Figuring out the return on investment that you stand to generate from a venture is one of the first steps of real estate investing. In fact, having a clear idea of what to expect is the only way to ensure the longevity of the investment and avoid any unpleasant surprises. But how should you go about determining the average real estate return on investment? And what is a good return on real estate investment? This article will answer these questions and show you how to calculate return on real estate investment with complete ease.

Related: How to Determine the Profitability of Real Estate Investments

The Average Return on Investment in the US Housing Market

Before delving into the details of how to calculate the return on investment, we must first give you an idea of what to expect. Naturally, most investors would like to know the average return on investment of a particular venture before committing to anything. In the case of real estate return on investment, you can expect to generate a rate of 8.8% in the US housing market. Having said that, the rate might vary widely depending on the type of investment property as well as the real estate investment strategy that you choose to implement. For example, residential real estate can generate a return of up to 10.6%. On the other hand, commercial real estate tends to generate a relatively lower return on investment.

Related: Real Estate Investing for Beginners: The Rate of Return Formula

Does the Average Return on Investment Paint the Whole Picture?

At this point, you are probably asking yourself this question: Is the average real estate return on investment the only thing I need in order to assess the potential of a real estate investment? The short answer is no. While knowing the average ROI is still helpful, it’s important to remember that it does not factor in all the variables that influence profitability. A more thorough analysis should include the average cash on cash return and average cap rate in the location. Incorporating these metrics will help reflect the multifaceted nature of real estate investments.

Now that you have an idea of the average rate of return on rental property, let’s take a deeper look at the ROI and explore its implications for real estate investors.

The Real Estate Return on Investment Formula

The real estate return on investment takes into consideration all variables that pertain to rental income and expenses. Consequently, determining the ROI is simply a function of subtracting expenses from income and dividing the result by property price.

Here is an example that illustrates the simplicity of calculating return on investment. If you invest in a $300,000 income property that requires $1,500 in annual expenses and generates $3,000 in monthly rental income, your ROI is calculated in the following way:

(3,000×12-1500) ÷ 300,000= 0.115 = 11.5%

Is this a good return on real estate investment? It definitely is. As you can see, the ROI of this rental property is substantially higher than the market-wide average of 8.8%. But as we mentioned above, you still need other metrics to paint an accurate picture of the investment. Keep reading as we break down the concepts of cash on cash return and cap rate in real estate.

Related: 15 Real Estate Formulas Every Beginner Should Learn

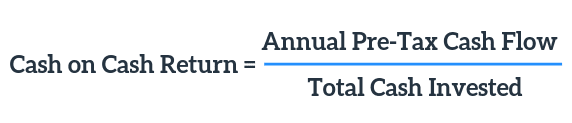

Definition of Cash on Cash Return

The CoC return is fairly similar to the real estate return on investment. The only difference is that the cash on cash return formula substitutes property price with property cash investments. Moreover, the formula relies on pre-tax cash flow rather than the subtraction of expenses from income.

If we posit that you invested $100,000 cash in a property that generates a cash flow of $15,000, the CoC is:

15,000/100,000= 0.15 = 15%

The fact that the cash on cash return relies on cash investment rather than property price adds a significant level of accuracy to the metric. After all, the amount of cash that you put in is more reflective of your profitability than the property value.

The Ideal Cash on Cash Return Range

Generally speaking, it’s advisable that you stick to investment properties that are within the 6-12% range. The rate is influenced by a host of factors that include everything from location and property type to macroeconomic shifts.

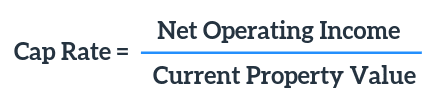

Definition of Cap Rate

Cap rate stands for capitalization rate. Unlike other metrics, this ratio assesses profitability regardless of the financing method. This is why the cap rate is often used to compare different rental properties across various real estate markets. Here is how you can calculate the cap rate.

Let’s take the same $300,000 property and assume that it generates a net operating income of $35,000. The cap rate in this case is:

35,000/300,000= 0.116 = 11.6%

The Ideal Cap Rate Range

So what is a good cap rate? The simple answer is that the same factors that influence ROI and CoC apply here. The ideal rate lies in the same 6-12% range, and much like the other two metrics, it varies depending on location, property type, etc.

How to Find the Best Return on Investment for Real Estate

In light of everything outlined above, all that is left is to find the best real estate return on investment the housing market has to offer. Fortunately, you don’t have to go very far to achieve that. In fact, you can find properties with a high return on investment right here on Mashvisor. The tools that the platform provides you with are extremely effective when it comes to identifying profitable investment opportunities. A perfect example of this is the real estate investment calculator. Using this calculator will enable you to find properties with a high ROI, CoC, and cap rate. Additionally, the tool boasts other features that help personalize and streamline the search process.

Get a 14-day free trial with Mashvisor and start using our real estate return on investment calculator right now by clicking here.

Real Estate Return on Investment: The Bottom Line

As a real estate investor, profitability should be at the top of your priorities. Having a comprehensive idea of the potential real estate return on investment that your income property can generate will allow you to set realistic expectations and work efficiently toward meeting them.