A lot of folks are wondering how to invest in real estate with no money because they are aware of how potentially rewarding the returns are.

But is real estate investing for beginners with no money truly possible? How can a new investor with very few resources get in? Is it possible to build equity and wealth in real estate investing without enough starting capital or with bad credit? We will answer them in the article below.

Table of Contents

- 9 Ways Beginner Investors Can Get Into Real Estate Investing With Very Little or No Money

- How Much Money Is Needed to Get Started in Real Estate Investing?

- How to Find a Profitable Real Estate Investment Property You Can Afford

The above questions and others like them tend to weigh down many aspiring real estate investors who lack access to a large amount of money to get started in real estate. After all, when you invest in real estate properties, you will need a big wad of cash, right?

Well, technically, yes and no.

It is true that you need money to make money and real estate investing typically costs a lot. But knowing how to get into real estate investing with no money at all? That’s an entirely different ball game. There are other creative ways to work around the norm and get in the game with no money down or very little money involved.

Real estate investing for beginners with no money makes for a great discussion topic, and, lucky for you, that’s what we will talk about in this article.

Related: How to Buy Airbnb Property With No Money

9 Ways Beginner Investors Can Get Into Real Estate Investing With Very Little or No Money

The truth of the matter is that to make money, you need to have money. But it doesn’t mean you need a huge amount of money to get started in real estate investing. You may look at the different “how to” articles online about building wealth and equity. However, they generally don’t talk about investing with poor credit or those who have no money for capital.

We’ve listed different ways of “how to invest in real estate” with no money down required. Some may even work if you have a poor credit score.

Is real estate investing for beginners with no money possible? Are there feasible ways how to buy a house with no money down?

Yes and no, depending on how you define “no money or no money down.”

As mentioned earlier, it typically takes money to make money. It is a rule of thumb in investing. We already know how expensive real estate investing is and how it is almost always an industry meant to be ruled by the wealthy.

So if we talk about investing in real estate with absolutely no money down or bad credit, then no. However, there are a few exceptions to that rule.

The good news is that real estate investing has become more accessible to people of average income status, as there are several inexpensive ways to get into the game. Even if you only have $1,000 to spare or have a poor credit score, you can easily invest in real estate, thanks to these available investment vehicles.

For those of you who are wondering how to invest in real estate with no money, here are a few very affordable options to consider:

1. House Hacking

House hacking is, perhaps, the most inexpensive way to make money off of real estate without spending too much. If you’re a homeowner with bad credit and there’s considerable space on your property that can be rented out, you can start by renting out that space.

It is an easy way of utilizing your property to make money for you. Plenty of resources online show you how to hack your home and convert parts of it into rental spaces. Many investors with no money at the start were able to earn decent rental income, allowing them to build wealth and purchase properties.

2. Master Leases and Other Lease Options

Having no money and poor credit can be a hindrance to your dreams of becoming a real estate investor, but they shouldn’t stop you from pursuing your goal. There is another way of getting into real estate investing, even if you don’t have enough money to get started. It is called master leasing.

Newbie investors might be surprised to know that they don’t need to buy a house to make money in real estate. Instead, they can just rent one and sublease extra bedrooms. In a way, it is quite similar to house hacking, the only difference being that instead of owning a house, the investor is renting one.

3. REITs

What used to be an investment vehicle for the rich and wealthy is now accessible to regular individuals who wish to build equity and wealth. Another “how to invest in real estate with no money” option is through REITs. Investors with no access to hundreds of thousands of dollars can still invest in real estate through them.

Real estate investment trusts, or REITs, level the playing field for everyone. They make real estate investing within one’s reach since a newbie investor can get in with a minimum of $1,000 in private REITs. It means that even if you have a poor credit score but have enough money to invest in a REIT, you’re golden.

REIT investors are able to buy and sell shares, making it more liquid compared to other real estate investments. It allows them to make more money and start building wealth and equity incrementally.

Is real estate investment trusts a good career path? If we’re talking about real estate investing for beginners with no money or bad credit, it is a very good start to get into real estate.

As for making REIT investing a career path, it will depend on how smart and brave an investor is if they want to make it the primary real estate investment vehicle. Either way, it still offers lots of potential for a good return on investment.

