As a short-term rental owner or host, having access to AirDNA MarketMinder is an important way to ensure you make smart business decisions.

Table of Contents

- What Is AirDNA?

- How Does AirDNA Work?

- What Does AirDNA MarketMinder Do For Investors?

- Mashvisor: A MarketMinder Alternative

- Bottom Line

In today’s world, it’s almost impossible to do any type of real estate investing without using software tools. It is especially true with the short-term rental strategy. With the traditional rental strategy, it’s easy to estimate expected rental income since most information is publicly available for free.

Short-term rentals can be a bit complicated since the market is usually unpredictable. The unpredictability is mainly because the data isn’t easy to come by. However, it is no longer the case nowadays.

There are now many online real estate tools that collect the data for you, analyze it, and present it in a way that’s simple for you to understand. Now, you can access all data related to short-term rentals, including occupancy rates, monthly rental income, nightly rates, and overall market size, in just a matter of minutes.

One of such tools is AirDNA. In today’s article, we’ll look at what AirDNA is and how their MarketMinder tool can help you in your business. Also, learn about a viable alternative for your rental property investing needs.

What Is AirDNA?

First, we need to understand what the software is.

AirDNA is one of the leading Airbnb data analytics and software platforms today. Short-term rental investors use the tool to calculate and determine an investment property’s profitability in the vacation rental market.

With AirDNA, real estate investors can search for potential short-term investment rentals, optimize the listings, and access market-wide data and resources.

In 2012, Scott Shatford, AirDNA’s co-founder, decided to list his apartment on Airbnb as he went on a holiday. He made quite a significant income from the short-term rental that he decided to scale the business in Southern California.

However, there was one problem. Shatford realized that he lacked enough intel on the short-term rental market. The idea of AirDNA was born. He created a software solution to help him and other real estate investors monitor their short-term rentals on Airbnb.

How Does AirDNA Work?

Currently, AirDNA offers two services. They are:

- MarketMinder: AirDNA MarketMinder is an online tool that helps investors by displaying various metrics for every Airbnb rental anywhere in the world. It’s marketed as a resource that provides Airbnb rental research, competitive research, and a strategic game plan. MarketMinder aims to help investors identify where they can invest and also set the ideal nightly rates for their Airbnb rentals.

- Enterprise Solutions: Enterprise Solutions offers tailor-made Airbnb analytics and solutions to help individual investors grow their businesses. The service offers solutions such as real estate market trends, property-level data, lead-generation tools, and market forecasts. Investors who subscribe to the service can also access the AirDNA calculator to help them analyze Airbnb performance and set ideal nightly rates. They can request and download the Airbnb data they need.

Since our main focus today is on MarketMinder AirDNA, let’s look at what it does for investors.

What Does AirDNA MarketMinder Do for Investors?

MarketMinder allows real estate investors to conduct short-term rental market research. According to the company’s website, the tool pulls its data for over 10 million listings worldwide from Airbnb and Vrbo platforms.

While pulling its data from such reliable sources is crucial, the data isn’t up-to-date since the platform only updates its database once a month or only 12 times a year. For real estate investors, it is a crucial factor since real-time information helps you make crucial business decisions.

Other than the market research, MarketMinder AirDNA also provides a dynamic Airbnb pricing tool for investors. AirDNA aims to help investors optimize their pricing strategies so that they can maximize their Airbnb income and invest in profitable properties.

The platform’s dynamic pricing strategy tool is known as Smart Rates, and it provides investors with personalized Airbnb pricing suggestions for up to a year. According to AirDNA’s website, Smart Rates creates tailor-made pricing for investors by using Airbnb rental data and market demand analysis.

AirDNA also claims that its MarketMinder tool provides resources, rankings, and reports to help Airbnb investors invest in the best locations. In addition, the tool allows investors to link their Airbnb listings to the platform’s database to create their custom comparable set. In such a way, investors can evaluate their rental’s performance based on occupancy rate, booked rate, and reservation lead time.

So, what’s the actual information provided by AirDNA Market Minder? We’ve divided the following section into the free and paid version.

