Is it okay to use a commercial loan to buy a rental property? Find out more about how to get a commercial loan for rental property below.

Generally, when investors need to take out a loan, they typically go for the conventional mortgage. However, it is possible to get a commercial loan if you want to buy an investment property and start a rental property business.

Table of Contents

- Step #1: Be Clear With Your Goals

- Step #2: Get Your Finances in Order

- Step #3: Shop Around for Lenders

- Step #4: Prepare All the Required Documents

- Step #5: Start the Application Process

- Mortgage vs. Commercial Loan: What’s the Difference?

- How to Find a Profitable Rental Property

- Frequently Asked Questions

The main concern among most investors with real estate investing is capital. To get into it, you’ll need enough money to back up your projects, whether it’s house flipping, BRRRR strategy, or rental property. You need money to make money, as they say.

In an ideal world, investors wouldn’t face any financial restrictions, and they can buy any investment property they want. However, realistically, a lot of real estate investors are without enough cash lying around to put into investment ventures. Most who wish to get into real estate need to take out a loan to finance their projects.

While the typical route, especially for rental property investors, is to look for a good mortgage deal, it is possible to use a commercial loan for rental property investing. Of course, they come with certain caveats, but technically, you can use a commercial loan to invest in rental properties. Let’s go over each step of getting a commercial loan for a rental property below.

Step #1: Be Clear With Your Goals

From the very start, you should come up with a clear goal. It is important for investors to write down their goals so they stay on track.

Your goals will determine your strategies and actions. They include deciding which lender to go with and the type of loan to apply for, among other things.

If you’re unclear about your goals, you will first need to ask yourself questions like:

- How much money do I need for the loan?

- What do I need the money for?

- How long will it take me to pay off the loan?

- Do I have collateral to put up?

- What is my financial status?

Answering questions like the above will help you outline clearer goals that will give you an idea of how to go about your business.

The more specific the question, the more specific the answer. And the more specific the answer, the clearer your goals will be.

SMART Goal Setting

When you start setting goals, they should be SMART. SMART is an acronym for Specific, Measurable, Achievable, Realistic, and Timely. Your goals should be:

- Specific. Don’t be vague. Don’t just go, “I want to get rich.” Set real numbers for your goals with real deadlines.

- Measurable. Ensure that the goals you set can be measured so you can keep track of your progress.

- Achievable. While ambition is a good thing, a lofty one can be quite overwhelming. If you have a big goal, set smaller goals that will help you reach it without being discouraged.

- Realistic. You need to also be brutally honest with yourself and your realities. You cannot earn a million dollars in profit in a week.

- Timely. Give yourself a target deadline and do your best to hit It. Setting a deadline will give you more focus and motivation. Plus, you can see how much progress you’re making and if you’re within your timetable.

The above are a few criteria you should use to help you streamline your goals so you can reach them in the shortest amount of time.

Step #2: Get Your Finances in Order

It is already common knowledge that real estate investing is quite expensive. You need access to financial resources to help you with the expenses associated with buying an investment property. And since most investors don’t have enough money lying around for an all-cash purchase, most are compelled to take out loans.

Getting approved for an ordinary mortgage is already challenging as it is. Applying for a commercial loan is a ballgame on a whole new level.

One of the main things that will hinder your commercial loan application is your financial condition. You need to be brutally honest with yourself when you evaluate your financial standing.

If you have any recent bankruptcies or tax liens or consistently fail to make prompt payments, chances are you will have a hard time getting that financing you want.

Lenders and financial institutions have stricter standards when it comes to commercial loans.

Work on improving your financial status and make sure everything is in order before you work on that application form.

In addition, they will take a look at your investment’s income-generating potential as part of their evaluation of your loan. So, you should be able to justify that your investment is worth taking the risk. You better come up with a sound financial strategy, or else you’ll risk your application being rejected.

