Whether it’s a single-family home or just land, a reliable market data approach in real estate is crucial to value rental properties accurately.

Before buying a property, it is necessary to get an accurate valuation of the property. It can be done by using an extensive and reliable market data approach.

Table of Contents

- What Is Market Data Approach in Real Estate?

- Who Should Use Market Data Approach in Real Estate?

- 5 Advantages of Using Market Data Approach in Real Estate

- 5 Limitations of Using Market Data Approach in Real Estate

- How to Use Market Data Approach in Real Estate in 5 Steps

- What’s the Best Tool for Market Data Approach in Real Estate?

As a real estate investor, you deserve the best tool to help you accurately analyze and value a property. That tool is Mashvisor. Mashvisor produces accurate real estate data on any property you are looking to purchase. It does so by using its artificial intelligence (AI) tool to make the process of valuing a property easier and quicker.

In this article, you will discover what the market data approach is and how it will benefit you. Then, you will be shown the best tool for market data approach in real estate.

What Is Market Data Approach in Real Estate?

The market data approach in real estate is the process of determining the value of a property by looking at other properties with similar features. Suppose you want to buy a property with five bedrooms, six bathrooms, and 10,000 square feet in size. If you find three other properties with the same features priced at $450,000, then the price of your primary property will be $450,000.

The market data approach uses the theory of substitution to value a property. The theory states that a property is worth how much you can get another similar property just like it. It’s most suitable for residential and vacant properties.

It means that you find properties similar to yours, so you are better able to estimate how much your property is. It is the method used by most appraisers and is the most accepted type of valuation in real estate.

If the property you are looking for is to be rented out, the appraisers look for rental comps that were sold in the last six months. They then determine the price of your property based on the average prices of the comparable properties.

Who Should Use Market Data Approach in Real Estate?

The market data approach in real estate can be used by real estate investors, mortgage lenders, and insurance agencies. Plus, even though valuing a property is usually left to the appraisers, anyone can take a small portion of their time to learn the market data approach.

5 Advantages of Using Market Data Approach in Real Estate

Although the market data approach is used to know the value of a property, there are other benefits from this type of competitive market analysis. Below are five advantages of using the market data approach in real estate:

1. Fewer Assumptions

The market data approach is used based on readily available public data. It means that there would be fewer assumptions about the value of a property. The data needed for an accurate valuation of the property is already in the open.

2. Accurate for Residential Properties

The market data approach is known in the real estate world as the most accurate method of valuing long-term rental property. It is because, with residential properties, there are many other similar properties that an appraiser can use to ascertain the value of a property.

3. Accurate for Vacant Lots

Also, the market data approach is very accurate for vacant properties of similar features because there are fewer variables to consider and adjust on a vacant property. Therefore, the process of valuing the property is usually pretty straightforward.

4. Data Easily Accessible for Public Companies

In a situation where a public company owns real estate, data about the properties will be easily accessible to an appraiser. It makes the job easier for all the parties involved in the transaction.

The data sources for a public company are tax commissions and property tax assessors. They are the ones that keep sales records of public companies. They do so to help with the valuation of properties.

Sometimes, the public uses the available data to identify and compare sales in the real estate industry.

5. Great for Active Markets

The market data approach is usually done with properties that are sold frequently. If the market is very active, the accuracy of the appraisal will be high.

As long as properties are being sold regularly, the income and cost projections of the property will be accurate. Also, since many properties are being sold, the valuation of a property will be accurate.

5 Limitations of Using Market Data Approach in Real Estate

Although there are many benefits of using the market data approach in real estate investing, like any other thing, it comes with limitations. Below are five limitations of using the market data approach in real estate.

1. Unreliable in an Inactive Market

Since the market data approach uses the prices of similar properties with the same features sold within six months, it can be unreliable if the market is not active.

It means that if no one is buying properties in a market, there will be no property that an appraiser can compare to the primary property.

2. Impractical With Limited Data

The market data approach can be an impractical way of valuing a property if there are few properties with similar features. It is different from an inactive market.

An inactive market is where no houses are being sold while limited data means houses are being sold, but very few share similar features to the primary property. It usually occurs with heavily customized homes.

The above is also true with a niched private company, where there are very few properties that can be compared with the current one.

3. Unofficial Appraisal

As we’ve mentioned above, anyone can use the market data approach to find the value of a property. The problem with such an approach is that it is not an official appraisal.

Therefore, the investor will need to get an official appraiser to take a look at the property. In such a way, whatever the appraiser values the property at will be an official valuation. It is especially helpful if the property comes with unique features and is hard to value.

4. Too Many Adjustments

When comparing properties, you may find properties that are completely similar to the one you want to invest in. But more often than not, you will find properties that are just closely related to the property that you want.

It means that you’ll need to make certain adjustments for the dissimilar characteristics to get to a close enough value of the property.

5. Time of Scale

You may find a comparable property, but you must also take note of the time the property was sold. The property must’ve been sold three years ago, while the property you are looking at was sold four months ago.

