Investing in a short term rental property entails having a good grasp of the market and the various metrics that will help you determine the profit potential of your property. You would need tons of data to do a proper investment property analysis, and the related activities can be tedious. However, two platforms — Rabbu Airbnb Analytics and Mashvisor Airbnb Analytics — are at your disposal if you’d like a quick, accurate assessment of your Airbnb income property.

In this article, we will review both platforms based on factors that matter to new and seasoned investors alike including investment property search feature, comprehensive short term rental analytics, data accuracy, and pricing.

Overview

Before we dive into the technical stuff, let’s get to know Rabbu Analytics and Mashvisor Analytics. Here are their company profiles in brief:

Rabbu Airbnb Analytics

Emir DuKic founded Rabbu Airbnb Analytics in 2016. Rabbu is a property management platform that promises a 60% higher return on investment through short term rentals. It offers end-to-end property management services, beginning with purchasing the best rental properties, estimating the return on investment, listing the property, managing the rental operations, and taking care of the financial aspects of the venture. Rabbu is based in Charlotte, North California, and has 16 employees.

Mashvisor Airbnb Analytics

Mashvisor is a website that empowers real estate investors to find the right investment property, be it Airbnb or traditional rental, and gain an attractive profit from it. Its scope of service includes the provision of comprehensive short term rental analytics covering rental property pricing, seasonality trends, revenue potential, occupancy rates, cash flow calculation, cap rate, cash on cash return, and many more. Based in Campbell, California, the business was established in 2014 and has around 25 employees.

This platform has earned the attention of media biggies, including Forbes, TechCrunch, The Wall Street Journal, and more. It has a vast network of real estate agents, brokers, investors, Airbnb hosts, and property managers.

Investment Property Search

One of the challenges a first-time Airbnb investor faces is finding the most lucrative income property for sale. So where do you start?

Often, newbies at short term rentals would focus on their local market, completely unaware of the many profitable opportunities that await them in other areas. The tendency to limit the investment property search within one’s neighborhood is understandable, considering the amount of time and effort required to find the best rental property. However, if you expand your search, you will find that properties outside your local housing market might be significantly more affordable while also bringing better returns.

An efficient platform is what you need to do an extensive search for the best Airbnb property within your budget.

Searching for Airbnb Properties with the Rabbu Analytics

The Rabbu Airbnb Analytics platform does not have a tool that points you to the location with the best short term rental properties despite assisting with purchasing properties. Its menu of services is geared towards evaluating your property’s viability as an Airbnb rental.

Searching for Short Term Rentals With the Mashvisor Analytics

Meanwhile, Mashvisor has three tools for locating the best investment properties: Search Bar, Heat Map, and Property Finder.

Search Bar

When you go to the Mashvisor homepage, the first thing you will see is the search bar. Type in the name of a state, a city, a neighborhood, or a zip code. A drop-down list will show the cities or neighborhoods with properties listed on Mashvisor’s platform. Once a location is selected, you will be redirected to the map page, showing which neighborhoods in the location you selected have available properties.

When you click on one of those tiny circles on the map, you will find the median property price, average cash on cash return, and average cap rate for Airbnb and traditional rental properties within that neighborhood.

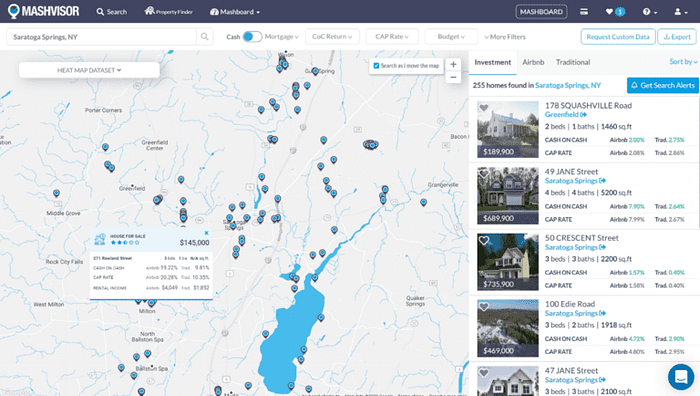

Mashvisor Airbnb Analytics: Investment Property Search

Heat Map

Alternatively, if you are a standard or professional plan subscriber, you have the option to access your selected area’s real estate heat map. You may do so by clicking on the drop-down arrow next to Heat Map Dataset found on the top left corner of the map. A drop-down menu will appear so you can select the metric you’d like to evaluate. These metrics include:

- Listing Price

- Airbnb Rental Income

- Traditional Rental Income

- Airbnb CoC Return

- Traditional CoC Return

- Airbnb Occupancy Rate

Upon selecting a metric, the heat map — or a color-coded map — will appear. The green-shaded areas represent the high-value ones, the red-shaded ones are low-value, and the orange, blue, and yellow-shaded ones are somewhere in between.

