

To come up with a fairly decent rental property analysis, investors should have at least three rental comps. To find them, you may get in touch with a local real estate agent or property manager. Or you can simply use a real estate website like Mashvisor to look for these properties.

Step 3: Compute the Per-Square-Foot Rental Rate

As mentioned above, one of the main considerations in finding rental comps is the property size in square footage. This basically just pertains to the amount of liveable space in the property expressed in square feet.

When you already have a prospective property in mind and at least three rental comps, you can compute the square footage rate easily. All you need to do is find the average rental rate per square foot of the three properties to determine how much you can charge. While there’s no real rule of thumb to this as the rates vary throughout the country, it is an easy way to determine the reasonable rates in a neighborhood.

Take note, though, that certain amenities could potentially increase your rental rates, like a jacuzzi, a sauna, or a pool. If your desired property has a pool and the rental comps do not, it is safe to assume that the property you’re considering will have higher rates compared to the others.

To see whether a subject property is truly worth investing in, you can take the average rental rate per square foot and multiply it by the size of other available properties. This should give you a better insight into the neighborhood you’re looking into.

Step 4: Adjust Your Rental Rates Accordingly

Once you’ve already figured out what the general rates are in the neighborhood, you may now make the necessary adjustments according to your goals. If you choose your rental comps well, you should get a very close estimate of the reasonable neighborhood rates. You will only need to make some minor tweaks here and there to satisfy your investment needs.

As mentioned earlier, certain amenities can make your rates go higher. You also need to consider the occupancy rate in the neighborhood. Ideally, you should look into neighborhoods that have an above 50% occupancy rate. Depending on the actual occupancy rate, you can adjust your rental rates to attract more tenants. This is especially useful for vacation rental properties.

Bottom Line: Rental Property Analysis

Rental property analysis is a crucial step for your investment. When done correctly, investors can greatly reduce or even eliminate any risks associated with investing in an investment property. It gives investors greater confidence that the property will be profitable. A rental property analysis also helps investors carefully plan and prepare for different scenarios and contingencies. It lets you, as an investor, maximize your profits and optimize them for your type of investment.

Searching for rental properties has never been easier. Using Mashvisor, you can now easily search for rental properties and obtain all the necessary data related to these properties. It can save you months of research and analysis. You can now find the best property in the most ideal location according to your goals within minutes.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.