Therefore, the appraiser must determine how a three-year-old sale involving a highly comparable piece of property signals value now. They must also find out how a recent sale of a home with dissimilar features reflects the worth of your home.

How to Use Market Data Approach in Real Estate in 5 Steps

You can use the market data approach in real estate to accurately estimate the value of a property in five simple steps. The following steps help the appraiser to make a direct comparison between the primary property and other similar properties sold or listed for sale.

1. Studying the Market

Getting to know and studying the market is the first step and foundation of the market data approach.

It is the process where you, as the appraiser, or an appraiser you hire, compare the prices of recently sold houses in the same neighborhood with the primary property.

Here, you will look at other homes with similar features in the same neighborhood and then be valued based on the said features.

2. Collecting and Verifying Data

After studying the market, your next step is to collect data on all the comparable properties. It is advisable that you get the data from verifiable sources like the ones mentioned above, which are tax commissions and property tax assessors. Also, make sure that the data sources are up-to-date.

Collecting the said data will provide more information on how much you may need to pay in taxes. It will accurately let you know your projected real estate expenses. It also helps to see the seller’s tax returns.

When collecting data, make sure they are organized. Chances are you may still need the information later in case you want to invest in more properties in the same neighborhood.

3. Analyzing and Comparing Properties

Now that you’ve collected your data, it is time to analyze them. Firstly, the comparable properties will be of similar features. Therefore, in analyzing such properties, you will look at how different the prices are from each other and the cause of the price differences.

In addition to the prices, you will also see minor differences in the square footage, the number of bedrooms and bathrooms, and other amenities in the neighborhood.

Sometimes, it could be that the comps were sold at a different time when the cost of such properties was lower or higher. Whatever it is, as long as there are some differences in each of the properties, the next step will be important.

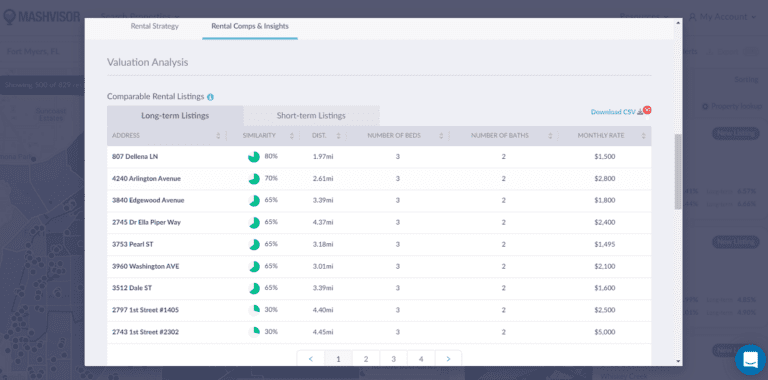

Mashvisor’s Rental Comps & Insights feature helps investors analyze properties based on their unique characteristics and come up with a price estimate.

4. Adjusting the Prices of Comparable Properties

Now that you’ve analyzed the properties and discovered some of the differences, it is time to adjust their prices.

The adjustments are made in the form of reducing or increasing the value of the properties based on their differences. This way, you won’t value the property more than or less than it is worth.

5. Reconciling the Newly Adjusted Prices

After adjusting the prices of the comparable properties, the next thing the appraiser will do is reconcile the newly adjusted prices.

Reconciliation in real estate simply means breaking down the adjusted prices of comparable properties, as stated here. Afterward, you calculate the percentage that each similar property should contribute to the worth of the primary property.

Note that your reconciled value must be around the adjusted prices of the comps as well as its unadjusted price range.

What’s the Best Tool for Market Data Approach in Real Estate?

To accurately value a property, you need a reliable tool for market data approach in real estate that can easily and quickly perform all the tasks discussed above. Mashvisor is such a tool. Any real estate investor can use Mashvisor to better analyze a market to get the best deal possible.

Mashvisor’s tools can help you find excellent properties and analyze them by using the market data approach so that you won’t need to work so hard. It also assists you in determining the return on your investment based on comparative and predictive models.

The platform’s data API tool provides data on any real estate market on demand and is available all the time. It will help you scale your real estate investment and grow your portfolio to the next level. The tool comes with over 11,000,000 listings, 3,000,000 long-term rentals, and 2,000,000 short-term rentals.

Mashvisor provides you with trustworthy data about the city, neighborhood, street, or zip code of the property. And as mentioned before, you will also get a precise estimation of the anticipated return on investment.

Click here and take advantage of Mashvisor’s 7-day free trial.

Conclusion

In this article, you’ve discovered what the market data approach in real estate is and how who can use it. You also know its benefits and limitations. Plus, you were shown how to use the market data approach in real estate in five simple steps.

Finally, you’ve discovered the best tool for the market data approach, which is Mashvisor. The platform’s tools help many real estate investors beat the market and blow their returns through the roof. It will do the same for you.

Schedule a demo today to find out more about Mashvisor.