An accurate rent estimate is crucial to ensure your property generates enough cash flow. But where can you find a good rent estimator? If you’ve just acquired an investment property, you should determine how much to charge for rent before you think about marketing it. As a rental property owner, the majority of your profit will come from rent. Therefore, the amount you charge for rent will determine how much income you will earn.

Table of Contents

- Why Rent Out Your Property?

- How to Use a Rent Analysis Tool and Get Rent Estimate

- What’s the Best Way to Find an Accurate Rent Estimate?

- Why Use Mashvisor’s Rent Estimate Tools

- Get Accurate Rent Estimates to Invest Wisely

Real estate investors approach the process of calculating rental prices differently. However, not all methods provide an accurate rent estimate that will yield good returns. Using a rent analysis tool to get the right rent price estimate will surely pay off. It doesn’t only help you determine the correct rental price estimate; it also helps you become successful.

A comprehensive rental estimate tool can help you establish the appropriate rent for your property. You cannot just use any calculator to get a correct rent estimate. A few of the best real estate investing tools to make an accurate rental price estimate are Mashvisor’s rental comps, neighborhood analysis tool, and rental property calculator.

In this article, you will learn that:

- Choosing the right traditional rental rate and Airbnb rent estimate isn’t just about charging the highest possible rate.

- Investing in home rentals has both benefits and risks.

- Using the best rent analysis tools and knowing how to use them will help provide an accurate rent price estimate.

Let’s dive in.

Why Rent Out Your Property?

Before you start learning how to estimate rental value of your property with an estimator, you first need to consider your reasons for renting your property out. Doing so will allow you to learn how to manage your rental investment based on your goals.

Property owners list their rental properties on the market for a number of reasons. Most of them want to earn additional income or generate a steady cash flow to help cover the maintenance costs and other expenses related to managing the property.

Sometimes, property owners rent out their home or a portion of it to generate extra cash to help pay for their mortgage. If so, learning how to get the right price estimate for your rental property is very crucial.

Investors also expect their rental property to increase in value over time. They may consider renting out the property first for some time before selling it in the future.

In a seller’s market, properties will appreciate in value because the economy is doing good, and there’s an increased demand. With this, you should know how to choose the right address for your investment.

In other instances, property owners rent out their homes because they want to diversify their real estate investment strategy. They use the rental income to finance the acquisition of additional properties or invest in another real estate investment vehicle, such as REITs.

Whatever your reason for renting out your home, you should be ready to tweak your overall rental strategy when the need arises. Also, you need to learn how to estimate your property’s rental value accurately to attract quality would-be tenants easily. As long as you use a good estimator, it can help generate a steady income stream for yourself.

Benefits of Renting Out Your Property

Renting out your home can be daunting, especially if you’re not really into the business of home rentals. However, there are many good reasons why real estate investors are earning a good amount of profits from investing in a rental home.

Here are the important benefits of renting out your home:

1. Earn Passive Income

One of the most common reasons why many people are investing in real estate is that renting out a home is a good source of passive income. It is a great way to make extra money on the side, especially if you manage to strike the right rent estimate. Although you need to invest time and effort for your home rental business to be successful, it doesn’t really require you to manage it 24/7.

If property management is all that’s hindering you from buying a rental property, you can always work with a property management company to help run your rental business. Many investors are satisfied with the results despite the added cost of rental management fees.

2. Home Value Appreciation

When you invest in the right location or specific address, there’s a good chance that the value of your home will appreciate quickly. There are locations with high appreciation rates, where home values surge in just a few years. However, as an investor, it is important to know that certain markets offer you different things where home values are concerned.

Home appreciation in certain markets tends to go faster compared to most other markets. Also, some markets will experience home depreciation based on a number of factors. It is why picking the right location and doing research is important in rental property investment.

At the end of the day, though, renting out your home will allow you to earn a decent monthly income while holding on to your investment until its value goes up.

