For those who aren’t familiar with the term “distressed property”, it’s basically any property whose owner can no longer keep up with mortgage payments, tax bills, or both. It can be a short sale, a foreclosure, REO property, or HUD home.

Many potential real estate investors overlook distressed property when looking for potential investments. Some investors are intimidated by these properties because they are usually in poor condition and need renovations.

However, savvy investors understand that these properties offer lucrative investment opportunities. Distressed property will typically be sold at a price that is below market value. This means that you can buy an investment property in a neighborhood you couldn’t otherwise afford. Moreover, if you buy the right distressed property, the potential for profit is high.

Related: Buying Distressed Properties: 3 Pros and 3 Cons

If you are looking for an investment property that is below market value, has high-profit potential, and don’t mind handling some repairs, then distressed real estate may be a good choice for you. However, when buying distressed property as a beginner real estate investor, you need to tread with caution. There are a few quirks and potential pitfalls that you should take into account.

If you’re wondering how to buy distressed property, we’ve broken it down into 8 easy steps.

1. Set Your Budget and Put Your Finances in Order

While you may be able to find distressed properties for sale at discounted prices, it’s still crucial to have a budget. You should understand what mortgage payments you can cope with to avoid falling into foreclosure. Be sure to also budget for possible repairs and improvements. If you plan to start a rental property business, using a rental property or Airbnb calculator will help a lot. Having a sizable down payment and cash reserves will also improve your chances of qualifying for a loan.

Moreover, you should ensure that your finances are in order. For instance, review your credit report and correct any errors. Don’t make any major purchases before you buy the investment property. This will improve your chances of qualifying for investment loans and getting better loan terms.

2. Hire an Experienced Real Estate Agent

If you are new to distressed properties, it will be well worth your while and money to work with a real estate agent who specializes in distressed homes and is knowledgeable about the local housing market. A seasoned professional can help you spot quality bargains and help you avoid the common pitfalls of buying distressed property.

To find a top-performing real estate agent in your state or city of choice, click here!

3. Find a Profitable Real Estate Market

Some distressed properties for sale are located in bad neighborhoods. However, buying a distressed property in such a location severely limits your potential profit. Location is a very crucial aspect of real estate investing that you should never compromise on.

Therefore, even before you begin shopping around for distressed property for sale, you should research the neighborhoods. You’ll want to focus on up-and-coming neighborhoods that fit your budget.

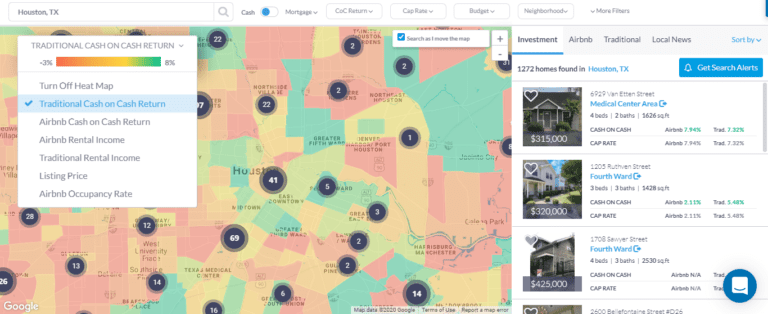

To find a good neighborhood for rental investment, you can use Mashvisor’s real estate heatmap to conduct a neighborhood analysis. With this tool, you can research the best neighborhoods in any city the US housing market based on key real estate metrics like median property price, rental income, cash on cash return, and Airbnb occupancy rate.

Related: How to Choose a Real Estate Market to Invest In

4. Get Preapproved for a Mortgage

If you can afford it, it’s best to buy distressed property with cash as it boosts your bargaining power and ensures a quick sale. Plus, you won’t be subject to lender requirements. However, if you are planning on using investment loans, you need to acquire a pre-approval letter from a lender.

You should get a pre-approval letter even before you begin your search for distressed property for sale. It will show the seller that you are a serious buyer and can pay in short order. Therefore, a pre-approval letter will give you a competitive advantage. Distressed properties tend to move fast, so be prepared to move quickly. It also spells out how much you can borrow so that you can narrow down your property search to what you can actually afford.