4. Real Estate Crowdfunding

If you’re low on cash and wondering how to get into real estate with no money down, you may want to consider real estate crowdfunding.

Real estate crowdfunding is a lot like REITs as it allows individuals to own some shares of income-generating properties. As the name suggests, an investor gets to pool in their money (typically ranging from $1,000 to $5,000) along with other investors (the crowd).

The investments can be used either to purchase income properties for sale or as hard money loans to investors looking for financing. That’s no money down on your part, as the down payment is taken collectively from a pool of investors. It means that you can own a piece (technically) or property even if you have no money or with bad credit.

Investors just need to look for the right platform to make their money work for them.

Related: Learn and Experience the Power of Real Estate Crowdfunding

5. Airbnb Rentals

Airbnb rentals are a big thing today. It gives tourists and visitors more affordable alternatives to expensive hotels and resorts. If you own a property, you can get it listed on Airbnb or other similar vacation rental platforms and rent it out (or part of it) for shorter periods.

A lot of investors have benefited from this low-cost way of getting into the real estate investment game. If you own a property and have enough space to convert it into vacation rental space, this is an option you can try out.

There’s no money involved since you already own the property. All you need to do is spruce it up a bit to make it compliant with short term rental standards.

6. Seller Financing

Although the seller financing method is a bit harder to find compared to the other ones on this list, many investors have made their way into the real estate market through seller financing.

Essentially, the seller becomes the “lender” in that they allow the buyer to purchase the property and make periodic payments over a mutually agreed-upon period.

Seller financing is a great “how to invest in real estate with no money” way because the buyer is not bound by any traditional lending requirements from lenders.

7. Partnerships

Even after all the options stated above, if you’re still wondering how to get into real estate with no money or very little cash output, here’s another one for you.

Private partnerships or real estate investment groups (REIGs) are other feasible options for investors looking to own actual physical real estate instead of just REIT shares.

The partnership method allows groups of investors to buy one or more apartment or condo units through an operating company. The company takes care of the management aspect of the investment for a certain percentage of the monthly rent. Such an arrangement frees the investors of any time-consuming property management concerns.

8. BRRRR Method

Buy. Remodel. Rent. Refinance. Repeat.

The BRRRR method has been used by a lot of successful investors who initially didn’t have enough money to buy brand-new properties. The trick to making the strategy is looking for undervalued properties to develop.

It’s just like house flipping because of the buy and remodel aspects of it, but unlike fix-and-flips, investors keep the properties to grow their rental portfolio.

The refinance part allows investors to refinance and pull out their cash to purchase other investment properties.

For this one, having no money will not exactly work for you, but if you have a good enough credit score, perhaps you can land a good deal on a housing loan.

9. Bird Dog

For those with very little to zero money to buy or invest, becoming an investor’s bird dog may be your key to getting into real estate investing.

The term bird dog refers to a dog used to sniff out and point to a game for hunters. Similarly, real estate bird dogs sniff out good deals and point house hunters in the right direction. It is somewhat of a specialized real estate agent role, so if you want to earn finder’s fees legally, you’ll need a real estate license.

All you need to do is focus on investors and lead them to profitable investment properties.

With the bird dog method, even if you literally have no money and very bad credit, you can still make a good enough income to get started on your real estate investing journey.

How Much Money Is Needed to Get Started in Real Estate Investing?

While investing in real estate with absolutely no money is very unrealistic―again, it takes money to make money―it is possible to get into it without spending hundreds or even tens of thousands of dollars.

As we mentioned in the list above, the average person can invest as little as $1,000 in REITs to get access to the commercial real estate market. Homeowners with plenty of space can rent out a room to boarders or develop their properties and list them on Airbnb. Some even take the Airbnb arbitrage route to make extra money as tenants themselves.

It just takes a little creativity and lots of research to find the best and most affordable way to get into real estate investing. It’s a matter of knowing how to break into the business with the very limited resources you have on hand.

Related: Buying Rental Property With No Money Down—10 Ways It’s Possible

How to Find a Profitable Real Estate Investment Property You Can Afford

If you’re an aspiring investor but with limited resources, one of the things you should know how to do is find the right investment property that fits your budget and meets your goals.

We keep saying it takes money to make money in real estate investing. While this statement is generally true, it is possible to get by with little money and some resourcefulness.