3. Option to Sell When the Time Is Right

While you’re waiting for the value of your home to go up, you can generate profit from it through rent. Then, when its value is high enough to generate a very attractive return, you can opt to sell it at fair market value. Renting out an investment home is an excellent strategy for investors who buy, hold, and sell at the right time. Do a bit more research on the BRRRR strategy to see if it aligns with your investment strategy and goal.

4. Tax Benefits

If you rent out a home, you get to benefit from certain tax deductions. You can deduct certain costs, such as maintenance, management, improvement, and travel expenses. You can also enjoy other tax benefits as a landlord, including rental property depreciation.

We recommend consulting with a local tax attorney to understand such benefits so you can plan a strategy that will fully maximize it.

5. Diversify Your Investments

If you want to grow your net worth, investing in real estate is one way to diversify your investment portfolio. Owning a rental home will provide you with a passive income stream and steady cash flow (if you set the right rental price estimate).

In addition, it can also help protect your assets against market fluctuations and other risks since real estate isn’t directly correlated to the more volatile stock market. You get better peace of mind renting out an investment property instead of putting your money in stocks.

Risks of Renting Out Your Property

While owning a rental home can be a profitable investment, it doesn’t come without risks. Keep in mind that investing in real estate can be very tricky, especially if you don’t know the risks. It’s essential to understand the risks of investing in home rentals so you’ll know how to manage and minimize them.

Below are some of the most common risks of renting out your home:

1. Investing in a Bad Location

The city, neighborhood, and specific address of your rental home are crucial factors that can either make or break your investment. That’s why experts keep stressing how important it is to choose a good location . If you end up investing in an area where the demand is low because of economic or safety issues, you’re setting yourself up for a disaster.

For this reason, we highly recommend going online and using a real estate platform like Mashvisor to find out if a neighborhood is worth your time and money. Having a high average rent estimate is a strong indicator that a market is attractive for tenants.

2. Buying an Undesirable Rental Property

Not all rental homes in a good location or safe address can attract tenants. Even if you choose a good and progressive location for your investment home, if your property is unattractive, it won’t get easily occupied. When buying a rental home, you need to make sure that tenants would want to rent it.

Also, avoid buying a home with major architectural or structural problems. It will cost you more in rehabilitation costs and will significantly affect your rental rates. If your rental rates are too expensive, the chances of landing a tenant willing to pay for an overpriced property are low.

3. Low Occupancy Rate

Another common risk of investing in rental properties is experiencing a low occupancy rate or extended vacancy periods. When your rental home is vacant, it means it is not generating income. However, you still need to pay your bills, such as utility, mortgage, property tax, and insurance.

A home with a low occupancy rate is risky and can affect your overall profitability. A proven way to minimize vacancy is to calculate an accurate rent estimate from the get go.

4. Slow Appreciation Rate

Another risk of buying an investment home in a bad location is the slow appreciation rate. Conventionally, rental properties depreciate in value at a rate of 3.636% each year for 27.5 years. If the home value does not appreciate quickly enough before the rental property depreciates, you risk not being able to sell it for a profit in the future.

Before buying a home as an investment property, make sure to check the appreciation rates in the location or specific address you’re investing in.

5. Problematic Tenants

Lastly, problematic tenants are among the most dreaded risks for many rental property homeowners. Such tenants do not pay their rent on time, do not take care of your home properly, deliberately damage your home, and could even cause trouble with the neighbors.

Be vigilant in screening your potential tenants and make sure to perform appropriate due diligence before accepting anyone into your home. It would also help if you do a bit of research about your location’s landlord-tenant regulations. Some states and counties are more in favor of tenants while others are more supportive of rental property owners.

How to Use a Rent Analysis Tool and Get Rent Estimate

Setting the right rent price estimate is crucial. If you don’t know how to estimate rent correctly, you can own the best rental property for investing and still not succeed in making money. Thus, it’s important to use a rent analysis tool and investment property calculator to come up with an accurate rent estimate.

