One of the most basic skills you need as a real estate investor is how to evaluate a rental property successfully before you invest in one.

If you cannot quickly evaluate a rental property for sale and determine if it is a good income property, you can’t be assured success in your business. Instinct is always helpful. However, there are some tried-and-true real estate ratios and metrics you can apply to determine if an investment property you’re considering buying is a good rental property.

Table of Contents

- 5 Metrics You Need to Evaluate Rental Property

- How to Evaluate a Rental Property Using a Tool to Do the Math

- How to Understand the Results of a Rental Property Analysis

- Other Things You Need to Consider to Evaluate Rental Property

As an investor, evaluating a rental property quickly and effectively is essential to making informed decisions and maximizing your return on investment.

By assessing the property’s condition, researching the local rental market, and considering other key factors, you can quickly evaluate a rental property. It will help ensure you’re making a smart investment. In this article, you will discover the key elements needed to evaluate a rental property to make the best decision for your business.

You will also discover how Mashvisor can help you quickly evaluate a rental property for maximum return on your investment.

5 Metrics You Need to Evaluate Rental Property

You need a thorough understanding of specific metrics to effectively evaluate a rental property. The metrics include the net operating income, capitalization rate, cash on cash return, occupancy rate, and rent to value ratio.

In this section, we will look at each of the said metrics and explain how they can be used to evaluate a rental property effectively. You will also see examples to show you how to use them to evaluate your rental property easily.

1. Net Operating Income (NOI)

The net operating income (NOI) is a key metric used to evaluate the performance of a rental property. The NOI metric is calculated by subtracting all operating expenses from the property’s gross income. Here is the formula for the net operating income:

Net Operating Income (NOI) = Rental Property Income – Operating Expenses

The expenses include things like property management fees, insurance, and property taxes. A high NOI indicates that the property is generating a strong rental income and incurs low expenses. It means the property is performing well and can provide a good return on investment.

NOI is a key metric for real estate investors because it provides a clear picture of the property’s financial performance. It allows you to compare the property’s income and expenses to other properties and make informed decisions about the property’s future. profitability.

By analyzing the NOI, you can identify areas where expenses can be reduced or where income can be increased. It’s also useful to track the NOI over time to see how the property’s performance changes and make adjustments accordingly.

For example, a rental property generates a gross income of $75,000 per year. The operating expenses for the property are—

- Property management fees: $5,000

- Insurance: $2,000

- Property taxes: $5,000

- Maintenance and repairs: $10,000

To calculate the NOI, you would subtract the operating expenses from the gross income:

NOI = 75,000 – (5,000 + 2,000 + 5,000 + 10,000) = $53,000

In this example, the NOI is $53,000, which means the property is generating a net income of $53,000 after paying all operating expenses. It is a good indication that the property is performing well and providing a good return on investment.

Related: How to Calculate NOI for Real Estate Investments

2. Capitalization Rate (Cap Rate)

The capitalization rate (cap rate) is another important metric used to evaluate the potential return on investment of a rental property. The formula for the capitalization rate is—

Capitalization Rate (Cap Rate) = Net Operating Income (NOI) / Property Value

The result you get is expressed as a percentage, which can be used to compare the potential returns of different properties. A high cap rate shows a higher potential return on investment. Conversely, a low cap rate suggests a lower potential return on investment.

The cap rate helps you, as a real estate investor, compare the potential returns of different properties. By comparing the cap rate of a property to similar properties in the area, you can then decide if it is a good investment.

For example, if a rental property provides an NOI of $50,000 and a property value of $500,000, the cap rate would be 10% (50,000/500,000 = 0.1). For every $100,000 invested in the property, you can expect to earn a return of $10,000 in the form of net operating income.

3. Cash on Cash Return (CoC)

Cash on cash return is another important metric used to evaluate a rental property quickly. The formula for cash on cash return is:

Cash on Cash Return = (Annual Cash Flow / Total Amount Invested) x 100

A high cash on cash return means a higher potential return on investment, while a low cash on cash return suggests a lower potential return.

