In real estate, an assignment of contract is a strategy where one transfers his rights and obligations to another party. Read on to learn more.

Real estate investing is a great way to earn additional income. Are you planning to buy a property? If so, there are several real estate investment strategies available. These include purchasing a rental property, flipping houses, and buy-and-hold. Some investors also consider investing in real estate investment trusts (REITs).

Table of Contents

- What Is an Assignment Contract in Real Estate?

- Is an Assignment of Contract Legal?

- How Does Assignment of Contract Real Estate Work?

- Elements of an Assignment Contract

Wholesale real estate is another potentially lucrative strategy for making money in real estate. It involves finding real estate deals you don’t plan to buy but plan to transfer to an end buyer. This kind of transaction uses a principle called the assignment of contract. The real estate assignment of contract is a strategic act that offers several benefits to buyers and sellers.

The assignment of contract has gained prominence as a valuable tool in real estate transactions. It presents a great alternative to traditional buying and selling approaches. It opens doors to lucrative opportunities and flexible real estate transactions. Investors who invest in real estate wholesaling typically use this strategy.

Wholesaling investors secure properties under contract. They intend to assign them to another buyer for a profit. They won’t assume ownership during the process or undertake the associated risks. It allows for a streamlined process and reduces the need for substantial financial investment.

In general, the assignment of contract is a great option for those who want to enter the real estate market immediately. It is a powerful and versatile tool. It can unlock many opportunities for buyers, sellers, and investors alike.

What Is an Assignment Contract in Real Estate?

Assignment of contract in real estate takes place when the original party (assignor) transfers the contractual rights and obligations to a new party (assignee). The assignee, who is the recipient of the assignment, assumes the rights and duties outlined in the contract.

In an assignment of contract, the assignor essentially transfers their position in the contract to the assignee. The assignee will then become a party to the contract with the other original party. Note that the assignor does not necessarily absolve themselves entirely from the agreement. The assignor typically remains liable for any breaches that occurred prior to the assignment.

Related: 4 Types of Real Estate Contracts: A Beginner’s Guide

Benefits of Assignment of Contract in Real Estate

The assignment of contract real estate offers several benefits to buyers, sellers, and investors. It is one of the preferred ways to process real estate investments.

Here are a few benefits of a real estate assignment contract:

Increased Flexibility

Assigning a contract allows for greater flexibility in real estate transactions. It provides an opportunity to transfer contractual rights and obligations to a new party. This enables the original buyer or seller to adapt their position without completely withdrawing from the deal.

This flexibility can be valuable in situations where circumstances change. These include financial constraints or unexpected personal events.

Expedited Transactions

Assigning a contract can expedite the real estate transaction process. Rather than starting from scratch, a buyer can step into an existing contract. It saves time on negotiating terms, inspections, and other procedural aspects. This acceleration can benefit investors who aim to close deals quickly and efficiently.

Minimal Financial Investment

Assigning a contract lets investors take part in real estate with minimal financial investment. Instead of buying the property outright, investors can secure it under contract. Then, they can assign that contract to another buyer for a profit.

This strategy, often used in real estate wholesaling, reduces the need for substantial upfront capital. Plus, it lowers the risks associated with a real estate purchase.

Profit Generation

For investors, an assignment of contract can be a lucrative profit-generating strategy. They acquire properties at favorable terms and assign the contracts to buyers. This lets them earn the difference between the contract price and the assignment fee.

It allows investors to leverage their skills in finding attractive deals. It also helps them capitalize on market opportunities.

Related: How to Flip Real Estate Contracts: 8 Steps

Enhanced Collaboration

Real estate transactions are usually complex because they involve multiple parties. The assignment of contract facilitates collaboration and simplifies the negotiation process.

It enables parties to allocate responsibilities and delegate rights. It also helps ensure the smooth execution of agreements involving various stakeholders. This cooperative approach can expedite the transaction. What’s more, it can lead to outcomes that are beneficial to all parties involved.

Risk Mitigation

Assigning a contract can help mitigate risks associated with real estate transactions. Market conditions and investment circumstances may change. In this case, the assignor can transfer the contract to another party. It lets them avoid potential losses or unfavorable outcomes.

This risk management aspect provides a level of protection. It also offers adaptability in dynamic real estate environments.