Many landlords make the mistake of setting rent price that is too high. They think that a high rent price estimate will generate bigger profits. However, it only pushes tenants away and makes your property likely to remain vacant for longer. It will result in a low occupancy rate and high tenant turnover. This is where a rental estimator can be of great help.

On the other hand, setting the rent price too low is also not recommended. If you set the rental rate too low, you may attract more tenants, but you’ll be leaving money on the table. It means that your rental property may not generate enough income to cover the monthly expenses. Further, a rental rate that’s too low also runs the risk of attracting low-quality tenants.

Tips for Setting the Right Rental Price

To operate a successful rental home, you need to set the right rental value or price estimate for your rental. You must find the right balance to make sure the rental income covers all expenses and still attract quality tenants for your property. Correct rent estimates will minimize vacancy rates and improve your cash flow.

You need to conduct a comparative rental market analysis and estimate rental value with confidence. Setting the price of a rental home is just like pricing any other product in the market. It depends on supply and demand and the available competition. It is why it’s essential to know your competition within the same address.

With comprehensive rental market analysis, you can calculate a reliable rent estimate by zip code or specific address. From the analysis, you will know if you’ll generate a positive cash flow and achieve profitability from your rental home.

Occupancy Rate and Vacancy Rate

Finding an accurate rent estimate will optimize your rental income by maximizing your occupancy rate and minimizing your vacancy rate. Occupancy rate refers to the number of days your rental home is rented out or occupied by a tenant in a year. Vacancy rate refers to the number of days your rental home is vacant (and not generating rent income) in a year.

The occupancy rate is an important measure of rental demand. It significantly affects your rental income and the return on investment from your property. Knowing the vacancy rate of a rental home is also crucial. It can help you make contingency plans on how to generate cash flows to pay for your recurring expenses.

Always remember that an unoccupied property does not generate income for the rental homeowner or investor, especially for long periods. You need to ensure that you are able to attract tenants even during the lean months. With a steady rental income, you’ll be able to cover your rental expenses and generate a better return on investment.

How to Calculate Occupancy Rate and Vacancy Rate

Calculating the occupancy rate and vacancy rate of a rental property can be tedious and prone to error without a rental property calculator. If you want to know how to calculate the occupancy rate of a rental home, it’s best to use a rental property calculator to get an accurate estimate.

However, it is also possible to do this manually using the following formula:

Occupancy Rate = Number of Days Occupied / Number of Rentable Days

Conversely, if you want to calculate the vacancy rate of an investment home, you can use the formula below:

Vacancy Rate = Number of Days Vacant / Number of Days Available for Rent

Again, to get an accurate estimate for both occupancy and vacancy rates, using a rental property calculator or estimator is your best option.

Rental Comps

The best approach to pricing your rental property is to research rental comps. Rental comps are comparable rental properties in the same neighborhood address as your rental home. The comparable properties should be similar in size and features to the home that you’re investigating.

It’s as simple as looking at a particular home to estimate the rent for a home of your liking.

Knowing what similar rental homes in the area are charging will help you determine a fair rent estimate that will make you competitive in the local housing market. Also, setting the right rent price estimate will also attract quality tenants who pay their rent on time.

Rental comps can also give you an idea of the rental demand in the area as well as the potential income you can earn.

How to Do Your Own Rental Comps

Finding accurate rental rate comps using traditional methods is not very easy. You need to move around and check properties at the same address to get information about them. Moreover, it can be time-consuming, and accuracy is not assured.

Here are the steps you need to take to gather and analyze rental comps manually:

Step 1: You need to drive around the neighborhood or within the address of your chosen rental home.

Step 2: You must ask landlords or Airbnb hosts how much they are charging for rent. The rent price that they are charging can also vary depending on the seasonality, especially for vacation rentals.

Step 3: You’ll need to input the rental data into an Excel spreadsheet to do the calculations.

Step 4: You must compare the data and make your own analysis.

