After a very hot few years in the Portland real estate market, the numbers are pointing to a softening and a cooling off in the market. Nonetheless, experts believe it’ll remain a strong market in 2019.

Home to over 600,000 residents, Portland is the 26th largest city in the country and the second largest city in the Pacific Northwest after Seattle. For the longest time, we’ve been hearing how hot housing markets in this region exist thanks to fierce competition and a limited supply of investment properties for sale. Portland, however, is currently undergoing some changes that could make it a good place for real estate investing. As a matter of fact, Forbes already named it one of The Best Markets for Real Estate Investments in 2019!

Let’s take a look at the current trends of the Portland real estate market and why rental property investment opportunities here might be profitable for investors in 2019 and beyond. If you’re interested in investing in Portland homes for sale, keep reading as we also list the best neighborhoods in this city for real estate investors according to Mashvisor’s data and predictive analytics.

Supply vs Demand Trends

For the last few years, Portland had a very low supply of homes for sale. In a normal housing market, there needs to be six months of inventory. This means that if 1,000 homes are selling every month, there need to be 6,000 homes listed for sale. In June 2018, the Portland real estate market only had around two months of home inventory. The demand for housing, on the other hand, continued to outpace supply.

According to Oreginlive.com, there were more than 6,000 homes on the market for sale in June of last year (this is the most the metro area has seen since 2014). In that period, Portland saw 3,187 home sales, a drop of 7.6% from the previous year. These numbers show that home sales have slumped in the Portland housing market – a trend that real estate brokers and economists expect to continue in 2019 not just in Portland, but across the nation as well.

Related: US Home Sales Fall Thanks to High Mortgage Rates

However, it seems that things are slowly starting to improve in Portland in terms of supply. According to the PwC’s Emerging Trends in Real Estate 2019 Report, the city is the second prospect in the nation for development/redevelopment opportunities (the first prospect is Miami, FL). As more supply is emerging in the market, this gives real estate investors more choices. In addition, they’ll also have the luxury of more time to think before buying an investment property. The Portland real estate market, thus, remains a great investment location.

Opportunity Zones in Portland

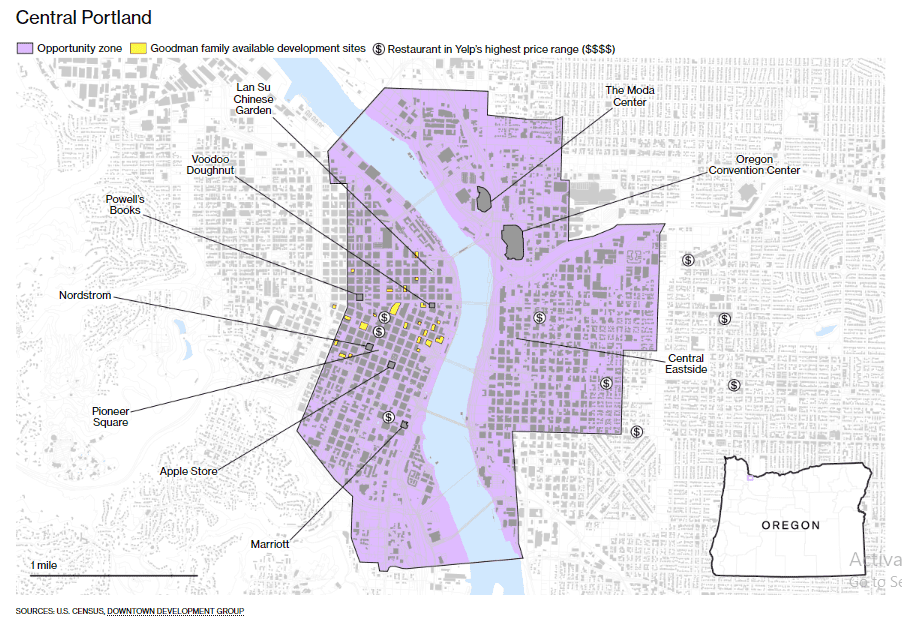

According to an article by Bloomberg BusinessWeek, the reason why Portland is about to see a burst of new construction is due to the Opportunity Zones Program that was introduced in the Tax Cuts and Jobs Act of 2017. Essentially, this is a new investment program aimed at utilizing private capital to encourage economic development and job growth in communities that, in theory, have been ignored by investors.

Today, there are over 8,700 Opportunity Zones across the country that you can choose from. To qualify as an Opportunity Zone, the community must be nominated by its state, and that nomination must be certified by the Secretary of the U.S. Treasury. Typically, states nominated low-income communities that are in need of redevelopment. Oregon, however, did something different: it selected the entire downtown of Portland to be eligible as an Opportunity Zone as well as other neighborhoods such as the Pearl District and the Central Eastside.

