Real estate owned properties (REOs), otherwise known as bank owned properties, present unique investment opportunities for real estate investors. These are properties that have failed to sell at foreclosure auctions and ownership transferred to the bank or lender. The lenders now have to sell the homes themselves, a process that may involve tenant eviction, clearance of any liens, and sometimes some repairs.

REO properties are usually listed below market value, have low competition, and have the potential to yield high returns. However, like all real estate investments, buying REO homes comes with risks that can lead to huge financial loss. These properties often require a lot of repair and renovations, more so than other investment property options. Nevertheless, this should not intimidate you. If you take your time and understand how to buy REO properties, you can find a great real estate deal.

Here is a step-by-step guide to provide you with some insight into how to buy REO properties.

11 Steps to Buying REO Properties

1. Research the Real Estate Market

When learning how to buy REO properties, investors should first know how to find them. The first step to finding a good real estate investment is to research the market. You need to perform a real estate market analysis to find a profitable location. Your investment location will have a huge influence on property price, occupancy rate, rental income, and return on investment. Therefore, make sure you do enough research before settling for a particular location.

Here are some of the factors to consider when looking for a good housing market to buy an REO property to rent out:

- Low crime rates

- A good job market

- Good infrastructure

- Proximity to schools, hospitals, and other social amenities

- Rising population

- Development projects

2. Find REO Listings in Your Target Real Estate Market

After finding a potentially profitable location for investment, you need to find available REO properties in your target market. Learning how to find REO listings is a crucial part of REO investing. As a first-time investor, it is best to go for REO properties in your local real estate market.

But how do I find REO properties near me?

If you are wondering how to find bank owned homes near you, here are some options to consider:

- Listing agents: A listing agent can pull up REO listings on your behalf.

- Bank websites: Many banks have sections on their websites dedicated to their REO listings.

- Multiple Listing Service (MLS): Most banks list their REO properties on the MLS, making it easy for agents to show them to potential buyers.

- Contact lenders directly

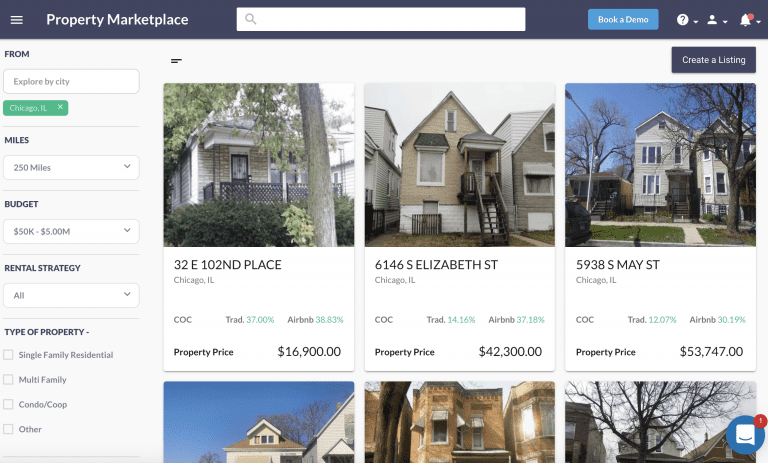

- Real estate sites: There are many real estate websites that have REO listings. However, the best way to find REO properties in the US housing market is to use the Mashvisor Property Marketplace.

Related: Are Rental Properties for Sale Near Me Good for Real Estate Investing?

3. Hire a Real Estate Agent

For a first-time buyer, you may not know how to buy REO properties the right way. A buyer’s agent who is familiar with REO properties will guide you through every stage of the investment property buying process. With their expertise and experience, you will be able to save yourself a lot of time and effort trying to locate profitable bank owned homes. A real estate agent also knows how best to negotiate with the lender.

Related: Do I Need a Real Estate Agent to Buy Investment Property?

4. Narrow Down Your Search List

With a real estate agent to help you, you can now begin narrowing down your search list. You need to refine your list of REO properties and keep a few that meet your investment goals. Your initial criteria for narrowing your list should be based on your “must-have” characteristics such as:

- Your Budget

- Investment strategy

- Property type

- Number of bedrooms and bathrooms

If you are using the Mashvisor Property Marketplace, you can use filters to customize your search based on your criteria.