The above process can be very tedious. Not to mention that some investors might not be willing to share the rental price estimate that they are charging. It is definitely not optimal in this time and age. Also, you need to know how to determine the properties of similar features and amenities within the same address, which is not an easy task.

Fortunately, there are real estate data and analytics websites available that can help make the process simpler. The best real estate website that can provide rental comps is Mashvisor. With Mashvisor, you’ll get updated information on rental comps. Also, you’ll be able to access tools like the investment calculator, neighborhood analysis tool, and comprehensive real estate data.

Other Methods

On certain occasions, investors use a real estate website to estimate the rent price for their investment home. Online platforms, websites, or real estate management software like Redfin and Zillow can help provide a correct rent price estimate for their rental home. The websites typically provide tools such as a rent estimate calculator to help determine the right rent value.

Redfin Rental Estimate

Redfin is a real estate brokerage website that lists homes for sale and for rent. The Redfin Rental Estimate feature allows investors to see how much homes within the same neighborhood address charge for rent.

It’s not that hard to learn how to use Redfin’s rental estimate calculator. It is relatively easy. It only needs the street address of the home, and the website estimator will generate its value and rent price estimate.

According to Redfin’s website, its rent estimate tool acts as a calculator that computes the fair market value of a home. To get the rent estimate or rental home value, Redfin compares several similar homes currently listed for rent within the same neighborhood or street address. However, the company made it clear on its website that its estimates are not a form of an appraisal.

Redfin’s rental estimate tool and calculator are generally simple to use. You just need to enter the neighborhood or street address where your rental home is located. However, depending on the state, the rent estimate generated from Redfin’s website shows a median error of up to 14.56%. Such a margin of error is quite significant and can greatly impact your decision.

Zillow Rental Estimate

Zillow is a real estate marketplace website that allows investors to search for homes for sale by typing an address, city, or zip code. Similar to Redfin, it also lists for-rent properties for tenants looking for a home to rent. Zillow also offers a rent price estimate calculator, called Rent Zestimate, which helps provide an estimate of the rent price by address.

The website’s Zestimate calculator tool can help perform rental property analysis in the address to help determine the starting rent price estimate for a home rental. The Zillow rent estimate tool takes into consideration the home’s physical features, size, and amenities.

The estimator also considers the comparable rental properties within the neighborhood address to determine the rental value. Also, it takes into account the owner-updated home facts and other public information about the home, like the latest home value or sale price.

Zillow’s rent price estimate calculator lets investors type the street address of the rental home they want to estimate. While the tool is easy to use, its accuracy can vary significantly based on the amount of data the website collects.

Rentometer

Rentometer is another real estate website that provides a rental price calculator tool to estimate the rental value of similar homes in a neighborhood or street address. To use the website to determine a rental’s rent value estimate, it needs the property address, the monthly rent in dollars, and the number of bedrooms.

In general, the Rentometer website is a calculator tool that offers rental value estimates and rental analysis reports based on rent comparison data across the US. The website provides reports on the home value based on the property’s price per square foot. It also provides a rental price and home value estimate of similar rental listings within the address.

While Rentometer comes with a free version, it only provides limited searches and doesn’t offer as many options. The website’s free version gives a general overview of the rent value within the address. However, investors who need a detailed analysis must subscribe to the paid version, which costs up to $299 or more.

The bottom line is that it is a bit expensive, especially if you’re just a beginner investor.

What’s the Best Way to Find an Accurate Rent Estimate?

You’ve just learned the different methods of finding the rent value of a home rental. Would you be surprised if you find an even better process?

Modern technology’s made it possible for anyone to figure out the value of a rental home easily. As a result, it’s possible for investors to know how to estimate the best price to charge for rent. Plus, investors do not need to leave the comfort of their homes if they use a real estate website or online rent estimator by address.

