Do you want to know how to buy Airbnb property with no money? The fact is that the process is much simpler than it looks. Find out more here.

Table of Contents

To start with, Airbnb rental properties can be a profitable investment if you know where to look. The location of your rental property is critical to your success. However, you must remember that not all places are suitable for vacation rental investments.

If you’ve always seen yourself as a real estate investor, but you’ve never had the financial means to begin with—that, whether you believe it or not, may not matter.

Renters and landlords can become real estate investors and begin accumulating capital via home equity—even if they have little or no cash.

So, if you’re thinking about how to buy a vacation home with no money, you’ve come to the right place. Moreover, a platform like Mashvisor makes the process much easier.

Is It Worth Buying a House to Put On Airbnb?

Yes. Many people have decided to invest in Airbnb homes and have been wondering how to buy Airbnb property in recent years. Moreover, the short-term platform has grown in popularity, especially among travelers and tourist looking for a place to stay.

And why is that? We will start with some of the most important advantages of buying or owning an Airbnb property you want to rent out to guests.

1. Cultural Connections

Consider this: you can have visitors from France, Italy, Canada, and almost every other country on the planet. Think about the adventures you’ll hear about as an Airbnb host and the many cultural traits you’ll encounter.

You can welcome nations worldwide to your home if you’ve always wished to be a world traveler but didn’t have the time or money to do so. Travelers from various backgrounds and locations may come, giving you a glimpse of their respective cultures.

2. Rental Terms Flexibility

You have complete control over the renting dates. Assume you want to remove your Airbnb home from the market for Christmas. You can do it so that your relatives can stay for free throughout their vacation.

If you need to make extensive repairs, you may postpone them until after the New Year (and all the associated expenditures). You can completely control when you list, how much you charge for rent, and when you withdraw the house from the online renting list.

3. Host Security on Airbnb

Airbnb provides host protection in several countries. Leasing to strangers comes with several risks. In the case of guest vandalism, theft, or other damages, Airbnb covers up to $1 million in various locations worldwide if you are a member of their host insurance plan.

4. Free Listing on the Platform

It is free to list your real estate investment home on the website. There are no charges to pay to a listing site or other third-party websites. All you need to do is photograph the property in high resolution and upload the photos to the platform.

Write an enticing description. Moreover, include important information such as location and amenities. Also, put in the rental rates and terms, and you’re ready to move forward from there.

5. Big ROI Is a Possibility

You can make a profit on your Airbnb investment property. What is more, you will have no trouble renting out your house, particularly if you purchase in a high-tourist location. If you rent it out frequently enough, the leases can cover your mortgage, HOA charges in the region, taxes, and even the price of essential renovations.

How Much Down Payment Do You Need for an Airbnb?

A substantial down payment, usually at least 15%, will almost certainly be required to obtain the loan, as will higher interest rates.

There are various approaches to financing Airbnb homes. If you currently own a house, you may be able to take advantage of its current value by refinancing your mortgage or obtaining a home equity loan.

However, if you do not own a house or have sufficient equity to pay the purchase cost of your holiday rental, you can obtain a traditional mortgage or a hard money loan instead.

Whatever option you pick, financing your holiday property may be subject to more rigorous standards than purchasing your first. Because lenders consider investment homes riskier, you’ll need a solid credit score and a minimal debt ratio to enroll.

You may also be required to put down more funds and demonstrate that you have cash set aside to cover your mortgage during vacant periods. In addition, second-house loans often come with higher interest rates, so consider that in your expected costs.

Considering Down Payments on Properties

The sum you choose as a down payment assists a lender in determining how much money to give you and which form of mortgage is ideal for your circumstances.

But what is the ideal amount? Over time, investing too little will cost you money in fees and interest. On the other hand, too much may drain your funds or harm your long-term financial health.

You must also account for closing charges, moving expenditures, and other monthly payments. Finally, you will determine the amount you’ll front: your resources, income, and home-buying budget.

Calculating Your Monthly Payments

The home’s cost, down payment, loan length, real estate taxes, landlord’s insurance, and loan interest rate will determine your monthly mortgage amount.

