Whether you decide to buy a traditional rental property or to invest in Airbnb for sale instead, “How much should I charge for rent?” becomes one of the most important questions to answer in order to maximize your return on investment. The rental income – together with the property price, the startup costs, and the recurring costs – determines the profitability of any investment property.

Unfortunately, this question doesn’t have a straightforward answer and requires diligent, detailed rental market analysis and real estate data collection. In this article, we will show you how to find rental comps – both traditional and Airbnb – to always ask for the right price for your income property.

What Are Rental Comps?

While you are probably aware of the concept of real estate comparables, or real estate comps, you might be wondering what rental comps are. Rental comparables are rental properties which are located in the same real estate market and neighborhood and are very similar to the one that you own or plan to purchase. These can be either long term investment properties – traditional comps – or short term income properties – Airbnb comps.

Related: How to Find Real Estate Comps

When getting rental comps, there are a few key property characteristics that you need to focus on and not omit at any cost. These include:

- Location: city and neighborhood

- Proximity and access to public transportation, public facilities, shopping opportunities, and others

- Property type: single family home, condo, apartment, townhouse, duplex, triplex, fourplex, multi family home, or another

- Square footage

- Number of floors

- Number of bedrooms and bathrooms

- Year of construction

- Date of most recent major maintenance and repairs

- Pets policy

- HOA presence

- Parking availability

- Washer and dryer availability

- Type of heating and cooling system

- Furniture availability and quality

- Utilities cost

- Amenities such as swimming pool, balcony, veranda, garden, lawn, and others

All these factors affect the rental rate of an investment property no matter if you rent it out on a long term or short term basis.

Why Are Traditional and Airbnb Comps So Important?

The success of a real estate investment depends on different types of real estate data and real estate investment analysis. One of these crucially important data is rental comps.

Knowing how other similar investment properties in your neighborhood perform will allow you to optimize the performance – and thus rate of return – of your own income property. Most straightforward, running rental comps will help you answer the question “How much rent should I ask for?” and set the right rental rate for your property.

Having a monthly rent (in case of traditional investment properties) or daily rate (in case of Airbnb rentals) comparable to those in your area will help you minimize your vacancy rate and maximize your occupancy rate, which is one of the most significant factors in enhancing your rental income. In turn, the higher the rental income, the better the return on investment that your income property can generate, all else equal.

So, the short answer to the question of why finding and using traditional and Airbnb rental comps is so essential is that they will help you be competitive in the local rental market and succeed as a landlord or an Airbnb host.

How to Find Rental Comps: 5 Different Ways

Now that you know what rental comps are and why you need them in order to make informed and profitable real estate investing decisions, it is time to discuss how to get rental comps in the US housing market.

There are a number of different ways to do that which vary significantly in the time and effort that they require on behalf of real estate investors. Let’s take a look at each one of them:

1. Performing Rental Market Analysis

The first – and most traditional – approach to finding rental comps – whether traditional comps or Airbnb comps – is to conduct rental market analysis of the local housing market. This is a specific type of real estate market analysis which is similar to comparative market analysis (CMA) but focuses on rental properties and active rental listings rather than recent sales and active real estate listings.

This real estate investment analysis entails identifying income properties like your long term or short term investment property (in terms of size, structure, characteristics, etc.) currently rented out in your neighborhood and figuring out for how much they get rented out.

Ideally, you should also aim to find out their traditional or Airbnb occupancy rate, respectively, as this will help you determine whether their rental rate is too high, too low, or just about right.

In addition, you need to take a look at local rental listings which are unable to find tenants or Airbnb hosts as this will show you what monthly rent or daily rental rate is too high for this rental property type.

Related: 5 Steps to Conducting an Accurate Rental Market Analysis

As you can imagine, conducting this type of analysis – especially if you are considering a few different real estate markets and property types – requires weeks of going around neighborhoods, searching for rental properties, gathering rental data, and entering it into a real estate investment spreadsheet before you are ready to start working on the calculations.

