High income properties attract more real estate investors, whether they’re new or experienced ones, because of their income-generating potential.

A lot of investors see the wisdom in investing in high income properties as they’re a smart strategy to build wealth and equity. Such properties offer significant returns and generate enough cash flow through rental income. High income properties come in several forms, such as apartment complexes, commercial real estate, and single family homes in highly profitable neighborhoods.

Table of Contents

- What Type of Investment Property Generates the Highest Income?

- 5 Characteristics of a High Income Rental Property

- How to Find High Income Properties in Any US Location

One of the primary benefits of investing in high income properties is that they make for a great and steady regular income stream. However, you must do your due diligence before investing in a high income property, or any type of investment property, for that matter. It ensures that property helps you achieve your investment goals and aligns with your risk tolerance.

In this article, we will talk about investment properties with high income potential and the features and characteristics that make for a high income property. And finally, you will discover how to find high income properties in the US using Mashvisor’s Market Finder tool.

What Type of Investment Property Generates the Highest Income?

Investing in rental properties is one of the most popular ways to generate income. Rentals are very attractive for both novice and experienced investors. However, not all rental properties are created equal, and some investment property types earn more than others.

Here, we will take a closer look at investment properties that generate the highest income, especially rental properties.

Before we dive any further, it’s important to understand the two main types of rental strategies: long term rentals and short term rentals.

Long term rentals are rented out for an extended period of time, typically six months at least. They are a lot more common as those who cannot afford to buy a home or take out a loan choose to rent instead. Long term rental properties make for a more stable income source as you can expect a fixed amount to come in regularly, thanks to a long-term lease agreement.

Such properties require less management and maintenance work compared to short term rentals. It makes them a more passive income source since you’re not involved a lot.

Short term rentals, on the other hand, are properties rented out for shorter periods, typically from a few days to a few weeks. Such properties can give investors higher rental income compared to long term rentals.

The downside to owning short term rental properties is that they need more hands-on management and are far less stable in terms of rental income compared to long term rentals. It is because occupancy rates fluctuate based on the season and market demand.

Now that we know the two types of rental properties, let’s explore the types of investment properties that generate the highest income.

Multifamily Properties

Multifamily properties are property types like apartment complexes and duplexes. They are a popular choice for investors who are looking to earn more on a single purchase. Their advantage over single family units is they can provide economies of scale, as multiple units can be rented out to multiple tenants simultaneously.

In some cases, multifamily properties can be quite easier to manage than single family homes, especially if you’re working with a property manager.

Vacation Rentals

Vacation rental properties are homes like beach houses and cabins. Such types of investment properties can generate higher rental income, especially during peak travel seasons. However, vacation rentals also require more attention than long term rentals, mainly because they need to be cleaned and prepared for every booking.

One disadvantage is they are susceptible to seasonal fluctuations. They get higher traffic during peak season, but it dramatically drops in the off-season.

College Rentals

College rentals are apartments and homes located near universities. Such types of rental properties are lucrative as long as you’re willing to put in the work. However, college rentals can also be challenging to manage, as tenants are usually on the move and turnover can be higher.

Single Family Homes

Single family homes are a good passive source of rental income, especially when used as a long term rental. However, they also work well as a short term rental property.

While single family units may not generate as much rental income as multifamily properties, they are a lot easier to manage and require far fewer maintenance tasks.

Additionally, single family homes tend to appreciate over time, allowing you to get a good return on your investment and build equity.

Commercial Rentals

Commercial rentals are retail spaces or office buildings. Such types of rentals can generate high rental income for those who are willing to take on the additional risk and management responsibilities. Commercial rentals need more maintenance and tenant management, but they also provide longer lease terms and higher rental rates.

5 Characteristics of a High Income Rental Property

Here are five characteristics of a high income rental property to help you identify opportunities with the potential for greater returns.

1. Strong Location

One of the major factors that will determine a rental property’s income-generating potential is its location. If you want an investment property that will optimize your investment, look for properties in desirable neighborhoods or areas with high demand for rental units. Such areas are more likely to give you rentals that generate a higher income.

You should also look at a property’s proximity to important amenities, such as public transportation, shopping centers, and recreational facilities. The said factors can influence the potential for long term tenant retention and rental income.

As a real estate investor, you should take the time to study and research the local real estate market and trends. It will give you a better idea of what your earning potential is.

Related: 40 Best Places for Buying Investment Property in 2023

2. Low Vacancy Rates

Another key metric to look for is vacancy rates. Ideally, you should look for properties in areas with low vacancy rates. A vacant property will make a huge dent in your bottom line as it does not generate any rental income but will still cost you with upkeep.

You should evaluate the property’s historical vacancy rates and consider the local rental market to determine the potential for tenant retention. Also, putting a strategy in place to minimize vacancy periods will help a lot. Offering incentives to your current tenants for lease renewals or investing in property upgrades that may attract new tenants is a good place to start.

3. Positive Cash Flow

Positive cash flow is essential in a rental property business, especially if you want to build wealth.

A rental property with positive cash flow is characterized as providing a higher rental income compared to the expenses of owning and operating one. So, if you want to get a good ROI and earn a decent profit, the property’s cash flow should be greater than its total monthly expenses. The expenses include mortgage payments, property taxes, insurance, and maintenance.

For this reason, you should always perform a thorough analysis of the property’s cash flow potential. You should take into account all income and expenses related to owning and operating it as a rental property. You should also consider future rent increases and appreciation, as they can further boost your property’s income potential over time.

4. Low Maintenance Costs

Owning and operating a rental property requires regular maintenance and repairs. However, properties with lower maintenance costs offer greater potential to increase your income. It is because you don’t need to spend much on upkeep and repairs.