Financing is often easier if you are buying a banked owned property. However, it’s not always possible to finance a distressed house with a traditional mortgage, particularly when it needs significant repairs. Therefore, you may need alternative financing.

There are many distressed property loans. The right financing option will depend on your situation and investment goals. Some financing options for distressed property you could consider include hard money loans and Home Equity Line of Credit (HELOC).

5. Find Distressed Property

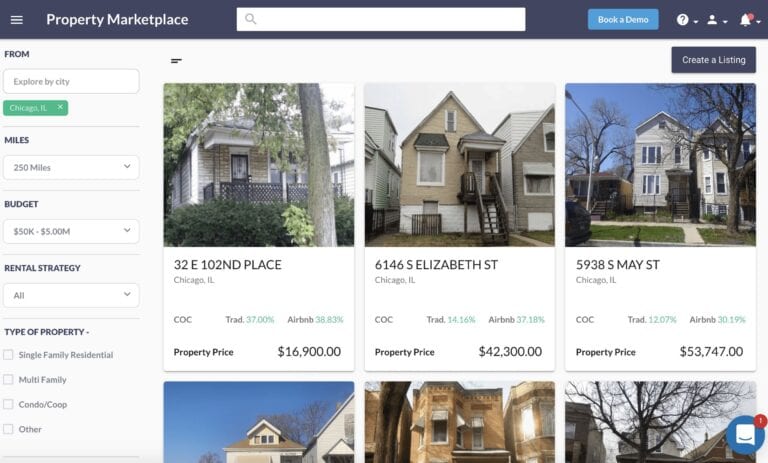

Finding distressed properties for sale can be challenging for beginner real estate investors because they hardly ever make their way to the MLS. Thankfully, Mashvisor’s real estate investment software offers an easy and effective solution for those looking for investment properties for sale in the US housing market. Using the Mashvisor Property Marketplace, you can quickly search for a variety of distressed properties for sale that meet your criteria.

The advantage of using this tool is that it allows you to analyze distressed properties on the platform so that you can make wiser investment decisions. Using our investment property calculator, you can get pre-calculated data on the expected rate of return on a rental property. Additionally, you can use Mashboad to find distressed property owners. You can access property owner data such as email addresses and phone numbers and connect with them.

Other common resources that seasoned investors use to find distressed properties for sale include:

- Government agency websites

- Bank and lender websites

- Distressed property websites like Auction.com and Foreclosure.com

- Foreclosure, probate, and family attorneys

- Tax records

- Real estate agents

- Real estate wholesalers

- Driving for dollars

- Property auctions

6. Do Your Due Diligence

It’s important to understand that not all distressed properties for sale will make good investments. There are also many pitfalls to buying distressed property that could obliterate your returns.

Therefore, in order to have a good rate of return on an investment property and avoid unpleasant surprises, you should spend some time doing your due diligence before putting in an offer.

Investment property analysis, which can be easily done using Mashvisor’s calculator in a matter of minutes, is only one part of the equation. There are other crucial factors that you should take into account before you decide to buy. As part of your due diligence, you should do the following:

-

Property inspection

Distressed properties are typically sold ”as-is”. Don’t expect repairs to be done for you. Therefore, you should hire a home inspector to verify the condition of the property and estimate the cost of repairs that are needed.

-

Title search

Hire a title company to run a title search to ensure that the distressed property is free of liens.

Related: How to Do Your Real Estate Diligence When Buying an Investment Property

7. Make an Offer

After identifying a potentially profitable distressed property, it’s time to make an offer. But how much should you offer on a distressed property? If you offer too little, your offer may get rejected. However, it’s always best to go below the seller’s offer. To know the right price to offer, you should look at what other comparable properties in the area have recently sold for. Be sure to also factor potential repair costs into your final offer price. A good realtor will help you write a competitive offer and negotiate the best deal.

8. Close the Deal

If the seller accepts your offer, you’ll sign the purchase agreement and set a closing date.

The Bottom Line

Buying distressed property can score you a great deal and stands out as one of the top investment options for property investors. However, the process of buying distressed property is slightly different from buying traditional properties. The most important thing to remember is to do your analysis and due diligence more carefully to avoid buying a money pit.