When buying a home or investment property, unexpected costs may arise. However, there are few mortgage calculators for investors. Calculating monthly mortgage payments is only one part of the equation; you also need to consider other charges.

But how to calculate your monthly payments?

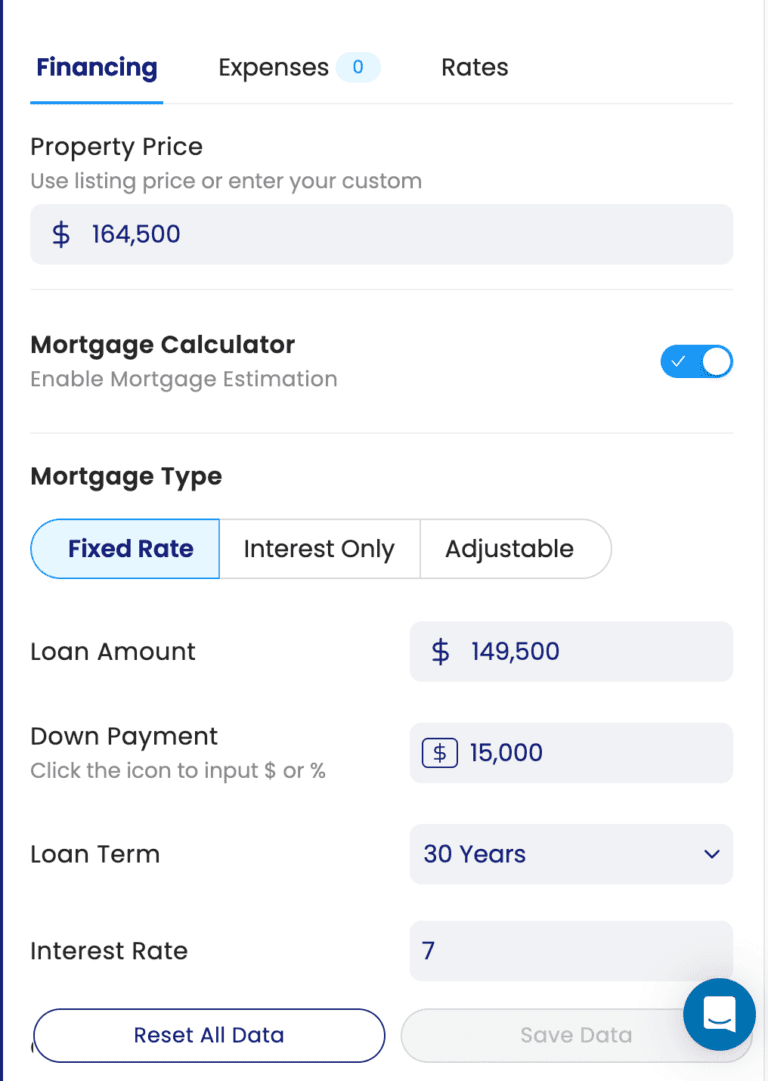

Mashvisor’s mortgage calculator comes in handy here. Here is a brief overview of how it works.

Mashvisor’s Mortgage Calculator

Mashvisor’s mortgage calculator, designed exclusively for investors, offers an approximate calculation of your expenditures. Depending on your selected investment strategy and loan size, the calculator will display your cash on cash return and cap rates in real-time, as well as the 10-year payback balance.

It is important to remember that a mortgage calculator, like every other calculator, depends on your input to assist you in making lucrative decisions. As a result, make sure you conduct adequate research and due diligence. Remember to include insurance, HOA dues, and property taxes in the costs (expenses) area.

Moreover, Mashvisor offers real estate analytics solutions for short-term and long-term rental investments. The mortgage calculator on the platform is part of the whole rental property calculator, which provides statistics on the viability of your intended investment on a single page.

In addition, the property page is often comparable to a traditional property listing page, with many high-quality photos and a property description. Moving on, you may change any parameters based on your previous analysis or requirements to observe how it affects your profitability.

You can find a lot more features on Mashvisor’s investment property calculator, but it is better if you head onto the website and try it out yourself. You will drastically minimize the time and effort it takes to conduct such an analysis.

Moving on, let’s see what is important to keep in mind when applying for loans and how to do it.

How Much Can You Afford?