Disadvantages of an Assignment of Contract

The assignment of contract real estate can offer numerous advantages. But, it also carries certain disadvantages. You need to know these drawbacks before deciding to use this strategy, such as:

Limited Time Frame

Assignments often need to be executed within a specified time frame outlined in the original contract. This can add pressure to find a suitable assignee and complete the process within the designated period. It can potentially lead to rushed decisions or inadequate due diligence.

Loss of Owner’s Rights

As the assignor, you transfer your contractual rights and obligations to the assignee. This means you no longer have control over the property. You also won’t be able to make decisions regarding its use, modifications, or other aspects associated with ownership.

Potential Buyer Disinterest

The presence of an assignment fee, which compensates the assignor, may deter some buyers. The additional cost can make the overall transaction less attractive. This may limit the pool of potential buyers. It also makes it more challenging to find a willing assignee.

Non-Assignable Properties

Not every property is assignable. Some purchase agreements contain clauses that prohibit or restrict assignments. In such cases, the assignor may face limitations or even be unable to assign the contract. It limits their options for exit strategies.

Difficulty Confirming Buyer Financing

When assigning a contract, the assignee may need to secure financing to fulfill their obligations. However, confirming buyer financing can be challenging. Lenders may require additional assessments or have specific criteria for accepting an assignment. This can cause delays or complications in finalizing the transaction.

What Is an Assignment Fee?

An assignment fee in real estate refers to monetary compensation for the assignor. The assignor charges the fee when assigning their contractual rights and obligations to an assignee. It represents the assignor’s profit for finding a deal and facilitating the assignment. The price is typically negotiated and agreed upon as part of the assignment agreement.

The assignment fee is separate from the purchase price or consideration mentioned in the original contract. It serves as compensation for the assignor’s efforts in securing the deal. It is also a fee that the assignee must pay for assuming the position in the contract from the original buyer.

Example of Assignment Contracts Real Estate

An assignment contract real estate is a great tool to use when an investor wants to transfer his rights and duties to another party.

Here is a good example of an assignment of contract real estate:

John identifies an Airbnb house for sale in a good neighborhood. He negotiates a purchase agreement with the property owner, Mary. They then enter into a contract for the sale of the property. However, John realizes that he doesn’t have the financial resources to proceed with the real estate purchase. But he sees the potential for a profitable deal.

In this scenario, John decides to assign the contract to another investor, Sarah. Sarah has the necessary funds and is interested in acquiring properties for short term rentals. John and Sarah agree on an assignment fee, which compensates John for his efforts in securing the deal.

John transfers his contractual rights and responsibilities to Sarah. Sarah becomes the new buyer in the contract. She assumes the duty of buying the house from Mary at the agreed-upon terms and conditions.

By assigning the contract, John avoids the need to secure financing. Plus, it eliminates the risks associated with investing in short term rentals. Such risks include repairs, maintenance, seasonality, and market fluctuations.

For Sarah, the assignment of contract presents an opportunity to own a property without going through the entire process. It eliminates the need for negotiation and due diligence. She benefits from John’s efforts in securing the deal. Such efforts include identifying the property, negotiating favorable terms, and establishing a rapport with the seller.

Ultimately, Mary completes the transaction with Sarah, who steps into John’s position as the buyer. John then earns the assignment fee as his profit for getting the deal.

Is an Assignment of Contract Legal?

Yes, the assignment of contract in real estate is legal. However, real estate contract assignment will not be enforced in the following circumstances:

- There is no written consent. Before a real estate assignment contract takes effect, all parties must give written consent.

- The contract doesn’t allow assignments. Some contracts come with a non-assignment clause. It prohibits the original buyer from assigning the deal to another.

- The assignment violates public policy or the law. Some jurisdictions have laws that prohibit or limit assignments.

- The property has restrictions. Certain properties, such as HUD homes, REOs, and short sales, might have deed restrictions. These prohibit the assignment of real estate contracts within a specific period.

Overall, it’s legal to assign real estate contracts to another buyer. By default, all contracts are assignable. But make sure to check the agreement for any stipulations prohibiting contract assignments.

How Does Assignment of Contract Real Estate Work?

The assignment of contract is a straightforward exit strategy when it comes to real estate investing. But, a successful and efficient contract assignment requires careful adherence to a specific process.