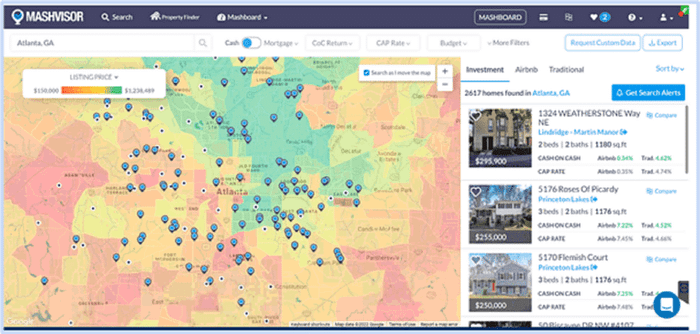

Mashvisor Airbnb Analytics: Heat Map

What’s nice about this tool is the ease of modifying the search parameters based on what’s important to you. It allows you to sort the database based on the budget, rental income, cash on cash return, or Airbnb occupancy rate.

A word of caution, though, each search criterion will have a different impact on your property’s investment potential, so do not rely on the green-shaded always. For example, if your selected metric is Airbnb cash on cash return, you would want to see a high value for this. However, when you use the listing price as your metric, you prefer to go to the red-shaded areas to purchase properties at a lower price.

The tool makes it easy to evaluate several options with just a few taps on the keyboard. For example, you can check out your potential income if you make a cash purchase, but you may also find out how putting the property on a mortgage will impact your income. Similarly, you can tweak the down payments, interest rates, and payment terms to find out how increasing or decreasing the value of each metric would influence the rate of return on the subject property.

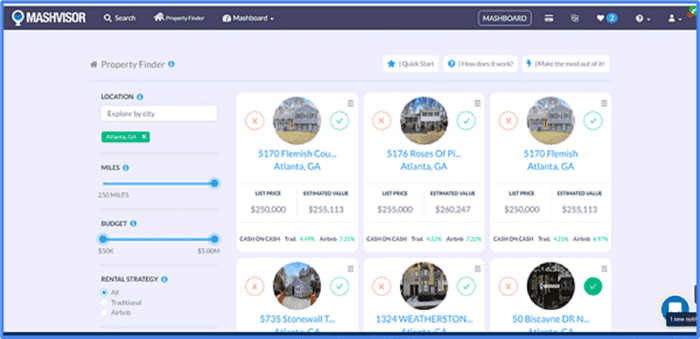

Property Finder

One of Mashvisor’s features is the Property Finder, which uses predictive analytics to identify the most suitable investment property for sale for your needs. With Mashvisor’s up-to-date machine-learning algorithms, you may do a simultaneous search in 5 cities for the best investment property.

Click on Property Finder next to the Search icon found in the upper left corner of the page.

After choosing a location and area range, select Airbnb as your rental strategy. You may narrow down your search by specifying the following information:

- Property Type

- Property Price

- Number of Bedrooms

- Number of Bathrooms

Mashvisor Airbnb Analytics: Property Finder

Comprehensive Data Analytics

Both the Rabbu Airbnb Analytics and Mashvisor Airbnb analytics claim to produce quick and accurate rental property analysis through user-friendly tools. However, a closer look reveals there are differences between the two platforms in terms of the number of metrics each one evaluates and how the analytics are presented.

Rabbu Airbnb Data

Rabbu has added Insights to its array of technology-based solutions. Insights is a free tool that works on both mobile and desktop, designed for short term rental investors, real estate agents, and brokers in search of an accurate quantitative analysis of their rental property’s viability.

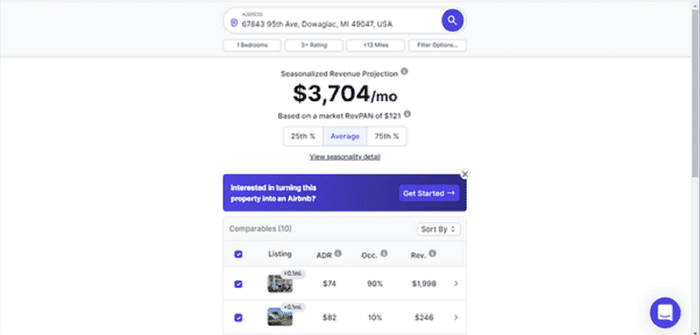

Start by typing in the address where your property is located. Then, select the number of bedrooms at the property before clicking on the search icon. The tool will then calculate the potential monthly revenue you will be earning for that property. Users are given three revenue estimates: the 25th percentile, the average, and the 75th percentile.