A lender will inform you of the highest loan amount for which you apply when pre-approved for a mortgage, depending on the answers in your paperwork. Your mortgage application will request information about your expected down payment, earnings, job, debts, and possessions.

In addition, a lender will also obtain a copy of your credit record and credit score. All the above elements impact a lender’s choice to give you money for a house purchase, how much cash to give you, and under what terms and circumstances.

As a general rule, many potential homeowners can manage to finance a home that costs between two and two and a half times their annual income. If you make $50,000 per year, you can buy a house worth between $100,000 and $125,000.

Rather than just borrowing the highest loan amount approved by a lender, consider your expected monthly mortgage payment. So, for example, assume you’ve been accepted for a $350,000 loan.

If your monthly mortgage payment and other monthly expenses surpass 45% of your annual gross income, you may find it hard to repay your loan if circumstances get difficult. In other words, don’t buy more property than you can actually afford.

Aside from purchasing a home, you may wish to contribute to other financial targets, such as preparing for retirement, starting a family, establishing a rainy day fund, and paying the debt. Taking on a substantial monthly mortgage will eat up funds that can otherwise be used for some of the other priorities, so be careful when making the decision.

In addition to your planned Airbnb purchase, you also need to consider your overall financial standing and other financial targets, such as preparing for retirement, starting a family, building an emergency fund, and repaying debt.

In addition to your planned Airbnb purchase, you also need to consider your overall financial standing and other financial targets, such as preparing for retirement, starting a family, building an emergency fund, and repaying debt.

How to Buy Airbnb Property With No Money: Is It Possible?

Yes. Here are seven strategies for purchasing a rental property with no money down, or, at the very least, less money down. There is no such thing as a free deal, but you have several alternatives to reduce or eliminate the deposit required to buy the first investment home.

Let’s start with the different ways how to buy Airbnb property with no money.

1. Conventional Loans

Believe it or not, leveraging conventional loans could still help you buy an Airbnb property with no money. Conventional loans are mortgage loans not insured by a government agency like the FHA, VA, or USDA. If you have a high credit score and low debt-to-income ratio, this method is perfect for you.

Some conventional loans have assistance programs through grants or second mortgages. If you’re a first-time homebuyer, for instance, you might be able to get financial assistance for paying the closing costs. By combining these benefits with conventional loans, you can minimize or eliminate the financial burden in buying an investment property.

2. House Hacking

House hacking is the most convenient approach to getting your first rental property with no money. In exchange, you get free housing.

The traditional home hacking idea is straightforward: you buy modest multifamily property, live in one, and lease out the rest of the units to other people. The rent paid by your neighbors covers your mortgages and the additional cost of housing, resulting in virtually free housing.

In addition, when you leave, you maintain the property as a traditional rental home, and the income flow improves.

How will it affect your down payment? Owner-occupied buildings require a considerably lower payment from traditional lenders than property investments. Borrowers are significantly less likely to skip on their property mortgage than on a rental property loan, so it’s a clear and simple risk analysis.

Moreover, the US Federal Housing Administration runs a low-down-payment financing program that permits a 3.5% down if your credit score exceeds 580. However, an FHA loan isn’t the only choice; there are traditional mortgage programs available that need even less money down, and occasionally none at all.

Finally, remember that multi-unit homes aren’t your only choice for house hacking. Try other property hacking methods for free Airbnb housing.

3. Financing From the Seller

Sellers sometimes fund the house for you, enabling you to negotiate any loan conditions you choose. It includes the option of purchasing an Airbnb home with no money down. Seller financing works particularly well for property owners who do not have a mortgage or sellers who inherited the home and are unsure what to do with it.

Frequently, sellers are willing to accept regular payments for the home in exchange for the revenue and the convenience of a rapid settlement without having to deal with real estate agents and taxes.

However, not every seller is interested in owner financing, but most are. It’s worth investigating with them since acquiring your first property with no money down can be an efficient approach.

4. BRRRR Strategy

The BRRRR strategy is a traditional concept that demands cash up front but refunds it. The term BRRRR stands for purchase, remodel, rent, refinance, and repeat.

