In 2023. your rental property investment decisions will be only as good as the data they use. So who’s the best real estate data provider?

Table of Contents

- 5 Reasons You Need Real Estate Data

- What Real Estate Data Points Investors Need

- Why Mashvisor Is the Best Real Estate Data Provider

- Getting Started With Real Estate Investments

The last decade witnessed explosive growth in real estate technology tools, which help investors make faster and smarter choices. Many of these PropTech platforms and apps are focused on collecting, analyzing, and providing real estate data to investors.

However, just because a company claims that it offers the best data on the market doesn’t mean that this is the case. Investors have to be careful when they decide which real estate providers to trust and which ones they shouldn’t.

In this article, we will provide you with all the information that you need in order to optimize the use of reliable data in your investment decisions.

We will explain why data is important and how it boosts your investing outcomes. We will go through the most crucial types of real estate and rental data that you need. Last but not least, we will show you where to find the best provider of all data points you need to buy profitable long term and short term rental properties in the US market.

Hint: Mashvisor offers comprehensive, accurate, nationwide data tailored to the specific needs of rental property investors across the US. Let’s see why!

5 Reasons You Need Real Estate Data

Before knowing where to find the best real estate data provider, investors need to understand why they need access to data. The reasons are many, and the main ones include the following:

Choosing the Best Market for Investing

As all experts agree, location is the single most important factor for the success of a real estate investment project. It determines a number of crucial factors, like down payment, financing options, rental demand, optimal rental strategy, occupancy, vacancy, rental rates, rental income, and profitability.

That’s why investors need to conduct careful research and analysis before choosing the most appropriate real estate market for their needs and aspirations. In addition to including qualitative factors like rental laws, the core of the real estate market analysis should focus on numbers, figures, and trends. That’s where market-level real estate data comes into play.

Access to median property prices, average prices per square, and mortgage, private, and hard money lenders data will help investors choose an affordable location within their budget. Things like the number of visitors, demographic statistics, homeownership vs. renting ratios, and occupancy rates will show income property buyers whether they will face enough demand.

Data points such as rental rates, rental expenses, cap rates, and cash on cash returns will indicate if rentals in a certain market will generate positive cash flow and good returns.

As you can see, a lot of different types of real estate data numbers come together to provide investors with an overall picture of the investment potential of a certain market.

Finding the Optimal Real Estate Investment Property

The next reason why real estate investors need access to data is to locate the most profitable long term and short term rentals for sale in their selected market. When shopping for an investment property, one needs to conduct detailed rental property analysis, and there are a lot of various data points that go into this.

You cannot know whether a certain property would be worth the investment unless you get accurate estimates of the rental income, the rental expenses, the cash flow, and the ROI.

The best way to forecast the performance of a rental before buying it is to look at the performance of comparable rental properties in the area, also known as rental comps. The top provider of real estate data in the market should be able to give investors information on both long term and short term rental comps.

Selecting the Right Rental Strategy

Not every property is equally well made for being rented out on a short term and long term basis. That’s why one of the most important decisions investors make when first getting started in real estate is to choose the optimal rental strategy for the property they are buying.

Once again, to make the right decision, you have to get access to reliable data and information. You need to know whether a traditional rental or a vacation rental will yield higher revenue, cash flow, cap rate, and cash on cash return.

Only after you know all these data points can you decide if it’s better to run a long term rental business or start an Airbnb business.

Unless you gain access to the top provider of data in the local real estate market, your results will be suboptimal.

Optimizing Performance

Owning a successful real estate investing business does not end with buying a rental property. You have to manage your income in the best possible way in order to maximize your short term and long term return on investment.

If you have a short term rental, you need to adjust the Airbnb daily rates all the time in order to strike the right balance between revenue and occupancy. If you go for a long term rental, you still have to adjust the rental rates every few months or couple of years to reflect local housing market trends. To do this, you need data on local trends and competitors’ performance.