Source: Bloomberg BusinessWeek

Real estate investors are encouraged to invest in Opportunity Zones as they benefit from tax incentives – specifically capital gains tax incentives. Todd Gooding, the president of ScanlanKemperBard (a real estate merchant bank based in Portland), recognized the profitable potential of investing in Opportunity Zones in the Portland real estate market as he believes that the city has “probably the best set of options on the entire West Coast”.

Related: 21 Best Opportunity Zones to Invest in Real Estate in the US

Portland Home Prices and Values

Like many major cities in the West Coast real estate market, property prices in Portland are higher than the national average. According to our data, the median property price in the Portland real estate market is now $573,778 (median price/square foot of $305). Many first-time buyers are, therefore, priced out and have been waiting to buy homes due to how competitive the housing market has been.

As for home value and appreciation, the Portland real estate market has definitely experienced some of the highest home appreciation rates in the nation. Over the last 10 years, properties in Portland have appreciated 39.47% which is an average annual real estate appreciation rate of 3.38%. However, this strong appreciation has slowed considerably over the last year or so. According to Zillow, Portland home values have gone up only 0.7% over the past year. This is mainly because homebuyers are unable to meet rising home prices.

In addition, based on Mashvisor’s Investment Property Calculator, the traditional monthly rental income from a Portland investment property is $2,720. This results in a price-to-rent ratio of 23 in the city. For a real estate investor, this means you can expect to see high demand for rental properties as a high price-to-rent ratio indicates that it makes more financial sense for residents to rent a house rather than to buy one. As a matter of fact, 53% of housing units in Portland are owner-occupied and the rest are all renter-occupied according to the US Census Bureau.

To start looking for and analyzing the best investment properties in your neighborhood of choice in the Portland real estate market, click here.

What About Investing in Portland Airbnb Rentals?

Buying a property to rent out on Airbnb has become the preferred real estate investment strategy for many investors in the US housing market. Before you do that, however, you need to check the laws and regulations regarding short-term rentals in your local market since they vary from city to city. Not only that, but some cities have banned Airbnb rental properties and owning an Airbnb property in these locations is illegal.

Related: 5 Cities Where Airbnb Is Illegal in 2019

While Airbnb is legal in the Portland real estate market, there are some regulations to keep in mind before investing in short-term rental property here. Most importantly, you can list your house on Airbnb only if you’re the primary resident of the rental and live in the property at least 9 months of the year. Meaning, if you’re investing in Portland from out-of-state, you can’t buy an investment property solely to rent it out on Airbnb. In this case, you’ll have to buy a property and actually live there for 9 months before you can rent it out as a short-term rental.

In addition, Portland requires hosts to obtain an accessory short-term rental permit to rent a residence to guests for periods less than 30 consecutive days. Otherwise, the city will consider that you’re operating illegally and will charge you fines for violating the law. After submitting an application for acquiring a permit, the city will contact you to schedule an inspection of your residence.

Finally, while you don’t need to get your neighbor’s approval, you must send a “Neighborhood Notice” to property owners living next to or directly across your rental property to inform them that the city allows you to rent out on Airbnb. For more information about short-term rentals laws and regulations in the Portland real estate market, read this.

Where to Buy Portland Investment Property in 2019

The following data is provided by Mashvisor’s Investment Property Calculator. This advanced tool gives real estate investors the ability to analyze and compare investment opportunities in any city/neighborhood in the US housing market to find the most lucrative ones out there! To learn more about our calculator and how to use it to make smarter and faster real estate investment decisions, click here.

#1 Sunderland

- Median Property Price: $498,225

- Price/Square Foot: $238

- Traditional Rental Income: $1,922

- Price-to-Rent Ratio: 22

- Cash on Cash Return: 4%

#2 King

- Median Property Price: $581,279

- Price/Square Foot: $321

- Traditional Rental Income: $2,523

- Price-to-Rent Ratio: 19

- Cash on Cash Return: 2%

#3 Roseway

- Median Property Price: $426,399

- Price/Square Foot: $222

- Traditional Rental Income: $2,083

- Price-to-Rent Ratio: 17

- Cash on Cash Return: 2%

What Will the Portland Real Estate Market Look Like in 2019?

Portland is going through many changes this year which experts believe are making the city a good place to invest in real estate for the long-term. The Portland housing market is slowing down and could shift into a buyer’s market soon. This means now is the best time to buy an investment property! So, if you’ve made up your mind and decided to invest in Portland homes for sale, start out your 14-day free trial with Mashvisor now to find and analyze the best rental properties in a matter of minutes using our investment tools.