Investment properties are one of the best and most common real estate investments. However, finding a good location and a good property for investment is not as easy as it may seem. There are several aspects that an investor needs to take into consideration before making a purchase. Still, you don’t have to be a mathematical genius or get a degree in real estate to be a successful real estate investor. One simple factor that savvy investors consider when deciding whether a potential investment property will be profitable is real estate return on investment (ROI).

ROI in real estate is arguably the most important metric for investors to look at before making a purchase. If accurately calculated before acquiring an income property, investors are more likely to increase their chances to succeed. This article takes a look at what real estate return on investment means, how to calculate return on real estate investment and the tools to use. Before we get into the details, let’s first define what ROI in real estate is.

What Is Real Estate Return on Investment?

Real estate return on investment measures how much profit an investment property makes as a percentage of its cost. In other words, it is the ratio of the profits of an investment to its cost. Knowing the ROI of an investment property allows an investor to assess whether it would be wise to put money into that particular investment or not. A higher ROI suggests that the real estate deal would be worthwhile since the returns the income property generates compare favorably to its cost.

Moreover, investors use ROI to compare the profitability of different properties available in a particular housing market. This way, they would be able to pick the best property to invest in. As you would expect, the potential for profit will vary from one rental property to another.

So, how is ROI calculated? Here is the basic real estate return on investment formula:

What Is a Good Return on Real Estate Investment?

You now have a fairly good understanding of the meaning of ROI in real estate and its broad formula. However, what is a good return on real estate investment? Well, real estate experts will often give you different answers. Generally speaking, anything above 6% would be a good return on real estate investment. However, the range for good ROI will differ from one area to another due to a number of factors. Therefore, real estate investors should have an idea of what is considered a good ROI in their respective locations. This can be done by first knowing the average real estate return on investment. They can then compare the average rate of return of the area with their ROI.

The 2 Real Estate Return on Investment Formulas

Although calculating real estate return on investment is quite easy, there are some variables that affect it. For instance, the method of financing investment property and its terms will affect the total cost of investment. Consequently, the ROI will be affected. Expenses like property taxes, maintenance, repairs, management fees, and utilities may also increase with time. Generally, the higher the investment costs, the lower the ROI.

Moreover, when calculating ROI, the assumption is that the property is rented out throughout the year. However, chances are that vacancies will occur in between tenants and no rental income will be generated in those months. With all these complications, the general ROI formula would not be accurate when assessing a property’s profitability. All these factors need to be factored into your ROI calculation.

To deal with the limitations of the general ROI formula, there are two different ways you can calculate the rate of return on a rental property. The ROI derivative you use will depend on what you are trying to figure out. With that in mind, here’s an overview of two real estate return on investment formulas:

1. Capitalization Rate (Cap Rate)

Capitalization rate or cap rate is a real estate metric that determines the profitability of an investment property when paid for fully in cash. Since there is no mortgage, monthly interest rates are not included in the ROI calculation. This makes this metric suitable for comparing different investment properties, regardless of the financing method.

Cap rate is the net operating income of an investment property as a percentage of its fair market value. In other words, it is the ratio between the net operating income and the purchase price of a property.

Here’s the cap rate formula:

Let’s examine the two variables in the cap rate formula:

-

Net Operating Income (NOI)

NOI is the difference between the annual rental income and the annual rental expenses (operating expenses) of an investment property.

NOI= Annual Rental Income- Annual Rental Expenses

Since the cap rate does not take the method of financing into account, mortgage payments and other financing costs will not be included in the rental expenses.

-

Fair Market Value (FMV)

The FMV or current market value is the price for which the property could sell at a certain time if it is exchanging hands between a willing buyer and a willing seller, both fully aware of the relevant factors. This is usually found by conducting a comparative market analysis.

Related: What Is a Good Cap Rate for Rental Property in 2020?

What Is a Good Cap Rate?

Knowing how to calculate cap rate is definitely not enough. For the calculation to be useful, you need to know whether the number you get is a good one or not. So, what is a good cap rate for an investment property? Well, the general range for good cap rates is 8% to 12%. However, narrowing down what is a good cap rate isn’t easy. This is because what is considered a good cap rate will vary depending on different factors such as location, investment property types, and the real estate investment strategy.

For instance, rural and suburban areas typically have higher cap rates than urban areas like cities. Despite the higher average rental income of urban income properties, they have considerably high prices, resulting in a lower cap rate. Moreover, Airbnb rentals are typically more profitable than traditional rentals. Therefore, they tend to have higher cap rates. Multifamily investment properties will also have higher cap rates on average than single-family rentals.

Related: 2020 Cap Rates by City: What Real Estate Investors Should Expect

All these factors will affect the range of what a good cap rate is. What you should do is determine the good cap rate range in a particular area.

2. Cash on Cash (CoC) Return

The other formula used to calculate real estate return on investment is the cash on cash return formula. Generally, it is the most used real estate return on investment formula. Cash on cash return is a metric used to determine the profitability of an investment property when paid for using a mortgage or loan. Therefore, when calculating cash on cash return, the property’s price (fair market value) is replaced with the total cash invested in the property. Another difference is that annual pre-tax cash flow is used instead of net operating income. When calculating annual pre-tax cash flow, the mortgage and costs accompanying it have to be accounted for.

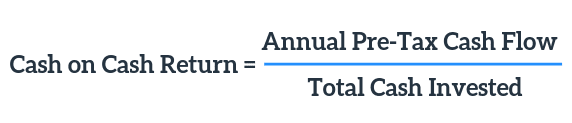

The cash on cash return formula is as follows:

The two variables in the CoC return formula are calculated as follows:

Annual Pre-Tax Cash Flow = NOI – Loan Costs

Total Cash Invested = Down Payment + Closing Costs + Remodeling Costs

Related: What Is a Good Cash on Cash Return in 2020?

What Is a Good Cash on Cash Return?

Just like the cap rate, good cash on cash return will vary depending on factors such as location, property type, and investment strategy. However, a good cash on cash return will generally range from 8% to 12%.

Mashvisor’s Real Estate Investment Property Calculator

As you can see, the process of calculating return on investment manually can be very time-consuming. However, with Mashvisor’s real estate investment calculator, investors can search for investment properties in the US housing market and accurately calculate their potential cap rate and cash on cash return in a matter of minutes. The calculator provides analysis for both Airbnb and traditional rental strategies. Therefore, you will be able to see which rental strategy would be the most profitable.

Are you only interested in Airbnb analysis? Use our free Airbnb calculator instead.

The Bottom Line

Calculating real estate return on investment of an investment property before a purchase is crucial in determining its profitability. However, ROI is a broad term in real estate. In its general form, it is not a very powerful metric due to the limitations it has. Using the two more specific formulas (cap rate and cash on cash return) to measure ROI for an investment property improves accuracy. If you are looking to buy an investment property, be sure to use our calculator to find the best return on investment for real estate.

To start your 14-day free trial with Mashvisor and subscribe to our services with a 20% discount after, click here.