The cash on cash return metric is an important metric because it provides a comprehensive understanding of the property’s cash flow and potential return on investment.

For example, let’s say you purchase a rental property for $200,000 with a 20% down payment of $40,000 and you are getting a rental income of $2,000 per month. Your annual cash flow will be $24,000 (12*$2,000), and your total cash invested is $40,000. To calculate the cash on cash return, you would divide the annual cash flow by the total cash invested:

Cash on Cash Return = (24,000 / 40,000) x 100 = 60%

In this example, the cash on cash return is 60%. It means that for every $1 invested, you are getting a return of $0.60. If the cash on cash return is above 10%, the rental property is a good investment to make.

4. Occupancy Rate

The occupancy rate is used to measure the percentage of the property’s units that are currently occupied in relation to the total time they are available to rent. A high occupancy rate indicates a strong demand for rental properties in the area, while a low occupancy rate suggests that the market is weak. The formula to calculate the occupancy rate is as follows:

Occupancy Rate = (Number of Occupied Units / Total Number of Units) x 100

If your occupancy rate is high, it means that the property is in high demand, and it’s likely that rental income will be steady. On the other hand, a low occupancy rate can indicate that the property is not in a desirable location or that the rent is too high. Either of the two reasons can lead to a reduction in rental income.

For example, if a rental property comprises 20 units and 18 are currently occupied, the occupancy rate would be 90%.

Occupancy Rate = (18/20) x 100 = 90%

This means that 90% of the units in the property are currently occupied. It is considered a high occupancy rate. It means that there is a strong demand for rental properties in the area.

5. Rent to Value Ratio (RTVR)

Rent to Value Ratio (RTVR) is a metric that compares the potential rental income to the property’s value. The formula to calculate RTVR is:

Rent to Value Ratio = (Annual Rental Income / Property Value) x 100

A high RTVR means a higher potential return on investment, while a low RTVR suggests a lower potential return on investment.

For example, you purchase a rental property for $300,000 and get a rental income of $2,000 per month. Your annual rental income will be $24,000 (12*$2,000). To calculate the rent to value ratio, you would divide the annual rental income by the property value:

Rent to Value Ratio = (24,000/300,000) x 100 = 8%

In this example, the rent to value ratio is 8%, which means that for every $100 invested in the property, you’re getting a return of $8 in the form of rental income. If the RTVR is above 8%, it is considered a good return on investment.

How to Evaluate a Rental Property Using a Tool to Do the Math

It can be challenging to evaluate a rental property all by yourself. To make the process simpler and more efficient, you can use a simple tool to do the math for you. Such a tool provides an easy-to-use interface that accurately calculates the important metrics in a fraction of the time.