5. Analyze the REO Properties

One of the most important steps when buying bank owned homes that you shouldn’t skip is property analysis. Not all REO properties for sale are bargains. Now that you have narrowed down your options, you need to assess the market value of the properties and find out their potential return on investment. It’s important that you do a thorough investment property analysis before buying REO properties.

The best way to analyze REO properties in the US housing market is by using Mashvisor’s tools. With our investment property calculator, you can conduct a comparative market analysis to estimate the true value of the properties on your list. This way, you will be able to know how the asking price compares to the market value of the house. Without looking at real estate comps, you might end up overpaying.

When buying REO properties to rent out, you also need to estimate metrics like rental income, cash flow, cash on cash return, and cap rate to know if it is a good investment. Again, our rental property and Airbnb calculator will help you calculate these real estate metrics and find the optimal rental strategy in a matter of minutes.

If you were searching for REO properties in the Mashvisor Property Marketplace, property analysis is even easier. You can easily get an analysis of any REO listing on the platform with just a few clicks.

Visit the Mashvisor Property Marketplace today to find and analyze an REO property.

Related: What Should You Look at in an Investment Property for Sale?

6. Get a Pre-Approval Letter or Proof of Fund Letter

If you plan to pay cash, you will need to submit a Proof of Funds letter to the selling bank. You can acquire it from the institution holding the cash. However, if you don’t have enough funds to purchase the property in cash, there are still some options on how to buy REO properties with no money. With a good credit score, you can acquire a pre-approval letter from the same lender who owns the REO property. Depending on your investment strategy, you could consider other financing options. For instance, when buying REO properties to flip, you could consider hard money loans or private money loans.

Putting your finances in order is particularly important because lenders are motivated and will want to get the property off the books as fast as possible. A pre-approval letter or proof of funds letter can put you ahead of the game and speed up the process of buying an REO property. They show the lender that you are willing and financially qualified to buy the property.

7. Inspect the REO Investment Property

Property inspection is a crucial part of buying any investment property but even more crucial when buying REO homes. This is because REO properties are usually sold “as is”. You need to inspect the house for any repairs that need to be fixed. The property may have been neglected for a long time due to the previous owner’s financial problems. Therefore, it’s crucial that you know all that needs to be fixed before committing to purchase. Hire a professional to conduct a thorough home inspection. You should add the repair cost to the asking price of the property to know what the house will cost you.

8. Make an Offer

After identifying a potentially profitable property that matches your criteria, the next step is to make an offer. Your real estate agent will help put together a good offer to submit to the lender.

Some lenders may require you to submit special contract forms and attach an earnest money deposit check.

Making your offer close to the asking price will increase your chances of landing the deal. However, patience is required at this stage because banks usually take long to respond. An REO offer will often be reviewed by several people and firms.

9. Negotiate

Another key aspect of learning how to buy REO properties from a bank is negotiation. Negotiating with a lender for an REO property is different from negotiating with a private homeowner. You need to be more prepared.

It is usually more difficult because banks need to show investors and shareholders that they did their best to get the best price for the REO property. Therefore, your offer is likely to be met with a counteroffer. You can ask for a reduction in closing costs or interest rates if the lender isn’t willing to negotiate on price. Your real estate agent should help you negotiate the deal. However, the advantage of buying REO homes is that they have no emotional attachments to the house that could influence their decision.

10. Run a Title Search

The bank usually clears the title before selling an REO property. However, you should never assume that this is the case. Such a mistake could cost you a lot of money. Apart from confirming with the lender if the title has been cleared, consider hiring a title company to run a full title search.

11. Close the Deal

Once you have filled out all the paperwork, it’s time to close on the REO property. This process is quite similar to any other closing. However, you may be charged a penalty if the deadline passes. Getting pre-qualified is one way to avoid such delays. After you and the lender’s representative have signed the transfer documents and the money goes through, you will be the new owner of the home.

The Bottom Line

Investing in REO properties can lead to potentially good real estate deals since you will be buying from a motivated seller. However, the process of buying REO homes is a little complex. Dealing with a lender is different from dealing with a usual homeowner. If it is your first time, it is wise to first learn how to buy REO properties and everything involved in the process. This will help you avoid some of the common pitfalls. By following this simple guide, you will be able to set yourself up for success with REO properties.

When you’re ready to start looking for and analyzing US bank owned homes for sale, Mashvisor gives you 14 days to try out our tools for free! To start out your 14-day free trial with Mashvisor, click here!