MarketMinder Free Version

Though the MarketMinder free version provides limited information, it may be more useful than you think. It’s a good starting point when you’re trying to figure out any real estate market.

Here are a few pieces of data you get here:

- Number of active short-term rentals: This information is quite crucial to an investor. If a market has a small number of active rentals (less than 100), the demand might be too small to justify investing in the said market. On the other hand, a large number of active rentals, such as 10,000+, will signify that the market is too competitive.

- Rental size: This information will show you the type of rentals that are in high demand in that specific market. For example, if it shows that one or two-bedroom rentals dominate the market, it makes sense to say they’re in demand. The rental size helps you understand which rentals have the potential to do better.

- Rental growth: This information shows you the overall market health by monitoring the number of rentals in it. A healthy market grows steadily – not too slow and not too fast. If the growth is drastic, it may mean the market is becoming very competitive. Inversely, if it drops off, it could mean the market is experiencing some issues, such as laws and regulations, that are compelling hosts to shut down their Airbnb business.

- Occupancy and average daily rates: Although many would say this information isn’t very helpful when you’re looking at a wider market, you can select different zip codes and see how the numbers change. The occupancy and average daily rates are particularly useful when applied to a smaller housing market.

AirDNA Rentalizer

There’s one more free MarketMinder tool that we must mention; it is the AirDNA Rentalizer tool. The free Rentalizer tool allows investors to enter an address for any investment property they desire and see its estimates for annual revenue, occupancy rates, and average daily rates.

AirDNA Rentalizer performs the said function by pulling data from other comparable short-term rental listings within the same neighborhood and then calculates the estimates based on the data. The tool is fairly accurate; you can expect the estimates to be plus or minus 15%. In addition, you can tweak the data to see different metrics for different numbers of bedrooms, bathrooms, or allowable guests.

MarketMinder Paid Reports

If you’re interested in an in-depth analysis of a specific market, you have the option of paying for MarketMinder neighborhood or city reports. It unlocks a higher level of market insights.

Here’s a breakdown of what you get from MarketMinder paid reports:

Researching Rates

The first piece of data you gain access to in the paid package is the rates. It allows you to see how the average daily rates change monthly and annually. It is powerful since it helps investors understand the overall health of the market, as well as what the seasonality looks like and how competitor growth is affecting the market.

When accessing the said data, you need to filter to see the metrics for the specific type of property you’re evaluating. For example, if you want to invest in a two-bedroom rental unit with two bathrooms to accommodate 3-5 guests, you can filter the data to suit this profile.

Researching Occupancy

After looking at the rates, you can now start exploring the occupancy trends. You can also customize the data for a certain type of property. In addition, if you own a high-end property that may be in the top 90 percentile of all market properties, you can choose that to see even more specific information.

Researching Seasonality

While the occupancy rate is important, it’s also vital to understand the effect that seasonality has on daily rates and revenue per available room (RevPAR) on a monthly basis. AirDNA provides this kind of data on a number of dashboards.

Firstly, you can see which days, weeks, and months over a 12-month period tend to command higher rates and perform better. If you pass the cursor over a particular day, you can actually see the average RevPAR.

Next, you can see the RevPAR for every month. Primarily, it is the average monthly income you can expect to make for every available room.

Researching Guest Profiles

On top of the market and property-level data you get access to, AirDNA also lets you see your guests’ profiles. In particular, you can see where they tend to come from and whether they’re international or domestic guests.

Mashvisor: A MarketMinder Alternative

Mashvisor is an AirDNA alternative that is a resource for real estate investors looking for real estate market analytics, data, and insights. It’s also a short-term rental analytics platform that helps investors carry out in-depth Airbnb analysis to help you invest in profitable and lucrative rental properties.

In short, Mashvisor provides you with accurate and comprehensive data and analytics to evaluate the performance of Airbnb rental properties.

Unlike AirDNA that’s exclusively a data and analytics platform, Mashvisor is also a marketplace where you can search for rental property listings by typing your desired city, neighborhood, state, or zip code. Mashvisor also provides various tools that allow you to analyze and evaluate rental properties to understand their potential performance and profitability.

