We Like to Define

Here at Mashvisor, we like to make clear every word that you may come across on your path of real estate investing. Today’s focus word is comparative market analysis.

A bit of a long word to type, but it is worth it, as we consider it one of the most crucial real estate market analysis tools out there. Now, we explain the “1,2,3’s” of a comparative market analysis.

Let’s Start-What is a Comparative Market Analysis?

Investment properties like to have value. We like to give things value in the real estate business, and one efficient way to do that is through comparative market analysis.

It is what it sounds like: comparing your investment properties to others in the same market as you go through analysis. So let’s get down to the tiny details of a comparative market analysis.

Through an examination of similar rental property prices in the same area you’re located in, you’re able to determine either a price to list when selling or a price to offer when buying. Investment properties are not twins, rather they are brother and sister.

You will never find two identical investment properties, so adjustments are needed. Depending on the differences between rental properties that have been sold and the one that you are looking to purchase, you can determine the fair offer/ sale price. In broad terms, a comparative market analysis is just a less “fancy” version of a professional home appraisal.

To learn how to do your own comparative market analysis without the need of a professional, click here.

The Skeleton of Comparative Market Analysis

So we know what the surface “skin” of a comparative market analysis looks like, but what about the insides? What makes up a comparative market analysis? Let’s go over the breakdown.

A comparative market analysis is determined by comparing rental properties in our area that have been sold within the past 4-6 months. Real estate performance analytics that is analyzed in a comparative market analysis include:

- Selling price

- Time on Market

- Improvements

- Square Footage

These are just some of the attributes used to give an approximate value to the income generating property of your choice.

Studying the records of sold properties helps real estate professionals select properties similar to the investment property of interest. Then, the comparison of the rental properties, adjustments for feature differences, and value estimation all take place.

Another form of comparative market analysis would be including comparisons to properties that are currently listed. This is the same process as the first form we spoke about, except we include more up to date listings. This way, you are able to assess the current competition. This could lead to an increase or decrease of the property valuation estimate, all based on those sold investment properties.

That’s a lot of words, we know.

Elements of a Comparative Market Analysis

You want to make sure the price of the investment property you are looking at matches the quality. This is where a comparative market analysis steps in. You need an effective comparative market analysis to do that. Here, we give you the “skeletal” elements of what you need to know to make an effective comparative market analysis.

You Know a Lil’ Something About Properties in Your Market

To be able to have a valuable, fair comparative market analysis, you should have a good amount of knowledge about the properties in your area- from the general descriptions, all the way down to the smallest details that could explain the price differences.

Related: 5 Tips on Researching Investment Properties

You Choose the Right Properties to Compare

Let’s say you’re out to buy a puppy and want to get an idea of what the “best breed” of dog is for people that have never owned a dog before. Now, are you going to compare dogs to horses, or dogs to dogs? This is the same idea that applies to picking investment properties to compare.

You want to choose rental properties that are close to identical. Similar “built” dates, square footage, and price. The careful collection of different investment properties will ensure you are correctly comparing. This makes making adjustments much easier.

You Know a Lil’ Something About Properties in OTHER Markets

There are thousands of U.S. housing markets in the real estate business. Comparing the market you are looking into with other markets gives you an idea of your competition. You want to beat the competition, so knowing a good amount about them gives you the ultimate advantage. Search for the real estate comps! Find the real estate comps and annihilate them! Well, not to that extent, but you want to make sure you come out on top.

Complete a comparative market analysis for another market listing the same types of investment properties you are looking into. Check out their prices, as this will allow you to evaluate how different markets assign the prices of each property.

You Can Read It!

Simple and to the point. You don’t want anything fancy going on. Charts, graphs, or tables are all good ways to organize your data. That way, you’re not bombarded with words. Instead, you have a clear, concise method to check out your findings.

Want to know more about what makes for the most effective comparative market analysis? Click here to learn more.

Example of a Comparative Market Analysis

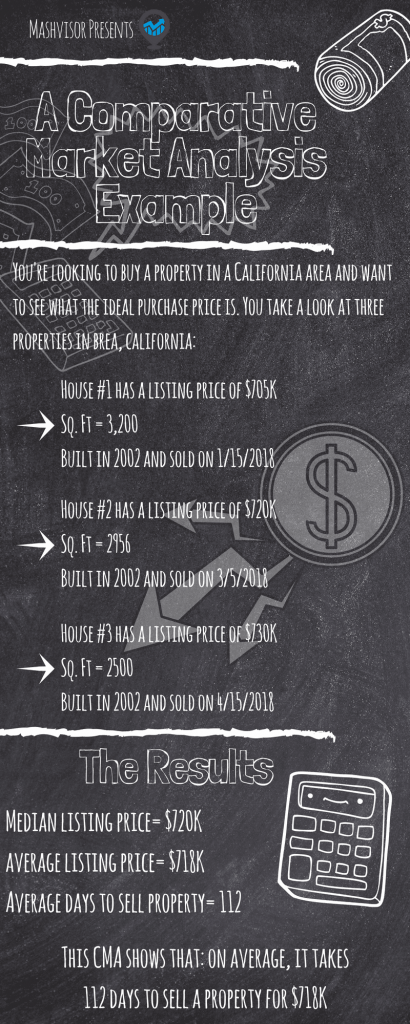

In case you’re overwhelmed with the information we just gave you, we’re going to give you an example of a comparative market analysis. This way, you can put numbers and visuals to those words. We don’t want you to blur out, so here’s a nice infographic to get the idea in that noggin of yours.

How Do You Like Them Apples?

We know that is a lot to take in, but just think of how many steps ahead you are of other real estate investors out there, just because you know what a comparative market analysis is. It is no secret that a comparative market analysis will do you no harm, and plenty of good. There is always room for more real estate investing tools in that toolbox of yours, so don’t leave this market analysis tool out!