As investors, you should pay special attention to the operating cash flow formula, as it is a crucial factor in your investment strategy.

Table of Contents

- What Is Operating Cash Flow?

- Understanding the Cash Flow Formula

- Why Is Operating Cash Flow Important?

- Operating Cash Flow Ratio: Explained

- Net Operating Income: How Is It Different?

- Why Is OCF Important for Airbnb Properties?

- Operating Cash Flow Formula: Summing Up

Investing in real estate is by no means a mundane process. It is, in fact, a complex process that requires investors to constantly monitor the statistics that determine the success of their investment and adjust their approach accordingly. Hence, investors should be able to predict the profitability of each project they are keen on investing in. Otherwise, if they are guided by miscalculations, they may find themselves in a major problem.

You’ve probably heard of the operating cash flow formula before. In short, the formula can predict whether your real estate investment will be a successful one or not.

Naturally, you should be able to sense its importance in your investments without us spelling it out. Your financial well-being—and all future investments—generally depend on the cash flow you’re able to generate right now. Still, many are unfamiliar with the crucial role it plays in financial planning, investing activities, and overall business operations.

If you’re hoping to brush up your knowledge on this investing metric, we’ll be discussing it in greater detail below. Scroll down for more information.

What Is Operating Cash Flow?

First and foremost, we should take the time to bring the concept of operating cash flow closer to someone who might not yet be fully familiar with it. If you’re new to real estate investing, it might be a good idea to read the following with care.

By definition, operating cash flow (OCF) represents the net amount of money that an individual—or an organization—generates from its activities (in this case, investments). The information gathered from the formula for operating cash flow is then used to assess the cost-effectiveness and viability of the investment project. The positive outcome in such a scenario would be generating a positive cash flow, i.e., a steady passive income—which is imperative for any short- or long-term investment to survive in the market.

Here’s something we feel the need to clarify before going any further. According to experts, calculating cash flow is generally a much more significant indicator of success than the more often discussed net operating income.

Now that you are familiar with this in theory, the next question is – how is this analyzed?

As a general rule, the operating cash flow formula is analyzed in detail by a team of analysts and financial experts. However, today’s investment tools can do the math for you—and save you crucial time.

Related: 10 Tips To Ensure A Profitable Short-Term Rental Investment in 2022

Ways of Calculating OCF: Direct and Indirect

There are two ways you may calculate your operating cash flow—direct and indirect.

In calculating OCF by following the direct method, the individual or organization uses specific accounting information to track the impact of money on all business transactions. The results of the calculations are viewed in cash inflows and outflows, which are linked to the following factors:

+ Money collected from customers

+ Interest income and dividends received

– Compensation paid

– Money paid to suppliers

– Interest paid to lenders

– Income taxes paid

= Operating Cash Flow

On the other hand, using the cash flow from operating activities formula according to the “indirect method,” all depreciation, income taxes, amortization of financial incomes—and other expenses—are subtracted from the net income.

Understanding the Cash Flow Formula

Investors should know how to use the formula for calculating cash flow—and for, hopefully, obvious reasons. Now, the most common formula would be:

Operating Cash Flow = Total Cash Received – Cash Paid For Operating Expenses

That’s far from the only way in which you can write the formula down. Here are some other examples you may come across as an investor:

OCF = (Your Revenue – Your Operating Expenses) + Depreciation– Income Taxes – Changes In Working Capital

Operating Cash Flow = Net Income + Depreciation – Changes In Working Capital

Operating Cash Flow = Net Income – Change In Working Capital + Non-Cash Expenses

Positive vs. Negative Cash Flow: How Does It Impact You?

The second important aspect regarding the net cash flow from operating activities formula is understanding the essential difference between positive and negative cash flow—and how it impacts you and your investment strategy.

Naturally, a positive cash flow means that you have more money coming in than out of your investment. It basically implies that the profits you are generating from your investment property are higher than what you initially put into it.

Positive cash flow is measured and compared approximately on a monthly basis. It is the standard practice for short-term rentals only, though. With long-term investments, it can be done every six or so months—or on a yearly basis.

Generating positive cash flow implies that the money in your bank account is accumulating; however, it does not necessarily mean more investment opportunities for the investor. Even with positive cash flow, the right thing to do would be to save money for potential future expenses.

Now, let’s talk about the not-so-good possibility—negative cash flow. It means that you’ve spent more money on your investment than you are making from it. The money in your bank account is not accumulating—and you could potentially find yourself struggling to make ends meet due to all the property expenses.

If you’re looking at negative cash flow, it’s a clear indicator that your return on investment has not been triumphant—and therefore, you’re in need of some major changes to your strategy.

That’s why the wise thing to do would be to assess the profitability of your investment plan in due time and prepare for any upcoming costs.

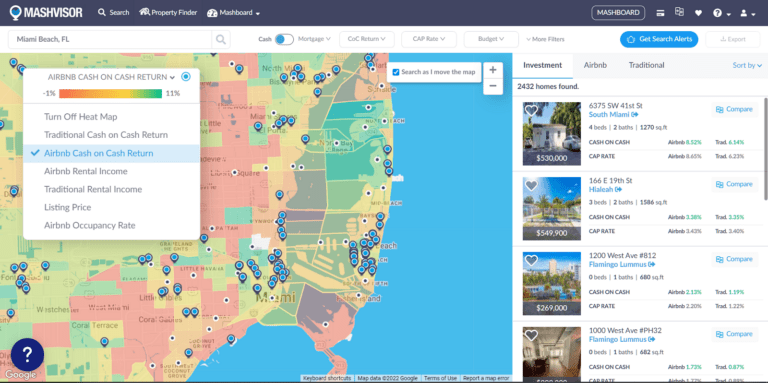

By using Mashvisor’s rental property calculator, you can estimate the profitability of your next short- or long-term investment strategy within minutes and, ultimately, make a well-calculated decision.