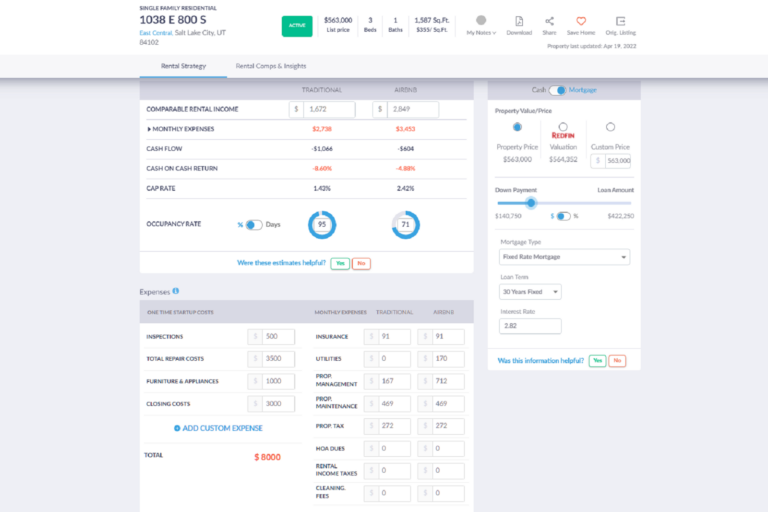

With Mashvisor tools, you can get an insight into a property’s income potential, understand the market trends, and formulate an ideal rental strategy. AirDNA MarketMinder only provides insights into the short-term rental strategy. Mashvisor, on the other hand, allows you to see data for both traditional and Airbnb rental strategies.

Before we can look at Mashvisor tools and how they can help you in your real estate investment journey, make sure you book your demo today.

Property Finder

Mashvisor’s Property Finder feature is created to help both new and experienced real estate investors to the most profitable rental properties. With the Property Finder, you can search for lucrative Airbnb listings in up to five areas simultaneously. The filters allow you to narrow down your search depending on the selling price, the number of bedrooms, and property type.

The tool uses machine-learning algorithms to bring you search results that meet your requirements. The results are ranked based on the rate of return on investment. The ones with the highest rate of return are ranked the highest.

In addition, Mashvisor’s Property Search feature helps investors find properties from MLS, as well as off-market and foreclosed properties. The tool also allows you to use filters to customize the search results. If you click on a property from the search results, you’ll be directed to a page where you can access the complete property analysis and Airbnb dataset.

Property Analytics

Once you’ve found a property that interests you, you can click on it. It will lead you to a page where you can access the relevant property details, such as monthly rental income, property expenses, cash on cash return, cap rate, cash flow, and occupancy rate. This page also lets you access the neighborhood analytics so that you can see the rental analysis of comparable properties within that area.

When using the AirDNA interface, you must go to other tabs to see comprehensive information about a particular property. Things are different with Mashvisor because the data and insights are presented in a way that even inexperienced investors can understand.

Our property analytics also provide Airbnb comps so that you can see how other comparable rentals in your neighborhood perform. If you’re really interested in the listing, you can contact the agent or seller on our interface.

Property Calculator

Our Airbnb Calculator is an interactive tool that allows you to input your own property metrics so that you can see how different metrics affect property performance. The calculator aims to allow you to conduct accurate property analysis so that you can get an idea of how the property will perform before you can buy it.

Since it’s interactive, you can enter your own numbers if your research indicates that the real performance is different. You can enter numbers such as mortgage details, rental income, and property expenses. The calculator will then use your metrics to calculate estimates for cash on cash return, cap rate, and cash flow.

Mashvisor’s Rental Property Calculator allows investors to input their own property metrics, such as rental income, mortgage details, and property expenses, to see how the different metrics affect property performance.

Bottom Line

AirDNA MarketMinder is an essential tool for real estate investors looking for short-term rental data. It provides important market and property data, such as the number of active Airbnb rentals, rental growth, and occupancy and daily rates. However, it has its own limitations when it comes to data reliability since it only updates its data once a month.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.