1. Set Realistic Goals

To do it, you must learn how to come up with realistic goals first. If you have no money and you want to know how to break into the real estate industry, you need to keep it real. Be ambitious at a later time. For now, focus on your realities. Even if you have no money and bad credit, you can come up with the right strategies as long as you keep your goals realistic.

2. Use the Right Tools

Learning how to invest in real estate with limited resources is a skill that you can pick up. The trick is knowing which tools to work with and how to use them accordingly. Once you know how to use each tool properly, they should point you in the right direction. They’ll help you find the best possible deals that fit your budget.

Mashvisor: The Right Real Estate Investment Tool for Beginners

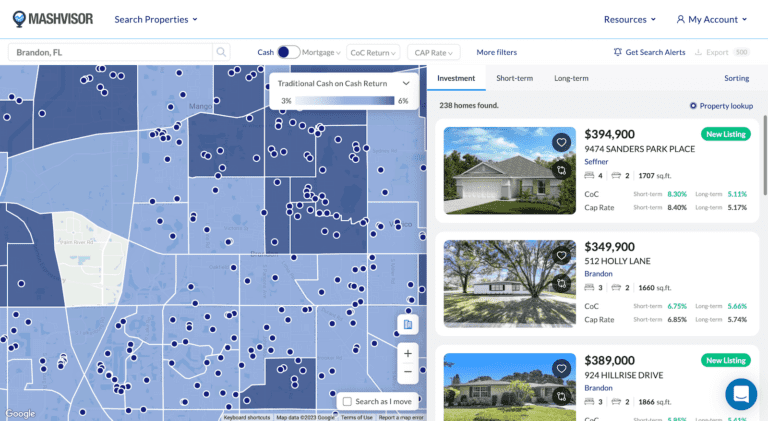

When it comes to finding the best real estate deals, especially when it comes to rental properties, Mashvisor is the way to go.

Mashvisor is a real estate website that helps investors spot real estate deals that are right up their alley. It maintains a massive database that covers almost all real estate markets in the US, which is perfect for those looking for out-of-state investment opportunities.

The website offers users access to its valuable real estate investment tools like the following:

Property Finder

The Property Finder tool allows users to find almost any residential property listed on the MLS. All you need to do is enter the city, neighborhood, or zip code of a location of your choice. The Property Finder will then display a list of properties for sale in an area.

Real Estate Heatmap

Mashvisor’s real estate heatmap is used to see how neighborhoods are performing under different filters (median property price, monthly rental income, and cash on cash return). The tool gives an investor greater insight into the market he or she is considering and whether it is worth investing in or not.

It is easy to find areas that perform very well or very poorly based on the colors shown on the map. The green areas represent the ones that are doing well, given certain factors. On the other hand, red ones indicate those that aren’t doing very well.

Mashvisor’s Real Estate Heatmap

Investment Property Calculator

Mashvisor’s investment property calculator allows investors to analyze market data and crunch the numbers to come up with highly accurate projections. It is especially helpful in finding the ROI and determining a property’s profitability. The website also now offers a free Airbnb calculator that estimates the potential Airbnb rental income and occupancy rate of a specific property.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.

3. Never Underestimate the Power of Due Diligence

If there’s one thing you need to value in real estate investing, especially when you have no money, it is the power of due diligence.

You may read all the “how to” articles you can get your hands on. However. if you’re not willing to put in the time and energy to do thorough research on particular investment vehicles, you won’t succeed.

Due diligence allows you to not just search for the best markets. It also gives you the added knowledge required to make calculated and well-informed decisions. As an investor with very limited resources, it is a skill that will serve you well in the long run.

Knowing how to perform due diligence will give you the upper hand in the real estate investing game. It’s especially true if you’re very good at processing and analyzing each bit of information you acquire from your research.

Wrapping It Up

Real estate investing for beginners with no money is possible as long as you know where to turn to. Several low-cost options do exist. Investors just need to perform their due diligence to find them. This involves using the right investment tools, like the ones from Mashvisor.

Knowing how to invest in real estate with no money can be truly empowering to you and inspiring to other aspiring real estate investors. It’s all a matter of knowing how to go about it in the most resourceful and intentional way possible.

Learn more about how Mashvisor can help you find the best deals in the most profitable markets by scheduling a demo now.