Multifamily investing is the cornerstone of real estate rentals. The reasons that multifamily investing makes sense are many. We will dive deeply into how to get started in multifamily investing in this story. However, first, let’s review some of the reasons why multifamily real estate investing is so popular.

First, multifamily homes for sale lend themselves well as rental units. As a real estate investor, you want to consolidate your rental properties as much as practical. There is no better way to consolidate a group of units than to have them all under one roof.

Second, a multifamily property can be cared for by one landscaper. One plow operator. A single electrician, plumber, handyman, and HVAC company. Your vendor list is much easier to manage with a multifamily investment. The property should have a lower overhead than a group of individual condos or single-family units in the same area.

In addition, if you are providing the heat and hot water (which most landlords avoid doing), you have one bill, not many. Also, the shared walls or floors will reduce the cost of heating. You may even be able to offer a laundry solution to tenants in the basement, which makes your rental property more attractive.

These are all reasons why multifamily investing makes sense. Now let’s focus a bit more on why it makes sense in particular and how to get started investing in multifamily homes.

How to Get Started in Multifamily Investing

Before we look at the ins and outs of locating multifamily investments, let’s look at why these are often the first investment by a person trying to break into real estate investing. The primary reason is financial. It is possible to invest in a multifamily property that you will rent part of with little money down.

How to buy a multifamily property with no money? In this real estate investor’s experience, it is tricky. However, you can do it if you have a relative or other co-investor willing to lend you a small down payment. It is possible to get an FHA loan for a multifamily investment as long as you will live in one of the units as your primary residence. Low-down payment loans are critical when one is starting in investing and this is a proven, entirely legal, way to break into the real estate business.

How much money do you need to get into multifamily investing? Your minimum capital should include the 5% or so FHA down payment on the investment property. Add to that a reasonable amount of cash. Cash is needed for repairs, plus enough for property taxes, utilities, and maintenance for about three months. A cash cushion will give you time to do needed updates and find tenants. A multifamily investment calculator like that found on Mashvisor is a handy tool for estimating future rental property expenses as well as how they will affect your return on investment. Sign up now to check it out.

Related: Multifamily Investing: An Easy Way to Get Started

Finding Multifamily Homes for Sale

The tricky part of finding a multifamily home for sale is that the multifamily market is limited in some areas. To help you start your search, here’s Mashvisor’s list of the 5 best cities for multifamily investing. The following cities all have plenty of multifamily homes for sale in Mashvisor’s real estate database. They also have the highest multifamily cap rates by city.