Step #3: Shop Around for Lenders

Part of performing due diligence is researching and comparing lenders. Take your time here because once you sign the papers and the loan gets approved, you’re stuck with that loan and lender for years.

You wouldn’t want to end up with a loan and find out that you could’ve gotten a much better deal with another lender had you done more research.

When comparing lenders, most investors look for the following:

- Loan products offered

- Application requirements

- Interest rates

- Origination fees

- Payment terms

- Prepayment penalties

- Bad-credit or fast-funding options (if needed)

Don’t settle for the first lender you see. Keep in mind that when you sign up for a loan and it gets approved, you’re tied down to it for years. So, do your research on the different lenders in your area. Talk to other investors or real estate professionals for recommendations and start from there. Ideally, you should short-list two or three lenders.

Once you’ve narrowed down your choices, go over each lender’s loan offer to see which one works best for you. As an investor, you need to keep in mind your investment goals when choosing a loan product. The loan you get should still help you achieve your goals and not hinder you from them.

Step #4: Prepare All the Required Documents

After finding the lender that meets your criteria and needs, start working on getting the requirements. Generally, when it comes to commercial loans, the requirements can be easily divided into three categories: security, income, and credit.

One, lenders will want to know that the property you’re getting can properly secure the loan you’re getting. It means that you will need to get 25% to 35% equity in the property. You will also need a down payment of 25%. Additionally, lenders will also require rental property insurance and check the title for any liens or claims against it.

Two, lenders will also check on your income to see if you earn enough relative to your expenses. In most cases, they use the debt-service coverage ratio (DSCR) to determine your earning ability. Although the DSCR will vary based on the property you’re borrowing against, lenders would like to see a DSCR of at least 1.25%.

Three, your business credit score also matters. However, in most cases, lenders also want a personal guarantee, so your personal credit score will also undergo scrutiny. They will also want to know how long you’ve been in business. To qualify for commercial loans, you must be in business for at least a year or two.

Prepare all the necessary documents so that when the time comes to finally start the application process, you’re all set.

Regardless of whether you’re buying a property as a residence or an investment property, you need to get your requirements in order. Lenders will look for the following records:

- Proper identification

- Proof of income

- Bank statements

- Tax returns (business and personal)

- Credit history

- Rental history

- Assets and debts

Step #5: Start the Application Process

When you’ve already made a decision and already have all the requirements on hand, go back to the lender of your choice to start the application process. Take note, though, that the process will take some time as lenders screen and evaluate each application thoroughly before approving a loan. As long as your finances are in order and your documents are complete, you have a pretty good chance of getting approved.

Once the loan is approved, close on the deal by reviewing your closing statement and signing some final documents.

Mortgage vs. Commercial Loan: What’s the Difference?

Loans are almost always a staple when it comes to buying any type of real estate, regardless of whether you’re a beginner investor or have been in the game for quite some time. A lot of rental property investors wouldn’t have been successful at it without the aid of loans.

However, the loan type you get also matters in the long run. Keep in mind that if you take out a loan, you are tied to it for several years. If you’re investing in rental properties, a huge chunk of what you make on rent monthly will go to mortgage payments. It is why we recommend exploring all your options before finalizing which loan you are getting.

Typically, most small-time investors go with a conventional mortgage, especially if they’re buying just one investment property at a time. However, there is another route for investors to take, and that is commercial loans. Before we get into discussing how to get a commercial loan for rental property investing, let’s talk about their differences first.

Conventional Mortgage

Generally speaking, conventional mortgages are consumer loans used to buy single family homes and up to four-unit multifamily properties, like duplexes, townhouses, and condos. Although an investor can buy up to ten of the said properties with a conventional loan, most lenders will only underwrite a maximum of five due to the risks.

Here are a few things to keep in mind when purchasing investment properties with a conventional loan:

- Application Process. Mortgages are a lot easier to qualify for compared to commercial loans. Lenders will look at your personal finances, which include your income, personal debts, and credit history.