Why Is Operating Cash Flow Important?

The key to understanding the importance of the cash flow operating activities formula would be the investor’s cash flow statement.

Briefly put, the cash flow statement shows information regarding all cash inflows and outflows that your investment has been aggregating over a specified period of time.

It’s of excellent value to investors because they can review the numbers and analyze them when needed to get a detailed breakdown of critical areas for generating income. A lot of things go into the equation, and getting to your bottom line is by no means easy.

On that note, the cash flow statement breaks down into:

- Operating Cash Flow: Money circulation concerning daily activities

- Investment Cash Flow: Investments that generate revenue

- Financing Cash Flow: Money circulation between the investment and its owners and creditors

- Net Cash Flow: The three previous sections give insight into the net operating income

For investors, the focus should be on the operating and net operating cash flow formula—as they are the two most reliable indicators of success.

By looking at the numbers closely, the investor can see if—and where—changes are needed so as to avoid going into debt and striving toward a high cap rate.

Related: What Is a Good Cap Rate?

Operating Cash Flow Ratio: Explained

How does the operating cash flow ratio formula fit into this—and why is it even necessary for investors?

For starters, the operating cash flow ratio shows the overall “health” of your business—how much money it has managed to accumulate from its basic activities.

The importance of calculating the operating cash flow formula—and ratio—is in being able to see if your business can pay off short-term liabilities. Here’s how to calculate it:

Operating Cash Flow Ratio = Operating Cash Flow / Current Liabilities

And that brings us to the next logical question:

What is considered a good ratio?

A higher cash flow ratio—meaning a ratio higher than 1.0—is anticipated among investors and analysts because it indicates that they are able to pay their current short-term liabilities.

The ideal ratio would be 1:1, which would mean that the business is in good standing.

The Pros and Cons of Calculating Cash Flow Ratio

Using the operating cash flow formula and calculating the ratio offers several advantages and disadvantages. Let’s start with the upsides of using the said formula:

It can be a reliable financial and success indicator for your business. Investors and analysts gain a better insight into the current state of their real estate business—and point out the potential weaknesses.

With that said, the reporting entity that is in charge of calculating the ratio can change and manipulate the derivation of cash operations. The deliberate changes can lead to overseeing certain problems—and creating a financial statement that does not reflect the current situation.

The terms “operating cash flow ratio” and “current ratio” can sometimes get mixed up, so we will use this opportunity to clarify the difference between the two.

The operating cash flow ratio implies that the cash accumulated will be used to pay current liabilities (primarily short-term), while the current ratio suggests existing assets will be used.

Net Operating Income: How Is It Different?

Since we’re already discussing the operating cash flow formula, there is another calculation that people confuse it with—and that, as such, deserves attention—the net operating income (NOI).

So, how’s the net cash flow operating activities formula different from the operating cash flow ratio we’ve just discussed?

First, we give you the definition of NOI. In a nutshell, the net operating income accounts for the profitability of the real estate property purchased. It assesses the profitability once the operating expenses have been subtracted. And in theory, the NOI is determined by taking all income minus all expenses.

Here’s the net operating cash flow formula:

Net Operating Income = (Gross Operating Income + Other Incomes) – Operating Expenses

Before you get into calculating the NOI, you’re going to need to calculate your gross income (meaning, what you make from the investment) first. You can do it by subtracting vacancy rates from potential rental income.

The main difference between the operating cash flow formula and NOI is the timeline it accounts for. With operating cash flow, investors are primarily focused on expenses behind daily activities and whether they will be able to pay short-term liabilities.

On the flip side, the NOI suggests whether the investor should put down their money into the property at all—or start looking for an alternative.

Related: Guide to the Net Operating Income Formula for Rental Properties

Why Is OCF Important for Airbnb Properties?

It is now clear why operating cash flow is crucial for investors—especially for people looking to invest in Airbnb properties. Here, the emphasis is on short-term rentals.

The operating cash flow is used to determine whether you can pay your short-term liabilities, and with Airbnb property, it is crucial. If you fall behind on your obligations, you could see your property foreclosed. In most cases, your tenants are going to leave your property after 30 days maximum—which gives you space to look at the numbers and do the necessary calculations.

Of course, there are several ways for you to increase the profitability of your Airbnb property, and one of the possible solutions would be to deal with some upfront costs. It includes transferring the bills to your name, taking the time to advertise the property, and taking care of necessary repairs—first.

Also, remember that with short-term rentals, location is vital. You can promote positive cash flow by picking out the best place to buy rental property.

You can use Mashvisor to search for profitable short-term rentals in your preferred location.

Operating Cash Flow Formula: Summing Up

That would be all on the operating cash flow formula—and why investors should learn how to determine the perfect cash flow ratio in their future investment projects.

Let’s just quickly go over the most critical facts, shall we?

First, the operating cash flow represents the amount of money a business generates from its activities. It can be labeled as positive or negative cash flow—and it essentially factors in all cash inflows and outflows over a specified period of time.

On the other hand, the NOI accounts for the overall profitability of the investment—focusing on all income minus all expenses after the investment process has been finalized.

The cash flow operating formula is essential, especially for investors, because it represents a reliable indicator of success. Even more so, it lets them see the bigger picture and determine whether they can pay their short-term liabilities.

Mashvisor helps investors establish a strong investment strategy and expand their portfolios.

To start your free 7-day trial of Mashvisor, click here.