For example, if your property comes with new or updated systems like heating, plumbing, and electrical, it will not be as high-maintenance as ones with outdated utilities.

5. Favorable Financing

Lastly, favorable financing terms also contribute to properties earning a higher income. Good financing helps real estate investors to maximize their return on investment. Lower interest rates, more flexible repayment terms, and lower down payments can all make a huge difference to your bottom line.

Ensure that you evaluate the many financing options at your disposal. It’s also in your best interest to work with a lender with experience in real estate. They can craft the best loan program that matches your investment goals.

You should always take into account how financing can affect your investment property’s overall cash flow. Consider factors such as monthly mortgage payments and interest rate fluctuations.

Related: How to Get the Best Mortgage Rate for Investment Property in 2023

How to Find High Income Properties in Any US Location

Buying investment properties is an excellent way to generate passive income and build wealth and equity over time. However, it can be hard to find the right properties, especially if you don’t know much about real estate markets.

Below is a step-by-step guide to finding high income properties in any location of your choice.

Step 1: Define Your Investment Criteria

Before you go out looking for high income properties, it’s important to define your investment criteria first. It includes:

- Coming up with a budget you can afford;

- Identifying a desired location;

- Having a type of property in mind (such as single-family homes or multi-unit buildings); and

- Projecting your return on investment.

By having clear investment criteria, you can narrow down your search to focus only on properties that meet your specific investment needs and goals.

Step 2: Research the Local Real Estate Market

Once you’ve already defined your investment criteria, it’s time to dig deeper into potential real estate markets. It includes evaluating market trends, such as home prices, rental rates, and occupancy rates.

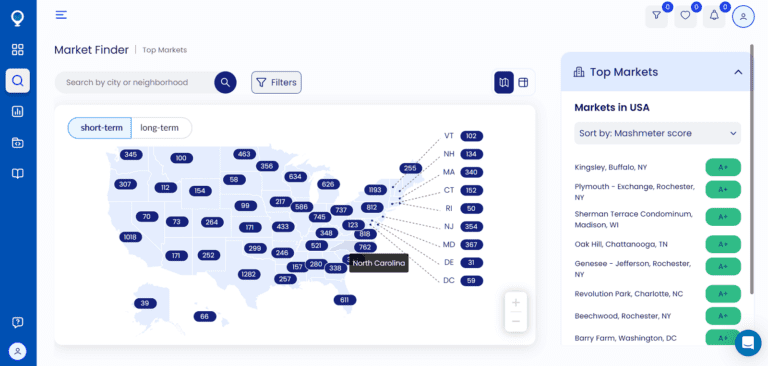

One tool that can help you is Mashvisor’s new Market Finder tool. The tool provides investors with real-time data on local real estate markets, including home prices, rental rates, and neighborhood information.

Using the Market Finder allows you to quickly evaluate the potential for profit of different markets. It makes the process of identifying areas with the potential to generate high income faster and more efficient.

The new Market Finder tool also allows you to easily compare multiple markets side-by-side and see how they stack up against each other. It lets you easily make informed investment decisions and maximize your returns. Overall, Mashvisor’s Market Finder is an essential tool for any real estate investor who wants to find high income properties anywhere in the US.

Start your free 7-day free trial with Mashvisor’s Market Finder tool to find high income properties in any US location.

Mashvisor’s Market Finder allows investors to quickly evaluate the potential for profit of real estate markets across the US.

Step 3: Identify High Income Neighborhoods

After evaluating your preferred real estate market, what comes next is identifying high income neighborhoods. Typically, they are high-demand neighborhoods with a track record of high rental and occupancy rates.

Mashvisor’s Neighborhood Analysis tool can help you identify high income neighborhoods in the best real estate housing markets. The tool provides data on neighborhood demographics, crime rates, and other factors that may influence the potential for high rental income.

Related: How to Find Affordable Investment Properties With Huge Potential

Step 4: Evaluate Properties

Once you’ve already identified high income neighborhoods, you must now evaluate properties. It includes taking a closer look at the property’s condition, its location within the neighborhood, and its rental income potential.

Mashvisor provides rental property analysis that can help you easily evaluate properties. The tool gives you access to data on property values, rental rates, and potential cash flow. Additionally, it gives you a breakdown of expected expenses associated with the property, such as mortgage payments, property taxes, and maintenance costs.

Step 5: Analyze Potential Returns

The final step is to analyze the potential returns of the property. It includes calculating the expected ROI, along with potential risks and challenges.

Mashvisor’s investment property calculator is a tool that can help you analyze potential returns. The tool provides data on expected cash flow, cap rate, and cash on cash return. Additionally, it provides a breakdown of expected expenses, so you can accurately evaluate the property’s potential profitability.

Final Thoughts on High Income Properties

Finding high income properties anywhere requires the right strategy and a thorough understanding of the local real estate market. By considering factors like rental market data, along with the local economy, you can easily identify high income neighborhoods with the potential for profitable rental income.

To make the process easier, you can take advantage of Mashvisor’s various real estate investment tools. Mashvisor’s tools provide real-time data on local real estate markets, property values, and rental rates, allowing you to evaluate different markets and properties quickly and efficiently.

Airbnb hosts can use Mashvisor real estate tools to ensure that they invest in the best properties available in the market. Real estate investors can use the platform to identify lucrative investment opportunities, estimate property expenses and profitability, and compare potential investments across multiple markets.

In this article, you discovered the best types of investment properties you can invest in. You were also shown the top features and characteristics of a high income property. Then, you learned how to find high income properties in any US location by making use of Mashvisor’s Market Finder.

With Mashvisor’s real estate tools, you can access real-time data on local real estate markets. It will help you to quickly assess the potential of different markets and identify areas with a high potential for generating high rental income.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.