When considering a real estate investment, one of the main aspects that you should learn about and apply is a real estate market analysis for determining the best investment properties and opportunities for your investment. A real estate market analysis is one of the most important steps towards achieving a successful real estate investment.

For this reasons, many tools have been developed to allow real estate investors to conduct a real estate market analysis with ease and to streamline the process and make it accessible for all types of investors, both beginner and experienced.

So, this article will go through the different real estate market analysis tools which are available online and how real estate investors can use them for finding the best investment properties and achieving the highest returns on their investments.

Related: How to Perform a Real Estate Market Analysis

Real estate market analysis tools – Why are they important?

As mentioned above, a real estate market analysis is important for any real estate investor looking to maximize his/her profits and find the optimal investment properties in any market.

A real estate market analysis has two major aspects to it:

- Locating potential investment properties in a market

- Analyzing these investment properties to determine the best one for your investment

So, we will be breaking down the available real estate market analysis tools that can be used for each of these two aspects.

Real estate market analysis tools for finding investment properties

The first crucial step to any real estate market analysis, and in real estate investing in general, is the step of locating or finding potential investment properties. For this step, you will need to find tools that will help you search the different areas, states, cities, neighborhoods, or markets for investment properties.

However, searching for available listings or investment properties for sale is not enough. For this step, you will need to find real estate tools which provide you more than just a list of available properties for sale.

There are certain data about investment properties that you will need to gather and use for your real estate market analysis. The main data that you will need to know about each property includes the property’s listing price, potential rental income, and an estimate of the expenses that will apply.

Property finder tools

There are numerous online tools and real estate investing websites that any real estate investor can use to gain access to the listings in each market, and each website will provide additional information related to the investment property.

Zillow.com, Trulia.com, Redfin.com, and Mashvisor.com are all great options when it comes to finding listings and investment properties and learning about their price, rental income, and other aspects related to them.

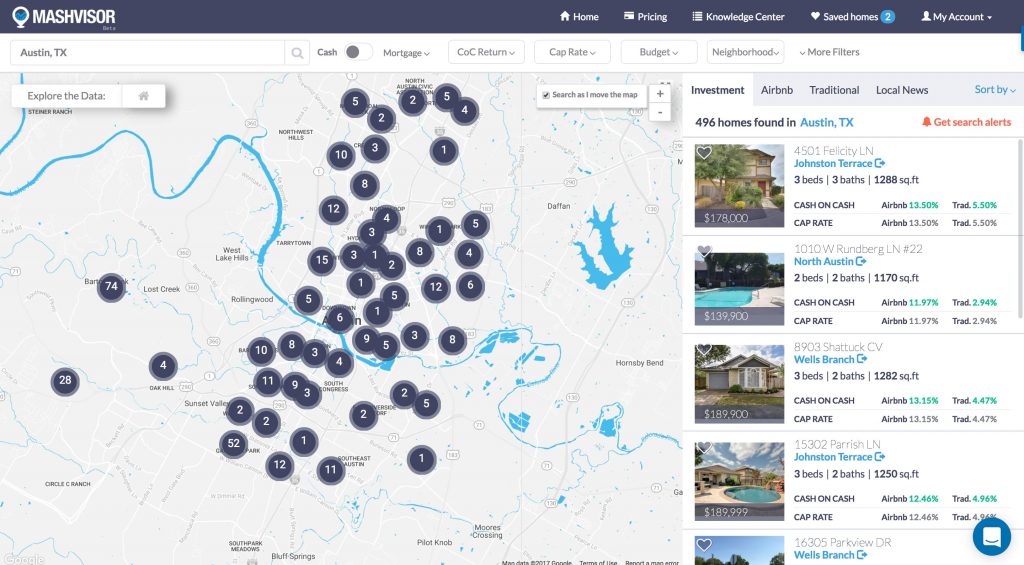

Mashvisor, in particular, is a great pick when it comes to real estate market analysis tools, as you will see later in this article, as it includes all the necessary tools for conducting a real estate market analysis with ease and in a very short time.

Mashvisor also provides estimates for each investment property’s expected returns using metrics such as the cap rate and the cash on cash return, which are the two most commonly used metrics for measuring an investment property’s profitability.

