There are several factors that contribute to the success of a real estate investor. However, one of the most crucial ones, which every investor should always keep an eye on, is real estate cash flow. As a real estate investor, you want to ensure that your rental properties generate enough income to cover rental expenses and contingencies and still make a profit. As the saying goes, “cash flow is king”. It’s through real estate cash flow that property investors can build their portfolio and attain financial freedom.

But how much cash flow is good for rental property? Well, this will vary depending on a number of factors including location, property type, financing method, and investment strategy. However, you should always aim to get as much positive cash flow as possible. Therefore, it’s important to understand how to maximize real estate cash flow. In this blog, we share some of the top strategies for cash flow real estate investing.

Related: Why Positive Cash Flow Is a Must with Income Properties

Strategies for Maximizing Real Estate Cash Flow

1. Do Your Due Diligence Before Buying

The first step to maximizing real estate cash flow is to ensure that your investment property is cash flow positive right from the start. To find cash flow income properties, you have to do a thorough market analysis and investment property analysis.

Your search for cash flow real estate should begin with finding high yield locations. You can quickly find the best cities for cash flow properties in the US housing market by checking out Mashvisor’s blog.

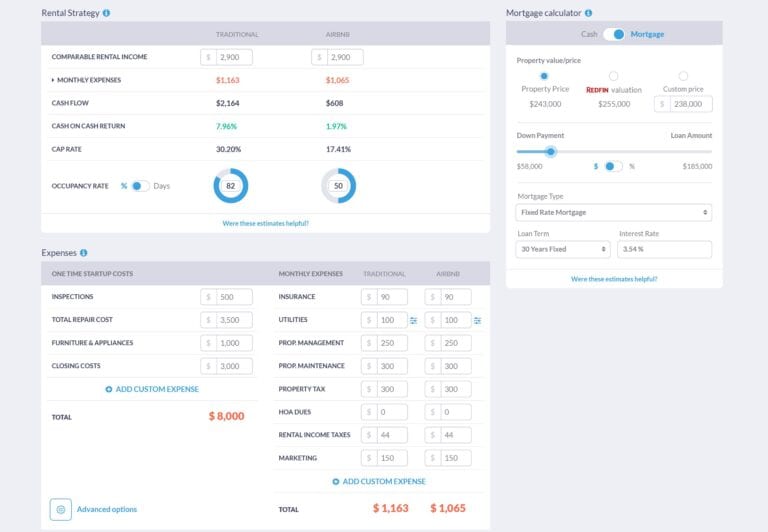

Once you’ve identified a good rental market for cash flow properties and have found rental properties that match or criteria, you can use Mashvisor’s real estate cash flow calculator to conduct a real estate cash flow analysis in a matter of minutes. This tool eliminates the need for a real estate cash flow analysis spreadsheet, which is often time-consuming and sometimes inaccurate.

2. Find the Optimal Rental Strategy

Depending on the location of an investment property, one rental strategy may yield better cash flow than the other. For example, properties that are located near airports, beaches, or theme parks will typically yield more real estate cash flow if they are rented out on Airbnb than when rented out on a long-term basis. Generally, if there is a high demand for short-term rentals in an area, Airbnb properties will generate more rental income and more cash flow.

3. Set the Right Rental Price

When it comes to pricing rental properties, setting the highest possible price is not always the best strategy for real estate cash flow. If you overprice your rental, it could sit vacant for months until you are forced to drop the price. If it’s occupied, it could force tenants to move out. On the other hand, if you price your rental too low, you could lose out on money that could have boosted your real estate cash flow.

To set the right price for your rental, you should consider what other comparable rentals (rental comps) in the neighborhood are charging and adjust the price according to the amenities. This price will ensure that the property rents as quickly as possible without leaving money on the table.

Remember, setting rent prices is not a one-time event. You should constantly review your rate and adjust it based on rental comps if you want to maximize real estate cash flow. Be sure to check the local rent control laws so that you stay in line with the law.

Related: How to Set the Right Rent Price for Your Investment Property

4. Find Ways to Get Extra Income from Your Rental Property

Apart from monthly rental payments, real estate investors can earn additional revenue from their property by offering extra amenities or services at a fee. The fee can be included in the rent or you may have tenants pay separately.

Here are examples of ways in which landlords can create an additional stream of income and increase real estate cash flow:

- Laundry machines

- Vending machines

- Cleaning services

- Parking space

- Storage space

- Gym

- Pet fees

- A game room

5. Find the Right Tenant

Another crucial strategy to maximize real estate cash flow is to select the right tenant. Tenants who destroy property, default on their rent payments, or don’t pay on time could cause serious cash flow issues. Not only will you have no rental income but it could also cost you a lot of money to legally evict such tenants.

To find the best tenant for your rental, you need to screen every prospective tenant thoroughly before selecting the final candidate. This may involve running a credit check, running a background check (eviction history, criminal history, & employment history), and interviewing them. Taking your time to find good tenants will always pay off in the long run.

Related: How to Screen Tenants for a Rental Property: 7 Steps

6. Consider DIY Property Management

If you have a small rental property portfolio, you could easily save hundreds of dollars on management costs by managing it yourself. However, you need to equip yourself with the right property management skills and put the right systems in place. Rather than hiring a property manager to manage everything on your behalf, you can do some of the tasks and outsource other aspects. This option is more viable when your time is not limited by a 9-5 job and you live in close proximity.

7. Refinance Your Mortgage

If mortgage rates are low, you could maximize real estate cash flow by refinancing your loan. Since debt service is usually the largest expense for real estate investors, even a reduction in the interest rate could lead to significant savings. This will free up some of the rental income and improve your real estate cash flow. However, it’s important that you consult a mortgage expert before taking this route.

Related: Is It Worth It to Refinance Rental Property?

8. Make Your Tenants Responsible for Utilities

Another effective way of making your cash flow investment more cash flow positive is to monitor and cut operating expenses where possible. One of the best ways to cut rental expenses is to assign the responsibility of paying utility bills (water, electricity, gas, etc.) to tenants. Be sure to include a clause in the tenancy agreement about this.

If you let utility bills be your responsibility, they can eat a big chunk into your rental income. After all, tenants are typically less conservative when they aren’t paying for utilities based on usage.

The Bottom Line

Many investors understand the importance of investing in cash flow real estate but not how to maximize their cash flow. However, if you follow these strategies, you can easily boost your cash flow, grow your portfolio, and become financially free. While these strategies aren’t exhaustive, they are the most crucial to keep in mind.