Variety is one of the reasons we encourage people to invest in real estate. The myriad of ways to make money has made it possible for many real estate investors to accumulate wealth, especially with rental properties. Corporate rentals are one rental strategy that made it possible for those investors. Want to know the secret?

Here’s all you need to know about how to make money in real estate with corporate rentals:

What Is a Corporate Rental?

As the name suggests, corporate rentals are rental units which are dedicated to accommodating corporate (business) travelers. These types of rental properties are pre-furnished and are ready to rent out. The unit has everything a tenant might need in addition to other services such as security and parking.

Considering the previous definition, it is easy to confuse corporate rentals with furnished apartments and hotels. However, the difference is in the purpose, price, and the type of tenants they are designed for. For example, hotels are more expensive and are open to all types of guests such as vacationers and short-term business travelers. Furnished apartments, on the other hand, are designed for long-term rentals, short-term rentals, as well as being open to all types of tenants to rent out. Corporate rentals are similar in the sense that they are pre-furnished. However, the difference is that they are typically cheaper, better for medium-term stays and specifically target corporate executives and other select personnel.

Advantages of Investing in Corporate Rentals

The top advantage of investing in a corporate rental is the fact that the demand is not going down any time soon. This type of rental is no longer exclusive to executives. Instead, nowadays it expanded to travelers for medical purposes, military personnel, and travelers from all business fields who are looking for a place to stay for more than one month. Therefore, the tenant base extends to include other people which guarantees a high occupancy rate for your rental property.

The second reason for investing in corporate rentals is the quality of tenants that it targets. These are typically high-quality tenants who are looking for the best accommodation options that provide the best services.

Another reason is the fact that there is always a chance of expanding this type of rentals to other areas where the corporate sector is developing. Let’s say your local area is experiencing the establishment of a new corporate employer. That area will be, for sure, the next target for the corporate rental industry. In essence, it is always easy to predict the next best location for such type of rental properties.

Finally, and the most important reason you should invest in corporate rentals, is the fact that it is a very lucrative venture; it provides higher rental incomes than those of regular rentals such as long-term or Airbnb rental properties.

Related: Are Corporate Rentals a Good Real Estate Investment Strategy?

How to Buy a Corporate Rental

Buying a rental property for corporate lease is similar to any investment property purchase. However, due to the higher expense of owning such a rental property, you need to be more careful with the numbers. Acquiring corporate rentals is more expensive than other types of property. Therefore, you will need to run precise analyses before you purchase the rental. The good news is that investing in corporate rentals promises high occupancy rates. Thus meaning that the right property is guaranteed to generate positive cash flow. But, what type of analyses do you need to perform?

1) A Neighborhood Analysis

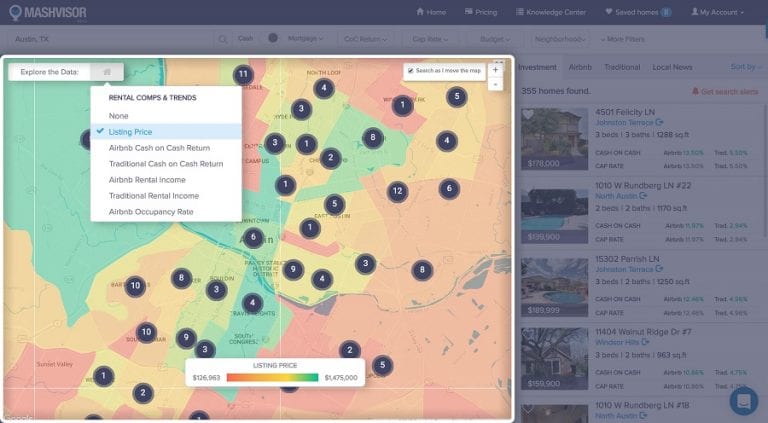

Whether you decide to buy a corporate rental in San Francisco or Chicago, performing a neighborhood analysis is a must. This process will ensure that you find the best place to buy a corporate rental. So, for this, you need to choose a specific location of interest to you. What you do next is start analyzing that location for appreciation rates, median rental income, the median occupancy rate for corporate rentals as well as the amenities that location provides. So, in essence, you are analyzing the rental demand in that neighborhood. Our Heatmap can help you with this analysis! It gives you an overview of the neighborhood to quickly understand if it’s a good place to invest in real estate.

Here’s a guide to the Real Estate Heat Map: A Revolutionary Tool for Neighborhood Analysis

Another aspect of your neighborhood analysis should be a job market analysis. Since corporate rentals serve a select group of people, it is important to check for what type of employers there are, the percentage of occupancy rates as well as talk to other corporate rental investors to learn from them about the specifics of the business.

2) An Investment Property Analysis

The next important step is to perform an investment property analysis. This process consists of a thorough examination of the return on investment. You start by analyzing cash flow which indicates whether the property has the potential to generate positive cash flow. From there, you move on to analyzing capitalization rate and cash on cash return. The cap rate is the annual cash flow divided by the total property price. On the other hand, for the cash on cash return, you divide the annual cash flow by the down payment and any other costs you paid upfront (total cash you put into it).

Check out Mashvisor’s Investment Property Calculator: Real Estate Investing Made Easier

Once you analyze the property and confirm that it makes for a good real estate investment, put up an offer based on your comparative market analysis.

Rental Property Management

Now, any rental property requires some level of management. However, with corporate rentals, it is a different story. Since you are going to have a few tenants throughout the year, it is always important to keep up with the property. The type of tenants you are working with are usually demanding and they won’t think twice before waking you up in the middle of the night to complain about a broken outlet. Therefore, you have one of two options: 1) you either manage it on your own, or 2) you hire professional property management. Either way, it will depend on your financial planning and whether you want to save money or not. Here’s Your Guide to Professional Property Management Fees.

To learn more about how we will help you make faster and smarter real estate investment decisions, click here.