You might be wondering what other sorts of mortgages are available if you can’t qualify for a traditional mortgage or simply don’t want one. There are additional possibilities for you outside conventional and even unconventional loans, which are generally grouped together under the umbrella phrase “nontraditional” mortgages.

But what exactly is a nontraditional mortgage, and is it good for you? Continue reading to learn about the many sorts of unconventional loans, as well as some of their advantages and disadvantages.

Related: 6 Non Conventional Loans for Investment Property

What Is A Non-Traditional Mortgage?

Nontraditional mortgage loans is a one-of-a-kind loan that does not meet the criteria for a regular or even unorthodox loan. Nontraditional mortgage financing is typically easier to qualify for in terms of credit score and debt-to-income ratio (DTI), but it can be dangerous for lenders and consumers alike. These mortgages include unusual repayment arrangements, such as the ability to delay payments or pay only interest until the debt is paid off.

Nontraditional Mortgage Characteristics

The following characteristics are common in nontraditional mortgage loans:

- They have a nonstandard amortization schedule in most cases.

- The terms of repayment may be varied.

- Due to unusual payment arrangements and lower credit score restrictions, there is a higher risk.

- It’s easier to qualify for a payday loan than it is for a traditional loan.

- In other circumstances, rates may be higher.

- Deferral of principal or interest is possible.

Other Loans vs. Nontraditional Mortgages

If the above qualities don’t make sense to you, don’t worry; we’ll compare nontraditional and conventional mortgages to see how they differ.

The terms of repayment for a regular or conventional mortgage are quite simple. You borrow money from a lender to finance a home or property at a fixed or variable interest rate. Then you pay your lender’s interest and principal until it’s all paid off, at which point you own the property outright.

These terms of repayment are a little different from a nontraditional mortgage in order to provide more options to house buyers for whom a standard mortgage may not be suitable. Nontraditional mortgages come in a variety of shapes and sizes, which we’ll go into later, but they all have one thing in common: the opportunity to forego the traditional payment plan in favor of a more flexible payment schedule.

This can range from paying simply interest on a loan until the end, when you’ll owe the whole principal debt, to acquiring the opportunity to defer payments with little consequence other than raising the amount you’ll owe your lender at the end.

What is the difference between nontraditional and nonconforming?

Unconventional or nonconforming loans are sometimes mistaken with nontraditional loans. Unconventional loans are not the same as non-conforming loans, yet nontraditional loans are virtually invariably non-conforming. So, what’s the distinction, and how can a loan be both?

Nonconforming loans are any loans that do not match the purchasing criteria set forth by Fannie Mae and Freddie Mac, i.e., they are not conventional. Many of them, including FHA and VA loans, nonetheless operate in the same way as traditional mortgages in terms of repayment model and timeline. Despite the fact that you repay an FHA loan in the same way you would a conventional loan, they are deemed nonconforming because they are government-backed and frequently have a lower credit score and DTI standards.

Nontraditional loans are those that do not meet Fannie Mae and Freddie Mac’s lending criteria and do not have traditional repayment schedules. Unconventional loans, unlike FHA or VA loans, may not need monthly payments. For a few years – or for the whole term of the loan – you may simply be paying interest.

Classifications of Nontraditional Mortgages

There are three basic forms of mortgages classified as nontraditional: balloon loans, interest-only mortgages, and payment-option adjustable-rate mortgages (ARMs).

Balloon loans

A balloon loan is a mortgage with a one-time payment schedule. This means that you’ll have to pay the remaining debt in full at some time throughout the loan’s term, usually at the end. Depending on your lender, you may pay solely interest throughout the life of your loan and then make a single large principal payment at the conclusion, or you may pay a combination of interest and principal with a somewhat lower lump-sum payment at the end.

With a balloon loan, you’ll have minimum monthly payments and the freedom to put your money toward other items before paying your final lump-sum payment, such as credit building or savings. These loans can be a smart option for homeowners who know they won’t be in their property for long or who can pay the lump sum money soon to avoid having to make mortgage payments in the future.

Interest-Only Mortgage

An interest-only mortgage, like some balloon loans, allows a borrower to pay only interest on the loan instead of interest plus principal for their monthly payment. Interest-only mortgages, unlike balloon loans, normally only allow you to pay interest for a certain number of years before your debt begins to amortize, which might significantly increase your monthly payment.

Most interest-only loans are adjustable-rate mortgages (ARMs), which means your interest rate will be raised a certain number of times each year based on current rates, causing your monthly payments to rise or fall. These loans are sometimes arranged as “5/6,” with the 5 reflecting the number of years you’ll pay solely interest and the 6 indicating that your rate will be modified every six months.

Interest-only fixed-rate mortgages do exist, although they are extremely rare. ARMs can be more expensive in the long run, so if a rate that is guaranteed not to rise appeals to you, you should refinance to a traditional fixed-rate loan.

Payment-Option ARMs

Optional payment ARMs change monthly, giving borrowers the freedom to choose how they wish to pay off their debt. Borrowers can pick from a variety of payment alternatives, including 15-, 30-, or 4-year completely amortizing payments, minimum-and-over payments, and even interest-only payments, which are akin to balloon loans.

Payment-option ARMs can be particularly risky for borrowers since, depending on your rate and how much over the minimum you’re paying each month on the mortgage, your monthly payments may climb and the amount of debt you owe may actually increase while you’re striving to pay it down. These loans can be useful for people looking to make short-term investments, but they may be too hazardous for homeowners looking for a long-term loan.