But how to carry out a BRRRR strategy? Well, it goes like this: you take out a purchase-rehab deal, which requires a down payment. You then rehabilitate the foreclosed property, using the purchase-rehab loan to finance the improvements.

When the repairs are completed, you refinance the home with a long-term homeowner loan and withdraw your initial capital. It works since the new landlord loan depends on the property’s increased after-repair value (ARV), not what you originally spent. Therefore, if you’ve built up enough equity, you may use it to fund your front money when you refinance.

If you’re having trouble coming up with the first down payment, consider using some of the options listed in this article to borrow the money.

Take into account that, while novices like the concept of complete funding, the BRRRR approach is best suited to more professional Airbnb investors due to the increased risk that comes with larger leverage. If you’re new to real estate investment, start with lower-risk techniques.

5. Assuming the Seller’s Mortgage

If the owner is unwilling to finance the property entirely, you may be able to figure out a way to buy a rental property with no money down with them.

You can propose taking over the seller’s mortgage and making payments on their account. You assume their (probably low-interest) loan, providing you with simply the difference to pay. Just be cautious not to trigger the current mortgage’s “due on sale” condition.

Note that when you use traditional finance to buy a property, lenders frequently refuse to let you borrow the down payment. However, in such a scenario, you are not borrowing an acquisition mortgage. Instead, you are assuming the current one and paying the difference to the owner independently.

It means you may pay them in whatever way you choose. You may borrow money from relatives and friends, use your credit card, or take out a private loan. Alternatively, negotiate a loan directly with the seller, and you got yourself a deal with no money involved.

6. Gap Financing

Gap lenders are experts at financing the down payment for your next real estate purchase. They acquire a second lien behind your primary lender and demand excessive interest and fees to compensate for their increased risk.

They often do not charge interest or place a lien on the home. In exchange for funding some or all of your down payment, they obtain a 50% ownership stake in the property.

Whatever you spend on, or in this situation, what you don’t pay, is what you receive. Gap financing may cost you a large portion of the deal, but any deal is better than nothing. If you can’t afford to do a decent deal by yourself, go to a gap lender about it.

7. Seller-Held Second Mortgage

Assume you discover a lender ready to finance 70% of the purchase cost on a landlord loan, but you lack the funds to complete the 30% down payment. Now, where can you borrow that money? Again, the seller.

It’s not like every lender will approve it, so go to your main lender first before negotiating with the seller for a new mortgage. It’s worth remembering that seller-held second mortgages are not permitted on FHA loans.

8. Partnerships

Consider friends and relatives as potential sources of funds for your “with no money” down payment. But, of course, remember that borrowing money is not your only option. For example, someone may wish to partner with you in a real estate transaction.

Consider this situation: you don’t have any cash for a down payment, but you have real estate investing experience (or the desire to grow it). On the other hand, your acquaintance has the funds for a down payment but not the time to study the ins and outs of owning rental homes.

It is an ideal situation you can be in. Your acquaintance provides the initial investment, and you offer the expertise and work.

You probably know someone who is trying to expand and invest in real estate. Moreover, who doesn’t appreciate additional, passive income? And rental homes provide more passive income than almost any other asset.

9. Leveraging Home Equity

If you own your primary residence or already have an investment property, you leverage financial tools like Home Equity Loans (HEL) or Home Equity Lines of Credit (HELOC) to buy an Airbnb property with no money. These can help you access your property’s equity and use it to pay for the partial or entire purchase cost of an Airbnb property.

A Home Equity Loan allows you to borrow a lump sum against the equity in your home, usually up to 85% of its appraised value minus any outstanding mortgage balance. You will then have to repay this loan over a fixed term through regular monthly payments. You can also use this lump sum to pay for necessary renovations that can increase your Airbnb property’s rental value and appeal.

Alternatively, a Home Equity Line of Credit offers a more flexible financing option. It functions like a credit card, with its credit limit based on your home’s equity. You can draw funds as needed, up to a predetermined limit, and pay interest only on the amount that you used. This is not only useful for buying an Airbnb property, but you can also use it to cover emergency expenses. Note that HELOCs have variable interest rates that can fluctuate over time.

If you’re considering this option, make sure that the rental income from your new investment property can cover your debt payment and be mindful of the risks associated with leveraging your home equity.

