Do you want to get into the real estate investing boom but don’t have the liquid cash to start? If so, you’re most likely considering the many financing options available to beginner real estate investors. One of the most common financing options is mortgage loans, but this is not the ideal option for everyone as there are requirements that can limit some investors. If you can’t get a mortgage, consider other options for buying an investment property before giving up! For example, did you know that you can invest your 401k in real estate? Whether you want to buy a house for personal use or for rental income, read this to learn how your 401k can be a funding source to invest in real estate.

Related: Real Estate Investment Financing: 7 Ways That Work for Beginners

Is It a Good Idea to Use Your 401k to Buy a House?

Before we jump into how to invest your 401k in real estate, let’s answer one important question. It’s possible to use 401k money in real estate investing, but is it actually a good idea to do so? Here are the pros and cons to consider:

Advantages of Investing Your 401k in Real Estate

When mortgage interest rates rise, a 401k loan can provide cost-effective access to money. With interest rates just above the prime rate on most 401k loans, this can be an affordable option to cover a large down payment on an investment property. And while we’re on the subject of interest, here’s another benefit of borrowing from your 401k for a down payment: as you pay back your 401k loan, you’re repaying yourself with interest which is going back into your 401k account.

Finally, another reason why you might want to invest your 401k in real estate is the tax exemption that comes with 401k loans. When you borrow from your 401k, there are no tax consequences and no tax-related fees. For example, when you withdraw from an IRA to put a down payment on an investment property, you’ll have to pay income taxes on the distribution. However, because the money you borrow from your 401k is a loan, you don’t need to pay income taxes on it. As a matter of fact, it doesn’t count as income at all.

Disadvantages of Investing Your 401k in Real Estate

While you can withdraw money from your 401k accounts to cover the costs of buying rental properties, the purpose of these accounts is to encourage long-term savings and discourage you from making early withdrawals. Hence, when withdrawing money from your 401k early to invest in real estate (or any other purpose), you will most likely pay a penalty. The IRS allows “hardship withdrawals” in certain scenarios such as using 401k to buy a primary residence (not as a real estate investment property).

Furthermore, you need to realize that if you take out a loan against your 401k, the loan must be repaid by the deadline. Otherwise, the 401k loan is considered and taxed as though it were an early withdrawal. So, if you lose your job or are otherwise unable to pay up, this loan could cost you more than what you’ve bargained for – you should always budget accordingly! Lastly, before you invest your 401k in real estate, you need to consider the loss of retirement income since that’s what a 401k is supposed to be.

Related: Real Estate Investing vs. 401k: Which Should You Go For?

How to Invest in Real Estate with Your 401k

1- 401k Loans

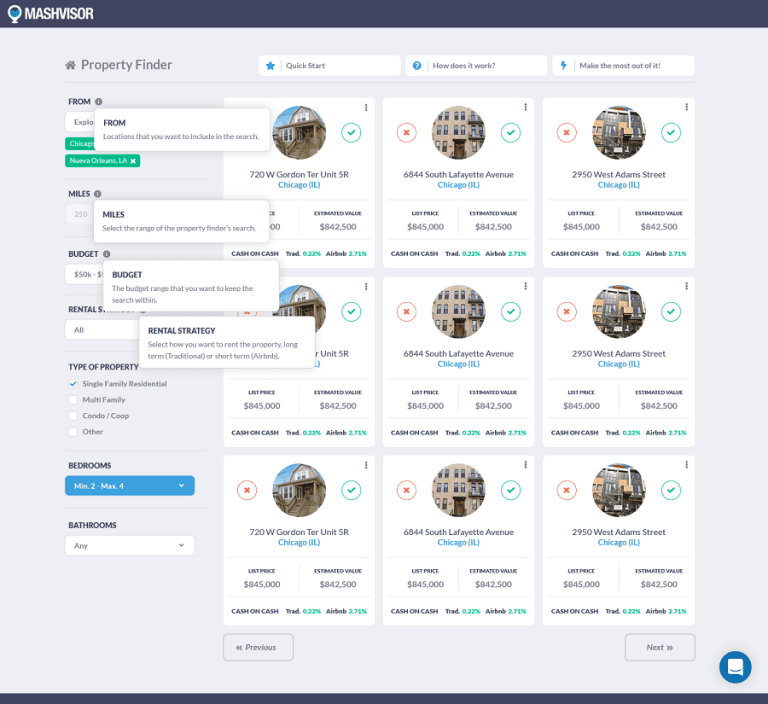

There are a few options to consider that will allow using 401k to invest in real estate properties. The first one is to take out a loan against your 401k (if your plan rules allow loans) to access funds to finance buying rental properties. The IRS allows you to borrow as much as $50,000 or half of your balance (whichever is lower) including any outstanding loan balances. This money can be used as a down payment for your first rental property which you can find right here on Mashvisor and in just a matter of minutes! Our Property Finder is a must-have tool for anyone thinking of getting into real estate investing but doesn’t know what makes for a profitable investment property for sale. All you have to do is set your criteria (budget, location, property type, etc.) and our tool will provide a list of properties for sale that best match what you’re looking for.

To learn more about our tool and how to use it, read Rental Property Finder: A Revolutionary Tool for Investing in Real Estate.

401k loans used to buy a principal residence can be repaid over a long time period (up to 15 years) if your plan allows. However, if the loan is used to finance investment properties, then the real estate investor must repay the loan within 5 years if he/she wants to keep it tax-free. Remember, the interest you pay adds to your 401k savings. So with careful planning, you can invest your 401k in real estate and get access to investment property financing with little or no tax consequences.

Do you have a free Mashvisor account? Use our Property Finder to find lucrative investment properties that match your criteria in a matter of minutes!

2- 401k Rollover to a Roth IRA

A lot of experts recommend real estate investors to roll over their 401k into a Roth IRA. As mentioned earlier, doing this allows you to roll over your investment tax-free and then simply use the proceeds to invest in real estate rental properties. In addition, when you roll over as much as $10,000 that you’ve set aside for buying your first investment property into a Roth IRA, you can avoid the 10% early withdrawal penalty and restrictions imposed on a 401k distribution! However, it should be mentioned that because 401k funds are pre-tax contributions while Roth IRA contributions are post-tax, you’ll be required to pay income tax on the money transferred to the Roth IRA.

3- Self-Directed 401k

An important thing for beginner real estate investors to understand is that a traditional 401k won’t allow you to invest directly in real estate. This is why you need to have a self-directed 401k plan – this is basically a do-it-yourself retirement plan that you manage. Many think this is the best way to invest your 401k in real estate if you want real estate as an investment choice for your retirement savings. This is because a self-directed 401k allows you to buy land, commercial property, and residential income property. Plus, you’ll also have any income generated tax-free! However, self-directed 401ks have limits on the type of transactions that the investor can undertake. For example, they can’t involve property bought or sold to relatives or property in which you live. This way to invest your 401k in real estate is only advised for those who are savvy about the real estate market.

The Bottom Line

So can you invest your 401k in real estate? Absolutely. Should you do it? This depends on your personal goals, investment strategy, and how you weigh the pros and cons of this financing method. Still not sure about this strategy? We recommend sitting down with your accountant or retirement advisor to ensure you’re making the right decision. Investing in real estate – using 401k or other sources of money – should always be evaluated in the context of your larger financial goals.