Here are a series of essential steps for assigning a contract:

1. Find an Investment Property for Sale

The first thing you need to do is find a motivated seller willing to sell their home at a price below market value. The main difference between motivated and regular sellers is the former’s sense of urgency.

Motivated sellers want to sell fast due to several reasons. These include divorce, relocation, living out-of-state, delinquent taxes, or job transfers. This sense of urgency could work to your advantage during negotiation.

You can use the following strategies to find homeowners that want to sell fast:

Driving for Dollars

As the name suggests, this involves driving or walking around neighborhoods looking for signs of distressed properties. Signs of distress include overgrown grass, overfill of newspapers or mail, broken windows, deferred maintenance, and code enforcement signs. Write down the addresses of such homes and use them to locate the homeowner. Then, ask them if they are willing to sell so you can make an offer.

Look for the County’s Delinquent Tax List

This list is a goldmine for finding motivated sellers in an area. Simply visit the county government’s website or offices to get the delinquent tax list. This will give you an idea of potential properties that you can buy.

Use Mashvisor’s Real Estate Tools

Mashvisor is an online real estate analytics platform that can help you find the perfect investment property in no time. It is the best place to find cheap houses, including short sales, foreclosed, bank-owned, and auctioned homes. You can use the following tools to help you search for a property for sale in your preferred location:

Property Finder

The Property Finder tool lets you narrow down your options by customizing filters. You can set your budget, property type, size, and investment strategy. Just type in the city or neighborhood of your choice, and the system will generate results based on your criteria.

Another great thing about the Property Finder tool is that you can search multiple cities and neighborhoods simultaneously. After you find a property you like, you can just click on it and see its details. This information will help you decide whether or not the property will make a good investment.

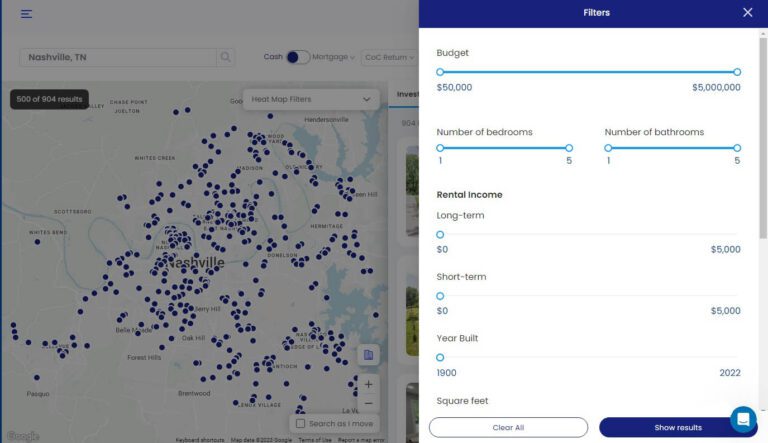

Mashvisor’s Property Finder tool makes finding suitable investment properties much easier with its filters.

Heat Map

Another tool that can help you find a good investment property is Mashvisor’s Heat Map. When doing a map search, you can set your custom filters to narrow down the results. You can filter by budget, property size, property type, or property status. You can also set preferred rental income, cap rate, and cash on cash return.

Select a property from the results; then, you’ll be taken to a page where you can find all the important real estate data. You will see the investment potential of the property. You can also use the Airbnb Calculator to determine if it will make a good short term rental investment.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.

Airbnb Rental Calculator

Bedrooms

Bathrooms

2. Perform Due Diligence

After you find a profitable investment property, it’s crucial to perform due diligence. You should do this before signing any agreement with the seller. Work with a professional to inspect the property and perform a title search.

Property inspections are necessary. They ensure there are no major structural defects that may require costly repairs. Also, a title search is another important part of due diligence. It will look into the history of the home to ensure that there are no liens attached to the title.

3. Get the Purchase Contract

The next step is to get a purchase agreement from the seller. Make sure to have a real estate attorney read and approve the agreement. This will assure you that the contract is legally sound. It also gives you peace of mind that you will have a lawyer’s support in case of issues.

One crucial detail that needs to be included in the agreement is the “and/or assigns” next to your name. This clause authorizes you to transfer the contract to an interested buyer. Be sure to disclose this information to the seller. Explain the meaning of the clause if necessary. Give assurance that the seller will still get the agreed-upon purchase amount.