Use Mashvisor’s investment calculator to find great property deals

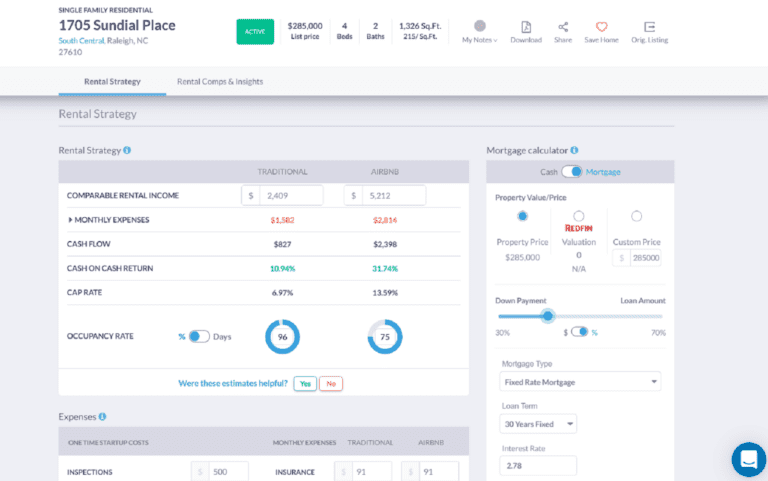

Before we look at the pros and cons of nontraditional mortgages, you should know that as an investor in real estate you need to make use of the Mashvisor’s investment calculator. This calculator will speed up your investment property analysis and you’ll know which type of property to invest in without going through any daunting hurdles.

The Mashvisor investment property calculator is an all-in-one real estate investing tool that provides users with information on the cap rate, cash on cash return, and cash flow of an investment property, as well as a variety of other features. They include:

- The Best Rental Strategy: the optimal rental strategy function determines whether Airbnb or traditional rental properties are better for the investor in each area based on historical and analytical data, real estate comps, and then determines whether they are better for the investor in that area.

- The Mashmeter: it is a Mashvisor-only feature of the investment property calculator. Based on a number of parameters included in the formula, this function advises an investor whether or not investing in a specific neighborhood or location is a wise investment. This value is displayed to the user as a percentage score and is computed using the platform’s qualitative and quantitative data.

- Neighborhood analysis: The Mashvisor investment property calculator has powerful property search and visualization features that help real estate investors figure out which places in a certain state, city, or neighborhood offer the best investment opportunities. Users can use the investment property calculator filter to provide precise values on their search in order to see all properties in a certain location that satisfy their requirements based on their selected metric or combination of metrics.

Furthermore, the neighborhood analysis allows the investor to decide not only the greatest investment property in a given location but also which regions are better suited for investing than others depending on specific criteria or investment techniques, such as Airbnb or traditional rental properties.

Mashvisor’s investment property calculator gives the user more options and functionalities to help real estate investors make the finest real estate investment and rental strategy decisions.

Related: Mashvisor: The #1 Investment Property Calculator for 2021

Nontraditional Mortgages: Benefits and Drawbacks

Nontraditional mortgages have a reputation for being “riskier loans,” yet depending on the circumstances, they can be extremely beneficial to borrowers. Let’s look at some of the benefits and drawbacks of a nontraditional loan to see if it’s right for you.

Pros

- Reduced monthly payments: Most unconventional mortgages allow you to make lower monthly payments – or even pay off the full principal balance in one single sum.

- They enable you to amass wealth before making a payment: Being able to pay off your balance in full at a later date has the advantage of allowing you to save money without having to make big monthly payments.

- They enable you to amass wealth before making a payment: Being able to pay off your balance in full at a later date has the advantage of allowing you to save money without having to make big monthly payments.

- You’ll be able to buy a home sooner: Because interest-only mortgages have smaller monthly payments than traditional mortgages, you may be able to buy a property sooner than you would otherwise be able to.

Cons

- Potentially high-interest rates: While not all unconventional loans have high-interest rates by default, many of them are adjustable rate mortgages (ARMs) with the ability to increase your rate at any time. Your rate may be higher to account for the risk of you defaulting on the loan, as many atypical mortgages have less stringent credit and DTI standards.

- Greater chance of default: While flexible payment options might be quite beneficial, they can also be extremely harmful to borrowers. If you just make minimum payments or defer payments on any of these atypical loans, the amount you owe your lender may actually climb. You may no longer be able to afford your monthly payment if it rises too high.

- Housing prices may fall: If you have an interest-only loan and want to sell your home before the interest-only period expires, but the value of your home drops dramatically, you may be unable to sell your home and be stuck with a substantially larger payment, forcing you to default on the loan.

- There is no equity: The option to pay solely interest on many atypical loans is appealing since it allows you to make cheaper payments while also preventing you from accumulating equity in your house. If you have little to no equity in your property, you may end up making nothing or possibly having to pay to sell it.

Is it A Good Idea To Get A Nontraditional Mortgage?

Nontraditional mortgages provide cheaper monthly payments and more flexible payment options than traditional loans, and they often have fewer qualification restrictions, making them quite appealing. These loans are excellent if you need money for a short-term investment or if you have a unique situation that necessitates a low-cost nonconventional loan at first. These flexible options, on the other hand, might be risky for borrowers, especially when combined with increased interest rates.

Before you decide to get a nontraditional mortgage, make sure you do your homework and assess whether the loan would be a good fit for you, even if your monthly payment increased by a significant amount in the worst-case scenario. Nontraditional loans are a viable alternative for borrowers in need of specialized financing, but they come with risks that you should consider before applying for one.