Real estate investing can be a good way to achieve your financial goals. If you succeed, you can create a stream of passive income and be financially free. However, most people who think about getting into real estate investing actually never get started. The reason most would-be real estate investors fail to take action rarely has anything to do with the risks of buying real estate or lack of financing. Instead, people are often held back from taking action because of real estate analysis paralysis.

This is something that every real estate investor should beware of when analyzing a potential investment property.

What Is Analysis Paralysis in Real Estate?

In real estate, analysis paralysis is a situation in which someone is unable to make an investment decision because they overthink and overanalyze property data.

As a result, real estate investment decisions are never taken. Analysis paralysis is common among first-time real estate investors. Buying an investment property is a big deal for most people. Considering the risks of real estate investing, nobody wants to make a mistake and lose money.

People often want to get things so right that they never actually make a move. They convince themselves that every real estate deal isn’t good enough. As a result, they get stuck and never even get started. Inaction, in turn, paralyzes the outcome.

Real estate analysis paralysis often leads to missed opportunities or even losses in a portfolio. By the time you make up your mind, someone else would have already bought the property.

Naturally, when faced with too many options and too much information, it’s hard to have clear answers. Therefore, most people end up doing nothing. Ultimately, real estate analysis paralysis can prevent you from achieving your financial goals. You can’t make great money in real estate through ceaseless analysis. That will only lead you to more confusion.

However, this is not to mean that you should make hasty decisions without proper analysis. Savvy real estate investors make good money in real estate because they are able to spot lucrative deals and take quick action.

To clear fear and doubt in your mind when buying an investment property, you should learn how to overcome analysis paralysis. With the right strategies, it can be avoided.

In this blog, we share some top tips on how to beat analysis paralysis so you can quickly take action without fear.

How to Overcome Analysis Paralysis: 4 Top Tips

1. Define Your Objectives

The first strategy that real estate investors can use to get beyond real estate analysis paralysis is to clarify their end goal and set clear deadlines.

Sometimes, you may be unable to make real estate investment decisions because you have no idea what you want. The real estate industry is quite broad and there are many investment options. As you are aware, too many options can easily paralyze you into inaction. However, if you define your goals, you will be able to eliminate the noise and focus on what is important.

If you know where you are going, it will also be easier for you to track your progress. Have a clear picture of what you want to achieve by buying real estate. The more specific your investment objectives are, the easier it will be to eliminate investment properties for sale that don’t meet your needs. Your property search will be more efficient. For instance, do you want to be an active or passive investor? Are you investing for the short term or long term? Know what you want to achieve and why.

When drafting your business plan, break the bigger, long-term objectives into smaller and more manageable chunks. Moreover, setting a specific timeframe to achieve your goals will motivate you to act quickly and stop procrastinating.

Related: How to Develop a Rental Property Business Plan

2. Use Mashvisor

Another strategy that investors can use to overcome real estate analysis paralysis and make good decisions quickly is to use real estate investment software like Mashvisor.

To find the best investment properties for sale, you need to do a lot of research. This involves both real estate market analysis and investment property analysis. However, collecting large amounts of property data and squeezing them through investment analysis spreadsheets can be time-consuming and a lot of hassle. This gives birth to real estate analysis paralysis.

Fortunately, investors can now use real estate technology to quickly and accurately analyze investment opportunities, thereby overcoming real estate analysis paralysis. Mashvisor’s real estate investment tools use reliable property data and the latest algorithms to help investors locate the most profitable investment properties for sale in the US housing market in a matter of minutes.

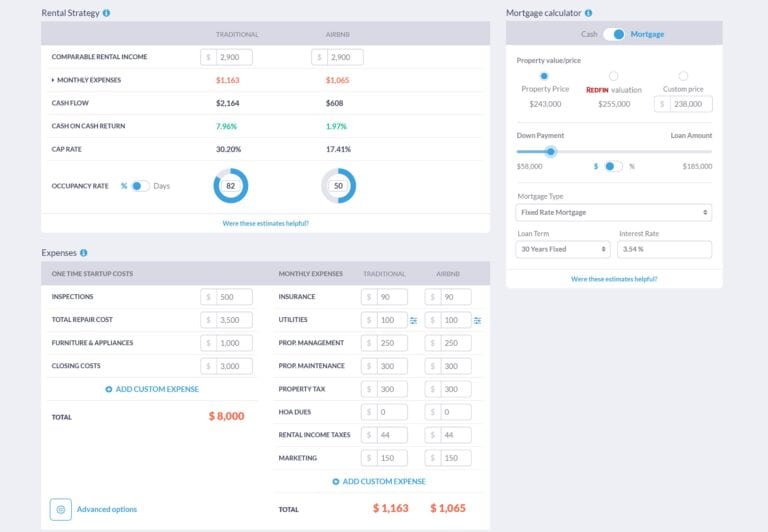

With Mashvisor’s Heatmap Tool, you can quickly do a neighborhood analysis on your city of choice to find the best area for rental investment. Mashvisor’s Property Finder will help you search for profitable investment properties for sale that match your criteria and preferences. Lastly, the Investment Property Calculator will enable you to quickly evaluate rental property based on key metrics like listing price, cash flow, cap rate, cash on cash return, and Airbnb occupancy rate.

Keep in mind that Mashvisor provides numbers for both Airbnb and traditional rental strategies. Therefore, if you want to buy an Airbnb rental property, it’s the best software for Airbnb market research and Airbnb investment analysis.

Related: How to Buy an Airbnb Investment Property with the Best Real Estate Investment App

3. Reach Out for Guidance

Often, real estate investment decisions have to be made quickly. However, as a newbie, analyzing investment properties all by yourself can be quite intimidating. This can lead to real estate analysis paralysis. Having a reliable person to provide some advice can help you make faster and better decisions.

For instance, you could consider hiring a real estate agent. They have great knowledge of the real estate market and can help you make better investment decisions. You could also seek advice from a mentor. You can learn a lot from them and avoid making mistakes.

Related: What to Look for to Find the Best Real Estate Agent for Buying an Investment Property

Also, try to learn as much as you can about real estate investing. You can use various resources such as real estate books, blogs, podcasts, seminars, etc. Building your real estate knowledge over time will make you feel more confident in your property analysis abilities.

4. Don’t Pursue Perfection

One of the biggest hurdles that beginner real estate investors struggle with is waiting for the “perfect” real estate deal. However, what they fail to understand is that there is no perfect investment property deal. The fact is that there will always be reasons not to purchase an investment property. It’s also important you accept that your first investment property may not be the best.

With that said, as long as you have done proper due diligence and seen that it meets your investment goals, it’s probably a good choice for you. If you wait for the perfect investment property to present itself, you could miss out on some great opportunities to take your real estate business forward.

For now, you should focus on getting your foot onto the ladder. As you grow your portfolio and get more experienced, you will be able to make better decisions.

The Bottom Line

Real estate investing always involves some risk. However, trying to find the perfect investment property for sale can lead to real estate analysis paralysis and keep you from moving forward. Buying real estate can be a lucrative investment if you do your due diligence and don’t let real estate analysis paralysis hold you back.

Always remember that it’s better to go for a great deal than wait for a perfect deal that will never come by. With these strategies, you will be able to streamline your decision-making process and achieve your investment goals.