Sure, you can use a free rent value analysis tool or another online calculator to find your home’s rent price estimate. However, free tools and calculators offered by various real estate websites do not always provide accuracy. When choosing a tool such as an online calculator to estimate your rental home’s rent value, it’s best to ensure its reliability and accuracy.

The best and most accurate real estate website tool that provides the right rent value estimate is Mashvisor’s rent estimate calculator. Mashvisor uses big data, predictive analytics, and machine-learning algorithms to estimate rental income in minutes. Plus, its calculator allows you to customize your expenses to get personalized results.

Apart from saving you a lot of time and energy, one good thing about using Mashvisor’s rent value estimate calculator is its accuracy. We aggregate our data from a number of reliable sources (Airbnb, the MLS, Redfin, Zillow, etc.). Then, we apply our own AI-powered investment analysis to provide savvy real estate investors with the accurate value estimate that they need.

Here’s the rental data that you can access through Mashvisor’s real estate investment software and how to use them:

Neighborhood Estimates

First, you can use Mashvisor to determine the average rental income for the neighborhood or street address where your investment property or home for rent is located. Mashvisor offers comprehensive neighborhood data for any area in the US. If you don’t know how to use the tool, there is no need to worry because it’s relatively simple.

You just need to first enter the address where your investment home is located to begin your rental market analysis. On the search results page, click on the name of the neighborhood or street address, then click the Neighborhood Analytics link. Here, you’ll be able to access all the real estate and rental data and analytics for that address.

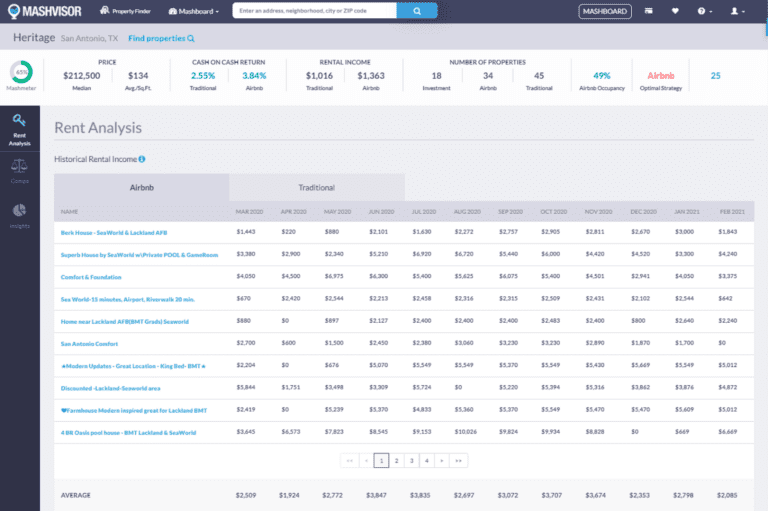

From the Summary bar, you will see all the key metrics you need to assess a neighborhood or street address. It includes the rental income stats and occupancy rate stats for both long and short term rental strategies. You’ll also see the historical rental income details of different properties within the same address.

Rent estimate by location or specific street address is important since it gives you an idea of what landlords in a particular address are charging. Plus, you can also use the rent value estimate by address data to compare the rental performance of your neighborhood with others.

Moreover, the long and short term rental listings with historical rental income let you see exactly what rental rates the properties in the given address are charging. You’ll also see how the figures evolved over the last 12 months. With the information, you’ll learn how to find an address or neighborhood where rents are going up rather than going down.

Mashvisor’s Neighborhood Analysis Pages

Investment Property Calculator

Mashvisor also offers an investment property calculator that provides monthly rent value estimates for each investment home listed on the website. The calculator can also provide rental value estimates for any off-market property as long as you enter its address. Access to a reliable investment property calculator can help your overall profitability.

For each investment home, the rental property calculator provides accurate value estimates for the vacation rental rate, Airbnb rental income, and long term rental income. You’ll know how to do comparative analysis using the information from Mashvisor’s investment property calculator.