Related: Finding an Investment Property: Traditional vs. Mashvisor

Related: Finding an Investment Property: Traditional vs. Mashvisor

Heat map tools

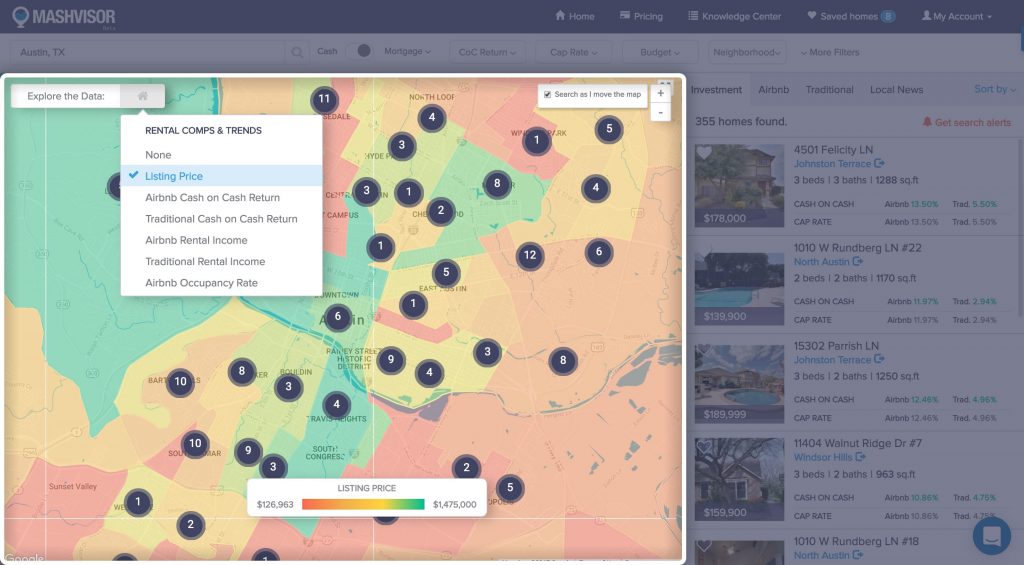

A heat map tool is another great asset to use in real estate investing when trying to narrow down your property search and focus on a smaller market within a large market. A heat map tool allows you to get a visual indicator of a large area’s performance or stats based on certain metrics.

Mashvisor’s heat map tool, for example, allows you to find areas that are performing especially well in terms of their cap rate, cash on cash return, and occupancy rate, and can all be further narrowed down based on the type of investment property or rental strategy as it includes filters for short-term rental properties (Airbnb rentals) as well as long-term rental properties (traditional rentals).

Related: What Are the Basics and Benefits of Heat Map Analysis for Finding Rental Properties?

Related: What Are the Basics and Benefits of Heat Map Analysis for Finding Rental Properties?

Real estate market analysis tools for analyzing investment properties

In addition to tools that allow you to easily find investment properties and determine the market that you would like to invest in, there are real estate market analysis tools that can help you analyze your investments or the potential investment properties to determine which one is more suitable for you and will generate the highest profits.