#1. Marco Island, FL

- Median Property Price: $682,029

- Price per Square Foot: $356

- Price to Rent Ratio: 11

- Traditional Rental Income: $5,128

- Traditional Cap Rate: 5.4%

#2. Naples, FL

- Median Property Price: $386,698

- Price to Rent Ratio: 11

- Traditional Rental Income: $2,993

- Traditional Cap Rate: 5.1%

#3. Chico, CA

- Median Property Price: $618,219

- Price per Square Foot: $370

- Price to Rent Ratio: 14

- Traditional Rental Income: $3,701

- Traditional Cap Rate: 3.0%

#4. Anaheim, CA

- Median Property Price: $1,284,420

- Price per Square Foot: $386

- Price to Rent Ratio: 16

- Traditional Rental Income: $6,540

- Traditional Cap Rate: 2.7%

#5. Fort Myers, FL

- Median Property Price: $201,053

- Price to Rent Ratio: 14

- Traditional Rental Income: $1,230

- Traditional Cap Rate: 2.4%

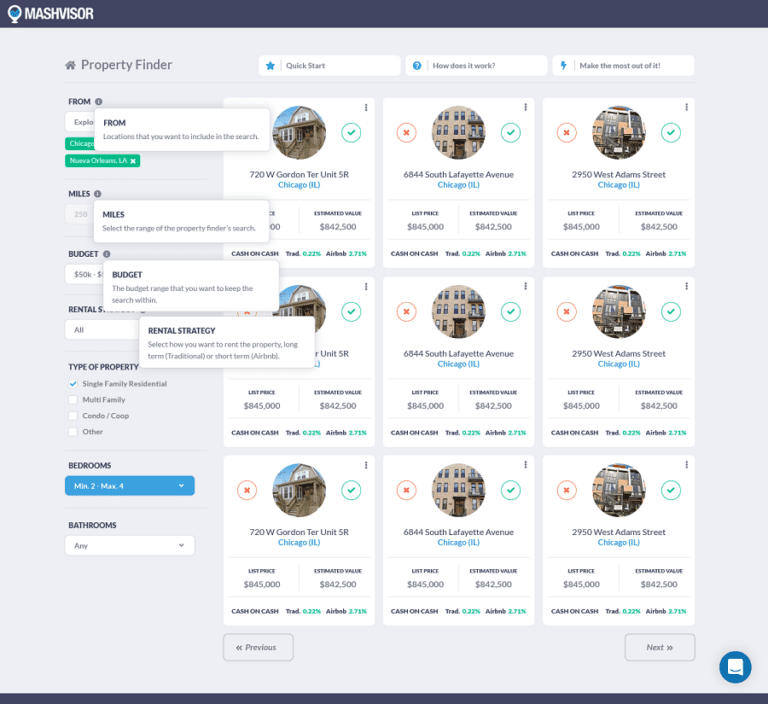

Most real estate investors are more interested in finding multifamily homes near themselves. If your question is, “how do I find multifamily homes for sale near me?” the answer is still Mashvisor. We have the tools that allow you to filter your search based on your specific parameters. Mashvisor is known for having the best investment property search tools to find multifamily real estate, like the real estate property finder tool. With this tool, you can set the multifamily filter along with other filters including your location, budget, rental strategy, and even the number of bathrooms and bedrooms. The tool will then list high return multifamily real estate for sale in that location.

Finding multifamily homes for sale yourself is an important part of the search. However, you are more likely to find off-market multifamily for sale if you have help. A real estate agent can be a critical partner in any new property search. Agents are the listers of property. They know about ones not yet posted on MLS for sale.

My personal agent is a good example. She is a top seller in my area. She currently knows that I have a property about to be listed. My realtor also knows that I am holding off due to the virus pandemic. If you were one of her clients, she would tell you about this property before it is listed. That gives you an edge in the purchase.

Agents also know how to find real estate opportunities in their own areas that you may overlook. Perhaps a single-family home for sale is perfect for an accessory dwelling unit? Or maybe the basement or attic is ideal for expansion as a rental unit? Agents look for these opportunities and can help guide you on local zoning regulations. They may even help you find a contractor to add a unit to an existing investment property. Find a top-performing real estate agent here.

Related: How to Find Multifamily for Sale for Investment

Multifamily Investing

This will be a highly unusual year for multifamily investing. The pandemic is changing everything in real estate. If you are an assertive buyer, ready to acquire a multifamily, the real estate market may be yours to exploit. Sales are happening, but many sellers are sitting on the sidelines right now.

To invest in a multifamily home, be ready when you find an investment property. Get your financial house in order ahead of time. Talk to a lender now about what you can afford. Be pre-approved if possible. Much, if not all of this, can be done by phone and via online signing. If you are serious about multifamily investing, act like it. Get ready right now.

Once the pandemic is under control, every real estate source we can find says that the housing market should rebound quickly. That means that many houses will come to market all at once, buyers who have been waiting will pounce, and the listings will go from sitting unseen to sold quickly. So be ready.

If you are one of the rare multifamily investors who have cash, or a big down payment and a secured mortgage, you may have your pick of the litter. One real concern for sellers will be deals that will fall through when the mortgage contingency is unfulfilled. With job loss a real problem, some buyers may not get mortgages. Cash will carry a lot of weight

Multifamily Foreclosures and Short Sale Opportunities

The economic impact of the pandemic in America is as of yet undetermined. However, it is not a stretch of the imagination to guess that many multifamily sales will be bank-related. Either investment that is lost to foreclosure, or short sales. Both are excellent opportunities for real estate investors with a hefty down payment and who can be patient.

Related: Why You Should Consider Buying Multifamily Foreclosures (And How To)

This year is shaping up to be a great one for multifamily investing. Mashvisor has the search tools, financial calculators, and other things you need to be prepared. To get started using Mashvisor, simply click here.