Another advantage of Mashvisor’s real estate calculator is that it allows you to customize certain figures. For instance, you can input your own value for expenses and financing.

It means that you’ll be able to get a more accurate and realistic result based on your own research. If you plan to take a loan to finance the property, you can include your mortgage in the calculation.

The rental property calculator will also provide an estimate of the property’s potential cash on cash return and cap rate. They are two important metrics that can help estimate an investment property’s profitability.

Rental Comps

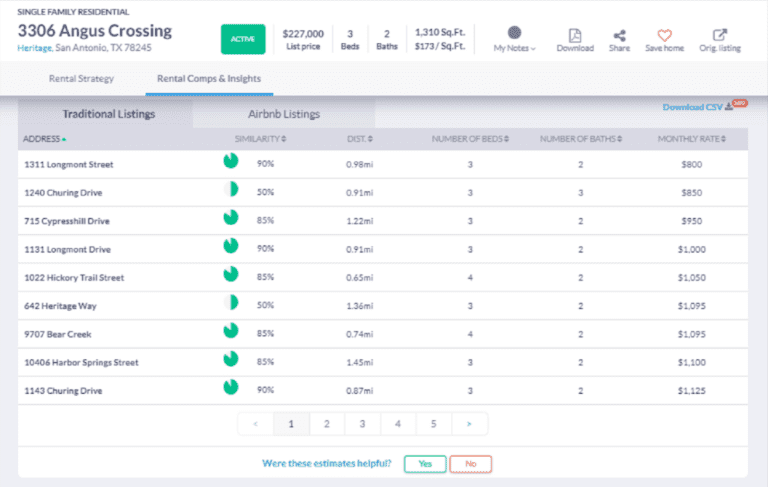

Mashvisor’s rent estimator also gives you access to rental comps (both vacation rental comps and long term rental comps) for your investment home. You will find a list of the comparables and all the relevant data on the Rental Comps & Insights tab.

Through rental comps, you’ll know how to determine the similarities of other properties to the home you are analyzing (in percentage). Also, you’ll see their address and how far the properties’ locations are from your home rental.

Mashvisor’s Rental Comps

Why Use Mashvisor’s Rent Estimate Tools

Unlike other real estate investment software platforms or websites, Mashvisor is not just limited to providing estimates for your investment home’s rent price. In general, Mashvisor helps you learn how to use its rent analysis tool to conduct a comprehensive rental property analysis. The platform allows you to make an informed investment decision.

Mashvisor website’s rent estimate calculator also provides access to useful data, such as cash flow, cap rate, cash on cash return, and Airbnb occupancy rate. With Mashvisor’s calculator, you can determine whether your investment home’s rent estimate will yield positive cash flow and a good return on investment.

Get Accurate Rent Estimates to Invest Wisely

If you’ve just purchased an investment property and want to begin earning good returns, getting an accurate rent estimate is one of the best ways to ensure success. What you charge for rent will directly affect your rental income and occupancy rate (or vacancy rate). After all, your rental price will determine how much profit you can generate from an investment home.

Whether you want to become a landlord or an Airbnb host, it’s important to use a reliable rent analysis tool and rental property calculator for your rent estimate needs. Doing manual rental comps and analysis to generate a good rent estimate can be tedious. Don’t waste your precious time when there are available tools from various websites to help you.

However, it’s worth noting that not all real estate websites are reliable sources of rent estimates. One rent estimator is different from another. Some offer more than others.

Fortunately, Mashvisor’s rent estimate calculator will help you learn how to determine the right rent price estimate to charge your tenants or guests in an easy process. With the tool, you don’t need to do the time-consuming process of gathering rental comps and data.

Whether you’re a beginner or a seasoned investor, you don’t need to worry about making errors when doing your rent estimate. You can be assured that Mashvisor will provide accurate rent estimates based on data-driven information.

Moreover, the website’s rent estimator calculator allows you to estimate your potential cash flow and return on investment.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.