What is the internal rate of return? The internal rate of return (IRR) is a measure of a real estate investment’s yield over its time horizon. A real estate investor looks at the internal rate of return as the rate of growth a real estate investment property is expected to generate. Real estate investors complement this measure with other profitability ratios to learn of the risk and reward associated with a real estate investment property. In this article, we aim to explain the internal rate of return in-depth and show you how to calculate IRR, either manually by hand or in Excel.

What Is the Definition of the Internal Rate of Return?

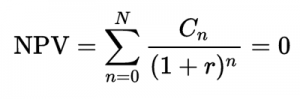

In finance, particularly capital budgeting, analysts use the internal rate of return to estimate the profitability of investments. The internal rate of return is the discount rate that makes the net present value of all cash flows from a particular period equal to zero. The net present value is the value of a property’s expected cash flows minus the initial investment. Project or property owners always want to have a positive net present value, as a negative net present value indicates the project is underperforming. When you set the NPV to zero to calculate the discount rate or the IRR, you would want to aim for a high IRR. The higher the IRR, the more promising an investment’s monthly cash flow and profitability. In summary, the IRR is the percentage of interest that you will have earned on each dollar you have invested in an investment property over its holding period.

When running an investment property analysis, many real estate investors rely on the return on investment as a measure of performance. The rate of return on rental property can also be calculated using the return on investment (ROI). However, as a real estate investor, you must identify the uses and benefits of the two terms and how they fit your objective. For example, the ROI differs from the IRR in the way the time horizon is weighed in. The ROI measures the performance of a rental property over a certain period of time, whereas the IRR measures the performance of that for shorter durations of time. Moreover, real estate investors use the IRR to calculate the annual growth rate of the investment and ROI to calculate an investment’s returns from the beginning to end.

Related: IRR vs ROI in Real Estate: What’s the Difference?

How to Calculate IRR

As a real estate investor, you must know how to calculate the internal rate of return and the steps associated. While there’s no specific internal rate of return equation, the IRR formula uses the definition of the NPV and sets it equal to zero in order to find the discount rate. The discount rate, whereby, is the value that the IRR seeks. The internal rate of return formula can then be calculated by equating the sum of the present values of future cash flows minus the initial investment to zero and solving for IRR. Below is the IRR formula:

As a real estate investor, you must know how to calculate the internal rate of return and the steps associated. While there’s no specific internal rate of return equation, the IRR formula uses the definition of the NPV and sets it equal to zero in order to find the discount rate. The discount rate, whereby, is the value that the IRR seeks. The internal rate of return formula can then be calculated by equating the sum of the present values of future cash flows minus the initial investment to zero and solving for IRR. Below is the IRR formula:

Where:

Where:

N: The total number of years

Cn: The cash flow in the current period

n: The current period

r: The internal rate of return

Or, similarly:

(Cash Flow Year 1/(1+IRR)^1 + Cash Flow Year 2/(1+IRR)2 + Cash Flow Year 3/(1+IRR)^3) -Initial Investment=0

Let’s look at some numbers. Take Tom who is considering buying a rental property for $100,000, for which he assumed revenues for the upcoming three years to be $10,000 each. So when we plug in the numbers, we get:

($10,000/(1+IRR)^1 + $10,000/(1+IRR)^2 + $10,000/(1+IRR)^3) -$100,000=0

Since we have different exponents, doing the internal rate of return calculation by hand can get long and messy. Therefore, we recommend that you use Excel or an internal rate of return calculator that you can find online.

You may be wondering then how to calculate IRR in Excel. Calculating the IRR in Excel is straightforward and can be summarized in one single step, where the syntax for the formula is given by =IRR (values, [guess]). When you select the IRR formula, you then select future cash flows for the desired period and the cost of the investment, then you get a percentage answer of what the discount rate or IRR of your investment will be.

One Big Limitation

Surely, the IRR provides a significant indicator of the performance of a real estate investment. However, the internal rate of return calculation has its limitations. The biggest limitation lies within the assumptions made; the formula makes large assumptions about investment costs, future interest rates, and broader market conditions. The assumptions render the IRR weak given the human subjectivity and potential for error and bias inevitably involved that may end up altering the results. To ensure that your IRR is as close as possible to the true rate of return desired, you should carefully assess and conclude on the assumptions before proceeding to calculate the internal rate of return.

Even though calculating the IRR for an investment does surely contribute a good deal to one’s decision on whether or not to undertake an investment, other ratios should be complemented with the IRR for a complete investment property analysis. You are probably thinking you have more calculations and time to put in for this quantitative analysis. However, that is not the case if you use Mashvisor’s investment property calculator. When you use Mashvisor’s investment property calculator, you can quickly get the cap rate, return on investment, cash on cash return, rental income, and traditional and Airbnb occupancy rate of an investment property. When you use this real estate investment tool, you ensure a well-rounded investment property analysis and viable conclusions on the feasibility of investing.

Start your 14-day free trial with Mashvisor and subscribe to our services with a 20% discount after.

Conclusion

The internal rate of return is a measure of the performance of a real estate investment. The purpose of the article is to facilitate the steps to how to calculate IRR. Calculating the IRR and comparing the IRR across investment properties will advance your case towards the viability of the investment. A successful real estate investor, moreover, will calculate the internal rate of return along with other ratios for a complete investment property analysis.

For more information about the IRR and other financial metrics, visit Mashvisor.