Are you wondering how to calculate cap rate for the most profitable decisions in real estate investing? Then, you’ve come to the right place.

The capitalization rate, or cap rate for short, is one of the most popular real estate metrics that every investor should know. Since this blog is dedicated to beginner real estate investors, we’ll cover the basics. We’ll take a look at what the cap rate is and how to calculate it.

Table of Contents

- What Is Cap Rate?

- What Affects Cap Rate?

- When to Use Cap Rate

- When Not to Use Cap Rate

- How Is Cap Rate Different From Cash on Cash Return?

- How to Calculate Cap Rate in 5 Steps

- Finding Rental Properties With Good Cap Rate

While cap rate is one of the most basic concepts in rental property investing, there are plenty of misconceptions and misunderstandings about it. Many investors kind of know what cap rate is, what it shows, and how it is calculated, but few are familiar enough with it to be able to make good investment decisions based on it.

In this article, we will cover everything you need to know about cap rate, focusing on how to calculate this metric of return on investment in real estate.

As you will see, having access to detailed and accurate real estate data is crucial to calculating cap rate, but beginners don’t always know where to find this information. So, we will show you how Mashvisor can help you each step of the way.

Spoiler alert: With the Mashvisor cap rate calculator, you don’t need to calculate cap rate ever as you can now analyze both long term and short term rentals with a few clicks of a button.

So, without further ado, let’s get started!

What Is Cap Rate?

The cap rate is one of the most important real estate metrics that every investor should know about. It does not matter whether you are an experienced or a new real estate investor, learning about cap rate is a must. The formula for cap rate is as follows:

Cap Rate Formula

Cap Rate = Net Operating Income (NOI)/Market Value of the Investment Property x 100%

Many think that the cap rate is mostly used in commercial real estate investing. However, savvy investors are able to boost the bottom line of their residential real estate investments, too, with the help of cap rate. The key is to know what exactly it shows, what its limitations are, and how to use it to your advantage.

In brief, cap rate is basically a measure that helps to estimate the return expected on a real estate investment property. It is commonly used to compare similar investment properties in the same location as it is easier to calculate than other ROI metrics.

In addition, the cap rate can also be applied at the market level to compare different locations and decide whether one market comes with a stronger potential than another. The same holds true for both cities and neighborhoods.

But let’s go back to the cap rate formula and take a more detailed look at what’s in it.

Cap Rate Formula Dissection

As you’ve noticed, part of the cap rate calculation is the NOI or net operating income. The NOI is simply the property expenses subtracted from the income generated by the property. Remember that the NOI is the figure before tax, which means it excludes loan interest, depreciation, and taxes.

Meanwhile, the value of the property is the actual market value of your investment property. Sometimes, investors use the purchase price of the rental instead if they are not sure about the current market value.

So, the NOI should be divided by the market value of the investment property, and the result needs to be multiplied by 100 to get the annual return on investment as a percentage.

Cap Rate in Action

The best way to learn anything in real estate—especially when it comes to mathematical calculations—is through an example. So, let’s look at an example of how to calculate cap rate:

Let’s say that you are considering buying your first rental property—an Airbnb for sale—as a new real estate investor. You find a property that costs $300,000. You expect this investment property to generate $50,000 a year in rental income after subtracting all property expenses but before paying any taxes. So, now apply the numbers to the formula as follows:

Cap Rate = Net Operating Income (NOI)/Market Value of the Investment Property x 100%

Cap Rate = $50,000/$300,000 x 100% = 17%

However, you should keep in mind that this is only a simple example of calculating the cap rate. You must understand that sometimes, in reality, things get a bit—or a lot—more complicated, depending on the factors surrounding your individual investment business.

But going back to that number: cap rate of 17%. What does it mean? Is it a good cap rate?

Good Cap Rate

Real estate experts define a good cap rate in the range between 8% and 12%. A lower limit on an ROI metric like the cap rate is understandable. After all, you want to ensure that you make at least a certain amount of return when you invest in long term or short term rentals for sale.

But the upper limit is less intuitive. The reason to set an upper limit on the optimal range of cap rate is that the metric also measures the risk associated with a specific real estate investment.

Naturally, you want to avoid unnecessary risk in order to put your money where it offers the highest chance of bringing you more money. That’s why it’s important to keep cap rate below a certain level.