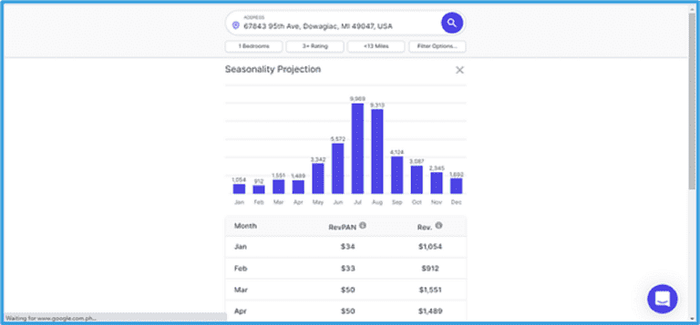

Rabbu Airbnb Analytics: Seasonalized Revenue Projection

Aside from the monthly revenue, Rabbu Airbnb data analysis will also calculate for you the revenue per available night (RevPAN), which is the average amount you will earn per night that the property is available to rent out. It is computed by multiplying the average daily rate (ADR) with the occupancy rate.

It compares the property with other similar properties within the neighborhood, also known as Airbnb comps, displaying the distance from your property’s location, ADR, occupancy rate, and revenue of each. The platform allows you to sort the Comparables listings according to your preferred parameter in order to display the Comparables listings in descending order of the selected filter. For instance, if you sort by revenue, the display will be rearranged to put the property with the highest revenue on top of the list.

Seasonality is factored in by Insights so that the monthly revenue it provides reflects an average income throughout the year. Rabbu allows you to view the seasonality projection.

Rabbu Airbnb Analytics: Seasonality Projection

You can tailor your search by adding filter options. Additionally, users have access to a drop-down menu that provides a complete perspective of the neighboring listings. It comes with a gallery of property images, a list of amenities, and pricing history.

Mashvisor Airbnb Data

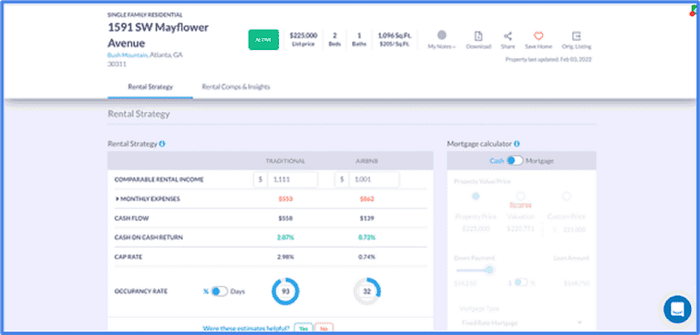

Mashvisor calculates metrics that Rabbu’s Airbnb analysis does not provide.

The Mashvisor Airbnb calculator pulls critical base information from various sources, including the search filters in the property finder and the property’s rental availability as well as occupancy rates. It then provides a comprehensive rental property analysis, providing you with cash on cash returns and the cap rates for Airbnb and traditional rental.

Mashvisor Airbnb Analytics Calculator

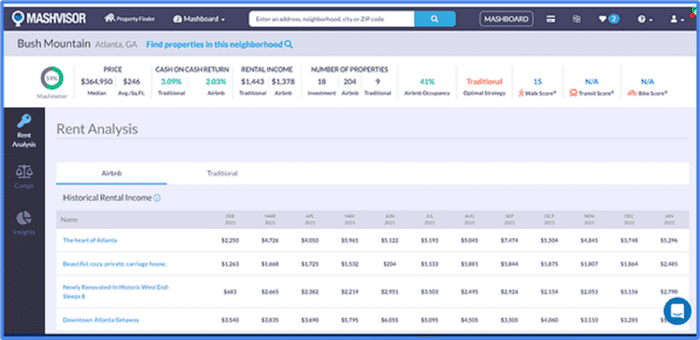

Mashvisor presents an overall rental comp of the selected area so you can see how other properties near your chosen location or similar to yours are performing. It offers an individual property summary and neighborhood summary.

If you are not completely sold on a property based on the rental analytics, you can go one step further by clicking on the Neighborhood Analysis to get a more detailed review of the area. You may check the Mashmeter, a general rating of the neighborhood’s viability as an investment location. More details are provided in this feature, such as the the average price per square foot and the optimal rental strategy — Airbnb vs long term rental — in the investigated area.

You will also see the rental income history of all listed properties within the neighborhood through the Rent Analysis feature, while the Insight feature gives you a glimpse of the rental features and rental property types in the area so you can better evaluate if the property for sale you are analyzing will give you the earnings you want.