Performing Due Diligence and Property Analysis

Now that you know how to buy an Airbnb property with no money, you need to make sure that the investment property you end up getting will get you high returns. To do that, you need to evaluate the property’s location, its condition, the market demand, and the property’s potential return on investment (ROI). Using a tool like Mashvisor can help you streamline this process.

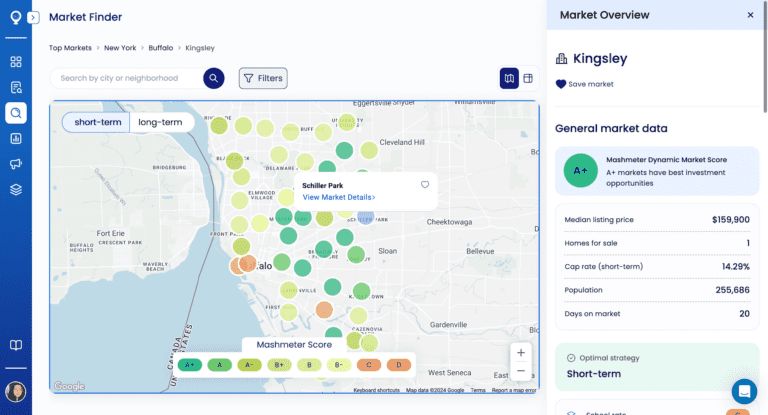

Researching the location. A profitable Airbnb investment property is usually situated in a high-demand area with a steady flow of tourists or business travelers. You need to consider its proximity to attractions, available public transportation, and amenities. Use Mashvisor’s Market Finder to assess the area’s short-term rental performance, which includes its average occupancy rate, rental income, and seasonality trends.

Mashvisor’s Market Finder allows you to perform due diligence by researching your investment property’s location

Evaluating the property itself. If possible, visit the prospective property in person and inspect its condition and layout. Houses with appealing features like multiple bedrooms, modern amenities, and unique characteristics tend to attract more guests. You should also check for any required repairs or renovations so you can factor these costs into your investment calculation.

