Over the past few years, real estate investing has become heavily reliant on a wide range of data analytics. In fact, savvy real estate investors often incorporate various tools into their investment property analysis. This goes a long way in minimizing risk and taking the guesswork out of the decision-making process. One of the most effective of these tools is the real estate investment calculator. So what exactly is this tool? What does it do when it comes to analyzing real estate rental properties? And what is the best investment calculator that is available on the market today? Keep reading as we answer all these questions.

Real Estate Investment Calculator: A Brief Definition

As the name suggests, an investment calculator is a tool that helps investors determine a slew of real estate investment metrics. A rental property calculator can provide you with everything from cash flow estimates and cap rate to ROI and real estate comps. These tools tend to boast simple interfaces and are fairly easy to use. More importantly, the emergence of such products has made the old Excel spreadsheets completely obsolete. Nowadays, real estate investors with little to no technical know-how can carry out a full investment property analysis in a few minutes.

What Is the Best Tool on the Market?

Here are the three essential features that a good real estate investment calculator should have:

- The tool should be relatively affordable. The market is filled with overpriced options that offer very little when it comes to intrinsic value. Needless to say, real estate investors should avoid these products.

- The tool must be simple to use. Figuring out how a real estate investment calculator works shouldn’t be a complicated task. After all, most real estate investors don’t have the skills nor the time to navigate complex interfaces.

- The investment property calculator must be a one-stop-shop for all your needs. In other words, the tool should be able to provide a full assessment of the property’s value and its ability to generate positive cash flow.

No other tool on the market meets these criteria as well as Mashvisor’s very own rental property calculator. This real estate investment calculator covers everything you need to know when investing in real estate.

Let’s delve into the main features of this highly effective real estate investment calculator.

Related: Buying an Investment Property? These Are the Best Tools to Use

How to Use the Mashvisor Real Estate Investment Calculator

After narrowing your real estate property search down to a few income properties, the next step is to use the investment calculator to assess their viability as investments. You will first have to input some values before obtaining the desired metrics. Here is how the process works:

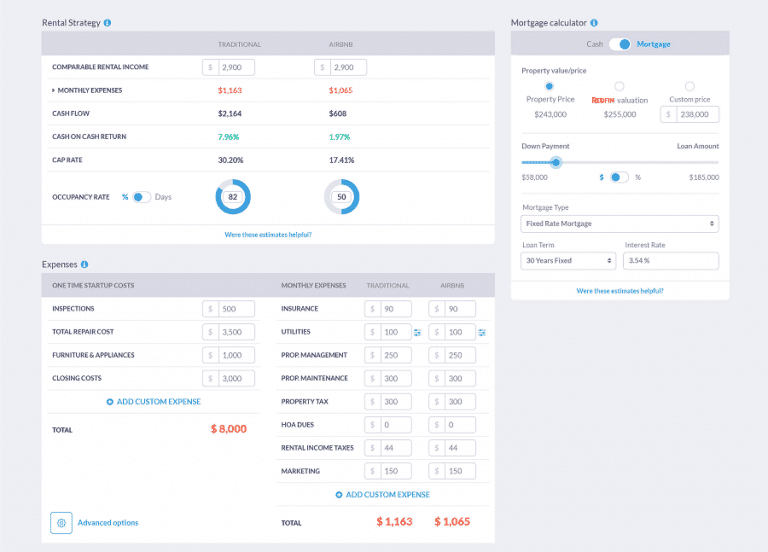

1- Financing

The first figure that you have to input in the real estate investment calculator is the purchase price (you can use the list price provided or enter in how much you’re willing to offer). You will then have to specify your method of financing. Are you planning on purchasing the property using cash or a mortgage? If it is the latter, you must provide all the data that pertains to your mortgage. This includes the type of loan, the down payment, and the interest rate. Based on this, the real estate return on investment calculator will provide you with an accurate estimate of the investment’s potential.

Related: 7 Easy Methods for Investment Property Financing

2- Rental property expenses

Operating a rental property investment comes with a host of expenses. Getting an accurate projection of your investment’s cash flow is predicated on inputting these expenses in the real estate investment calculator. It is worth noting that there are two types of real estate costs: initial expenses and recurring expenses. Here is a brief overview of the two:

- Initial expenses: This refers to the costs of getting your investment property up and running. Some of the initial costs that you can expect include closing costs, furniture, and repairs. These expenses occur only at the start of the venture.

- Recurring expenses: These are the regularly occurring expenses that come with operating rental properties. Examples of this include property management, taxes, utilities, and insurance.

These inputs are what enable the real estate investment calculator to determine the various analysis metrics. This is why the values entered in this section have to be as accurate as possible.

Related: How to Minimize Your Monthly Expenses in Real Estate Investing

The Property Evaluator Outputs

After adding the financing and expense figures in the real estate investment calculator, you will be able to determine the following metrics:

- Cash flow: This is basically the real estate income that you can expect from your investment property. More specifically, the cash flow calculator gives you the profit you are left with after you take out expenses. This metric is very important since it gives real estate investors an idea of the property’s earning potential.

- Cash on cash return: This metric represents the income generated by the property relative to the overall expenses. In other words, the CoC return lets you know how efficient your investment is in terms of expenditure.

- Cap rate: Unlike the CoC return, the cap rate assesses the potential of the property regardless of expenses. This metric really comes in handy when you’re trying to compare the potential returns of different investment properties.

The Unique Features of the Mashvisor Rental Property Calculator

The great thing about the Mashvisor real estate investment calculator is that it boasts several unique features. For example, the tool outlines various rental investment strategies and helps investors pick the one that can yield the highest returns. In addition to this, the calculator provides you with real estate comps and valuable insights that are based on various advanced analytics.

The Bottom Line

A real estate investment calculator is the first tool that real estate investors should consider using when buying rental properties. The full overview that these tools give you is simply invaluable. Moreover, an investment decision that is based on thorough analysis is more likely to yield a high return on investment.