It’s no secret that investing in income properties is an excellent way to make money. After all, 90 percent of the world’s millionaires have created their wealth through real estate. The catch, however, is that investing in income producing properties is not a walk in the park. Just as you can’t simply plant a seed and expect a grand oak, you can’t merely buy an income property and expect high ROI.

So, what is the best way to invest in income properties? In this blog, we’ll go over how to invest in income properties in five steps. We’ll also show you how Mashvisor can help with every step of the way!

Step 1: Learn More About Getting Started in Real Estate

Buying income property requires a lot of effort and time. Even if you plan to invest in Airbnb or vacation rentals, real estate is a long-term business. Therefore, the first thing you need to do is learn more about real estate. Find out if buying an investment property is meant for you. Take the time to learn about the strategies, financing, risks, and rewards of income properties. Dig your nose deep into various real estate education sources. Local realtors, landlords, property managers, books, and the Internet can be invaluable for learning about real estate.

Speaking of the Internet as a useful source, consider using Mashvisor! Mashvisor provides all the real estate knowledge you need to get started in two excellent forms. The Mashvisor blog is a free daily resource for all potential and active investors. It covers everything to do with the US housing market, including best locations, financing tips, property types, and real estate news. You can also get hands-on real estate analytical knowledge using Mashvisor’s investment tools. With these tools, you can analyze any rental market or income property in the US.

Step 2: Define Your Goals and Set Your Budget

As the name suggests, the purpose of an income property is to generate money. This does not mean, however, that you should purchase a property for the sake of investing and expect positive cash flow. A vital part of the process is outlining specific goals before investing. For instance, are you more interested in long-term or short-term investing? Is there a specific monthly return on investment you would like to generate? Do you plan on selling the investment property after a period of time? By defining your goals, you are one step closer to achieving them.

After some reflection and research, you can get right into planning an investment property purchase. We recommend you start by setting a budget. Start with saving for the 20% down payment and other purchasing costs. In addition, consider various business and rental property costs, such as insurance, property taxes, and utilities. Above all, creating a budget will inform you of your financial limitations and what you need to earn in order to generate positive cash flow.

Related: How to Budget for an Investment Property and Cash Flow

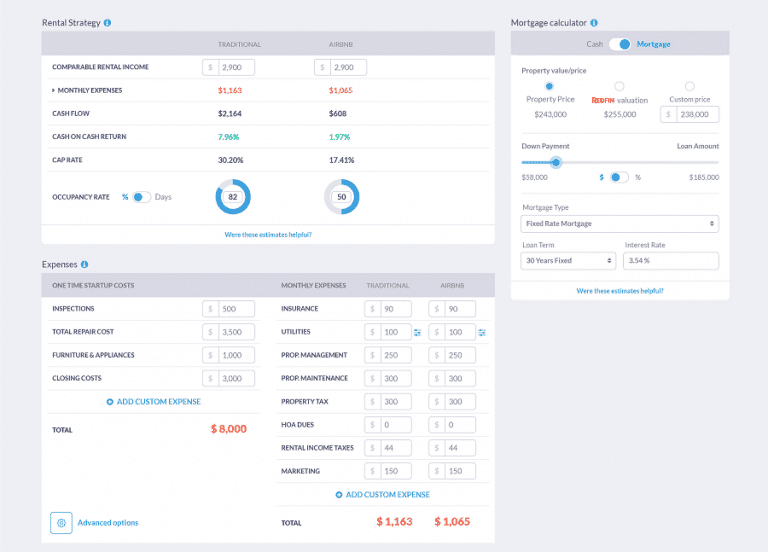

Mashvisor’s real estate investment tools are here to help with setting goals and budgets. Mashvisor’s investment property calculator, for example, provides cost estimates for every listing on the platform based on local real estate comps. You can also use the calculator to factor in your financing costs. By doing so, you can learn what is needed to achieve a certain ROI for income properties.