What Affects Cap Rate?

When it comes to learning how to calculate cap rate, you must understand that there are a few factors that affect it. In real estate investing for beginners, it is not enough to know the numbers. It’s important also to understand what’s behind the numbers, what drives them, and what affects them either positively or negatively.

Here are the factors that play the most significant role in determining a good cap rate:

Location

First, take into consideration the location of the investment property. Location is a major determinant for many things in real estate, including the cap rate of an investment property. It is only natural and is most easily explained through the risk factor.

For example, if you decide to buy an apartment to rent out on a long term basis in the middle of a busy city like New York, the cap rate is not going to be very high. There isn’t much risk associated with such an investment as rental demand is strong in the area. So, vacancy is nothing to worry about. However, low risk translates into a low return on investment.

In addition, while you will be able to charge a high rental rate for your apartment, the price you pay for the property will also be high. Eventually, the two numbers will cancel each other out, leading once again to an average cap rate.

However, if you decide to buy vacation rental property in the middle of a forest with nothing around to rent out on a short term basis, you could expect a high vacancy rate. A high vacancy rate is a risk in real estate investing. So, you can expect to be rewarded with a high potential return for such a high risk through a good cap rate.

It is the reason why small, isolated places have emerged as some of the most profitable markets for real estate investments, especially short term rentals.

Property Type

Another factor that affects the cap rate is the property type. Sure enough, you cannot expect to achieve the same cap rate for an apartment building and a single family home.

When you go for multifamily real estate investing to rent out, you end up owning a few separate rental units. It spreads the risk of vacancy as the odds of seeing all your units vacant at the same time and generating zero rental income are very slim. But since the risk is low, so is the cap rate when you invest in multifamily homes.

At the same time, when you invest in an apartment, a condo, or a townhouse, you either have your investment property rented out or not. In other words, you either make full rental income or don’t make any at all. This high risk is rewarded with higher cap rates typical for single family homes.

Rental Strategy

Last but not least, the rental strategy that you apply to your income property also affects the ROI you can expect on it. There are two main types of rental strategies: long term rentals (traditional rentals) and short term rentals (Airbnb rentals).

Mashvisor’s cap rate calculator analysis shows that over the past few years, short term rental properties have consistently been associated with higher cap rates.

When you rent a property on a nightly basis, your vacation rental might remain unoccupied for days or even weeks in a row until a major event hits your market.

Note: A cap rate calculator is an AI-powered tool that’s able to conduct nationwide real estate market analysis to estimate the average cap rate across cities for both rental strategies. It can also estimate the ROI expected on individual properties. We’ll discuss this in a bit.

However, when the season is on and demand is strong, the high daily rates will allow you to more than compensate for the slow season. So, the high risk of prolonged vacancy leads to high potential reward in terms of strong cap rate.

Meanwhile, once you find a tenant for your long term rental property, you may keep them for years on end. It makes the rental strategy a very low-risk and low-reward one. Thus, long term rentals yield lower cap rates, on average.

When to Use Cap Rate

First of all, beginner real estate investors can use the cap rate to choose between different markets and to find the best location for their budget and rental strategy. Because of the relative simplicity of how to calculate cap rate, the metric allows for a quick comparison between multiple markets. So, it should be an indispensable part of any rental market analysis.

Second, the cap rate is widely utilized to compare the investment potential of a number of different properties for sale within the same market. Properties with expected higher cap rate are more likely to turn into profitable real estate investments. But investors should also keep an eye on the associated risk leve. So, they should focus on properties that promise 8%–12%.

Third, the cap rate is obviously used to evaluate the expected return on investment on a certain property for sale to see if the investment property is worthwhile or not. A high cap rate indicates a positive cash flow that the property generates, which is great news. It means that the property will be able to make money for you rather than waste money.

That’s why it’s important to incorporate the cap rate into the investment property analysis you conduct on properties before buying them. It is an excellent first-line indicator of whether a property can turn into a profitable long term or short term rental investment.

When Not to Use Cap Rate

Most importantly, you should not use cap rate as the only measure for a good real estate investment property. While how to calculate cap rate is much easier than other ROI metrics, it’s also less comprehensive. It means that you should always utilize the cap rate in combination with other measures like the cash on cash return.