While manual rental market analysis is definitely one way to find rental comps in any US housing market, it is not optimal in the 21st century.

2. Talking to Landlords and Airbnb Hosts

A technique to speed up your rental market analysis is to identify some landlords or Airbnb hosts – depending on your preferred rental strategy – in the local market and ask them how much they rent their income properties for, whether that’s enough to cover their expenses, what their occupancy rate is, and whether they end up with positive cash flow properties.

Most real estate investors are happy to share their experience with beginners as they feel proud of their accomplishments, but you still need to figure out who owns a rental property in your neighborhood of choice and their contact information. Moreover, once again, you have to obtain rental comps from a few different sources in order to assure accuracy and reliability.

3. Hiring a Real Estate Agent

Many new investors assume that real estate agents can help them only with the property buying process. Actually, agents and brokers are professionals with extensive expertise in the local housing market which covers the rental market as well. Top-performing agents are able to tell their clients for how much comparable houses are renting and help them figure out the optimal rental rate for the real estate listings that they are considering.

4. Accessing Real Estate Investor Websites

With the development of the real estate technology, there is more and more traditional and Airbnb data that investors can find online, and this includes rental comps.

There are many real estate investing websites with traditional and vacation home rental listings which provide enough details about the property type and size as well as the number of bedrooms and bathrooms to enable beginner real estate investors to find income properties comparable to theirs.

So, this emerges as an efficient way to find rental comps. For long term rental properties, landlords can check out real estate investment websites such as Zillow, Rentometer, Apartments.com, and others. Similarly, with regards to short term investment properties, some of the best resources include Airbnb, Vrbo, Booking.com, and HomeAway.

Related: Where to Find Property Data Online

5. Using Mashvisor

We’ve left the best way of how to find rental comps – both traditional and Airbnb comparables – till the end. This is by using Mashvisor’s investment property calculator. Our real estate investment app provides even new investors with no previous experience in real estate with a quick and efficient way to access and analyze short term and long term rental comps.

What you have to do first is to find a few properties within your budget which match your investment requirements such as expected traditional or Airbnb income, cash on cash return, and cap rate as well a number of other filters you can choose from.

Then, for each of these investment properties for sale – whether MLS listings or off market properties, you can find a list of traditional rental comps and Airbnb rental comps on the Rental Comps & Insights tab.

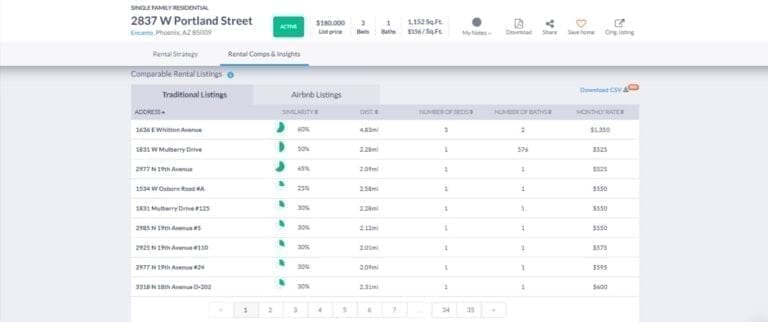

If you are thinking of renting out your income property on a long term basis, the list of traditional listings will show you all the rental properties in this area with a property address, number of bedrooms, and number of bathrooms.

You will also be able to see how similar each specific property is to the one that you are currently analyzing and at what distance it is located. Finally, you will gain access to the monthly rental rate which is the ultimate aim of every rental market analysis.