Outperforming the Competition

The last reason why you need data in real estate investing is simple—to perform better than your competitors. The US rental market is becoming increasingly competitive as more and more investors realize the amazing potential of this investment strategy and buy income properties.

This means that you have to base all your decisions on solid long term and short term rental analytics to attract more renters than competitors, get fewer vacancies, and make more money. And that’s why you need to locate the top provider of all the data that you need before starting to invest.

What Real Estate Data Points Investors Need

Rental property investors need a wide range of real estate data points to optimize their decisions, so they need to find a provider who has it all.

First and foremost, when buying an investment property, you need data related to one-time startup costs. This includes the down payment as the largest expense, which is based on the property price, the loan type, and the percentage requirement for a down payment.

You also have to know what appraisal costs, home inspection costs, and closing costs will look like. Similarly, since you are going to run a rental business, you should gather data on other startup expenses like fixes and repairs as well as furniture and appliances if you plan to own a vacation rental property.

Second, investors need market-level and property-level real estate data related to the expected performance of the income property they’re purchasing. This relates to things like average occupancy rate, rental rate, rental income, rental expenses, cash flow, and rate of return.

If leaning towards an Airbnb property, you also need to get information on the local short term rental regulations and laws in your location as part of your market research and analysis.

So, when you’re searching for the best real estate data provider, make sure to consider all these data points.

Why Mashvisor Is the Best Real Estate Data Provider

If you’re looking for the top provider of real estate and rental data analytics, you don’t need to look any further. Mashvisor is the best real estate data and analytics provider that you can potentially get your hands on in the US residential market.

Why?

For all the reasons listed below:

Mashvisor Helps You Find the Top Areas for Investing in Real Estate

The first step in making a profitable real estate investment decision is to choose the right market—both at the city and the neighborhood level. As the best real estate data provider, Mashvisor helps you in both of these regards.

The Mashvisor real estate blog provides regular updates on the best long term and the best short term rental markets across the US. In the Top Locations and Airbnb Rentals sections of the blog, you can find various rankings of the best places to invest in real estate.

Some criteria include the highest rental income, highest Airbnb occupancy rates, highest cap rates, and highest cash on cash returns. These rankings are based on nationwide real estate market analysis, which Mashvisor conducts after collecting data from a number of reliable sources and applying its own AI algorithms.

After you’ve selected potential cities for your investment, Mashvisor assists you in finding the best neighborhoods for both short term and long term rental properties. With the help of the Mashvisor real estate heatmap, you can use trustworthy data to search for areas in each US city and town with the following:

- Affordable median listing price

- High rental income

- Above-average cash on cash return

Once you have a few neighborhoods in mind, you can use the Mashvisor neighborhood analysis pages to expand your research and get all the data points you need for your investment.

These include averages for the following:

- Property price

- Price per square foot

- Rental income

- Cash on cash return

So, in brief, the data available on Mashvisor allows you to select the best markets for your specific budget and aspirations as an investor.

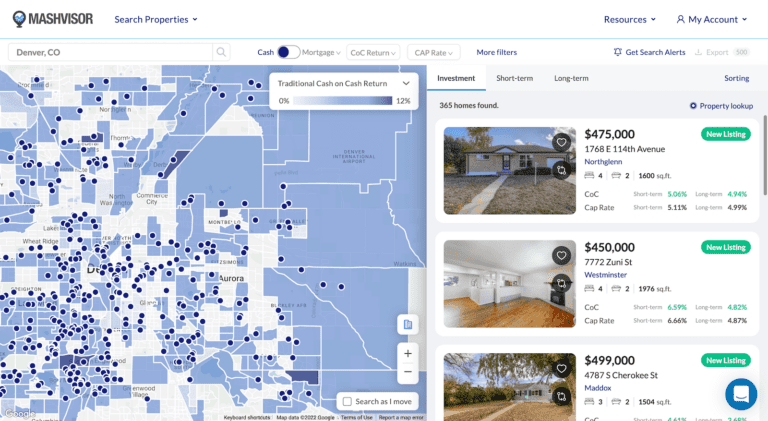

Mashvisor’s Investment Property Search w/ Heatmap

Mashvisor Helps You Locate Money-Making Rental Properties for Sale

The second reason why Mashvisor is the best provider of real estate and rental data in the US is that this real estate investing app helps you search for profitable properties.

