To thrive in real estate investing, you don’t need to work hard – you need to work smarter. Getting access to real estate data is the ultimate way to start making smarter investment decisions. This is especially important if you’re investing in short term rentals.

Vacation rentals like Airbnb rentals emerged as an optimal investment strategy for investors in many parts of the US. To this day, such rental properties are still one of the best ways to make money in real estate. But before making the decision to rent out on Airbnb, you need to make sure that this investment will actually bring you profits. This is why you need the following short-term rental data offered by Mashvisor.

Mashvisor is a real estate investment software that provides both traditional and Airbnb data. We pull our data from a number of reliable sources and, using machine learning models and predictive analytics, we interpret this data and present it in an easy-to-understand format. Thanks to Airbnb analytics platforms like Mashvisor, conducting an Airbnb investment analysis is easier than ever before!

Wondering what kind of Airbnb data Mashvisor provides and how to access them? Keep reading to get a glimpse of our short-term rental data and why you need them.

Related: How to Get Access to Airbnb Data Analytics

1) Market-Level Short Term Rental Data

The first type of data necessary for Airbnb investors is short term rental market data. Any successful real estate investor knows that investing in the best locations is key to making a good rate of return on rental property. This is because so much of an investment property’s profitability depends on factors like property prices, demand, nightly rates, monthly rental income, Airbnb occupancy rate, optimal rental property type, and others.

In order to find the best places to invest in Airbnb, other important factors to look at include tourism trends, the supply of Airbnb listings, taxes on short term rental properties, and Airbnb laws and regulations.

Searching for all these short term rental data sounds overwhelming for beginner investors hoping to succeed as Airbnb hosts. Fortunately, you don’t have to look for all this Airbnb data on your own. Instead, you can check Mashvisor’s investment blog where you’ll find everything you’re looking for.

We publish daily articles that are up-to-date with anything and everything real estate. For Airbnb hosts, you’ll need to check the Airbnb Rentals category or the Top Locations category where you can find blogs that highlight the best markets for buying an Airbnb investment property. These blogs include detailed data on each market based on real estate market analysis done by Mashvisor.

Short term rental market data and analytics found in those blogs include:

- Median property price

- Price per square foot

- Number of real estate listings for sale

- Number of Airbnb listings

- Airbnb occupancy rate

- Airbnb rental income

- Airbnb cash on cash return

- Airbnb cap rate

- Best neighborhoods for buying an Airbnb rental

- Airbnb laws and regulations

2) Neighborhood-Level Short Term Rental Data

When it comes to finding a good location for short term real estate investing, we don’t only mean finding a good city, but a good neighborhood as well. Vacation rentals don’t perform the same even if they’re in adjacent areas.

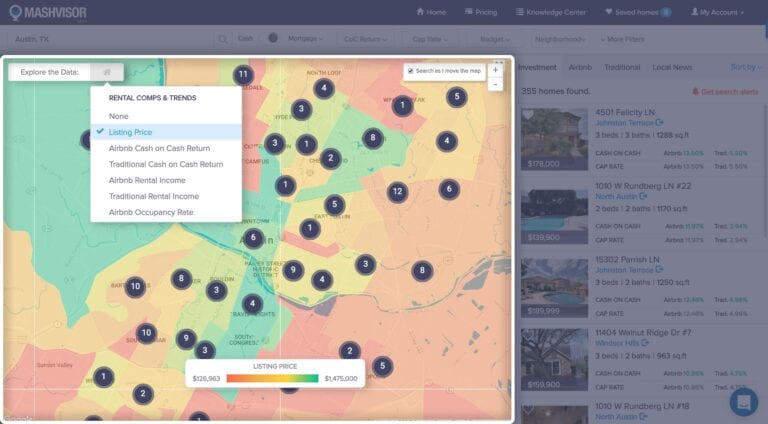

So, the next step of a short term rental market research is to find Airbnb data on the neighborhood level – which you can find right here! In fact, getting access to our neighborhood Airbnb data and analytics is very easy. After selecting your market, activate our Real Estate Heatmap to get an overview of how short term rental properties are performing in different neighborhoods based on certain metrics.

Related: Airbnb Rentals: Finding Income Properties Using a Heatmap

The great thing about using our Real Estate Heatmap to get neighborhood-level short term rental data and analytics is the accuracy. Again, all of Mashvisor’s estimates and calculations are based on reliable and actual data from Airbnb.com.

To provide you with neighborhood Airbnb data, we compute the averages from the information reported on all short term rental listings there, taking into consideration the property type and the number of bedrooms. Then, using the Real Estate Heatmap, you can choose which metric you wish to analyze neighborhoods by. It could be:

- Property listing price

- Airbnb rental income

- Airbnb cash on cash return

- Airbnb occupancy rate

Another place where you can get even more neighborhood-level Airbnb data is the neighborhood pages on Mashvisor’s Airbnb profit calculator. For any area in any US housing market, these pages will show you data including:

- Median property price

- Average price per square foot

- Average Airbnb cash on cash return

- Average Airbnb rental income

- Number of properties for sale

- Number of Airbnb listings

- Average Airbnb occupancy rate

- Optimal rental strategy

- Walk Score

- Real estate comps

- Airbnb rental comps

- Optimal property type

- Optimal number of bedrooms

3) Property-Level Short Term Rental Data

To invest in profitable vacation rentals, you should not just focus on choosing a good real estate market. Conducting Airbnb investment analysis is equally as important. After all, not all rentals in the same city or neighborhood have the same potential for ROI.

