Making money in real estate requires conducting thorough research and analysis. The first step of this process is identifying a high return real estate market. In fact, finding such markets is what allows investors to generate tremendous profits. In order to do this, you must familiarize yourself with the main characteristics of a good real estate market. So how does one go about identifying a high return real estate market? And what is the best way to zero-in on the best places to invest in real estate? In this article, we will go over the main features of good housing markets and show you how to find the top neighborhoods for investment in a few simple steps.

How to Find a High Return Real Estate Market

Spotting a high return real estate market starts with knowing what to look for, along with the right tools like an Airbnb calculator. There are several moving parts that you need to pay close attention to. This ranges from property data to the various macroeconomic factors that affect the housing market. Here are the steps that you should take when you are looking to land a high return real estate investment.

1- Check the average performance of rental properties

The simplest way to spot a high return real estate market is to simply check the average performance of rentals. This includes both traditional rental properties and short term Airbnb rentals. This will give you an idea of how each rental market is performing relative to the other options and allow you to locate high cash flow properties with ease. As for what data to focus on, you will have to look at the average Airbnb and traditional rental income in each market, the cash on cash return by city, and the cap rates by city. Where can you find this data? Here, on Mashvisor’s blog. Start here: 2020 Cap Rates by City: What Real Estate Investors Should Expect.

2- Look for positive economic and demographic trends

The local economy is a huge determining factor when it comes to the rate of return on a rental property. As a matter of fact, the best high return real estate investments are always found in cities with strong local economies. The key here is finding markets that are trending upwards in terms of every economic metric. This includes the GDP, job growth rate, and population growth among a host of other factors.

3- Assess the health of the tourism sector

A healthy tourism sector is integral to a short term rental strategy. Any high return real estate market should have a strong tourism industry that attracts a decent number of yearly visitors and bolsters the local economy. Moreover, the influx of tourists must be on a rising trend as it is essential for the long term viability of the market. However, it is important that you check local short term rental laws before investing in a particular housing market. Not all tourist hotspots are Airbnb-friendly and many of them have outright banned short term rentals.

4- Focus on cities that have a high appreciation rate

As you surely know, rental income is not your only option when it comes to generating a real estate return. Profiting off the appreciation of home values is an evergreen strategy that continues to yield good results for real estate investors. In fact, you can easily find a high return real estate market that boasts an annual appreciation rate above the 5% mark. Examples of such markets include Odessa, TX, Idaho Falls, ID, and Pasco, WA.

5- Use the real estate heatmap

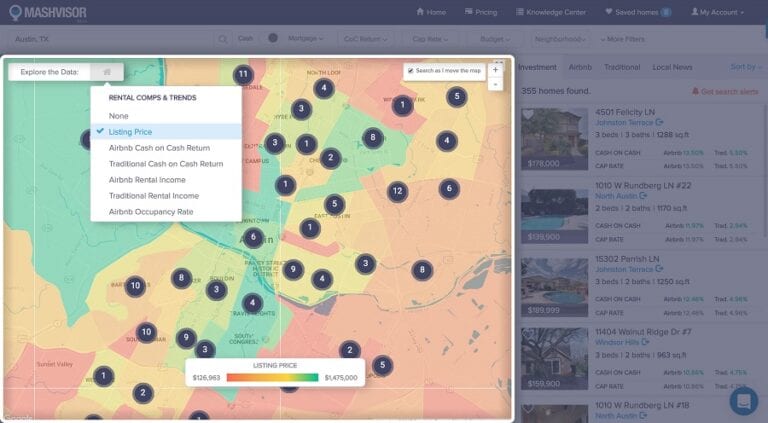

The emergence of a wide range of real estate investment software solutions has simplified a number of tasks for investors. A prime example is the process of identifying a market that can yield a good return on real estate investment. In fact, you can easily use the real estate heatmap to locate the top-performing areas in a city. This tool employs both traditional and Airbnb analytics and relies on a set of visual cues that make using the map a simple and intuitive process. Also, the tool’s filters allow you to narrow your results down to areas that have a high cap rate as well as high cash on cash return.

6– Look for areas with future development plans

One of the strongest indicators of a high return real estate market is the existence of major development plans. In fact, this usually signifies high growth potential and an overall expansion of the local market in the near future. Such markets are the safest bet you could make given the inevitable high real estate appreciation rate that will ensue as well as the increase that the tenant pool will experience. To spot these housing markets, contact the municipal planning department and inquire about future development plans in the area.

7- Identify areas with low vacancy rates

Generating consistent income from a rental property is only possible if you are able to maintain a low vacancy rate throughout the year. While this metric by itself is not enough to determine whether or not the housing market can provide high returns, it can definitely help you weed out locations that are not suited for rental strategies. So how do you get the average vacancy rate for each market? You can try the following methods:

- Analyze the vacancy rates that are provided by the US. Census Bureau. Keep in mind that such data is only available for the largest markets in the country.

- Work with local real estate agents who perform their own comparative market analysis.

- Talk to local property managers and calculate the rate yourself based on the number of unoccupied units.

- To determine the average Airbnb occupancy rate of a neighborhood, use Mashvisor’s real estate heatmap.

The Bottom Line

As you can see, there are several indicators that point to a high return real estate market. Make sure that the market you invest in meets at least a few of the criteria outlined above.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.