Financing investment properties may not be the sexiest thing on the planet, but it’s one of those things that you must do to climb up the investment ladder! Knowing how to finance investment property the right way can and will have a major effect on the profitability of your real estate business.

Whether you’re buying your first investment property or the 10th one, making a financing mistake can set you back and take away any financial profits that you’ve had. Accordingly, there are many investment property financing methods that lenders and banks creatively produce. Beware, my fellow investor! These financing methods may not be the best fit for all types of real estate investments, you must carefully select each one to fit your real estate investment strategy.

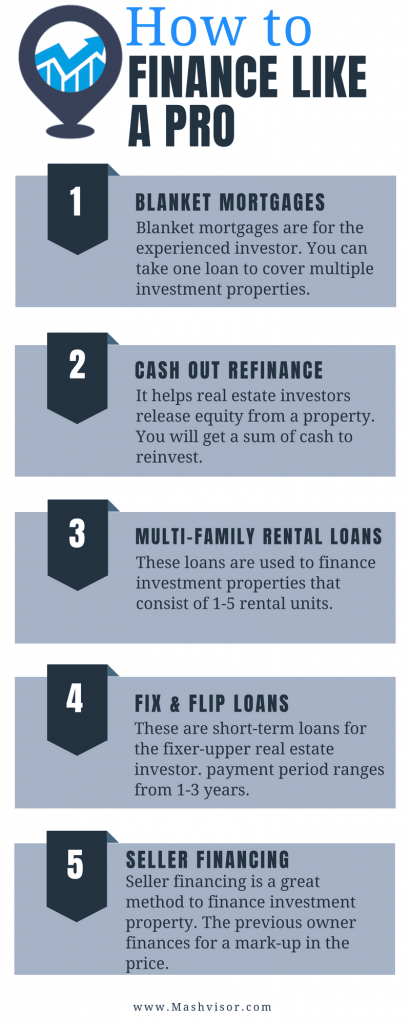

How to finance investment property with the right method

Blanket mortgages

Blanket mortgages are not very well-known among beginner real estate investors. A blanket mortgage implies financing multiple investment properties under a single loan. Pretty neat! A real estate investor will go for blanket mortgages for one of two reasons:

- Buying multiple investment properties

- Refinancing current investment properties under a single loan

If you’re a real estate investor who has thought about buying multi-family investment properties, then blanket mortgages are right for you.

Cash out refinance

A cash out refinance loan indicates releasing equity from a property. It is very similar to a home equity line of credit in a way. However, it offers the real estate investor much more freedom to utilize the cash.

Recommended Reading: Can You Use a Home Equity Loan or Line of Credit on an Investment Property?

With a cash out refinance, the real estate investor typically takes a new mortgage on an existing investment property. Typically, it’s to pay off the current loan and pocket the extra cash along the way. Not too bad of a plan! To be exact, a cash out refinance is a very useful tool to release equity from a property. Thus, allowing you to reinvest the money in another property and expand your real estate business.

On the other hand, a cash out refinance requires the property owner to have 30% or more of home equity in order for it to work. The reason for such a rule is that a cash out refinance works for 65-80% of the property’s market value at the time of the loan application.

If you’re still looking for that magical way of how to finance investment property with no money down, read this blog post: Financing a Rental Property: How to Buy a House with No Money Down.

Multifamily rental loans

For the expert real estate investors who have already figured out how to finance investment property like a pro, multifamily rental loans make perfect sense. Such a loan is used to purchase of a multifamily property consisting of one to more than 5 rental units.

To be exact, these multifamily loans only work for residential real estate properties. Meaning, you won’t be able to finance a mixed commercial and residential building with them.

If you’re wondering where to start with your first multifamily investment property, read this blog post: How to Buy Your First Multi Family Real Estate Investment.

Fix-and-flip loans

Fix and flips are not the easiest investment strategy in the real estate investment world to finance. Lending institutions generally view it as a high-risk investment but it’s slowly progressing into being viewed as a low-risk investment. Fix and flip loans are usually taken from hard-money lenders. Additionally, they are considered to be short-term loans as the term varies between one and three years. Be that as it may, most real estate investors and house flippers pay the loan off in a period between three and twelve months.

Of course, knowing how to finance investment property is just as equally important as analyzing it. A greatly helpful tool to fix-and-flip experts and real estate investors, in general, is an investment property calculator. The use of an investment property calculator is constantly increasing as more and more real estate investors are seeking to make low-risk investments with their money. Through such technology, you can conduct a real estate market analysis on any property you have your eyes on. As a matter of fact, you can use it on any type of residential real estate. With Mashvisor’s investment property calculator, you reduce your risk drastically as it calculates the cap rate, cash on cash return and even occupancy rate. All these figures work together to give you the real market value of any property.

To use Mashvisor’s investment property calculator, click here and make use of the 7-day free trial.

Seller financing

Seller financing is not your typical financing method. It’s for a savvy real estate investor who can hustle to get what he/she wants. If you manage to get one done, then you’ve learned how to finance investment property like a pro. With seller financing, the property’s owner is the one financing your purchase. In other words, you will be making payments on the property to the current owner.

This works best for those who do not want a conventional mortgage but are capable of making big payments. Keep in mind that the period does not usually exceed more than 5 years at most. If you want to know more about how to finance investment property with seller financing, read this: Everything You Need to Know About Selling and Buying a Home with Owner Financing.

Final Words

Of course, there are more financing methods that are available to both novice and expert real estate investors. We chose to highlight the ones that require more skill and effort to attain. Always keep in mind that making a successful real estate investment is all about the numbers. If you’ve figured out the numbers, well, you’ve got it!

If you have any more insights on how to finance investment property, feel free to share them with us in the comments section.