Mashvisor Airbnb Analytics: Neighborhood Analysis

Data Accuracy

A comparative market analysis is only as good as the quality of real estate data used. A platform may have the most sophisticated tool to put data into a comprehensive study of a rental market, but if the data is inaccurate or incomplete, the analytics will not mean anything to the investor. Worse, a first-time investor may even end up losing their hard-earned money.

So, how do Rabbu Airbnb Analytics and Mashvisor Airbnb analytics fare in the data accuracy department?

Rabbu Airbnb Data Accuracy

Rabbu Airbnb data is updated on Insights in real-time and regularly reviews the average occupancy and daily rate of similar Airbnb properties within the same area to ensure unmatched data and property appraisal accuracy.

Nothing much has been said on its website nor in the scarce Rabbu reviews about ensuring data accuracy.

Mashvisor Airbnb Data Accuracy

Mashvisor observes several measures to ensure data accuracy.

It collects and extracts data from multiple trusted channels. Aside from the Airbnb website, these trustworthy channels include the Multiple Listing Service (MLS), Realtor.com, Roofstock, Zillow, Auction.com, and Walk Score. Mashvisor goes a step further by collecting data from public records, including bank-owned or foreclosed rentals, making Mashvisor’s real estate and rental data accurate and complete.

Additionally, Mashvisor only uses verified Airbnb listings with at least 3 Airbnb reviews for its Airbnb data. The platform also compares its calculations with the results of actual Airbnb hosts on a regular basis. There’s nothing more authentic than the information shared by actual Airbnb guests as well hosts who have been in the business for some time.

Mashvisor also compares its analytics with the same trusted data sources to ensure that the results generated by its various tools are consistent with what these sources turn up with.

The platform may perform data analysis every ten months, but Mashvisor updates its data and the MLS database listings regularly. Algorithms are tested regularly to ensure reliable projections.

Finally, Mashvisor uses median instead of average values. Medians are more accurate and reliable because they eliminate exceptions and irregularities that distort the analysis.

To learn more about how Mashvisor can help you find profitable investment properties, schedule a demo.

Pricing

The cost of a real estate platform is important, especially when it comes to a subscription-based app that you plan to use for a long time.

Rabbu Pricing

Rabbu Airbnb Analytics offers a free trial but does not publish its cost, except its APIs, and datasets cost about $30 per purchase. A source only says it supports monthly and yearly payment terms. It also doesn’t say anything about the coverage of the free trial. You have to get in touch with them to discuss pricing.

Mashvisor Pricing

Whether you are an individual wanting to find out if an Airbnb rental property would be profitable, an investor in search of new properties to invest in, or a real estate agent looking at large dataset analysis, Mashvisor has a pricing plan for you.

The Lite Plan, a basic subscription, costs $17.99 per month. It allows the user to do a rental market analysis on individual properties. At $49.99 monthly, the Standard Plan is best for locating investment opportunities. It offers everything a Lite Plan offers plus more. If you want to go a step further to analyze large datasets and expand your search to other types of properties, the Professional Plan is the right one for you. With its $79.99 per month subscription rate, you will have access to all features found in the Standard Plan and a lot more.

Mashvisor offers a free trial and a flexible cancellation policy. A full free trial allows you to request a demo on all features to help you decide which plan is best for you. On the other hand, you may cancel your subscription at any time, directly through your account, and still use the covered services within the period you have paid for.

Conclusion

Let’s do a recap of the Rabbu vs Mashvisor matchup.

In terms of scope of services, Mashvisor has a slight edge over Rabbu because of its capacity to search for lucrative investment properties using multiple tools. Rabbu’s service begins with the assumption that a potential client has already selected a property for investment.

Both have an investment property calculator that provides essential data for evaluating a rental property’s viability. For Rabbu, the add-ons include the average revenues in 3 tiers: the 25th percentile, the average, and the 75th percentile. Rabbu allows you to view its seasonality projection that is factored in when calculating the average revenue.

On the other hand, Mashvisor provides more data for analysis, including cash on cash return and cap rate. Even as it provides an overall rental comp, Mashvisor enables you to dive deeper into the analysis through its Rent Analysis and Neighborhood Analysis features, making the analytics more comprehensive.

Whose data is more accurate? Mashvisor has very clear guidelines on how it keeps its data accurate. The coverage from which it extracts and compares data is far broader than Rabbu’s, which is limited to similar Airbnb properties within the same neighborhood.

Mashvisor’s plans are more defined than that of Rabbu’s. Although both offer a free trial, Rabbu does not indicate the duration or the coverage of the free trial.

Based on investment property search, the scope of analytics, data accuracy, and pricing, Mashvisor outshines Rabbu Airbnb Analytics. The attention given by big names in media boosts Mashvisor’s appeal and trustworthiness.

To get access to our real estate investment tools, sign up for Mashvisor today.