This series of articles aims to explain the different aspects of investment analysis in real estate investing, which include investment property analysis, comparative market analysis, and the property valuation methods, while also explaining the different aspects of each and the tools used to conduct investment analysis with ease and at high efficiency.

- What Is Investment Property Analysis?

- What Are the Different Property Valuation Methods?

- How to Calculate Cap Rate?

- How to Calculate Cash on Cash Return?

What Is Property Valuation?

Property valuation is a process of determining the value of an investment property based on the different metrics that evaluate the property’s return on investment and its profitability in both the short term and the long term.

The property valuation is an inseparable part of investment property analysis, which in turn is an inseparable part of real estate investment analysis.

While the investment property analysis deals with all the different aspects of an investment property on a general level, such as the property’s location and its effects on its appreciation and its occupancy rate, property valuation is more concerned with the financial aspects of the property, which are typically aspects that a real estate investor can control and adjust in order to reach the desired result from the investment property.

Learn More: Investment Property Analysis: Real Estate Investing

What Are the Different Methods and Metrics Used in Property Valuation?

When it comes to property valuation, there are a number of different methods and techniques that real estate investors use and rely on.

While some of the valuation methods rely on the general aspects of the investment property, such as its type, size, and unique features in order to determine its current market value, other methods rely more on the rental income that the investment property is expected to make in order to determine its return on investment.

Related: How Mashvisor Revolutionized Cap Rate and Investment Property Analysis

The Cost Approach

The cost approach is a property valuation method that is used to determine the current market value of an investment property based on the type of property, its size, the year it was built, and its current condition.

These aspects of an investment property are determiners of its market value and, therefore, its price.

One of the main aspects of the cost approach is to identify the condition of an investment property in order to estimate the costs that are associated with repairs and its expenses.

For example, older properties typically have lower market values due to their higher maintenance costs.

Additionally, the cost approach method usually assumes that the price a real estate investor should pay for an investment property should be equal to or lower than the cost of building an equivalent property.

This approach in property valuation is particularly useful when considering a unique property that has a few comparable sales or properties to compare it with. However, for this method to yield an accurate market value, it requires certain assumptions. If these assumptions aren’t available, then their values must be estimated, which makes the cost approach less reliable.

When following the cost approach in order to do property valuation, these are some aspects that you need to pay close attention to:

- Property’s land value

- Building costs of the property

- Depreciation costs

The simplest way to do property valuation based on the cost approach and using these values is to first add the land value to the building costs, and then to subtract the depreciation costs from the sum. The result you get will represent the current market value of the property.

Note: Click Here to Start Searching for Investment Properties Based on Their Cost and Value!

Learn More: Comparative Market Analysis: Real Estate Investing

The Income Approach

The income approach is especially useful in rental property valuation in investment analysis.

If an investment property is to be used to generate an income (rental property or income property), the income approach is used to estimate the value of the property based on its return on investment by relying on calculations that take into consideration the net operating income (NOI) of the property based on its rental income, while also using different variations related to the price of the property or the cash that was invested in it.

The most popular metric used in property valuation using the income approach is the cap rate.

The cap rate is a metric that is used to project an investment property’s return on investment by taking the NOI and dividing it by the current market value of the property.

Cap Rate = NOI/Current Market Value

So, for example, if a property’s current value is $400,000, and its NOI is $13,000, then the property’s cap rate would be 3.25%.

What this means is that the property is expected to generate 3.25% of its total value each year in profits.

Another metric that is used in the income approach of property valuation is the cash on cash return, which only takes into consideration the amount of actual cash invested in the property.

Cash on Cash Return = NOI/Cash Invested

So, for our previous example, if the real estate investor purchased the $400,000 property using 20% cash and 80% mortgage, based on the same $13,000 NOI, the cash on cash return on that property would be 16.25%.

In this case, this means that the property will be generating 16.25% each year of the actual cash that was invested in it.