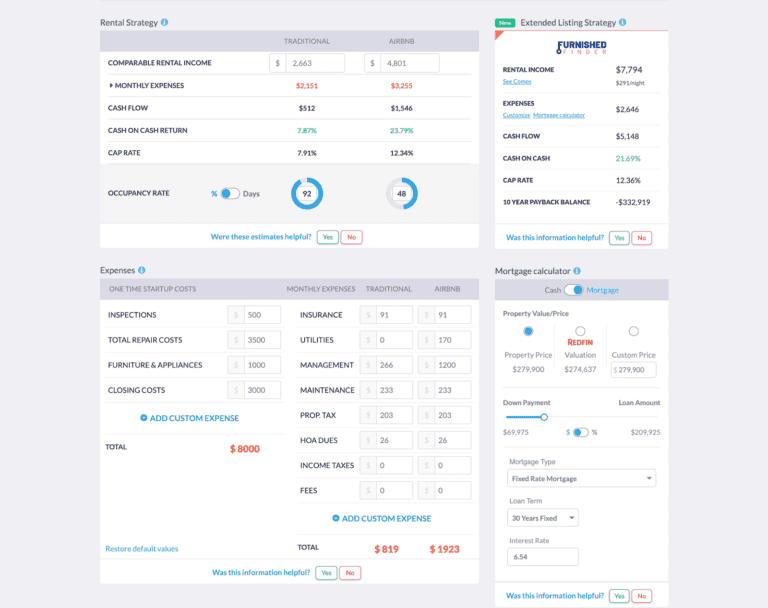

The tool is Mashvisor’s investment property calculator. It allows you to input relevant information about the property, like the purchase price, rental income, and operating expenses, and then calculates key metrics. It can help you quickly compare the performance of different properties and make informed investment decisions.

The calculator can save you a lot of time and help you make more informed decisions about your rental properties.

Mashvisor’s Rental Property Calculator

Vacation Property and Airbnb Calculators

Not all rental properties are let on traditional 12-month leases. Some are short term rentals. The two most popular types are vacation properties and Airbnb. You can conduct an Airbnb investment analysis or vacation property calculation the same way.

You should consider all of the possible rentals available to you as an investor. To evaluate a vacation rental property, you can use Mashvisor’s calculator as well!

Related: The Best Vacation Rental Calculator—A Complete Mashvisor Review

How to Understand the Results of a Rental Property Analysis

Now that you’ve discovered how the above calculations work to evaluate a rental property, what’s next? Of course, you need to understand what the resulting figures mean to you. If you’re comparing a list of rental properties, the property with the best result is the winner.

Input all the numbers obtained on a spreadsheet next to the properties you are looking at. Then, analyze the properties carefully. The property that comes out with the best numbers should be the one you invest in.

However, you may also want to do a bit of background research and determine what minimum values will work for you as an investor.

Other Things You Need to Consider to Evaluate Rental Property

In addition to analyzing key metrics like those mentioned earlier in this article, there are other important factors to consider in learning how to evaluate a rental property.

Mortgage Rate

The mortgage payment metric looks at the cost of the mortgage payment compared to the rental income. To calculate the metric, you need to use the formula below:

Mortgage Payment to Rental Income Ratio = Mortgage Payment / Monthly Rental Income

A lower percentage means that the mortgage payment is a smaller percentage of the rental income. It means that the property is generating a substantial rental income and offers a higher potential return on investment.

On the other hand, a higher percentage means that the mortgage payment is a larger percentage of the rental income. The property is not generating enough income to cover the mortgage payment and may provide a lower potential return on investment.

For example, if the property requires a mortgage payment of $1,200 and generates a monthly rental income of $1,500, the mortgage payment to rental income ratio would be:

Mortgage Payment to Rental Income Ratio = $1,200 / $1,500 = 0.8 or 80%

In this example, the mortgage payment to rental income ratio is 80%, which means that the mortgage payment is 80% of the rental income. The property is not generating enough income to cover the mortgage payment and may come with a lower potential return on investment.

Gross Rent Multiplier (GRM)

The gross rent multiplier (GRM) metric looks at the relationship between the property’s value and the rental income it generates. To calculate the metric, you need to use the formula below:

Gross Rent Multiplier (GRM) = Property Value / Gross Annual Rental Income

A lower GRM indicates that the property is generating a higher rental income than its value, meaning that the property provides a higher potential return on investment.

On the other hand, a higher GRM means that the property is providing a lower rental income compared to its value. It means that the property offers a lower potential return on investment.

For example, if the property is valued at $300,000 and with a gross annual rental income of $30,000, the gross rent multiplier would be:

Gross Rent Multiplier = $300,000 / $30,000 = 10

In this example, the gross rent multiplier is 10, which means that the property value is 10 times the gross annual rental income. The property is generating a lower rental income in relation to its total value and may offer a lower potential return on investment.