- Down Payment. Banks normally ask for 20% to 25% of the property value as a down payment for loans on properties you will not live in. Primary residence FHA loans, on the other hand, require a much lower down payment of only 3.5%.

- Loan Term. For most investment properties, the loan payment is typically spread over a 15- or 30-year period.

- Mortgage Rates. Interest rates for investment properties are higher compared to primary residence mortgages but lower than commercial mortgages.

Commercial Loan

On the other hand, if you plan to buy more than five multifamily properties, a commercial loan might be the one for you. Remember that a lot of bankers and lending companies will only approve up to five properties as the risks and complexities of underwriting are magnified for more than that.

A good number of investors choose commercial loans for their flexibility. Here are a few things to consider when it comes to commercial loans:

- Application Process. Getting approved for a commercial loan is tougher compared to a regular mortgage application. Banks have higher standards and stricter requirements for applicants. On top of that, they will also want to look at your investment property’s earning potential to evaluate your application.

- Down Payment. Depending on the loan type, you’re looking at a down payment range of anywhere from 15% to 35% of the property’s value.

- Loan Term. Unlike conventional mortgages, commercial loan terms are much shorter, usually between 10 and 20 years. In some cases, it is less than that. You will need good negotiating skills if you want to add a few years to the repayment period.

- Interest Rates. Rates on commercial loans vary, but they will largely depend on the type of loan product you are getting.

Understandably, people who take out commercial loans have different needs and goals. We recommend working with an experienced and credible lender so they can help you create a loan that’s right for you.

How to Find a Profitable Rental Property

Now there may be some of you who think that getting a commercial loan for an investment property may be daunting and overwhelming. And it is. But that doesn’t mean it’s not doable.

Here are a few tips you can take on how to get a commercial loan for rental property investments so you can find the right rental property that’s right up your alley:

Tip #1: Have a Good Understanding of Your Lending Limits

Before applying for a commercial loan, you need to see the bigger picture first. You need to know the parameters of what you’re working with so you can make informed decisions. Understanding your lending limits is one of them.

Lending institutions put different norms set in place on the loan maximum one can carry. Most lenders set their upper limits to within a 6- to 8-loan range. Some lenders on the upper limits allow up to ten loan credits at a time. One such example is Fannie Mae. Knowing the lenders’ limits will give you a good idea of what you can get as an investor.

If you find the right lender that suits your needs, they can help you choose or craft the right loan type to optimize your investment. It is especially helpful if you want to get good leverage. They can work things out that will keep your out-of-pocket expenses to a minimum during the first few stages of repayment.

We recommend consulting with a seasoned real estate advisor to see how many loans you will need in the first place.

Tip #2: Ensure You Have Enough Cash Reserves

Even if you take out a commercial loan, you still need to ensure that you have enough cash to shoulder the other costs and expenses associated with your project. Investing in rental properties can be costly, especially if you’re buying multifamily properties that need repairs and updates to be habitable. You need to have enough money to spend on such updates.

Additionally, you also need to have money to cover maintenance and utilities for unoccupied units. When you start your rental business, you are not guaranteed that you will achieve a 100% occupancy rate from the get-go. You will also go through transition periods from one tenant to another. Such vacancies cost money.

If your primary residence is also on loan, you need to factor the additional payments into the equation as well. The reality for most rental property investors is that they are paying for mortgages on more than one property.

This is why you should plan your budget wisely, not only for upfront costs but for your investment’s regular upkeep.

Tip #3: Perform Due Diligence

Lastly, you need to put in the work if you want to find the right rental property that won’t break the bank.

The process of choosing the right lender can be stressful, but if you do your homework, it will be easier to do. Your lender and loan product will affect your finances for the next few years, so it is one thing you will want to get right.

You need to look for a rental market that will give you a good return on your investment and create a decent positive cash flow for you. It will make repayments easier to deal with.