On the Mashvisor investment property search engine, real estate investors can enter all their criteria, such as location, budget, financing, property type, expected income, and ROI. Immediately, the platform will supply them with a list of available rental properties for sale that meet their exact expectations. These include both MLS listings and off market properties.

The fact that with Mashvisor you can get access to the MLS database without a license is one more reason why you should check out this app. Usually, only licensed realtors are able to search for listings on the MLS, which is the biggest database of residential properties for sale across the US.

Moreover, the Mashvisor rental property calculator helps you conduct detailed investment property analysis on any listing that you consider for purchasing. You get estimates of the expected startup costs, rental income, recurring expenses, occupancy rate, cash flow, cap rate, and cash on cash return.

Importantly, all these numbers are based on data reflecting the performance of comparable rental properties in the area, or rental comps. This makes the long term and short term rental property performance forecasts of Mashvisor highly accurate and reliable.

Mashvisor Helps You Choose the Best Rental Strategy

Yet another reason why Mashvisor is the most useful real estate data provider in the US residential market is that you can use it to select the optimal rental strategy for your property.

Short term and long term rentals yield very different results within the same market and within the same property type. That’s why it’s crucial to choose not only an excellent market and a high-potential property but also the best rental strategy for this market and this property.

In its investment property analysis, as a comprehensive data provider, Mashvisor offers side-by-side comparison of the performance of the same property when rented out on a short term and long term basis. So, within less than a minute, with the help of the Mashvisor property-level data, you are able to realize which rental strategy will bring you the best ROI.

Furthermore, on the Mashvisor short term rental regulations pages, you can figure out where a city allows non-owner occupied short term rentals. This is a must for buying an investment property with the sole purpose of renting it out on Airbnb or another vacation rental marketplace. Usually, data on Airbnb laws takes a lot of time to find and research properly.

Start out your 7-day free trial with Mashvisor now.

Mashvisor Covers the Entire US Real Estate Market and Both Rental Strategies

Another feature of the Mashvisor real estate data that makes it a top provider for the needs of investors is the fact that the platform covers the whole US market and both rental options.

With the help of Mashvisor, you can analyze neighborhoods and search for money-making properties for sale in the largest US metros as well as the smallest towns and villages. This means that every investor will be able to find profitable opportunities, regardless of their budget and preferences.

In addition, Mashvisor is easily the only technology-driven source of real estate data for both short term and long term rental properties, at least at this level of coverage and analysis. For example, while AirDNA can help with some aspects of Airbnb data analytics, it has zero data on long term rentals. With Mashvisor, you are not limited to one rental strategy or another.

Getting Started With Real Estate Investments

In brief, access to the best real estate data will equal access to power in the investment world. And the #1 real estate data provider in the coming year will once again be Mashvisor. For all the reasons listed above and for the fact that it helps investors turn three months of real estate research and analysis into 15 minutes.

Meanwhile, accelerating your rental property investment decisions with the help of Mashvisor does not mean that you should sacrifice accuracy and reliability.

On the contrary, all data and analytics available on the Mashvisor platform are fully accurate as they come from trustworthy sources like the MLS, Redfin, RentJungle, and Airbnb. In addition, they reflect the actual performance of real estate and rental comps from each market. After all, nothing less than that is expected from the top provider of real estate and rental data in the US market in 2021.

Learn more about how Mashvisor real estate data can help you find profitable long term and short term rental properties. Schedule a demo with our team now!