Related: The Beginner’s Guide to Rental Property Analysis

Return on investment tools

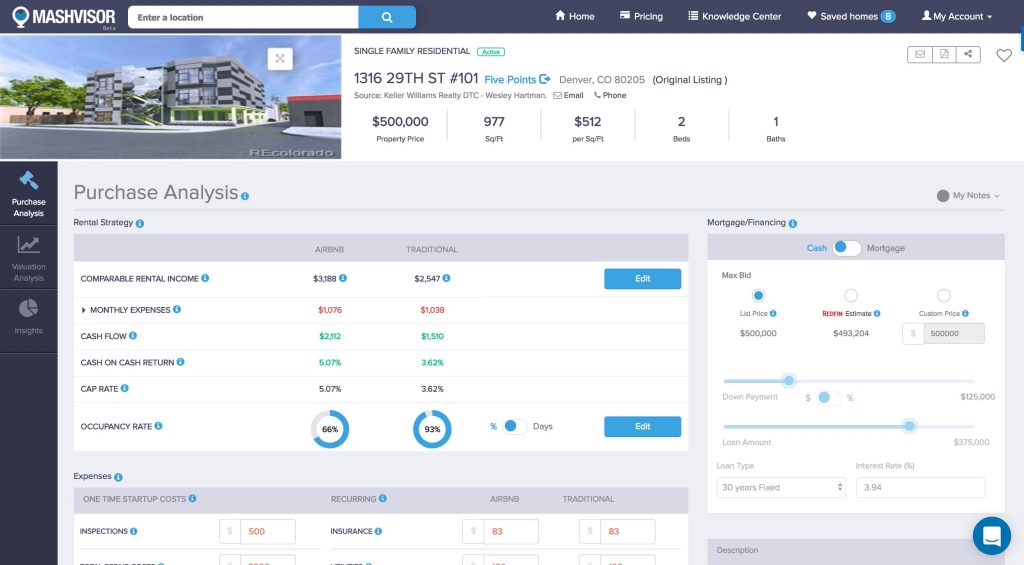

Real estate analytics tools can be used to calculate the estimated return on investment for each property. These tools typically rely on specific metrics for calculating the return on investment. The two main metrics used for these calculations, as mentioned above, are the cap rate and the cash on cash return.

The cap rate and the cash on cash return are metrics that allow real estate investors to determine the value of an investment and the expected return on investment for each property based on the property’s rental income, price, and expenses.

Mashvisor’s platform includes an Airbnb calculator which calculates both the cap rate and the cash on cash return for each property, allowing you to easily eliminate any options that do not meet your investment standards.

Comparative analysis tools

Comparative analysis tools

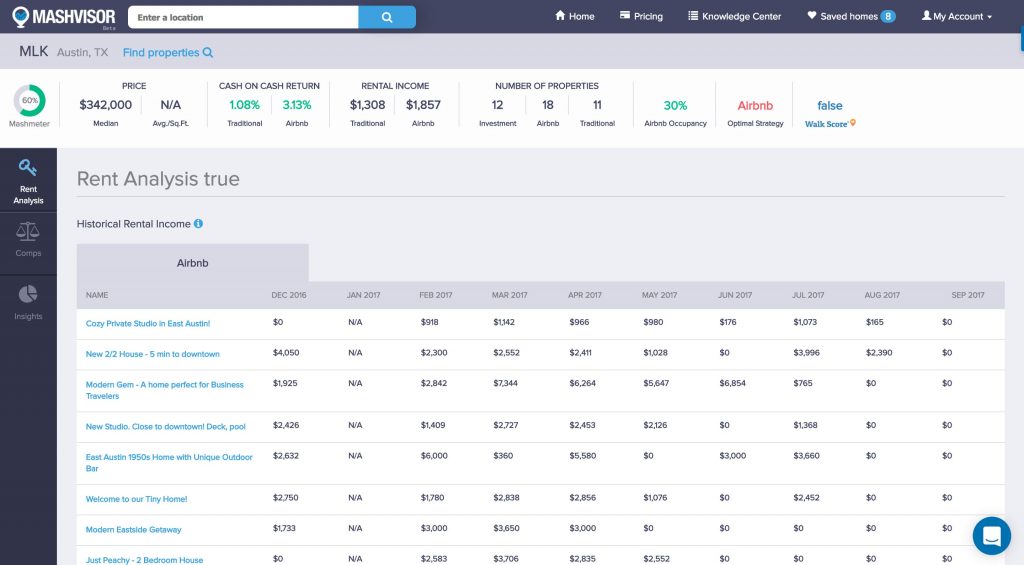

Comparative analysis tools are the tools used for conducting a real estate comparative market analysis. A comparative market analysis is the process of comparing different potential investment properties and determining which of these options is most suitable for you based on the same metrics mentioned above – the cap rate and the cash on cash return, while also taking into consideration the type of property, size, age, and other aspects related to it.

Typically, it is possible to conduct a comparative market analysis using a spreadsheet and a pencil, or an excel sheet. However, this process can be lengthy and daunting when done manually.

Alternatively, Mashvisor’s comparative market analysis report allows you to download an excel sheet report containing all the properties in your market of choice and based on the filters that you have active, such as the property’s size, age, price, and type.

But more importantly, Mashvisor’s report will include the readily calculated values for the cap rate and cash on cash return metrics, allowing you to easily find the most profitable investment property based on its projected return on investment in a matter of minutes.

Click here to find investment properties and export them in an easy to compare Excel sheet format!

Click here to find investment properties and export them in an easy to compare Excel sheet format!

Bottom Line

Real estate market analysis tools can be the most valuable tools available to any real estate investor looking to maximize profits in real estate. However, the number of different tools and real estate investing websites available and the variation of the tools that each website has available makes it difficult for real estate investors to decide on a single platform to gain access to all of these tools at once.

For this reason, Mashvisor was created to provide access to real estate investors to all of these tools in one place, making it an all-purpose online real estate market analysis tool.