The Right Tools Make It Easier

When it comes to researching various real estate markets, technology has somehow leveled the playing field for investors of different backgrounds. This is where an online real estate platform like Mashvisor can help you, especially if you’re new to the game.

Having access to Mashvisor’s massive database of rental markets and investment tools will help you find the right investment properties in the most profitable markets. As a source for real estate data and information, Mashvisor is known for its high-quality and up-to-date data. It uses reliable sources such as Realtor.com, the MLS, and Airbnb to gather real estate data.

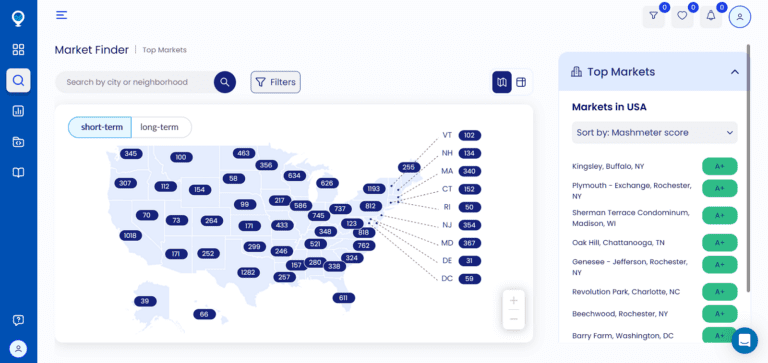

When it comes to tools, Mashvisor’s Market Finder feature gives you a bird’s eye view of rental markets in an area and what they can offer by way of rental income, occupancy rate, and cap rate. You can easily compare multiple rental markets with the Market Finder tool, which is an absolute timesaver.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.

Mashvisor’s Market Finder feature provides you with a bird’s eye view of rental markets across the US and what they can offer in terms of rental income, occupancy rate, and cap rate.

Wrapping It Up

To end, determining how to get a commercial loan for rental property investments isn’t as complicated as you might think. Getting a commercial loan for a rental property may be intimidating and overwhelming, but if you do it right, you might have better chances at it than taking out a conventional loan.

The important thing is you do your homework. Get to know what your lending limits are and what lending institutions have to offer before you make any final decisions. Talk with the right people so they can point you in the right direction. And, of course, have the best investment tools at your disposal when looking for the right real estate market.

Mashvisor is one of the best online investment platforms trusted by countless investors in all 50 states. Its high-quality data and valuable investing tools, like the Market Finder and real estate calculator, have helped rental property investors find properties that meet their goals and needs.

If you need help in analyzing the profitability of certain investment properties, schedule a demo with Mashvisor today to get access to the best real estate data and tools.

Frequently Asked Questions

Here are some responses to your frequently asked questions about loans and mortgages:

What Is a Blanket Mortgage in Real Estate?

A blanket mortgage, or a blanket loan, refers to a type of loan that helps you fund multiple real estate purchases simultaneously. This type of financing is popular among real estate investors, property developers, and commercial property owners as it streamlines and cuts costs on the lending process.

What Are Small Business Term Loans?

A small business term loan is a type of financing that lets you borrow a lump sum of money from a lender and repay on a fixed schedule for a specified period. This type of loan is used by investors and businesses for different purposes and is good for making investments in your business for the long haul.

How Does SBA Work?

According to its website, the US Small Business Administration works with lenders to provide loans to small businesses. SBA loans are loans guaranteed by the federal agency and are issued by participating lenders to small businesses. The loans help cover startup costs, fill in capital needs, finance expansions, and buy real estate properties, among other things.

Typically, you apply for an SBA loan in participating banks and lending institutions, which then send an application to the SBA for a loan guarantee. It means that if you miss payments on your SBA loan, the government will make payments on the guaranteed amount.

Once your SBA loan is approved, the lender closes the deal and disburses the loan proceeds. It is then your responsibility to make monthly payments directly to the lending institution.