Moreover, you should not use the cap rate alone if you plan to take a loan to purchase an income property. The reason is that the metric does not take into consideration the method of financing. It will yield the same results whether you buy your investment property in cash or with a loan.

In reality, though, the method of financing a rental property is a major factor of profitability. So, it doesn’t make sense to rely too heavily on cap rate in case you take a mortgage or another type of loan as the results would be misleading.

How Is Cap Rate Different From Cash on Cash Return?

Many new real estate investors get the cap rate and the cash on cash return mixed up when they are two distinct measures of return on investment in real estate. Though they might sound a bit similar, they are still used for different purposes.

The cash on cash return is calculated by dividing the cash flow after all expenses but before taxes by the original sum of money invested. Meanwhile, the cap rate is the NOI divided by the property’s sale price or current market value.

What it means is that the cash on cash return—unlike the cap rate—looks at how an investor pays for their property (cash vs loan), the down payment, the loan terms, etc. The vast majority of investors need to resort to taking out a mortgage. So, the cash on cash return measure gives them a much more realistic estimate of what the return on a certain property would look like.

Nevertheless, it also makes how to calculate cash on cash return even more complex than how to calculate cap rate, as there are more inputs that go into the formula. But that’s not something to worry about. As we will discuss briefly, the Mashvisor real estate investing app provides investors with all the numbers and figures they need to make profitable decisions.

How to Calculate Cap Rate in 5 Steps

Calculating the cap rate of a property that you are considering buying requires figuring out three main numbers:

- The monthly rental income

- The monthly operating expenses (together with the income, will give you the NOI)

- The property value

To obtain the above numbers, you need to go through the following steps:

1. Find Rental Comps

Good rental property analysis is based on the performance of existing rentals close to and similar to the one you are analyzing. In real estate investing, these are known as rental comps.

If you’re planning to invest in a long term rental, you can find rental comps on websites like Zillow, Redfin, Apartments.com, and any other website with rental listings. All you need to do is search for rentals as similar to the one you’re looking to buy as possible. Focus on things like property type, size, number of bedrooms and bathrooms, amenities, etc.

Alternatively, you can also talk to real estate investors and landlords in the area that invest in similar properties. You will be surprised how willing and happy experienced investors are to help those who are just getting started in real estate.

If, on the other hand, you’d like to buy a short term rental, you can check out Airbnb, Vrbo, Booking.com, and other vacation rental listing marketplaces. Again, you can try talking to local Airbnb hosts, too.

2. Estimate NOI (Income – Expenses)

Once you find a few good rental comps, it’s time to use them to figure out what rental income and rental expenses they generate per month or year. Finding the rental income, especially for long term rentals, is relatively easy. All you need to do is to take the rental rate and account for a 5%–10% vacancy rate.

However, calculating short term rental income is more complicated, as daily rates vary from day to day and occupancy rates are widely different across markets and properties. In addition, estimating the expenses that a rental property incurs requires hard work, as they are not available on rental websites.

Traditionally, there were two ways to go about it. One option is to gather real estate and rental data from various sources, enter it into Excel spreadsheets, and conduct a lot of manual calculations. However, the process is not only long and tedious but also prone to human error.

Another option is to resort to the help of existing real estate investors and try to get as much information from them about the performance of their investment rental properties as possible. The trick here is to meet and acquaint local investors focused on properties similar to the one you’d like to buy.

But in recent years, technology is helping beginner investors find comps and NOI estimates—as well as readily available cap rate estimates—much easier and faster than ever before. We will discuss how in a minute.

3. Find Real Estate Comps

After you’ve worked out what goes into the NOI calculation in the cap rate formula, it’s time to focus on the property value part. Unfortunately, you can’t take the listing price as is and apply it to the formula. In hot real estate markets like the current one, properties frequently sell for prices significantly above the listing value.

So, to get a good, reliable estimate of the property’s current value, you need to find real estate comps. They are something like rental comps but are actually properties similar to the one you’d like to buy and located in the same area that sold in the past three months. Once again, you must consider the number of floors and rooms, finishings, amenities, etc.

You should aim to find 3–5 real estate comps and see what price they sold for. Moreover, you can consider some expired listings and their price. It will give you a good idea of what is too much to pay in the local housing market.