It is important to note that in order to accurately calculate these values, a real estate investor needs to obtain the different values of the costs and expenses that will apply to the property as they will directly affect the NOI value of the property.

Property Valuation: Real Estate Investing

This will be discussed in further detail in the articles on how to calculate the cap rate and the cash on cash return values for an investment property.

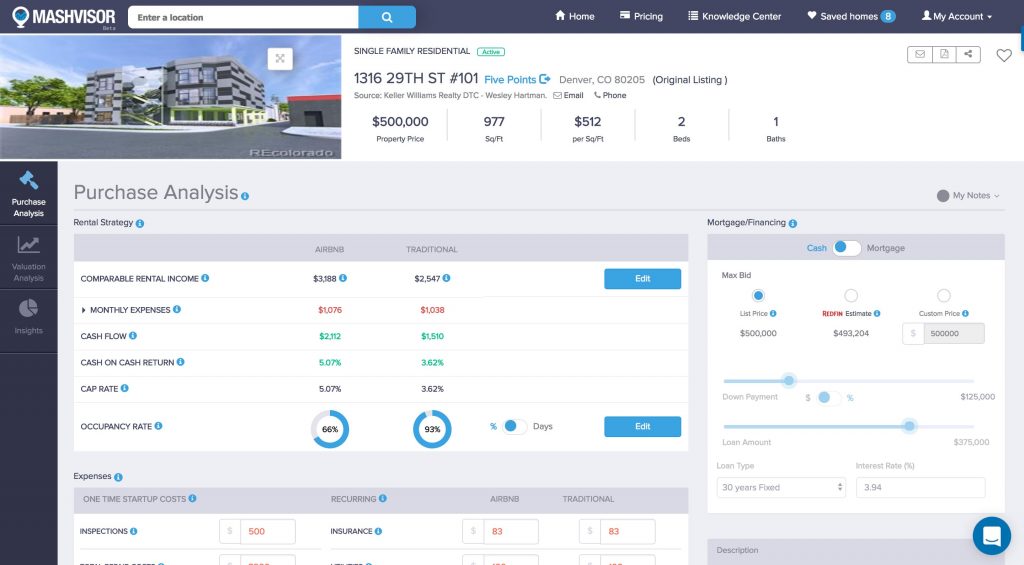

Note: Click Here to Start Searching for Investment Properties Based on Their Cap Rate and Cash on Cash Return Values!

The Capital Asset Pricing Model (CAPM)

This model of property valuation is very important for any investment analysis which has a level of risk tied to it.

The CAPM in property valuation describes the relationship between the risk and the expected return on investment. This model looks at the potential return on investment derived from the rental income and compares it to other investments that have no risk related to them.

For example, if the expected return on a risk-free investment exceeds the potential return on investment from rental income, then it simply wouldn’t make financial sense to take the risk of the rental property.

To put it more into context, when doing rental property valuation, the CAPM considers all risks that the rental property poses, such as its age and location. For example, renting out an older property might result in higher maintenance costs and expenses, and renting out properties in a high crime rate area might require additional costs for safety precautions. In this sense, the CAPM helps a real estate investor determine the return on investment that he/she deserve for putting his/her money at risk.

Related: An Investment Property Calculator is a Must – Read Here Why

Bottom Line

In previous articles, we’ve discussed the general topic of investment analysis and its importance in making all investment decisions.

We’ve also delved deeper into the aspect of investment analysis which deals with the individual investment property that you’re considering, which is the investment property analysis.

In this article, we have elaborated more on the property valuation side of investment property analysis, which deals with further details that are specific to the property, its types, age, size, and the projected return on investment that it will have.

To learn more about the methods used to calculate the different metrics mentioned in this article, such as the cap rate and the cash on cash return, we have written articles that tackle these specific topics to help you understand them and enable you to do your own calculations.

If you’re looking to find investment properties with readily calculated cap rate and cash on cash return values, head over to https://www.mashvisor.com/explore/ and start searching the area of your choice right away.