Buying an income property is no easy task. That’s because it’s not as easy as just handing money over to the seller – you have to ensure the property is a worthwhile investment. And that can be difficult. The only way to know if a potential property will pay off as an investment is by conducting an income property analysis (aka a rental property analysis). So, how can you conduct an income property analysis?

The Real Estate Investment Tools You’ll Need for an Income Property Analysis

The most reliable and accurate way to perform an analysis is to use real estate investment tools. Such online tools will provide the data and perform the calculations needed to study an investment property. In addition, they allow investors to save time and money that would otherwise be wasted with the use of outdated Excel income property analysis spreadsheets and manual analysis.

Related: Why Are You Still Using a Real Estate Investment Analysis Spreadsheet?

Where can you find the best real estate investment tools for an income property analysis? Well, look no further! Mashvisor’s real estate investment software is the only source you need for investment analysis tools. Mashvisor’s cutting edge tools utilize the most up-to-date data and predictive analytics available. But that’s not all! Mashvisor has unique tools, each one dedicated to a specific step of income property analysis:

Step #1: Study the Investment Location – This can be performed using the Real Estate Heatmap.

Step #2: Conduct an Investment Property Analysis – This is conducted by the Income Property Calculator.

Step #3: Perform a Comparative Market Analysis – The Income Property Calculator will also aid you in this step.

Let’s take a look at each step now and how Mashvisor’s tools will make them easier for you to perform.

1. Study the Investment Location Using the Real Estate Heatmap

Location is, by far, the most important feature of your real estate property. So it’s no surprise that analyzing the location is the first part of an income property analysis. Conduct a real estate market analysis first and learn about the different trends of the city where the investment property is located. Find out how the job market is doing, if the economy is diverse and growing, and whether the population is declining. You can check out Mashvisor’s blog and real estate market reports and analysis pages for this kind of information.

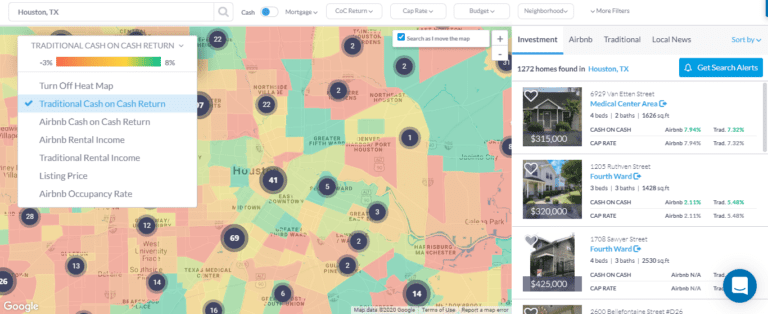

Next, conduct a neighborhood analysis. With Mashvisor’s heatmap analysis tool, you can accomplish this in mere minutes. You probably associate heatmaps with weather reports, but they are also used for analyzing residential income properties and markets. Mashvisor’s real estate heatmap uses various colors to represent important information. With a color-code ranging from yellows to reds to greens, it presents data in an easy to comprehend fashion.

The heatmap only requires a few steps to operate. Firstly, you will need to enter the city you wish to analyze. All of the neighborhoods in that city will appear on the map. Then, you can use a variety of filters to conduct your analysis. Mashvisor’s heatmap provides the following filters:

- Listing price

- Traditional rental income

- Airbnb rental income

- Traditional cash on cash return

- Airbnb cash on cash return

- Airbnb occupancy rate

Set a filter and you will see how the neighborhood of your choice performs for that metric. For example, if you set the listing price filter, you can see if your neighborhood is affordable (red) or expensive (green) compared to other neighborhoods in the city.

Related: Best Eastern States to Invest in

When it comes to real estate analytics, Mashvisor’s heatmap is all you need for a neighborhood analysis. You can then further study the neighborhood by visiting its Neighborhood Analytics Page. With that, you’ll have completed the first step of income property analysis.

Related: Finding Income Properties Using a Heatmap

2. Conduct an Investment Property Analysis with the Income Property Calculator

After studying the location where the investment property for sale is located, you can begin to analyze it directly. Mashvisor’s income property calculator is the top-tier tool for such a function. With Mashvisor’s calculator, your income property analysis will be swift and precise.

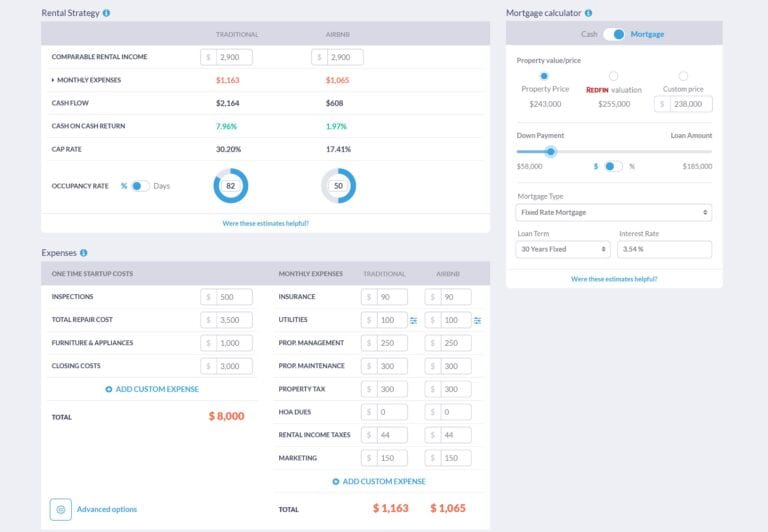

The calculator uses data from current MLS listings and Airbnb analytics based on data taken directly from Airbnb. The rental property calculator also requires user input to generate the most accurate results. These inputs primarily revolve around property expenses and financing cost estimates. Cost estimates are provided from rental comps. Still, investors are able to adjust these values to their own liking:

- Mortgage loan type

- Down payment

- Mortgage interest rates

- One-time startup fees

- Recurring costs

After that simple step, the calculator works its magic. It will provide a wide range of rental property metrics and data. These include, but are not limited to:

- Airbnb rental income

- Traditional rental income

- Airbnb and traditional cash flow

- Monthly rental property expense estimates

- Airbnb and traditional cash on cash return

- Airbnb and traditional cap rate

- Optimal rental strategy comparison (Airbnb or traditional)

- Traditional and Airbnb occupancy rate

- Investment payback balance

3. Perform a Comparative Market Analysis with the Income Property Calculator

After conducting an income property analysis, you need to make sure the income property for sale is reasonably priced. Many properties on the market are overpriced, which may be deliberate or unintentional on the seller’s part. To find out if the property is worth it, you need to perform a comparative market analysis (CMA).

To perform a CMA, you need to find income properties that are similar to yours. These properties, called real estate comps, are properties that match yours in terms of location, size, type, condition, amenities, and more. The most accurate and fastest way of finding income properties for comparison is through Mashvisor’s income property calculator. The calculator automatically generates a list of real estate comps for your investment property for sale. Afterward, you can quickly conduct a CMA. If the CMA shows that the property is reasonably priced, along with positive results from the neighborhood and investment property analysis, then you’ve just found a great property to invest in!

Related: Comparative Market Analysis: A How-To Guide for Real Estate Investors

To Wrap It All Up

And just like that, you’ve performed the most accurate income property analysis. Thanks to Mashvisor’s real estate investment tools, you’ll know if your property of interest is one of the top positive cash flow income properties in the area.

To start your own real estate income property analysis today, CLICK HERE to start a FREE trial with Mashvisor!