Like many real estate investors, you have probably dreamt of owning a beach house rental in an exotic location. Such a vacation rental property not only generates income but also provides free accommodation during your much-needed vacations. But, is buying a beach house to rent out a good real estate investment? To answer this question, let’s take a closer look at some of the advantages and disadvantages of this investment strategy.

Related: How to Make Money with Real Estate: Buy and Rent Out a Beach Investment Property

The Pros of Buying a Beach House for Investment

Let us first look at the pros of buying a beach house investment.

- Rental income – A major benefit of owning a beach house is the potential rental income you can earn. Typically, vacation rentals generate a much higher income than traditional rental properties.

- Tax benefits – Owners of vacation rentals are allowed to write off business-related expenses such as mortgage interest, property management fees, marketing costs, insurance, property taxes, and repair costs. Consult your local real estate attorney to find out what tax deductions apply to you.

- Property appreciation – The value of real estate usually increases with inflation. This means that your beach house will probably be worth much more in the long-term.

- Personal use and enjoyment – As mentioned earlier, a beach house can serve as a second home during your vacations. This saves you lots of money that you would have spent on accommodation elsewhere and is not a benefit that comes with long-term rental properties.

To learn more about how we will help you make faster and smarter real estate investment decisions when it comes to buying a beach house rental property, click here.

The Cons of Buying a Beach House for Investment

What are the downsides of buying a beach house to rent out?

- High down payment – When buying a second home, you might be expected to put down 20-30%. The credit score requirements could also be higher for a vacation rental property.

- High maintenance and repair costs – Short-term rentals usually have higher maintenance costs compared to traditional rentals. With many visitors coming and going, there is a higher chance of things getting damaged in your beach house.

- Additional expenses – Owning a vacation home comes with a wide range of expenses. Besides the basic costs of owning a rental property, which includes mortgage payments, taxes, insurance, and management fees, you may have to pay for additional permits, fees to short-term rental websites (if you’re using one), and utilities. Because your beach house will likely be in a different town or city so that you can enjoy it as well, you will incur costs traveling back and forth to check on your rental property.

- Upkeep and management can be time-consuming – Vacation rental properties require a lot of upkeep. You will need to handle guest check-ins and check-outs, restocking, housekeeping, and responding to guests’ concerns and questions. You could also hire a professional vacation rental property manager, but keep in mind this will be another additional cost.

- More risks – A beach house is prone to natural disasters. Hurricanes and flooding could result in significant damage to your rental property. This is why it is important to have insurance that covers every potential risk.

- Lack of flexibility when it comes to personal use – While visiting your second home will be great for the first few years, you may eventually get tired of the scenery and want to visit other locations. Of course, you will still have a beach house rental property to make money from, but you will no longer benefit from the free accommodation during your vacations.

Related: Should You Buy a Beach House as a Real Estate Investment?

What to Consider Before Buying a Beach House

Now that we know the pros and cons, you may have made up your mind to go ahead and buy a beach house. So let us look at some of the things you need to consider before buying a beach house to rent out:

Condition of the neighborhood

When looking at where to buy a beach house, select your location carefully. Since you are planning to rent out the investment property, the location should be a place that not only appeals to you but also to potential tenants. The first thing to consider is nearby activities. Besides the beach, are there other nearby attractions your guests can enjoy? This could be shopping centers, unique bars and restaurants, parks, museums, mountains, or forests, and other tourist attractions.

Accessibility is another important consideration before buying a beach house. Can guests easily access your investment property using a bus or train? Is there a car rental company nearby? Will your beach house offer private parking for guests? If not, where will they park? A location that is readily accessible will mean higher bookings for your vacation rental property investment.

The economic conditions of a town or city will also indicate if the location is good for investment. What impact does the tourism industry have on the economy? Does it employ a large number of the population? Consider such factors before buying a beach house in a certain location.

Related: Real Estate Investing: The Best Places to Own a Beach House

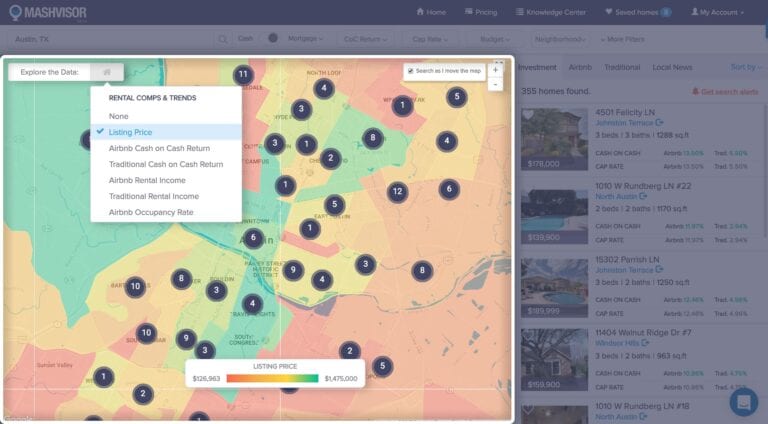

Because the main aim of buying a beach house is to make a good return on investment, it is important to conduct a real estate market analysis before settling on a location. You can use Mashvisor’s heatmap analysis tool to analyze different housing markets based on listing price, cash on cash return, rental income, and Airbnb occupancy rate. Within minutes, you will be able to find a profitable real estate market for investing in beach houses that is within your budget. For example, if you are thinking of buying a beach house in Key West, Florida, one of the best beach towns in the state, Mashvisor will help you analyze some of the best areas there like The Meadows, Midtown, and Old Town.

Earning potential of a beach house

After finding a great location, you need to analyze different rental properties for sale to determine if they are a viable investment. Your investment property analysis should reveal figures such as monthly expenses, cash flow, cap rate, cash on cash return, and occupancy rate. Mashvisor’s vacation rental income calculator will get all of this data (and more) for you automatically. Try it out now.

Short-term rental laws

Every location has laws regulating vacation rental properties. Before renting out a beach house, be sure to get familiar with the local laws. In many cities, you must acquire a license before renting out a house. Other cities have zoning laws that limit the number of vacation rentals within the area. In most places, you will be required to pay an occupancy tax to the local authority. If your investment property is within a planned development, you will need to adhere to the covenants, conditions, and restrictions (CC&Rs).

You can learn about short-term rental local laws on the Airbnb site, your local government’s website, or the Short Term Rental Advocacy Center.

Conclusion

If you mind your due diligence and prepare well, buying a beach house for rental income can be a very lucrative venture. To ensure that you end up making money with a beach house, continue researching the topic by visiting Mashvisor’s blog now and checking out some of our real estate investment tools. Buying a beach house could be the best thing you do for yourself. Just be sure to keep all the cons in mind and work to mitigate them along the way!

To learn more about how Mashvisor can help you find profitable beach house investment properties, schedule a demo.