This is why Mashvisor offers short term rental data and analytics to help you choose the best property to invest in. Here’s a glimpse of the type of short term rental data Mashvisor provides for Airbnb hosts and real estate investors:

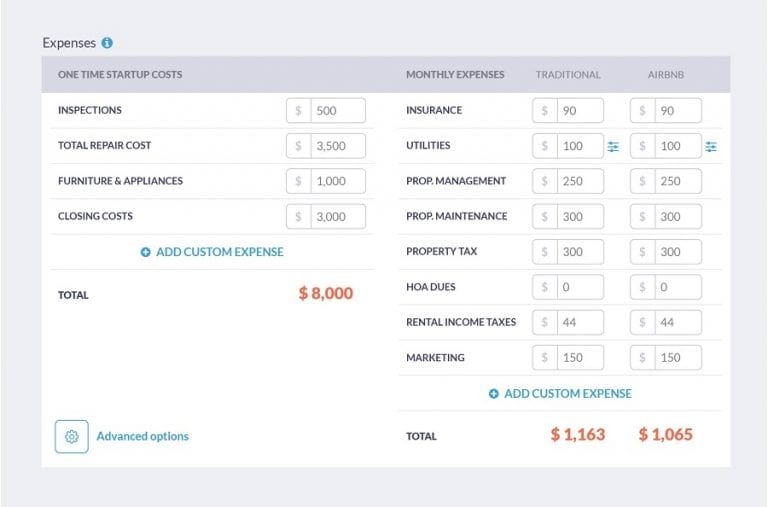

Property Expenses

Owning vacation rentals can be quite expensive and there are lots of costs to consider like tenant turnover, property management fees, insurance, and taxes.

No one wants to buy an Airbnb rental only to end up with negative cash flow – when your rental income can’t cover your expenses. But thanks to predictive analytics and Mashvisor’s Airbnb Profit Calculator, you won’t worry about falling into this issue.

Our tool allows provides Airbnb hosts with estimates for any listing on the platform based on averages of the area. If you have your own estimates, you can also enter them and our interactive tool will re-calculate the numbers to show you if you’ll end up with negative or positive cash flow.

Airbnb Rental Income

Of course, to complete the Airbnb cash flow calculation, you need short term rental income data. Rental income is one of the most important property data investors focus on because it tells them how much money they can expect to make per month. Eventually, this will determine if your short term rental property cash flow will be positive or negative.

To estimate Airbnb rental income, you need to look at the nightly rate and occupancy rate data. When using Mashvisor, however, you don’t have to look for such short term rental data on your own. Our Airbnb Profit Calculator finds Airbnb rental comps and comparable rental income of hundreds of active listings. Then, it calculates the expected monthly Airbnb rental income right away.

Try the Airbnb Profit Calculator Here!

Airbnb Cash Flow

Owning positive cash flow properties is a must for making money in real estate. Cash flow doesn’t only mean you’ll be making money at the end of every month, it also affects the rate of return investors can expect from vacation rentals.

Cash flow is basically the difference between rental income and expenses – both are data that Mashvisor already offers. However, that doesn’t mean you need to manually calculate short term rental property cash flow.

Mashvisor’s Airbnb Profit Calculator will automatically take these data and runs the numbers for you. Meaning, you will immediately see cash flow data for any short term rental on our platform.

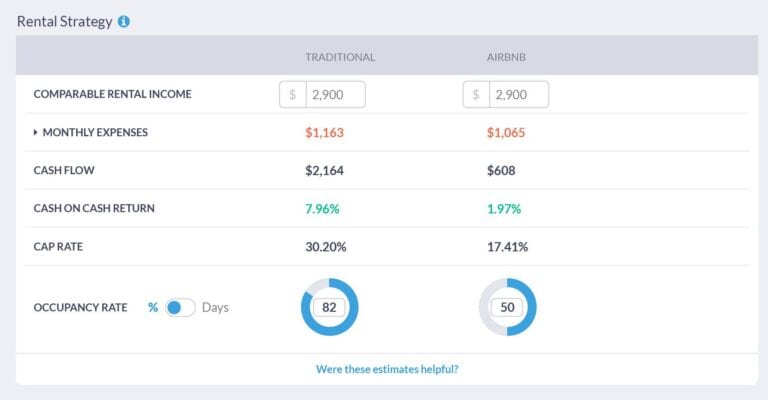

Airbnb Occupancy Rate

As mentioned, the Airbnb occupancy rate is important for determining Airbnb rental income. This will also play a role in your cash flow and Airbnb return on investment.

For every Airbnb listing on Mashvisor, you’ll find short term rental occupancy rate data. Again, Mashvisor pulls this type of Airbnb data and analytics from Airbnb.com and mirrors the performance of actual Airbnb rental listings over the past 12 months. Hence, you can ensure making decisions based on accurate numbers.

In addition, you will also see data that reflects how much Airbnb reviews by guests affect the occupancy rate of a specific property. As a result, you’ll find out how much effort you should put into getting positive reviews from your Airbnb guests.

Airbnb Return on Investment

Now, this is the type of short term rental data you absolutely need. Calculating the return on investment can be difficult for beginners looking to get into short term rental investing. Not only do you need to gather property data, but you also need to calculate ROI based on different formulas – namely the cap rate and cash on cash return.

Using predictive analytics, Mashvisor is able to provide accurate estimates of both the Airbnb cap rate and Airbnb cash on cash return of an investment property. What’s more, Mashvisor provides all of this property-level data for both the traditional and Airbnb rental strategy. You’ll have a rental strategy comparison to make sure that Airbnb is, in fact, the optimal strategy for earning a good return on investment.

The Bottom Line

To conclude, if you’re looking to invest in vacation rentals, make sure to get your hands on Mashvisor’s short term rental data! Investment property analysis used to take days – sometimes even weeks. But with the real estate investment tools that Mashvisor provides for Airbnb investors, it’ll be done in a matter of minutes.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.