Traditional Rental Comps for an Investment Property in the Phoenix Real Estate Market

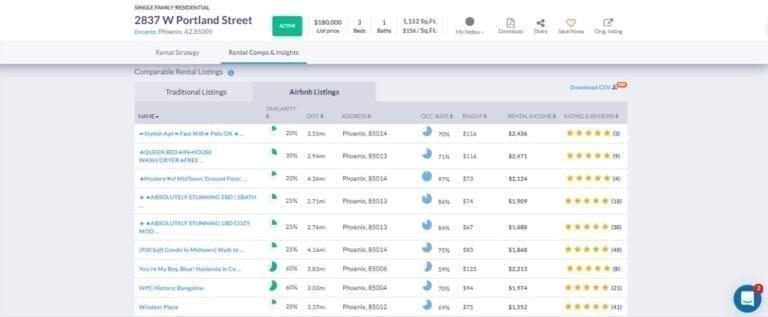

In terms of renting out on Airbnb or another homesharing platform, you can easily and efficiently obtain vacation home rental listings as well. All these comps come from Airbnb.com directly. Once again, you can see the address of the rental comps, their distance from your income property, and the degree of similarity expressed as a percentage.

Then, you also have available the Airbnb daily rate, the Airbnb occupancy rate, and the Airbnb monthly rental income. Furthermore, you can see how the number of reviews and ratings affects all these factors for short term rentals.

Airbnb Rental Comps for an Investment Property in the Phoenix Real Estate Market

In both cases – traditional and Airbnb rental comps – you don’t only get to see the comparables with all their data and information on the Mashvisor real estate investment software platform but also download them as a CSV file. This gives you the opportunity to share them with your real estate network and get their insights as well.

So, you might be wondering what the benefits of using Mashvisor for finding rental comps are? Here are the most important advantages which you can enjoy by using our rental property calculator:

- The real estate business has become more competitive than ever, and beginner investors have to find quick and efficient ways to obtain real estate data and conduct real estate investment analysis in order to be able to compete with those more experienced than them. That’s why using AI real estate investment tools is crucially important. Mashvisor provides you with traditional and Airbnb rental comps within seconds, which would otherwise require weeks or even months to get.

- All real estate data analytics presented on our platform are highly accurate and reliable as they come from the MLS, Zillow, and Airbnb. They reflect the actual performance of real rental listings. While a landlord or an Airbnb host might be unwilling to share all information at his/her disposal with you, Mashvisor provides you with a complete list of rental comps and all their relevant data.

- Unlike other real estate websites, on Mashvisor you are not limited to just the rental rate which properties similar to the one you are interested in buying generate. You get much more. Indeed, you get a comprehensive rental property analysis for any property listed on the platform as well as any other off market property in the US as long as you enter the address.

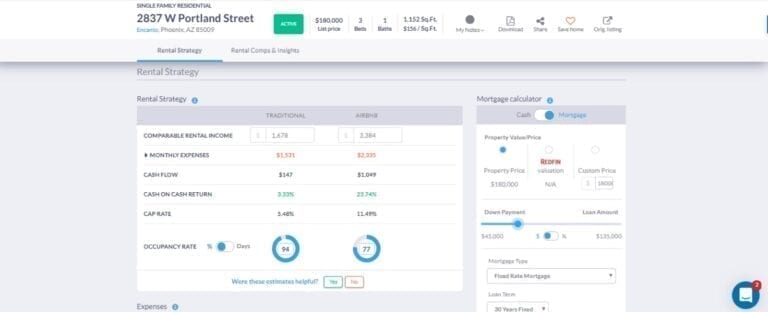

Our investment property calculator provides beginner real estate investors with all additional traditional and Airbnb data – other than rental comps – that they need in order to buy positive cash flow income properties with a high return on investment.

This includes but is not limited to the property price, one-time startup costs, recurring monthly expenses, rental income, occupancy rate, cash flow, cash on cash return, cap rate, and optimal rental strategy.

Mashvisor’s Investment Property Analysis

Obtaining rental comps for both traditional and Airbnb investment properties has changed significantly over the years and has become easier and faster than ever. All you need to do to find all the real estate data and analysis that you need in order to make evidence-based profitable real estate investing decisions is to sign up for Mashvisor today.