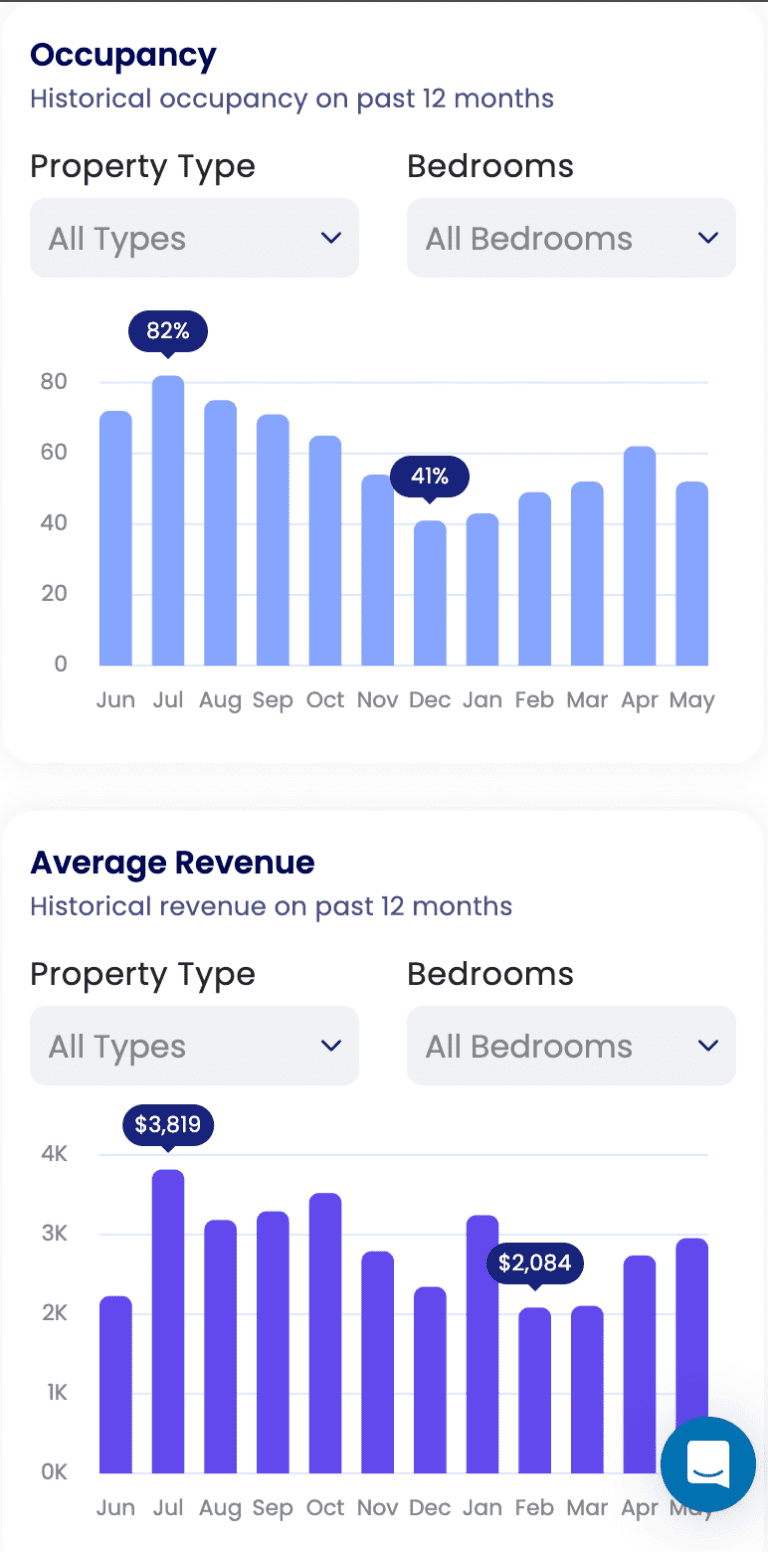

Understanding market demand. Mashvisor provides detailed data on comparable properties (or comps) in the area, such as their monthly income, occupancy rates, and daily rates. This comparative analysis can help you gauge the competitive landscape and set realistic pricing expectations for your property.

Mashvisor’s comparative analysis feature provides historical data on an area’s average Airbnb occupancy rate and rental income in the last 12 months.

Doing financial analysis. To calculate your potential ROI, estimate your expenses such as mortgage payments, property taxes, insurance, utilities, maintenance, and property management fees. Mashvisor’s rental calculator simplifies this by providing estimated costs and financial projections including cash flow, cash-on-cash return, and cap rate.

Reviewing local regulations and restrictions on short-term rentals. Some cities have strict rules that can impact your profitability. Ensure that you can comply to these rules so you can avoid legal issues that can disrupt your investment.

Conclusion: Start Looking for Profitable Airbnb Properties

Have you considered using your retirement funds to purchase an Airbnb rental property? What about crowdfunding platforms?

When it comes to “how to buy Airbnb property with no money,” there are always a few ways to do so. Nevertheless, there’s a thin line between being innovative with financing solutions to buy a rental home with no money down and over-leveraging yourself.

If uncertain, save up for a down payment instead of borrowing it. That is especially the case when you discover how to acquire your first rental property and your future ones. If you’re prepared to get inventive, you’ll be surprised at how little money you need to purchase your first rental home (or even with no money at all).

One tip: Invest in the finest locations when buying an Airbnb rental property. Since not all areas are ideal for Airbnb rentals, you need to complete a proper rental property analysis before deciding. Mashvisor can assist in analyzing potential investment properties and in evaluating your monthly payments and mortgage.

To learn more about Mashvisor’s different real estate investment tools, click here to sign up today and find the best deals on investment properties in the country.

FAQs

What is rental arbitrage, and how can it help me invest in Airbnb properties with no money down?

Rental arbitrage is an investment strategy where you lease a property and then re-rent it out for short-term stays on platforms like Airbnb, Vrbo, or Booking.com. In this arrangement, you’re acting as the middleman between your landlord and your guests.

Because your upfront costs will only involve the advanced rent, security deposit, and furnishing, you can start running an Airbnb business with no money down or even owning a property. Your profit will be the difference between your monthly rent and the income you generate from short-term rental.