4. Find an End Buyer or Assignee

Finding buyers is an important step in the strategy of real estate assignment of contract.

Once everything is in order, you’ll need to find your assignee who will assume the purchase of the property. You can find potential buyers using methods such as cold calling, posters, signage, and newspaper ads. You can also use social media ads, Craigslist, or networking on real estate forums to find an assignee. Alternatively, you could solicit the help of a local real estate agent.

Whatever strategies you choose, be sure to find a buyer before the contract expires. In fact, many investors who use this strategy work on putting together a buyers list before they even find a property for sale. Consider this approach as well.

5. Assign the Contract

You can easily download an assignment of contract template from the internet. You can use this to assign the contract to another buyer who will assume your duties and rights. Make sure to let your real estate attorney review the assignment of contract before letting your assignee sign it.

Once you’ve located an interested buyer, the first thing you need to do is ask for an earnest cash deposit. Your contract should clearly mention that earnest money will be paid upfront. This clause will protect you from any breach of contract with the seller. Since the earnest money is nonrefundable, you are sure to make a profit whether the deal closes or not.

6. Get Paid

As the assignor, you will get paid once the end buyer closes the deal and pays the purchase price. The difference between the agreed-upon value and the price you reach with the buyer will be your profit. It refers to the assignment fee, which serves as your compensation for securing the deal.

There are two ways to earn profit or charge an assignment fee:

- Charge a Difference in the Selling Price. For example, your agreed purchase price with the seller is $170,000. Then you assigned the contract to the buyer for $200,000. The difference, which is essentially your assignment fee, is $30,000. It becomes your profit for the transaction.

- Charge a Fixed Assignment Fee. Let’s say you find a new buyer that can fulfill the original terms of the sale agreement—such as purchase price and closing date. You then assign the contract to the new buyer in exchange for a fixed assignment fee. It is usually a certain percentage of the purchase price.

Who Handles Assignment of Contract?

A real estate attorney is the ideal professional to handle an assignment of contract. These legal documents involve substantial sums of money, making it wise to have expert guidance. Do you require assistance with a real estate assignment contract? Connect with trusted lawyers who can provide comprehensive advice throughout the entire process.

Who Buys Real Estate Contracts?

In general, real estate contracts are most common among real estate wholesalers. Real estate investors who venture into fix-and-flips usually buy real estate contracts from wholesalers.

Since fix-and-flippers want a fast transaction, they typically don’t have time to do the necessary due diligence. So they rely on wholesalers to find properties they can renovate and resell.

Elements of an Assignment Contract

The elements of real estate assignment contracts may differ from one another. When drafting your assignment of contract in real estate, here are the basic elements you should consider:

- Assignor. The assignor is the original party to the contract who transfers their rights and obligations to another party.

- Assignee. The assignee is the new party who receives the rights and obligations of the contract from the assignor.

- Original Contract. The assignment of contract refers to an existing valid and enforceable contract between the assignor and another party (the seller). It serves as the basis for the assignment.

- Assignment Agreement. The assignment agreement is a separate contract that outlines the terms and conditions of the assignment. It includes the rights being transferred, the assignment fee, and any additional provisions specific to the assignment.

- Assumed Obligations. The assignee typically assumes the obligations and responsibilities outlined in the original contract once the assignment is complete. This includes performing any required duties and fulfilling financial or performance obligations.

- Release of Assignor. Depending on the terms of the assignment agreement, the assignor may seek release from future liabilities. It releases them from any obligations under the original contract once the assignment is finalized.

- Consent (Optional). In some cases, obtaining the consent of the seller or other parties involved in the original contract may be necessary. It ensures the assignment is valid and enforceable.

The Bottom Line

Real estate assignment of contract takes less time to complete compared to other real estate investment strategies. It also requires little or no capital. However, working with sellers and buyers who are not conversant with the assignment of contract can be challenging. In addition, you might find a buyer that will want to back out at the last minute.

If you want to flip a real estate contract, you should anticipate such scenarios and prepare accordingly. Make sure to understand the process before using this exit strategy. Further, working with a trusted real estate attorney can help lessen your risks.

Are you ready to find the perfect investment property? Mashvisor can help you with this! Schedule a demo now to see how our platform works.