Are you planning on buying a rental property, but still need to run the numbers and analyze the rate of return (ROR) before investing? In this blog, we will look at how to perform a rate of return analysis to help you find the most profitable real estate investments.

What Is Rate of Return?

ROR measures the profitability of your investment property and how much money you can expect to make out of it. Therefore, every single property investor should know how to perform a rate of return analysis on a rental property.

Most real estate investors know the basic formula used in a rate of return analysis, but there are a couple of alternatives that could yield more accurate estimates. Unfortunately, there is no universal formula that suits all real estate investment properties and financing methods. Indeed, some of the formulas are better suited to certain situations than others. You need to be able to evaluate which applies to your investment property and situation the best. To start with, are you paying with cash or mortgage? You should choose the rate of return formula accordingly or else you will get misguided estimates.

Let us look at the three basic formulas you could choose for running a rate of return analysis depending on your situation.

Rate of Return Analysis: The Basic Formula

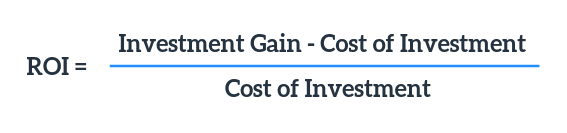

The most basic form of the rate of return formula that every real estate investor should know is the return on investment (ROI) formula:

For example, let’s imagine you invest $150,000 in a rental property. The total profits you expect to make with the investment sum up to $170,000. When using the above formula, your rate of return on this investment would be:

ROI = ($170,000 – $150,000) / $150,000 = 0.13 = 13%

You probably have many additional considerations and question marks in your head for which this basic formula might feel too general. So do note that this formula relies on rough estimates and can be used as a quick evaluation for an investment property.

Let us look at the cap rate and the cash on cash return formulas next. You can then determine which one to use depending on your situation and how you paid or are planning to pay for your investment property.

Related: How to Finance Investment Property: Mortgage vs. Cash

The Cap Rate Formula

Are you planning to buy your investment property entirely with cash? Then you might want to use the capitalization rate (i.e. cap rate) formula in your rate of return analysis. The cap rate calculation is also a very good tool for comparing different real estate investment properties with one another.

The cap rate is the ratio between an investment property’s net operating income (NOI = Rental Income – Operating Expenses) and the property’s purchase price:

Let us test this formula with a simple example. You are planning to buy a rental property worth $150,000 in cash. You want to use $10,000 for renovating the place. Another $1000 goes into closing costs. This makes your total investment in the rental property $161,000. Let us assume that the rental rate would be $900 per month. This means you will get a rental income of $10,800 on an annual basis. To make this ROR calculation as realistic as possible, let’s deduct $2,000 from this rental income per year to cover some of the expected expenses such as property taxes, insurance, maintenance costs and so on. As a result, your net income would be $8,800.

Now, let us test this with the cap rate formula above to see what kind of rate of return this investment property would yield. So, divide the annual income ($8,800) by the total investment you initially put in ($161,000).

Cap Rate = ($8,800 / $161,000) x 100% = 5.5%

This means that your rental property’s annual rate of return would be 5.5%. According to most real estate experts, this is not enough. Scroll down to learn what is an ideal rate of return on a rental property.

The Cash on Cash Return Formula

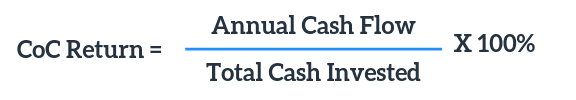

The third way to perform the rate of return analysis gets a little bit more complicated than the two previous ones because it takes into account mortgage payments. So, if you plan to pay for your real estate investment with a mortgage or loan, pay attention to this. The cash on cash return (CoC) of a rental property is the ratio of the property’s annual net operating income (NOI) and the total amount of cash invested in the investment property. Here’s the CoC formula:

Let us practice again the formula with a real-life example. Let’s imagine you are planning to buy a rental property worth $150,000. Instead of paying in cash, you put down 10% and take out a mortgage. Your costs with this scenario would be:

- $15,000 for the down payment ($150,000 purchase price x 10%)

- $3,000 for closing costs (higher due to the mortgage)

- $10,000 for renovation

As a result, your total cash invested is $28,000 ($15,000 + $3,000 + $10,000).

As you are opting for a mortgage, you need to include monthly repayments of the loan. Let’s assume it is $500 per month. Your rental rate is, let’s say, $900 every month, so your cash flow would be $400 per month ($900 rent – $500 mortgage payment). Your annual net income would hence be $4,800. In general, you want to have a positive cash flow, meaning that the cash flowing in is higher than cash outflows.

Related: Where to Find Investment Property Loans with Low Down Payment

Now, use the CoC formula above and divide the annual cash flow by the total cash invested to get the rate of return on investment (ROI).

Cash on Cash Return = (4,800/28,000) x 100% = 17.1%.

ROR Analysis Is Only a Click Away

Are you one of those who’d prefer an easier and faster way to analyze investment properties? You can utilize Mashvisor’s investment property calculator in your rate of return analysis and use any of these metrics to evaluate real estate properties. It will also help you estimate the potential rental income and positive/negative cash flows.

If you want to find some more properties to analyze, Mashvisor also provides neighborhood and investment property analysis to help you find the best investment properties in a city of your choice.

Related: The Easiest Way to Find Investment Property

What Is a Good Rate of Return on a Rental Property?

Knowing how to perform a rate of return analysis is one thing, but you also need to analyze and make decisions based on the results. So what is a good rate of return on a real estate investment? Unfortunately, there is no universal guideline here, as this entirely depends on your rental property’s size, location, and risk profile, just to name a few variables. However, if we must, a general rule of thumb is that a ROR above 7-8% is a good one.

In terms of cap rates, real estate experts agree that a good cap rate is around 10%, while great ones start from 12% and up. In terms of cash on cash return, however, an acceptable ROR is a contested matter. Some say CoC rates around 8-12% are acceptable and, in fact, very common. Others claim they would never invest in a rental property if it does not yield at least a 20% ROR. What is realistic and what is not is hard to determine without knowing the specs of the investment property. Ultimately, it is up to the real estate investor to determine an acceptable deal with the information they gather from their investment analysis.

To start looking for and analyzing the best investment properties in your city and neighborhood of choice, click here.

What do you think is an acceptable ROR on a rental property? Share your thoughts below.