Rent collection is critical for rental property owners to maintain cash flow and fund future real estate investments. However, late or partial payments and cumbersome rent payment processes can cause headaches for both landlords and tenants. As new investors enter the real estate market, they must figure out how to simplify the rent collection process. In this article, we’ll share common mistakes that rental property owners should avoid to ensure seamless rent collection every month.

3 common rent collection mistakes

1. Ignoring a tenant’s rent payment history

One common mistake landlords make during rent collection is failing to identify a tenant’s recurring late or missed payments. Rental property owners can get this information in two ways: tenant screening and tracking rent payment status.

Conducting tenant screening for rental applicants helps landlords find reliable tenants who have proven they can and will pay their rent on time. Tenant screening services typically review the tenant’s credit score, eviction reports, and criminal background checks and help landlords reduce the chance of choosing a problematic tenant.

Landlords can also use online platforms to monitor rent collection and view tenants’ payment status in real-time. This helps them keep an eye out for tenants who consistently miss the rent deadline, as well as identify reliable tenants who may be good candidates for long-term leases and renewals.

2. Being lenient on late rent payments

Late payments can cause financial stress and disrupt cash flow for landlords. Implementing a late fee – even just $20 – for rent payments made after the monthly deadline encourages on-time payments. Late fees also provide landlords compensation for the inconvenience that missed payments can cause. Landlords who don’t charge late fees can be taken advantage of by some tenants, as it inadvertently incentivizes regular late rent payments.

3. Failing to clarify the rent payment process

Rent collection can be conducted in a variety of ways, and landlords and tenants may have differing preferences for payment. That’s why it’s crucial for landlords to codify this process even before a lease agreement is signed. Lack of clear expectations and standards in rent collection can create significant challenges, such as tenants who pay late or refuse to pay when their preferred payment method is unavailable.

How simplified rent collection processes benefit landlords

Reduce the likelihood of late rent payments

Simplifying the rent collection process helps reduce the likelihood of late rent payment

Renting properties is a popular strategy for homeowners to generate an additional income stream. However, late or missed rent payments prevent them from achieving their financial goals. In fact, the National Equity Atlas recently revealed that over 5.7 million households are behind on rent payments.

A simple rent collection process that includes automatic payments makes it easy for busy tenants to remember to pay on time. Additionally, flexible payment methods can provide cash-strapped tenants with alternative options to pay rent, such as credit cards or payment plans.

Minimize tenant turnover

While most landlords and tenants expect rent collection to be a relatively smooth process, unclear rules, inconsistent payments, and inconvenient payment processes can create tension in tenant-landlord relationships. Clear and convenient rent payment processes can help to ease stress for all parties and increase tenant satisfaction. This makes it easy for property owners to reduce tenant turnover across their rental properties.

Forecast cash flow accurately

Landlords rely on regular rent payments to maintain a steady income, so it’s important to forecast cash flow and plan for expenses. However, it can be challenging to track rental income when landlords are juggling multiple properties with different rent deadlines and payment methods – and little insight into who’s paying rent on time. Consistent payment processes and consolidated financial data can help rental property owners achieve their business goals more effectively.

Use technology to optimize rent collection

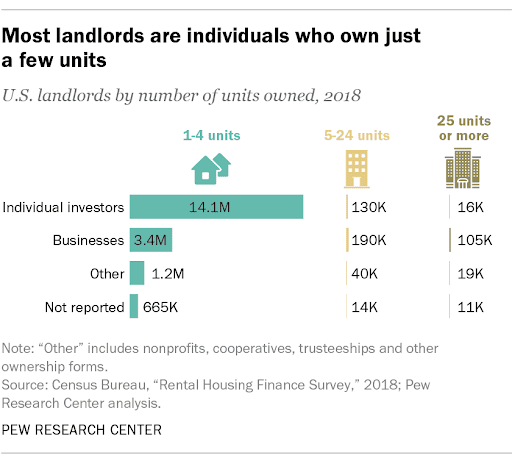

A vast majority of rental properties in the United States are owned and leased by individual investors who own fewer than five units. The needs of these investors are significantly different from the needs of large investment firms. Individual real estate investors value simplicity and ease of management while still requiring in-depth insight into their earnings and the financial performance of their investments.

Source: Pew Research Center

A consolidated rental property management platform can help improve rent collection processes across an investor’s real estate portfolio. This also gives landlords a holistic view of their earnings and aids financial planning.

Property owners who use modern property management software to collect and manage rent payments can find all the information they need to predict and plan for potential financial issues early. An effective real estate investing software solution displays each tenant’s payment history and transactions in a convenient and easily accessible location.

Rental property owners should look for the following capabilities in a rent collection platform to help simplify the process of collecting rent:

-

- Manage multiple properties and accounts: Many landlords own multiple units, or use different bank accounts for different properties. Having access to all of their property finances in one place will help landlords stay organized.

- Flexible payment methods: Accepting online payment methods such as credit card, debit card, and ACH bank transfer will give tenants more convenience and flexibility – which increases the likelihood of on-time rent payments.

- Real-time payment status: Landlords should be able to track the rent status of all their tenants in one place to minimize late or missed payments.

- Automated payments: Giving tenants the option to schedule or automate rent payments means they’re less likely to forget rent deadlines.

- Tax preparation: Tracking expenses and tagging them by Schedule E category will keep you organized for tax season.

- Holistic financial services: Some rent collection platforms offer more than just rent collection. Look for a platform that also provides valuable rental property services like banking, tenant screening, landlord and renters insurance, mortgages and loans, and more.

Simplified rent collection processes help landlords maintain positive cash flow, improve tenant satisfaction, and ensure sufficient real estate return on investment. Azibo’s free platform was built with these needs in mind – it provides real estate investors an overview of their rental income and delivers a convenient way for tenants to pay rent online. Our modern financial software built specifically for landlords and tenants can help create a simple rent collection process that enhances the experience of each party in a lease agreement.

This guest post has been contributed by our friends at Azibo.