Step 3: Start Finding Income Properties for Sale

Once the last two steps are taken care of, you can begin searching for an income property for sale. There are a variety of ways you can find investment properties for sale. Local advertisements and realtors, for instance, are excellent for nearby real estate opportunities. We are, however, in the 21st century. As a result, much of your investment property search will take place on the Internet. Online, you can find a real estate heatmap, which will help you search for an investment location.

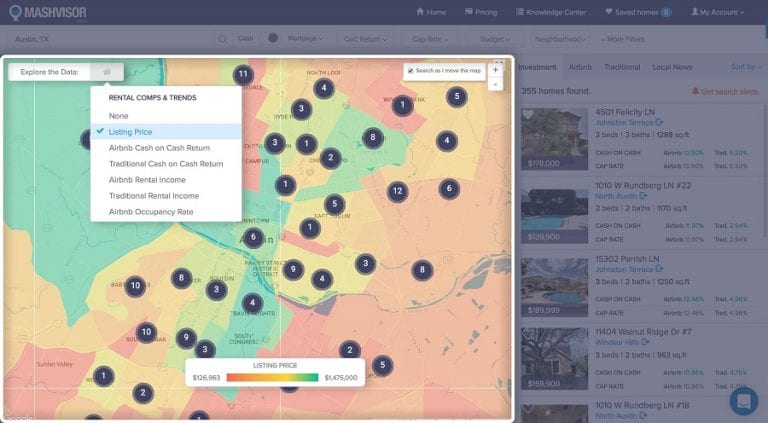

As you would expect, Mashvisor’s assortment of investment tools includes a heatmap. Mashvisor’s heatmap presents the data on neighborhoods with income properties for sale in a visual, easy-to-understand form. With the heatmap, you can scour the US housing market 2020 for locations based on your choosing, such as high ROI and low property prices, for example.

Once you find a good neighborhood, you’ll be able to see all the available income properties there. Select a few promising ones based on the quick analysis you’re given (which includes listing price and traditional and Airbnb cash on cash return) and move onto Step 4.

Step 4: Analyze the Income Property

After you’ve found potential residential income properties for sale, you can begin to analyze properties of interest. Ultimately, an investment property analysis evaluates a property’s profitability. Profitability is measured in three important metrics: cash flow, cash on cash return, and cap rate.

An accurate investment property analysis is not possible without the proper investment tools. With Mashvisor, all you need is one tool for a detailed investment property analysis. Mashvisor’s rental property calculator crunches all the profitability metrics of an investment property. It provides the data on a variety of factors for the analysis. These factors include, but are not limited to, the following:

- Property price

- Price per square foot

- Traditional and Airbnb rental income

- Rental property expenses

- Traditional and Airbnb cash flow

- Traditional and Airbnb cash on cash return/cap rate

- Projected traditional and Airbnb occupancy rate

What’s more, the calculator is also interactive. In other words, you can provide your own inputs and adjustments and see how they affect the estimated return on investment for a rental property. In addition, the calculator finds other similar rental income properties, or real estate comps, to further enhance the analysis.

Related: How to Find Real Estate Comps in 2020

Step 5: Finalize Your Financing Method

After using Mashvisor’s tools, you’ve finally found the best positive cash flow income properties out there. The final step to take is to finalize your income property financing. There are many methods to approach income property financing in 2020. Buyers could purchase property fully in cash (if possible), use a mortgage, or borrow money from private lenders. What’s important is finding the optimal financing method based on your financial and investment goals.

Related: 7 Types of Investment Loans for Real Estate Property

While all forms of income property financing have the same purpose, they can have different effects on a property’s ROI. You can easily find out how your financing method shifts return on investment through Mashvisor’s investment property analysis.

With these five fundamental steps in mind, you can tackle investing in income properties with ease, efficiency, and success. Get started now with Mashvisor.

To start your FREE 7-day trial with Mashvisor, CLICK HERE!