Related: How to Use the Gross Rent Multiplier Formula

Loan to Value Ratio

The loan to value ratio (LTV) looks at the relationship between the property’s value and the loan used to purchase it. To calculate the metric, you need to use the formula below:

Loan to Value Ratio = (Loan Amount / Property Value) x 100

A lower LTV ratio means the property has a higher value compared to the loan used to purchase it. The property will provide a higher potential return on investment as it means less debt on the property.

On the other hand, a higher LTV ratio means that the property has a lower value compared to the loan used to purchase it. The property has a lower potential return on investment as it means more debt on the property.

For example, if a property is valued at $500,000 and you took a loan of $350,000 to purchase it, the loan to value ratio would be:

Loan to Value Ratio = ($350,000 / $500,000) x 100 = 70%

In this example, the loan to value ratio is 70%, which means that the loan used to purchase the property is 70% of the property’s value. It indicates that the property has a lower value compared to the loan used to purchase it and may have a lower potential return on investment.

The 1% Rule

The 1% rule is a way to evaluate a rental property by looking at the relationship between the property’s rental income and its value. To calculate the metric, you need to use the formula below:

1% Rule = Monthly Rental Income / Purchase Price

The result is a percentage that can be used to evaluate the property’s potential return on investment.

A higher percentage means that the property is generating a higher rental income compared to its value. It means that the property comes with a higher potential return on investment.

On the other hand, a lower percentage means that the property is generating a lower rental income compared to its value. It means that the property may provide a lower potential return on investment.

For example, if the property comes with a purchase price of $300,000 and provides a monthly rental income of $2,500, the 1% rule would be:

1% Rule = Monthly Rental Income / Purchase Price

$2,500 / $300,000 = 0.0083 or 0.83%

In this example, you get 0.83%, which means the property is generating a rental income of 0.83% of its value. It indicates that the property may offer a lower potential return on investment.

The 50% Rule

In the 50% rule, you need to estimate all the property’s operating expenses like mortgage, insurance, property taxes, maintenance, and repairs and divide it by the monthly rental income. In mathematical terms, the rule is as follows:

The 50% Rule = Operating Expenses / Monthly Rental Income

The idea behind the 50% rule is that a property should generate enough rental income to cover at least half its operating expenses. If it does not, it may not be a profitable investment. A property that follows the 50% rule can generate a positive cash flow and offer a higher potential return on investment.

For example, if the property generates a monthly rental income of $2,500 and the operating expenses are $1,500, the 50% rule would be:

$1,500 / $2,500 = 0.6 or 60%

In this example, the operating expenses are 60% of the rental income. It means the property does not follow the 50% rule and may not be a profitable investment.

The 2% Rule

The 2% rule in real estate is a way to evaluate a rental property by looking at the relationship between the property’s rental income and its value. The formula for the 2% rule is—

2% Rule = Monthly Rental Income / Purchase Price

The result is a percentage that can be used to evaluate the property’s potential return on investment.

The idea is that a rental property should generate enough rental income to cover at least 2% of its purchase price per month.

For example, if the property comes with a purchase price of $300,000 and a monthly rental income of $2,500, the 2% rule would be calculated as follows:

$2,500 / $300,000 = 0.0083 or 0.83%

It means that the property is generating a rental income of 0.83% of its purchase price per month. The property may provide a lower potential return on investment.

Conclusion

To evaluate a rental property quickly and effectively, you should understand and analyze the key metrics mentioned in this article. Each metric provides a different perspective on the property’s financial performance and potential return on investment.

By analyzing the said metrics, you can make more informed decisions about buying, holding, or selling rental properties. Mashvisor’s calculator can help you quickly and easily evaluate any rental property.

The calculator can make the process of evaluating a rental property more manageable. All you need to do is input some numbers into the calculator. It will then tell you factually whether the property is a good investment or not.

Schedule a demo today with Mashvisor to evaluate a rental property quickly and easily.