4. Estimate the Purchase Price

After gathering the real estate comps, you can use their sales prices to form a range of the current market value that makes sense for your property. The more comparable the recent sales are to your property, the more accurate the value estimate will be.

5. Calculate the Cap Rate

The final step in how to calculate cap rate is to divide the NOI by the property price and multiply by 100 to obtain a percentage. It is the cap rate you can expect to generate based on the current performance of the local rental market.

Alternatively, Use a Cap Rate Calculator

As you can imagine, going through all the steps above to calculate cap rate is time-consuming and depends on access to reliable data.

It becomes particularly complicated if you’re considering a few different investment properties for sale located in various markets. And, as a smart beginner investor, you should analyze a number of markets and properties to select the best one.

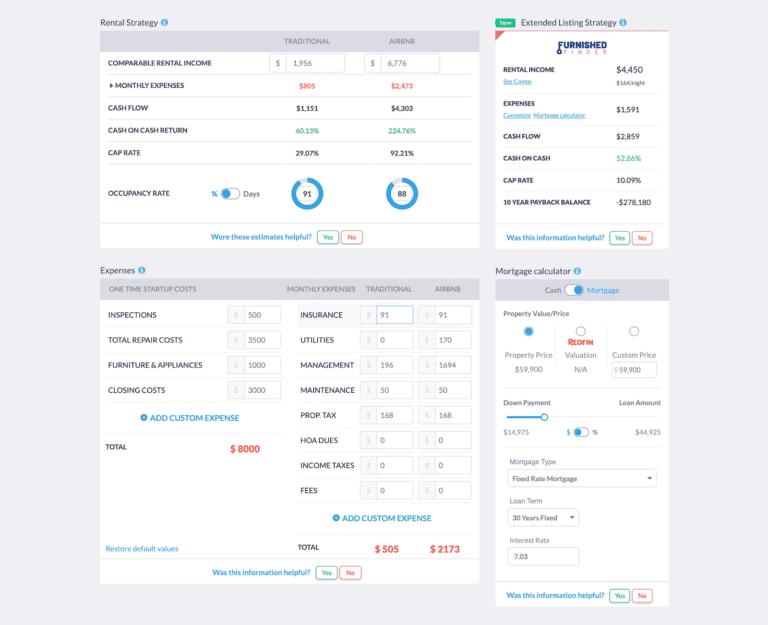

To save time, boost the accuracy of your calculations, and make more profitable and confident investments, you can use a cap rate calculator, like the one available on Mashvisor. It is an online investment property calculator that shows what ROI you can expect on a certain property before even buying it. Importantly, it shows you not just the cap rate but also:

- Listing price

- Price per square foot

- Breakdown of startup costs

- Monthly rental income

- Breakdown of monthly recurring expenses

- Occupancy rate

- Cash flow

- Cash on cash return

- Long term and short term rental comps

The above metrics are available for both long term and short term rentals, so you can compare which rental strategy yields better results for each property for sale.

Mashvisor’s Cap Rate Calculator

Before deciding to trust the Mashvisor cap rate calculator, it’s important to know that all data comes from reliable sources like the MLS, Redfin, RentJungle, Airbnb, and public records. Moreover, all calculations are based on the performance of rental comps that you can see and investigate yourself.

In addition, the numbers provided by the Mashvisor rental property and Airbnb calculator are customizable. If you think your property will behave differently from other rentals in the area, you can adjust the relevant figures, and the remaining numbers will be recalculated for you.

To test the power of our cap rate calculator, sign up for Mashvisor today.

Finding Rental Properties With Good Cap Rate

Now you know everything you should know about the cap rate: what it is, what factors affect it, when to use it and when not to use it, and how to calculate it. As you see, how to calculate cap rate is easier than how to calculate other ROI metrics, but it still requires a lot of manual work and calculations, as well as access to reliable data.

However, owing to recent advancements in technology, you don’t need to bury yourself in manual research, data collection and cleaning, and calculations to make profitable investments.

You can use Mashvisor’s cap rate calculator to estimate the return on investment on any residential property in the US market. All calculations will not only be fast and easy but also accurate and reliable as they are based on real estate and rental comps.

If you’re still not convinced about what Mashvisor can do for beginner real estate investors, schedule a free demo with our experts to get a personalized walkthrough of the platform.